Ethereum ETFs: VanEck, BlackRock file their S-1’s and that means…

- S-1 filings have been despatched by companies equivalent to VanEck and BlackRock to the SEC

- ETH’s worth motion has remained the identical, with community progress recording an uptick

Ethereum’s [ETH] worth has been clinging on to the $3,500-level for fairly a while now. Nevertheless, current progress within the ETF house might lend the world’s largest altcoin some much-needed respite on the charts.

S-1 filings on the rise

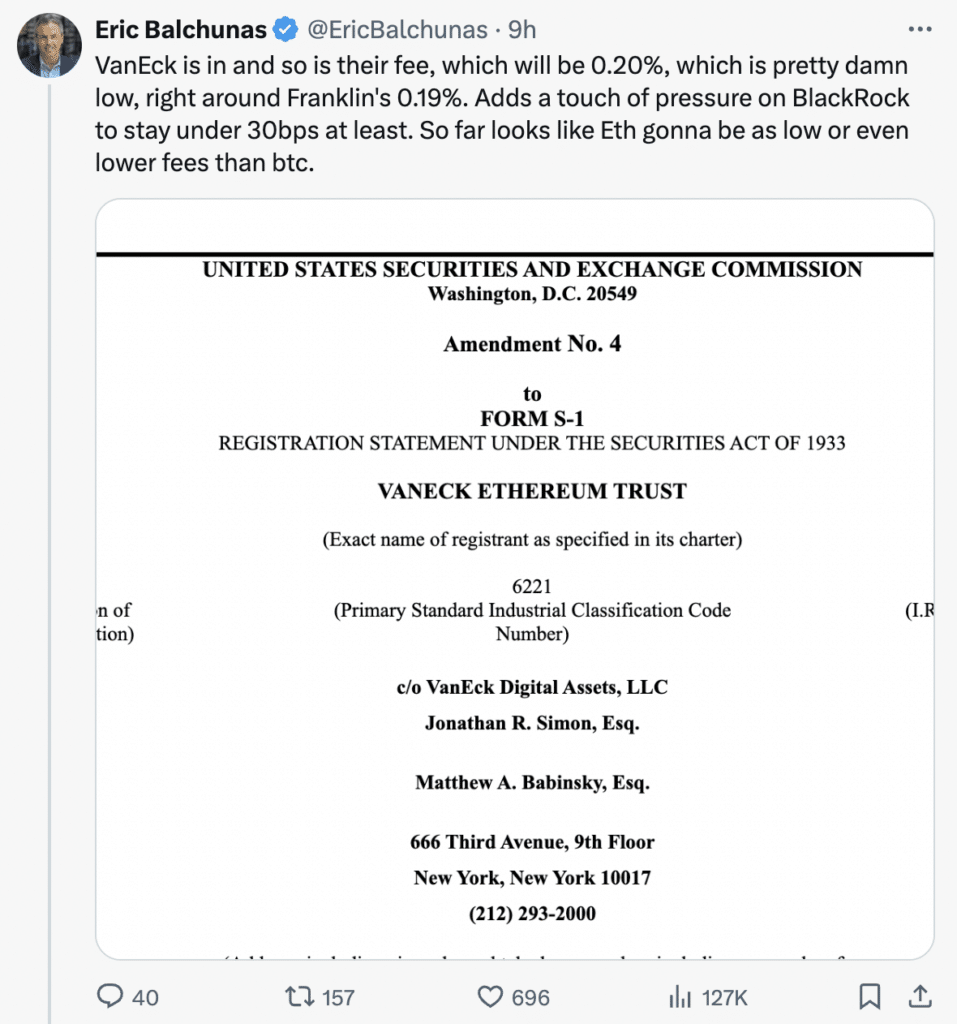

Inching nearer to launch, eight candidates for spot Ethereum ETFs, together with main gamers like Bitwise, Constancy, VanEck, and BlackRock, filed up to date variations of their registration statements with the SEC ,in line with Bloomberg analyst Eric Balchunas. These S-1 filings mark a key step within the approval course of for these ETFs.

Franklin and VanEck have already disclosed their expense ratios, with Franklin setting its charge at 0.19% final month and VanEck following swimsuit on Friday at 0.2%. BlackRock, alternatively, revealed a $10 million seed funding in its proposed ETF.

The SEC will now overview the up to date filings and supply any suggestions to the issuers earlier than a ultimate resolution is made. This improvement is a constructive signal for buyers who’ve been eagerly awaiting the launch of different spot Ethereum ETFs, probably opening up simpler entry to Ethereum for conventional funding portfolios.

