Ethereum ETFs: Bad news for Solana as investors ‘Go all in ETH’

- Solana has weakened towards Ethereum on the worth charts

- Nevertheless, SOL maintained a bullish sentiment and market construction.

The continued hypothesis on Ethereum [ETH] ETF approval may threaten Solana [SOL] worth prospects, not less than within the short-term, per some market watchers.

SOL has since turn out to be a goal of social media dunk because the market more and more adapts to the opportunity of an ETH ETF. One Solana builder and consumer, Nigel Eccles, commented,

‘As a Solana maxi who has been constructing on Solana since 2021, listening to the ETH ETF information has been extremely powerful. Like I believed ETH was completed and Solana was the long run.’

Eccles added that an ETH ETF approval would sanction ETH because the official sensible contract chain. Because of this, he would moderately pivot to it than stick with Solana,

‘But it surely’s not too late to pivot to the government-sanctioned chain. So, as of now, I’m dumping my Solana baggage and going all in ETH’

Is ETH eclipsing SOL?

Following the ETF growth, on Monday and Tuesday, SOL underperformed ETH on the worth chart. On the weekly chart, efficiency stood at 29% and 25% for ETH and SOL, respectively, per CoinMarketCap information.

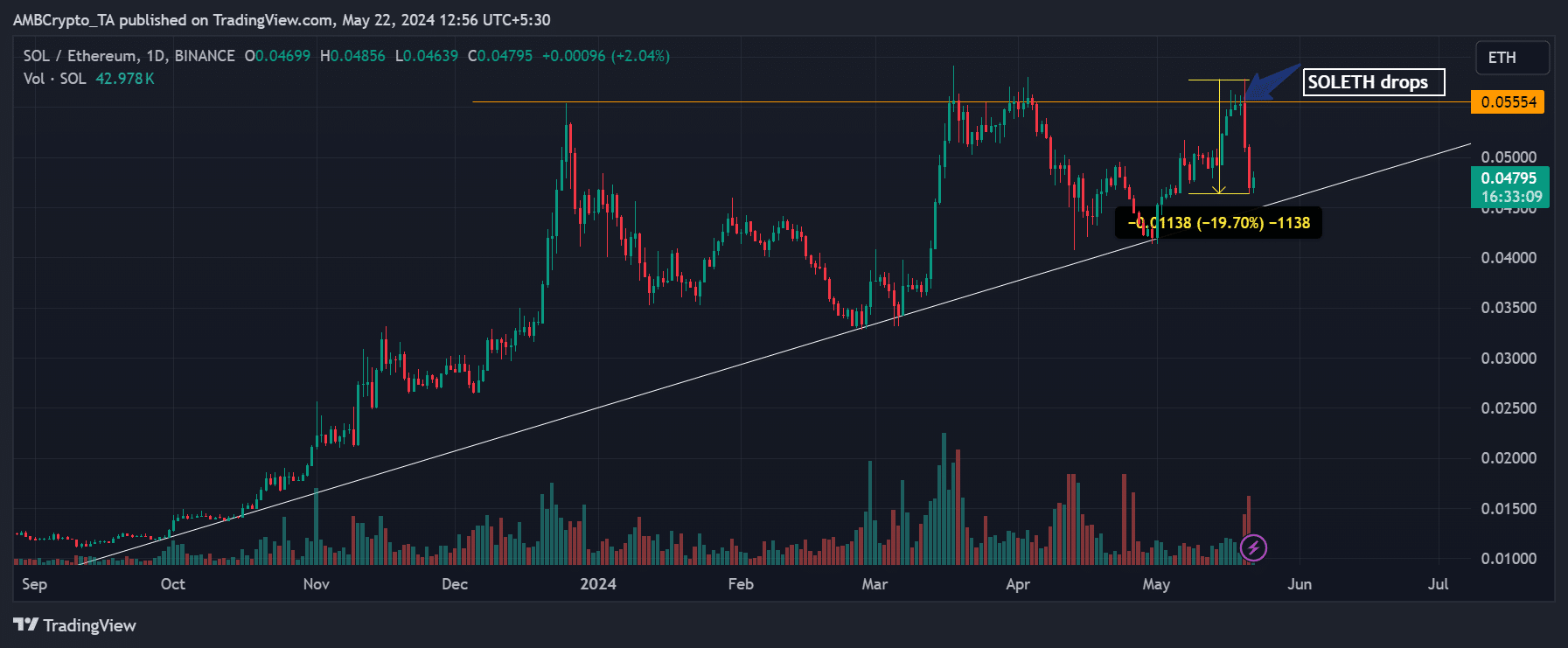

On a granular stage, the SOL/ETH ratio confirmed that SOL weakened towards ETH in the beginning of the week.

