Ethereum ETFs surge: What’s next for ETH after record inflows

- Are we set to see a requirement resurgence for ETH from Ethereum ETFs?

- Promote stress slows down however weak demand might gasoline directional uncertainty.

Ethereum [ETH] ETFs have been off to a rocky, but unsurprising begin, with noteworthy outflows registered within the first few days. Conversely, new information signifies that the tides is likely to be about to vary.

New studies point out that Ethereum ETFs simply registered their first optimistic web flows within the final 24 hours. That is the first time that optimistic flows have been recorded within the final 9 days.

Previous to that, the ETF outflows coincided with the promote stress that prevailed in ETH’s worth motion because the approvals. May this new shift pave the best way for restoration?

The optimistic Ethereum ETFs flows alone might not essentially help a bullish final result. The cryptocurrency has been experiencing some bullish aid within the final 5 days of July.

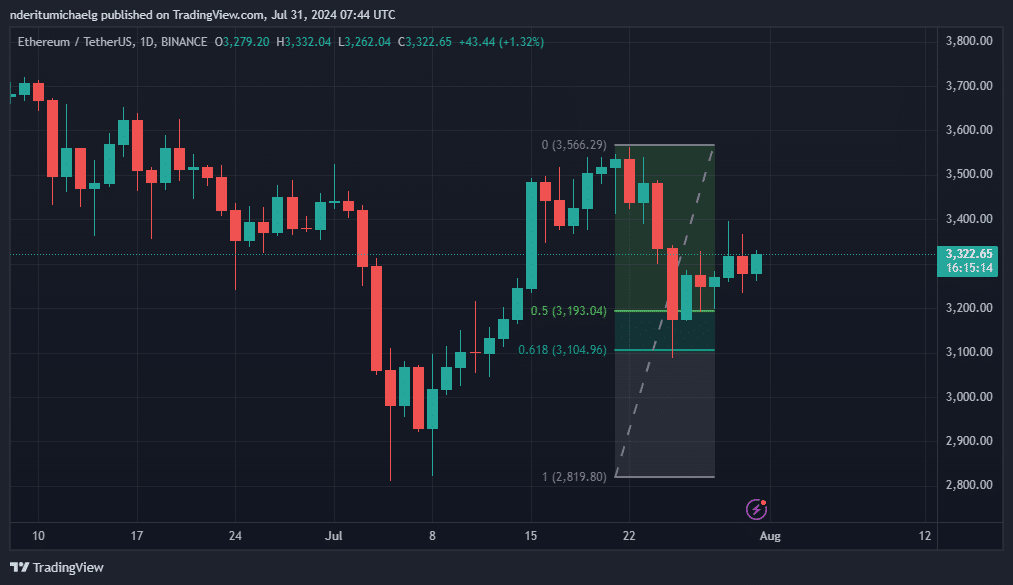

One doable cause could possibly be re-accumulation at key Fibonacci retracement ranges. ETH’s newest retracement discovered a resurgence of demand between the 0.5 and the 0.618 Fibonacci ranges.

Supply: TradingView

The noticed web optimistic inflows in Ethereum ETHs might help extra upside if sustained shopping for takes place. Nonetheless, this isn’t the one issue that’s influencing ETH worth motion.

ETH’s bullish aid may be fueled by extra optimism because the 20-day Transferring Common indicator crosses above the 50-day MA. This crossing is usually translated as a bullish signal.

Market information can also have an effect. FOMC information and FED announcement relating to rates of interest are anticipated to have a major affect within the degree of demand out there. For instance, the market anticipates charge cuts generally quickly and if that occurs, it might enhance investor sentiment in favor of the bulls.