Supply: X

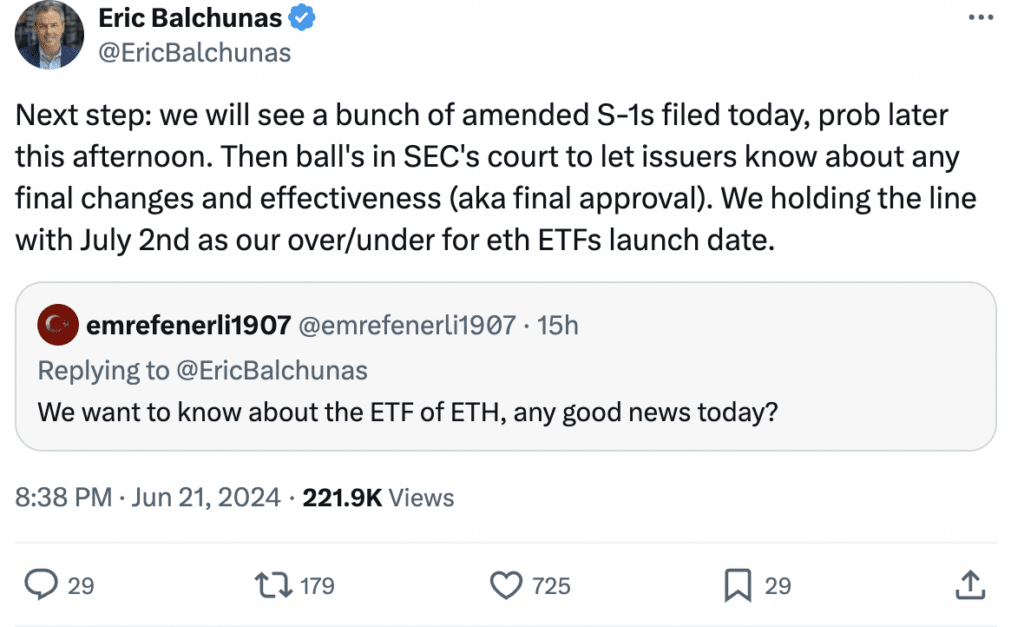

Balchunas additionally supplied a tentative date of two July as a goal for the launch of those Ethereum ETFs. Whereas this isn’t an official affirmation, it does present a clearer timeframe for buyers who’re eagerly awaiting entry to those ETFs.

Right here, it’s vital to notice that the SEC nonetheless must overview the filings and probably request modifications earlier than ultimate approval is granted. Nevertheless, Balchunas’ prediction suggests a possible launch window within the coming weeks, if the SEC’s overview course of progresses easily.

Supply: X

How is ETH doing?

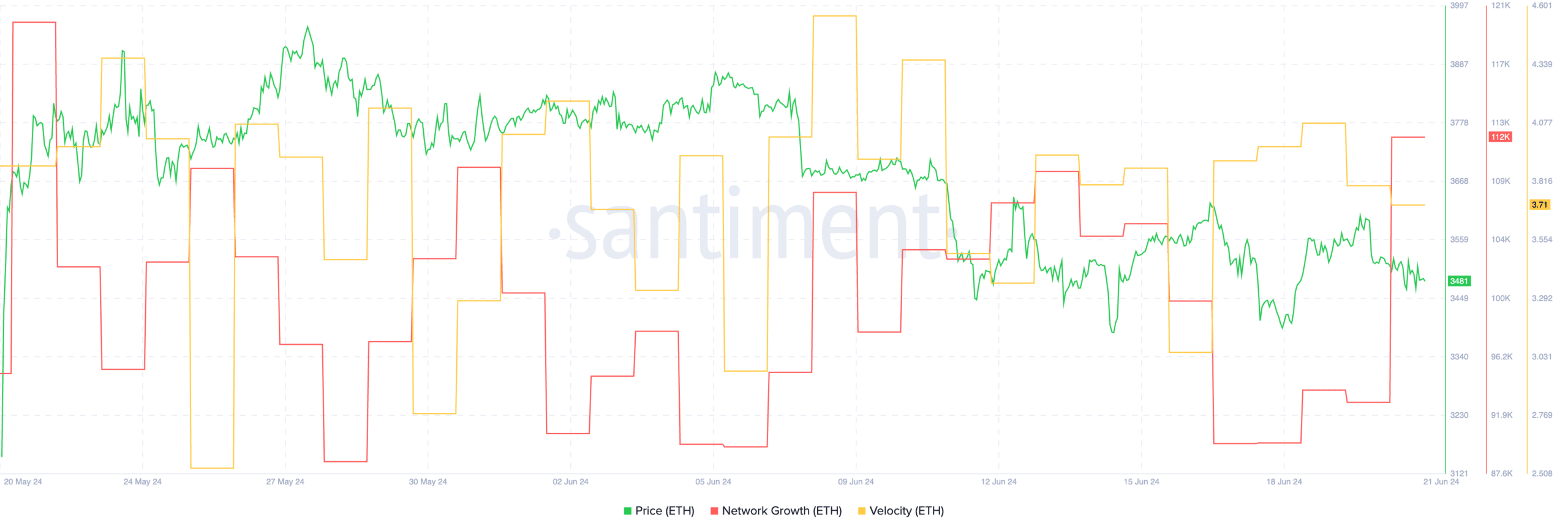

At press time, ETH was buying and selling at $3,502.74, with its worth down by 0.29% within the final 24 hours. Regardless of the decline in worth, nonetheless, its community progress surged considerably over the previous couple of days. A hike in community progress indicated that the variety of new addresses interacting with ETH had grown materially.

As curiosity from new addresses grows, the probabilities of ETH rising to its previously-claimed highs additionally improve.

Learn Ethereum’s [ETH] Value Prediction 2024-2025

Coupled with the hike in community progress, the speed of ETH additionally surged. This implied that the frequency with which ETH was buying and selling at had risen considerably over the previous couple of days.

Supply: Santiment