Ethereum ETFs may be coming soon – THIS is a huge sign

- Alternate outflows hit a yearly excessive, suggesting bullish conviction.

- ETH’s worth could discover it difficult to surpass $3,255 within the brief time period.

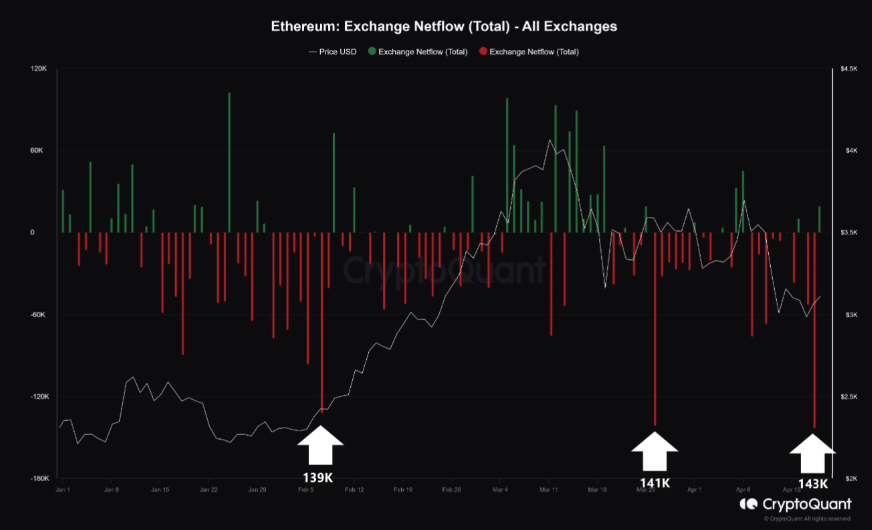

Unknown to many, Ethereum [ETH] registered its highest change outflows in 2024 on the 18th of April. On this date, market members withdrew 143,000 ETH from platforms, per CryptoQuant.

Alternate outflow is an indication of unwillingness to promote, suggesting that the altcoin won’t expertise a extreme capitulation. The final time ETH witnessed such was on the seventh of February and the twenty sixth of March.

When the buildup occurred in February, ETH’s worth was $2,372, and by the top of the month, the worth of the cryptocurrency was $3,386.

However the outflow in March didn’t deliver the identical end result as the worth fell later. Nevertheless, AMBCrypto discovered that there have been causes the outflow jumped.

Supply: CryptoQuant

Dogged holders hold the religion

Considered one of them is the rising enthusiasm that the U.S. SEC would approve Ethereum ETFs by Might. Whereas some members had been satisfied that approval would occur, some skeptics thought in any other case.

Burakkesmeci, an writer on CryptoQuant, additionally seemed to agree with the perspective, mentioning that,

“We witnessed a big quantity of BTC leaving exchanges earlier than the Bitcoin spot ETF approval. I can’t say the identical is occurring, however we must always hold this risk in thoughts.”

