Ethereum ETFs see declining interest: What does it mean for the future?

- Declining on-chain quantity in ETH signifies waning curiosity forward of ETF verdict.

- A monetary establishment predicted a delay for Ethereum ETF, however not an outright rejection.

Some main occasions are as a result of occur earlier than the top of Could. But when there’s one which the crypto group locations on the prime, it’s the U.S. SEC’s determination on the quite a few Ethereum [ETH] ETF functions.

ETF stands for Trade Traded Funds. Not like regular cryptocurrencies like ETH, an Ethereum ETF would solely expose traders to the altcoin, not that they’d personal it instantly.

However whether or not this could come to move stays a giant debate topic. For some, the SEC has no different choice than to approve it, because it gave Bitcoin ETFs the inexperienced gentle.

A stumbling block seems

Nevertheless, others imagine that latest developments point out that the regulator doesn’t share that view. One notable determine that might hinder the Ethereum ETF approval is Gary Gensler.

For a while, Gensler who’s the SEC chair, has publicly acknowledged his dislike for the crypto ecosystem. Not too long ago, the SEC served Effectively Notices to some corporations, together with Consensys.

A Wells Discover is a proper discover from the SEC written to let a recipient know that the company is planning to convey enforcement actions in opposition to them.

Consensys is a blockchain software program firm developed to develop into an Ethereum information middle. Because the agency has hyperlinks with Ethereum, it may very well be potential that the SEC says a giant no to the functions.

Nevertheless, J.P. Morgan had a contradicting thought to this. Whereas the agency mentioned it doesn’t anticipate an approval this month, it famous that it gained’t be an outright rejection. It defined that,

“Markets don’t anticipate an approval by this month as implied by the numerous low cost to NAV by the Grayscale Ethereum Belief ETHE.”

The SEC faces a deadline between the twenty third and twenty fourth of Could to resolve. Nevertheless, it appeared that the broader market was skeptical of fine information popping out of the event.

Curiosity in ETH falls

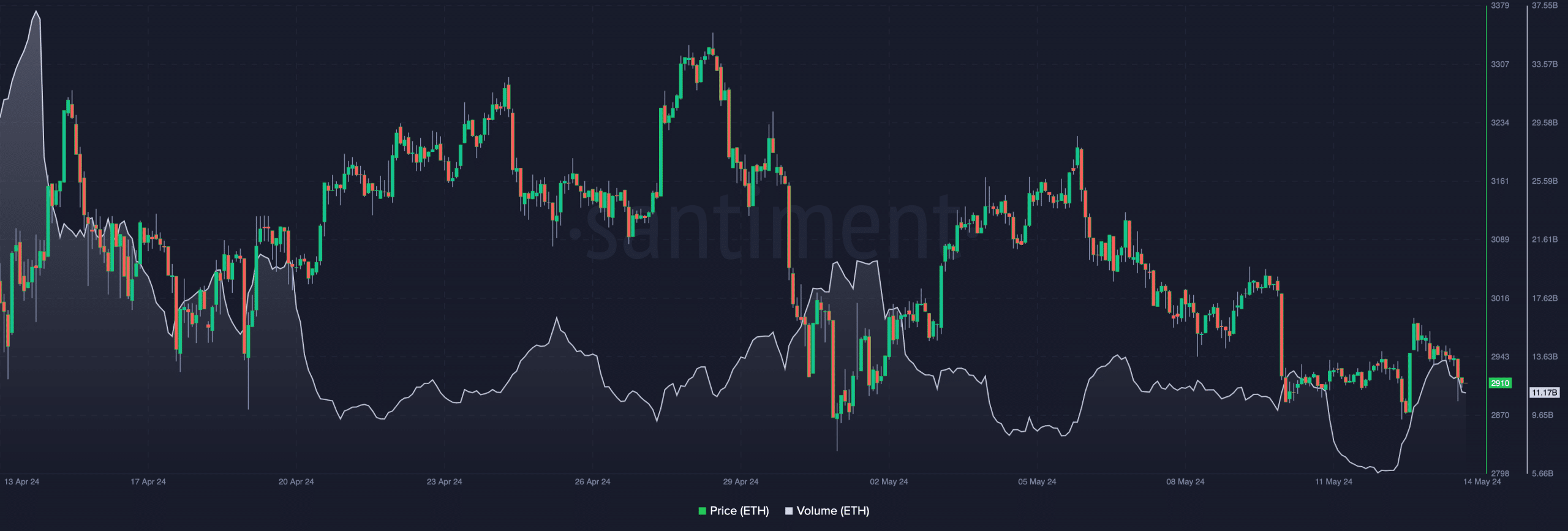

This was evident within the collection of outflows from Ethereum funding merchandise which AMBCrypto reported. By way of the quantity, we additionally assessed the on-chain quantity.