Assessing Ethereum ETFs affect on ETH’s on-chain information

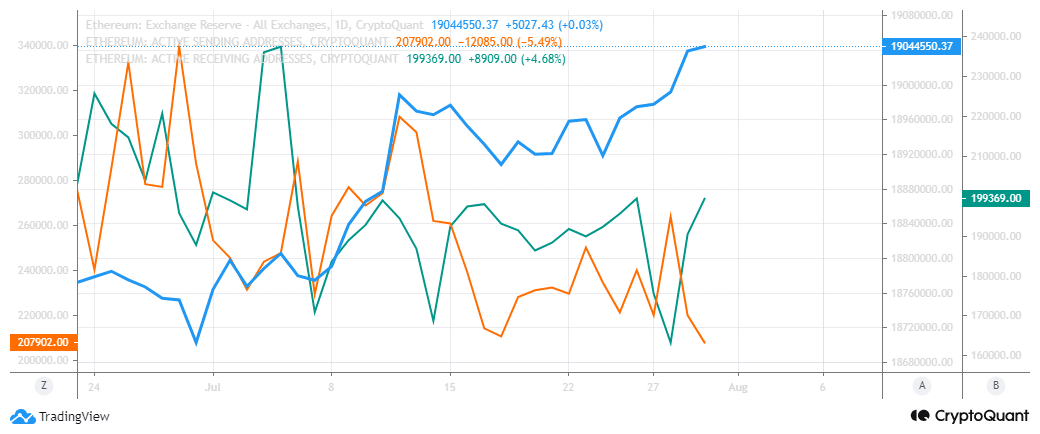

We explored Ethereum’s onchain information to find out the present state of demand. Alternate reserves grew by 341,374 ETH within the final 4 weeks, which can clarify why its bulls have struggled throughout the identical interval.

There has additionally been an total decline in lively addresses.

Supply: CryptoQuant

We noticed a surge in lively receiving addresses from 28 July and a dip in lively sending addresses throughout the identical interval. This statement might sign a requirement resurgence.

Nonetheless, alternate reserves are nonetheless at a month-to-month excessive, therefore demand is weak. Alternate flows collaborate this statement.

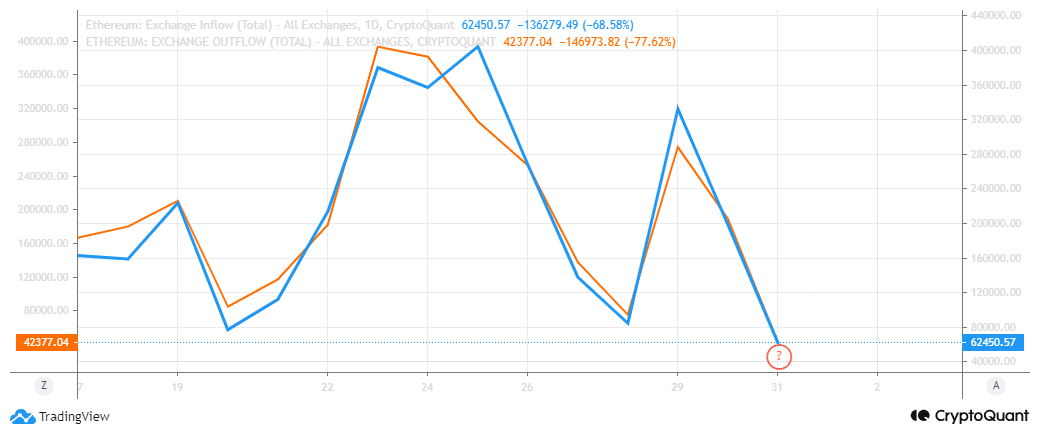

Supply: CryptoQuant

ETH alternate inflows have dipped over the past 5 days, explaining the promote stress slowdown. Nonetheless, we additionally noticed the same slowdown in alternate outflows.

Learn Ethereum (ETH) Value Prediction 2024-25

One doable cause behind the above statement could possibly be that the market is fearful. Submit-ETF approval promote stress might but push costs decrease and buyers are ready for clear conformation of bearish exhaustion.

Resurgence of sturdy demand for Ethereum ETFs and an alternate reserve pivot would offer sturdy affirmation.