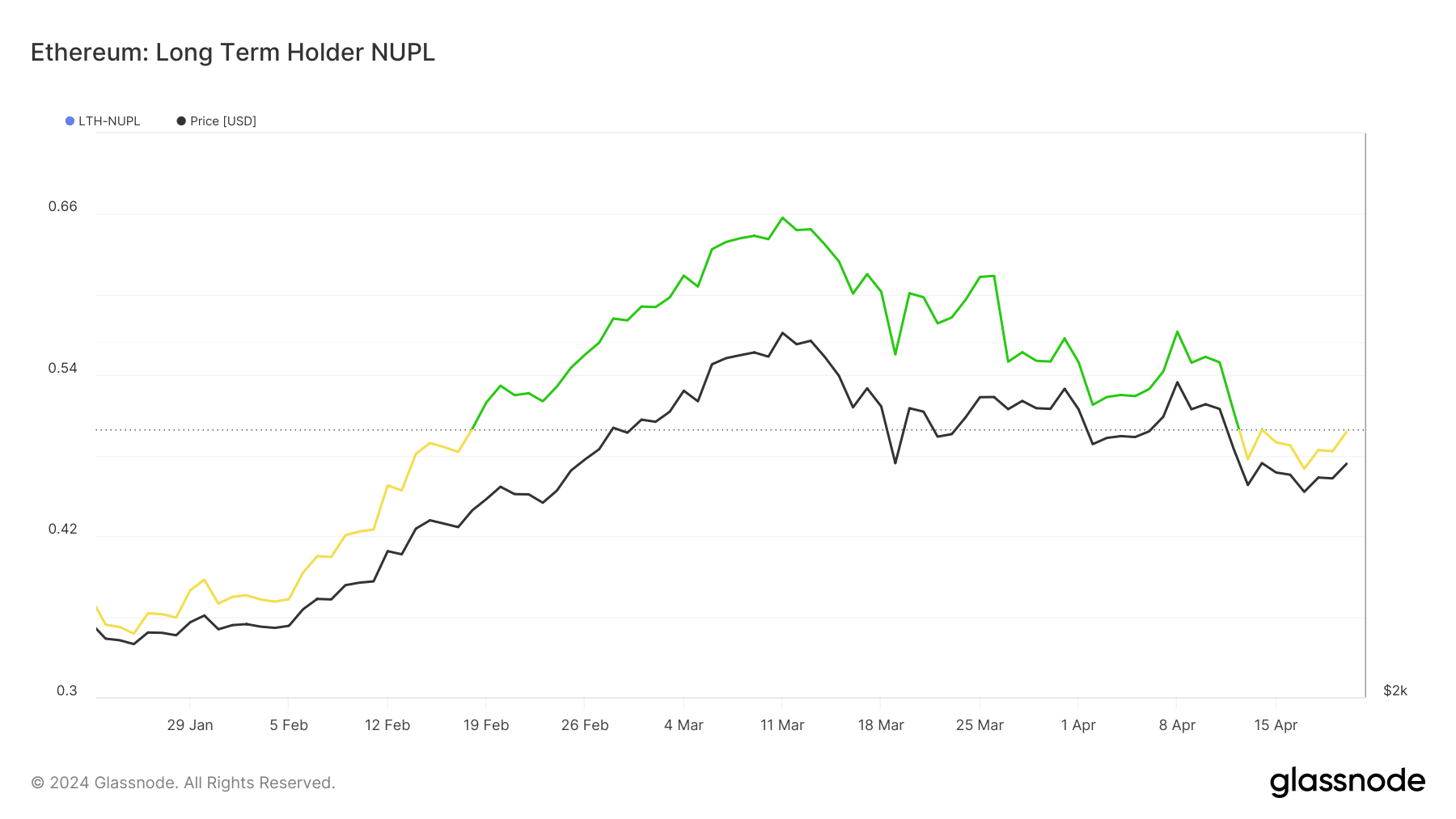

One more reason for the rise may very well be linked to the idea that ETH’s worth is destined to outperform Bitcoin [BTC] this cycle. Whereas this faculty of thought stays unfounded, AMBCrypto checked the LTH-NUPL.

LTH-NUPL is an acronym for Lengthy Time period Holder — Web Unrealized Revenue/Loss. This metric exhibits the habits of holders who’ve held the cryptocurrency for at the very least 155 days.

As of this writing, the LTH-NUPL was within the optimistic (yellow) area, regardless of transferring nearer to the euphoria aspect earlier. However that has not had a big affect on the worth.

Supply: Glassnode

ETH targets a decrease low

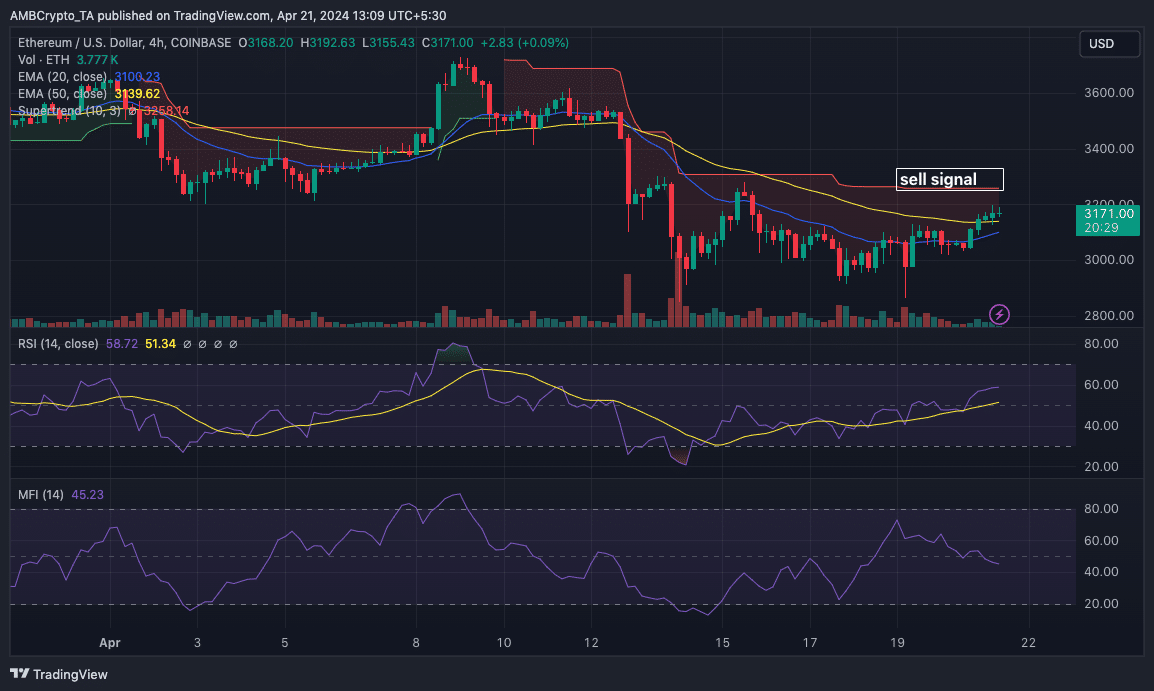

At press time, EHT modified arms at $3,175, representing a 3.67% enhance within the final 24 hours. From a technical perspective, momentum across the token elevated.

This was evident within the Relative Energy Index (RSI) whose studying was 58.64. Sometimes, that is purported to deliver a couple of additional enhance within the worth motion.

Nevertheless, the Exponential Transferring Common (EMA) confirmed a distinct sign. As of this writing, the 20 EMA (blue) was above the 50 EMA (yellow), indicating a bearish pattern.

As well as, the Supertrend flashed a promote sign at $3,255. Due to this fact, if the cryptocurrency’s worth retains appreciating, it might face rejection on the aforementioned worth.

Supply: TradingView

Learn Ethereum [ETH] Worth Prediction 2024-2025

Just like the Supertrend, the Cash Circulation Index (MFI) additionally displayed a bearish signal. With its downtrend, the MFI indicated that capital flowed out from the ETH market.

As such, the worth might fail to interrupt by the resistance at $3,500.