Ethereum ETFs struggle: Is the market losing interest in ETH?

- ETH skilled weak demand amid Ethereum ETFs outflows, indicating investor disinterest.

- Open Curiosity tanked, however high merchants went lengthy, indicating a potential shift forward.

Ethereum [ETH] ETFs have been experiencing steady outflows just lately, regardless of beforehand excessive hopes that ETFs would drive demand.

Many analysts have noticed this, and a few consider that this could possibly be the explanation why ETH has been bearish.

Wu Blockchain reported that Ethereum spot ETF web outflows peaked at $15.114 million on the seventeenth of September.

Subsequent, Ethereum ETFs data revealed that almost all ETFs didn’t register optimistic flows by means of the week. Outflows had been dominant through the week.

The Ethereum ETFs outflows could have had a heavy hand in ETH’s latest efficiency. The latter was in line with the dampened sentiment, which consequently influenced low community exercise.

The low investor pleasure was evident in ETH’s newest worth motion. Whereas Bitcoin was up over 14% from the present month-to-month low, ETH was solely up about 7.7%.

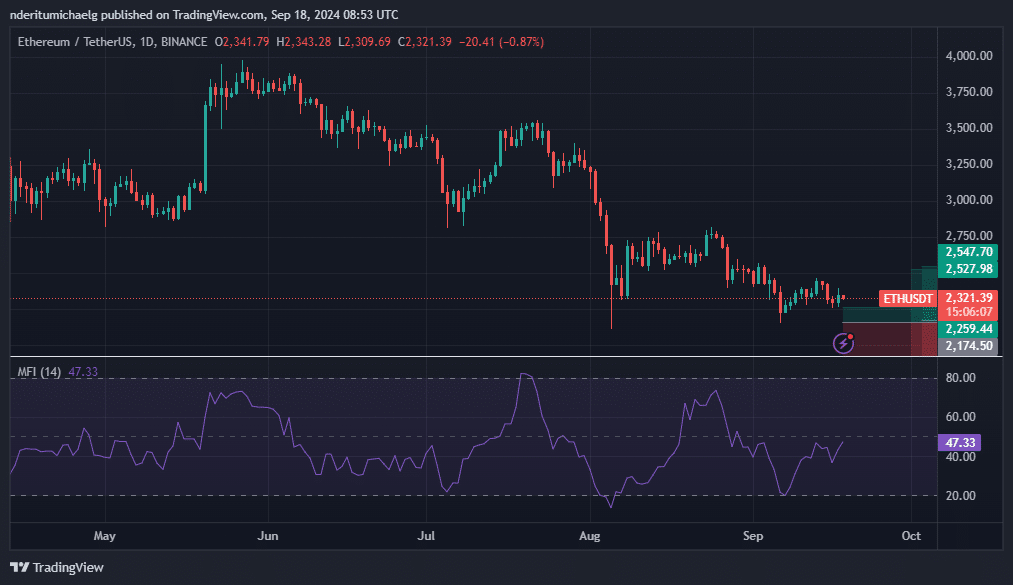

This highlighted the declining demand for ETH. The cryptocurrency traded at $2,321 at press time.

Supply: TradingView

ETH’s RSI has been struggling to push above its 50% degree, confirming the low bullish momentum. Regardless of this, its MFI exhibits that there’s nonetheless some liquidity flowing into the coin, albeit in small volumes.

Can ETH ship a robust comeback?

A powerful rally will not be completely off the desk. ETH’s present predicament is the fruits of assorted elements, together with ETF outflows and low on-chain exercise.

Nonetheless, a pivot in these elements could revive strong demand, particularly if Ethereum ETFs begin experiencing wholesome inflows.

ETH’s present worth degree can also be thought-about a wholesome zone. Nonetheless, it’s presently stuffed with uncertainty and this has affected its efficiency even within the derivatives section.

