Ethereum ETFs progress, but Solana may turn things bearish instead – How?

- New knowledge indicated that the chance of approval of Ethereum ETFs was comparatively excessive.

- Ethereum misplaced market share to Solana, nonetheless, the value of ETH continued to surge.

Ethereum [ETH] has been below a variety of warmth because of the rising speculations across the dismissal of the approval of Ethereum ETFs.

Uncertainty round ETFs

Whereas there may be uncertainty relating to well timed approval because of the SEC’s silence, it’s a matter of when, not if, a U.S. spot ETH ETF might be accredited, in line with Coinbase’s knowledge.

Nevertheless, potential justifications for disapproval could stem from variations between Ethereum and Bitcoin [BTC], significantly Ethereum’s proof-of-stake mechanism.

Clear regulatory steerage on asset staking is missing, making it unlikely that spot ETH ETFs enabling staking might be accredited quickly. Regardless of this, it’s believed that unstaked ETH shouldn’t be impacted.

There’s potential for a constructive shock within the approval determination, with odds estimated round 30-40%.

Contemplating crypto’s emergence as an election subject, the SEC could hesitate to disclaim approval, and litigation might overturn a rejection.

Moreover, not all spot ETH ETF functions should be accredited concurrently, as famous by Commissioner Uyeda’s assertion relating to spot BTC ETF approval.

Stiff competitors

Despite the fact that the potential for approval of Ethereum ETF’s was excessive, there have been another challenges that the Ethereum community could be dealing with. Particularly, competitors from different Layer 1 chains.

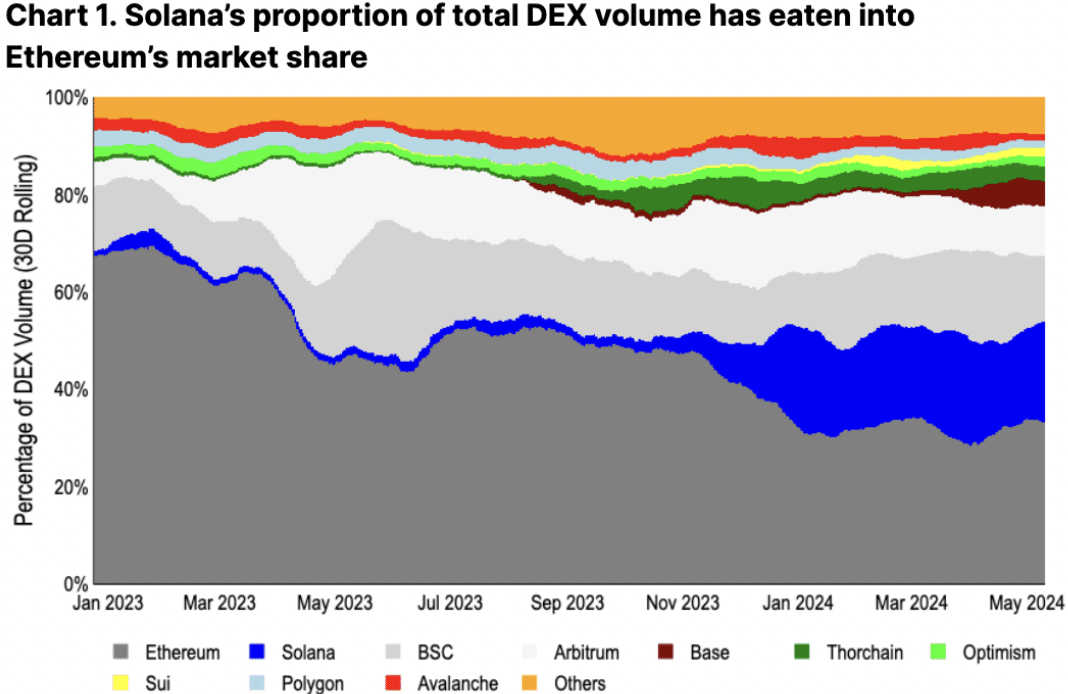

By way of adoption, the emergence of extremely scalable built-in chains, particularly Solana [SOL], appears to be impacting Ethereum’s dominance.

With its means to deal with numerous transactions at low charges, Solana has shifted the main focus of buying and selling exercise away from the Ethereum mainnet.

Over the previous 12 months, Solana’s ecosystem has seen exceptional development, rising its share of decentralized alternate (DEX) quantity from simply 2% to 21%.

Supply: Coinbase

Furthermore, the rising recognition of memecoins on the Solana community are additionally driving customers away from Ethereum and in direction of Solana.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

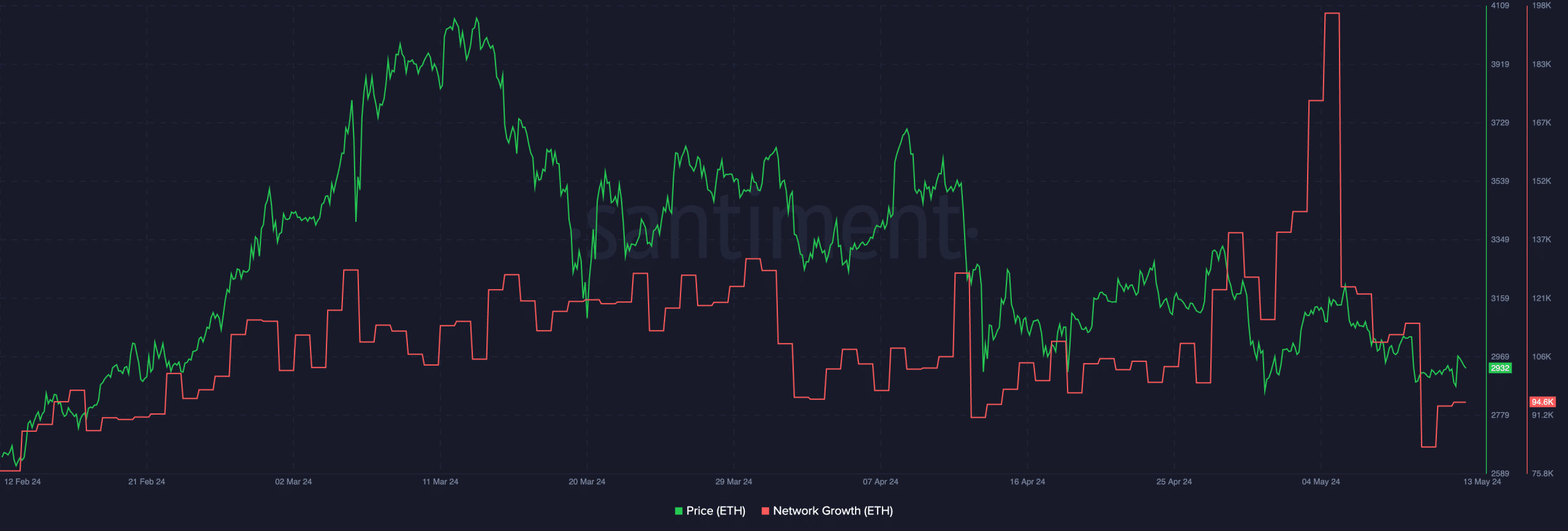

Regardless of these components, the value of ETH has seen some constructive motion. At press time, ETH was buying and selling at $3,117.82 which was a results of a 2.11% appreciation within the final 24 hours.

Despite the fact that the value of ETH was rising, its Community Development declined, indicating waning curiosity from new customers.

Supply: Santiment