Supply: SOL/ETH ratio, TradingView

For the uninitiated the SOL/ETH ratio tracks SOL’s efficiency towards ETH. A rising worth signifies that SOL outperforms ETH, whereas a drop within the ratio reveals a weakening SOL towards ETH.

That stated, the SOL/ETH ratio dipped by 19%, from 0.05 to 0.046, earlier than making an attempt a rebound at press time. It meant that SOL shed 19% of its worth towards ETH.

So, the 2 pink day by day candlesticks confirmed that SOL underperformed ETH on Monday and Tuesday. On the time of writing, ETH traded at $3.7K, up 2% prior to now 24 hours, whereas SOL traded at $180, down beneath 0.5% over the identical interval.

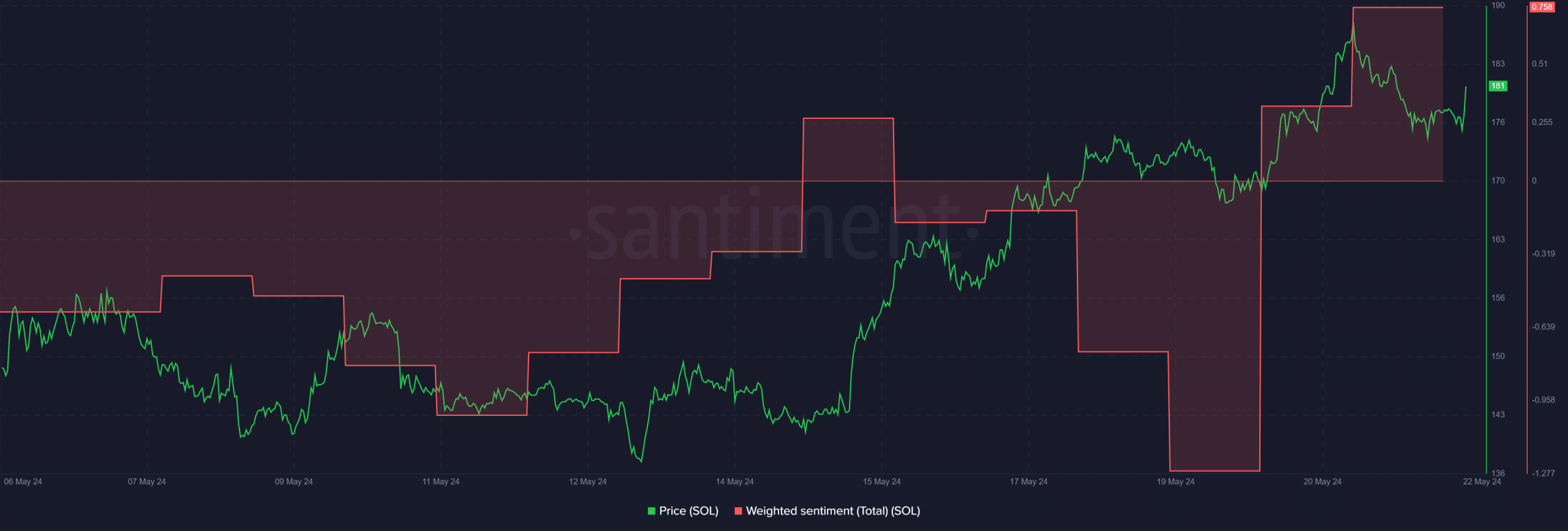

Regardless of the marginally dismal efficiency towards ETH and Eccles’s pessimistic view on ETH ETF’s affect on SOL’s prospect, market contributors have been nonetheless bullish on the house of meme coin buying and selling, as proven by the constructive Weighted Sentiment.

Supply: Santiment

Moreover, SOL maintained a bullish market construction on larger timeframe charts and will eye the $200 mark if the bulls defended the $180 as short-term assist.

That stated, market gamers have been nonetheless bullish on SOL amidst ETH ETF hypothesis, in contrast to Eccles’s adverse tackle the scenario.