Ethereum ETH upgrade debate: How will EIP 3074 impact ETH’s future?

- Builders had been in two minds about 3074 EIP in Ethereum’s latest builders name.

- Worth of ETH plummeted, on-chain metrics remained optimistic.

Ethereum’s [ETH] newest Dencun improve was a hit that helped many L2 options scale back charges to extraordinarily low ranges.

After this improve, the Ethereum builders set their sights on their upcoming improve, Prague, on their latest name.

New developments

Ethereum’s Pectra improve, anticipated in late 2024 or early 2025, is anticipated to deliver new options to crypto wallets, enhancing consumer expertise.

Ethereum Enchancment Proposal (EIP) 3074, permits common crypto wallets to operate like sensible contracts.

One key side of EIP-3074 is its potential to provide customary wallets, like MetaMask, sensible contract capabilities.

Moreover, it permits a 3rd get together to cowl the fuel charges related to a consumer’s transaction, probably making transactions extra inexpensive for customers.

It additionally contains options equivalent to transaction bundling, lowering the necessity for a number of signatures, and sponsored transactions, permitting wallets to delegate funds for others’ use, much like ERC-4337’s account abstraction.

Some builders argue that the proposed adjustments to EIP 3074 to permit broader use circumstances and international message revocation considerably improve its complexity, making it more durable to implement and probably introducing safety dangers.

Due to these circumstances, builders have determined to conduct a separate breakout assembly to debate the technical features of EIP 3074.

Their purpose is to achieve a consensus on its implementation in a means that satisfies everybody, given its controversial nature.

Supply: X

State of ETH

The developments being made to the Ethereum community could closely affect the value motion of ETH going ahead.

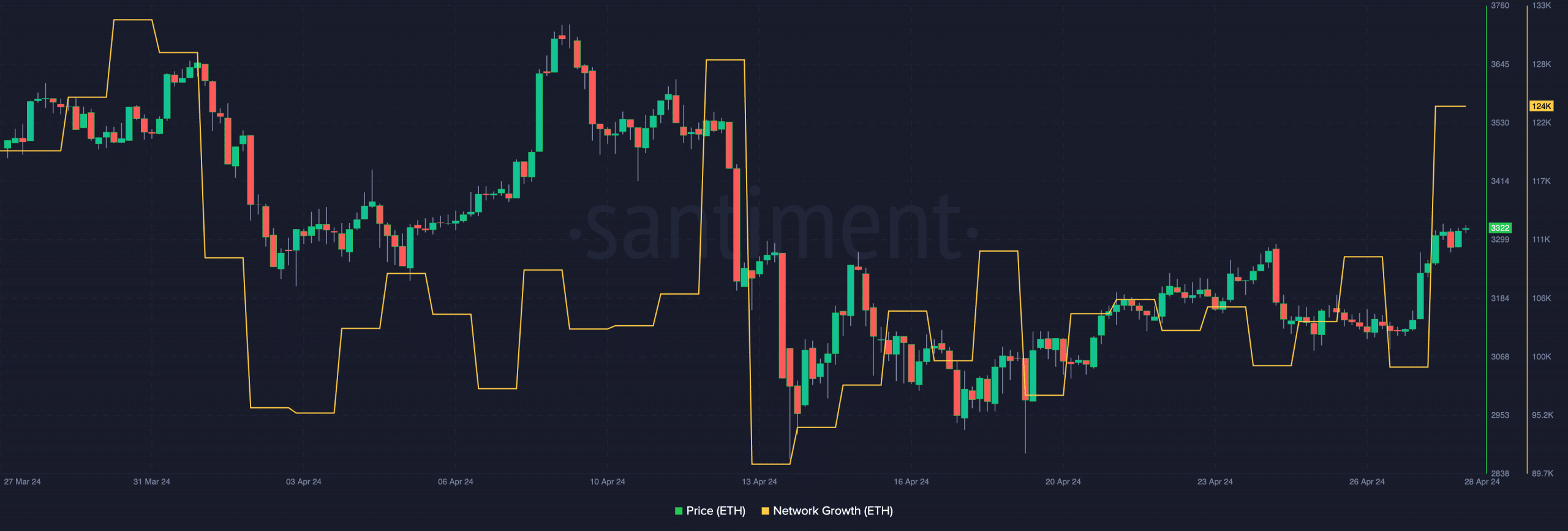

At press time, ETH was buying and selling at $3,170.97 and its value had fallen by 4.48% within the final 24 hours. Nonetheless, the quantity at which ETH was buying and selling at, had grown by 9.33% in the identical interval.

The hypothesis round Spot ETFs round ETH was one of many main drivers of value motion for ETH in the previous couple of days.

Is your portfolio inexperienced? Try the ETH Revenue Calculator

Regardless of the latest decline in value, the onchain metrics offered a optimistic image. The community development for ETH had additionally grown throughout this era, indicating that the variety of new addresses displaying curiosity in ETH had surged.

This renewed curiosity could assist ETH see additional bullish momentum going ahead. Together with that, the rate had additionally risen, indicating a heightened buying and selling frequency for ETH.

Supply: Santiment