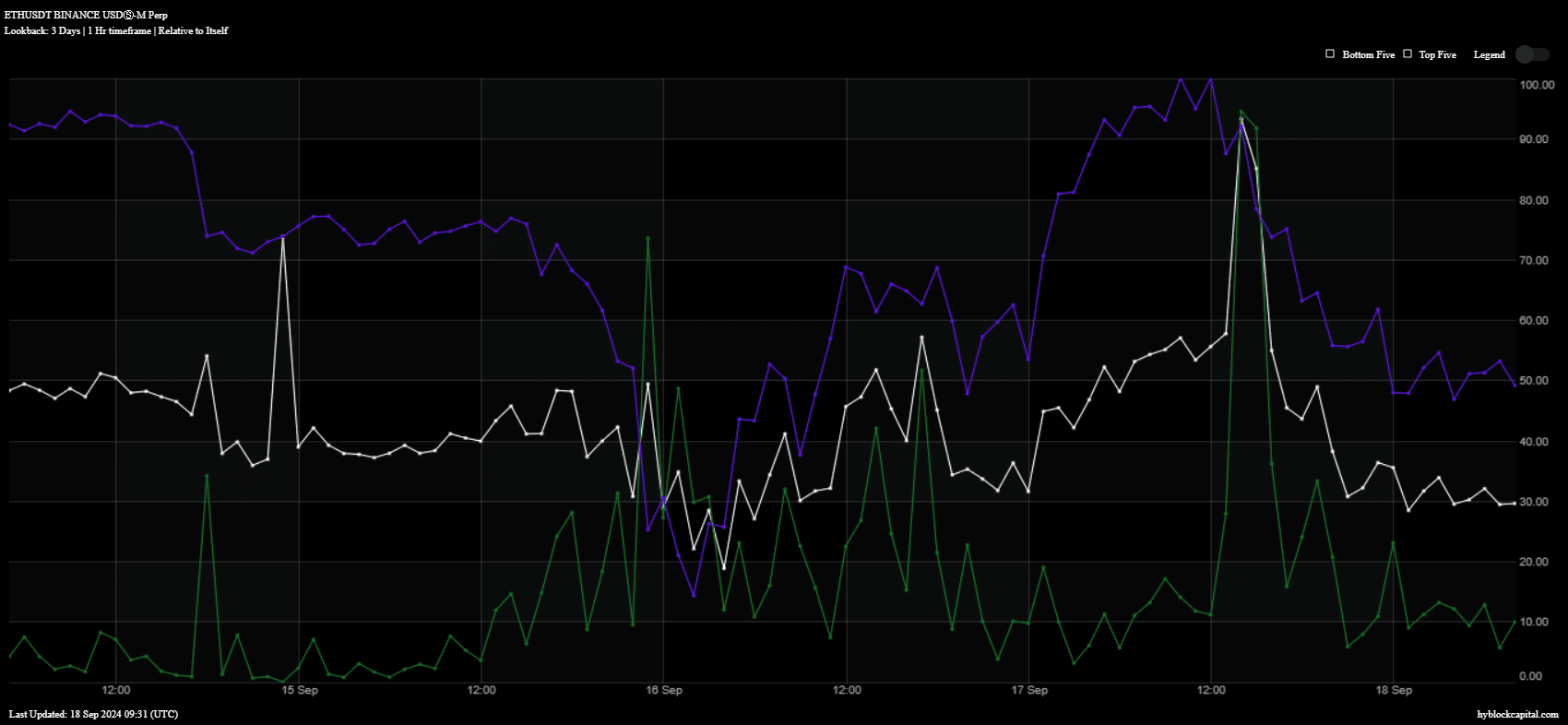

For instance, the extent of Open Curiosity (blue) tanked within the final 24 hours. We additionally noticed a dip in purchase quantity (inexperienced) throughout the identical interval.

Supply: Hyblock Capital

There have been additionally indicators that these outcomes in ETH’s efficiency can also be tied to whale manipulation. The variety of longs amongst high merchants dipped throughout Tuesday’s buying and selling session.

Nonetheless, it bounced again once more, indicating that high merchants are switching again to a bullish temper.