As of this writing, the quantity was 11.17 billion. This was a major lower from the height in March. Declining quantity in ETH is an indication that market contributors are dropping curiosity within the altcoin.

Supply: Santiment

If the SEC approves the Ethereum ETF, the value of ETH may also be affected. At press time, ETH’s worth was $2,910. A go-ahead might ship the cryptocurrency as excessive as $3,500.

But when this isn’t the case, the potential decline to $2,700 may come to move. Nevertheless, eyes can be on two main functions, that are from VanEck and ARK.

Candidates are closing the loopholes

Beforehand, ARK and 21 shares, who’ve a joint software, included staking of their Ethereum ETF submitting. However in an amended submission on the tenth of Could, they modified it.

The corporations had hoped that staking can be included and added it as a characteristic in February. The rationale for the inclusion was that ETH might have served as a part of the corporate’s earnings.

However the truth that the SEC nonetheless has points with labeling the cryptocurrency a safety or not, left them with no choice to be on the protected aspect. Nevertheless, this doesn’t indicate that the Ethereum ETF would get a nod.

Within the meantime, J.P. Morgan additionally commented on the opportunity of a delay.

In line with the monetary establishment, a denial might trigger a lawsuit, like the best way Grayscale took the regulator to court docket earlier than the Bitcoin ETFs have been authorized.

Learn Ethereum’s [ETH] Worth Prediction 2024-2025

It’s because Grayscale had additionally utilized to transform its Ethereum Belief to an ETF. The perspective learn,

“The template is more likely to be just like bitcoin: with futures-based Ethereum ETFs already authorized, the SEC ( if it denies the approval of spot Ethereum ETFs) is more likely to face a authorized problem and ultimately lose”

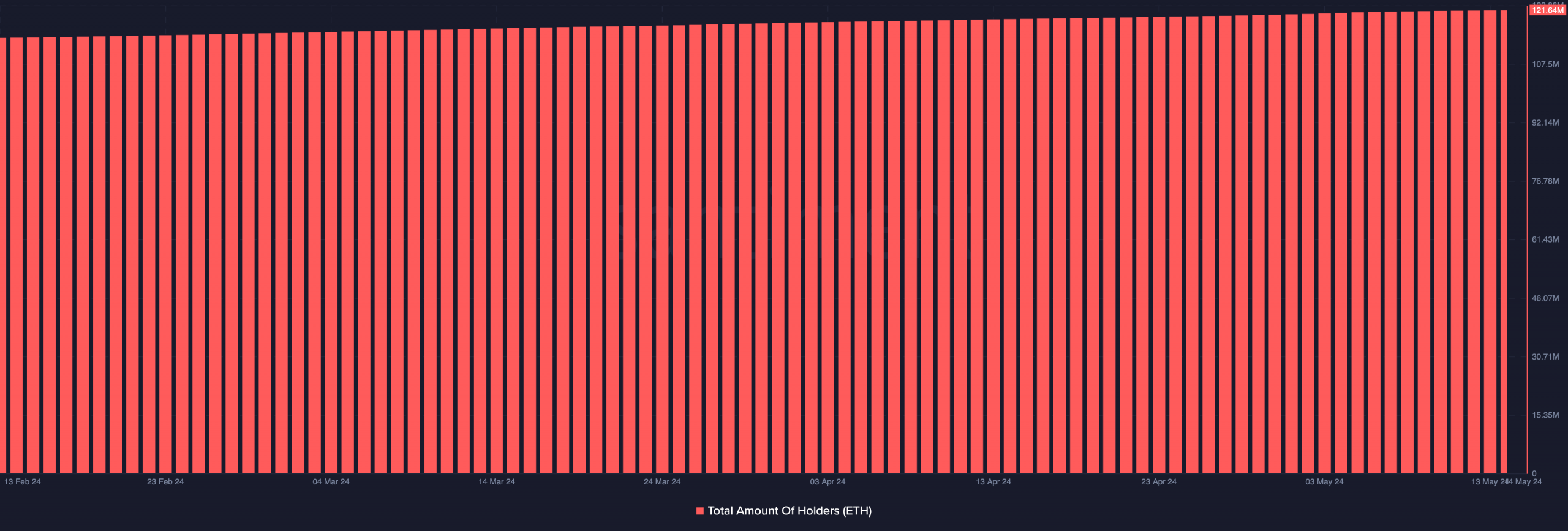

Regardless of the anticipated verdict, the variety of ETH holders has been rising. In line with Santiment, the overall quantity of contributors holding ETH was over 12o million.

Supply: Santiment