Ethereum ETFs struggle as Bitcoin ETFs see $252M inflows: Can ETH catch up?

- Bitcoin ETFs outperform Ethereum, with BTC inflows surging whereas ETH ETFs battle with outflows.

- Bitcoin’s dominance and first-mover benefit reinforce its lead over Ethereum within the ETF market.

Bitcoin [BTC] Change Traded Funds (ETFs) have considerably impacted the crypto market, displaying robust efficiency since their launch.

Bitcoin and Ethereum ETF evaluation

Based on the newest replace from Farside Investors, BTC ETFs recorded web inflows of $252 million.

Main the pack was BlackRock’s IBIT, with $86.8 million in inflows, adopted by Constancy’s FBTC, which noticed $64 million.

Nevertheless, amidst this influx race, Grayscale’s GBTC confronted challenges, recording $35.6 million in outflows as of twenty third August.

Alternatively, Ethereum [ETH] ETFs have struggled, primarily experiencing outflows since their inception. As of twenty third August, ETH ETFs recorded $5.7 million in outflows.

Notably, BlackRock’s ETHA noticed zero inflows, whereas Constancy’s FETH, Bitwise’s ETHW, and VanEck managed to report some inflows.

Nevertheless, Grayscale’s ETHE confronted important outflows, recording $9.8 million, surpassing the outflows of all different Ethereum ETFs mixed.

Remarking on the identical, an X deal with with the username- Crypto Crib famous,

“Final week, $ETH spot ETFs had a web outflow of $44 million.$BTC spot ETFs had a web influx of $506 million.”

Not so stunning!

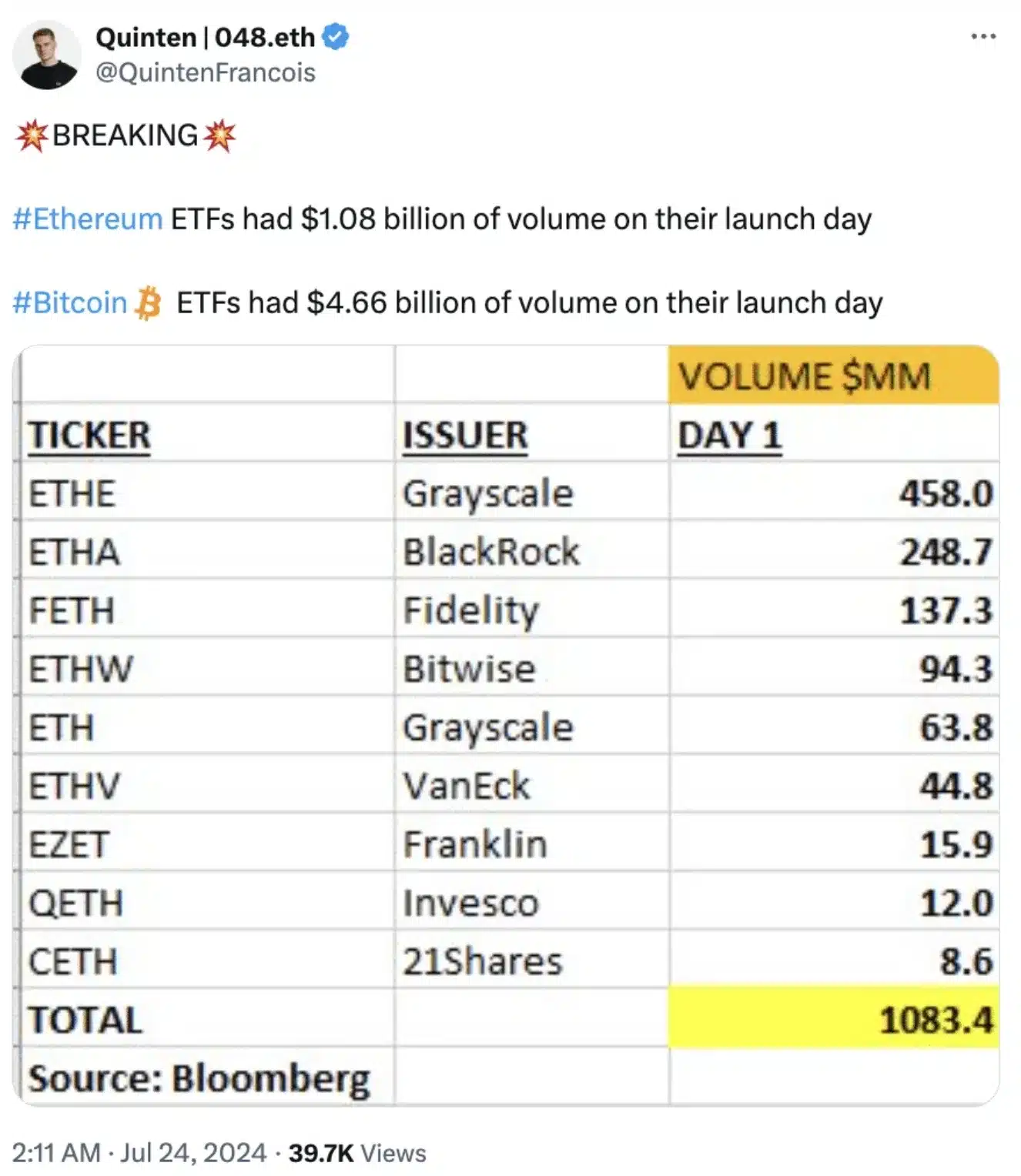

Nevertheless, this shouldn’t come as a shock, on condition that Ethereum ETFs’ buying and selling volumes on their first day had been solely 1 / 4 of what spot Bitcoin ETFs achieved on their debut.

Supply: Quinten/X

The launch of Spot Bitcoin ETFs created important pleasure available in the market, setting a excessive commonplace that Ethereum ETFs have but to match.

Whereas Bitcoin ETFs noticed spectacular buying and selling volumes proper from the beginning, Ethereum ETFs have struggled to generate comparable curiosity, reflecting a extra subdued market response and indicating that they haven’t captured the identical degree of enthusiasm.

Impression on the token’s costs

That being stated, following the launch of Bitcoin ETFs, BTC soared to a brand new all-time excessive of $73K in March.

In distinction, Ethereum has confronted challenges, struggling to surpass the $3K mark.

As per the newest CoinMarketCap replace, ETH was buying and selling at $2,735, falling wanting the sooner anticipated $4K degree.

What’s behind this?

This divergence is also attributed to Bitcoin’s established dominance and its first-mover benefit, which has solidified its place as the popular alternative for a lot of merchants.

Moreover, Bitcoin’s strong proof-of-work system, typically hailed as the top of decentralization, additional strengthens its enchantment in comparison with alternate options like Ethereum.