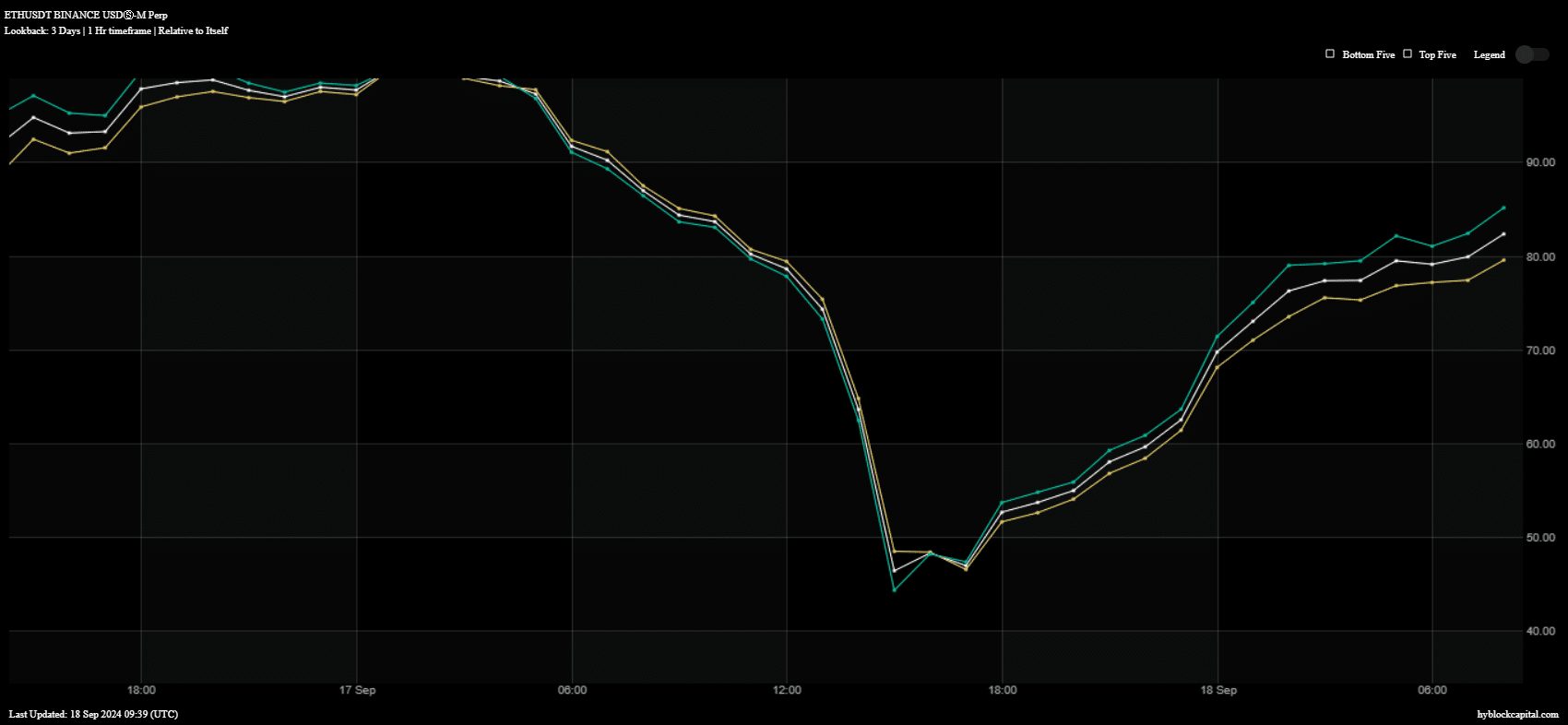

Supply: Hyblock Capital

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

ETH longs amongst high addresses (inexperienced) and longs globally (yellow) bounced again significantly within the final 24 hours. This steered that ETH bulls could flex their muscle tissue in the direction of the weekend.

Nonetheless, this shall be topic as to if ETH can sum up sufficient demand and momentum to push worth again on an upward trajectory.