Ethereum – Examining if restaking is good for your holdings

- Greater than 12% of the staked ETH has been restaked

- ETH is now step by step rising as a dependable yield-bearing asset

Ethereum [ETH] staking has turn out to be way more fascinating for the reason that idea of restaking was launched.

A brand new paradigm for Ethereum staking

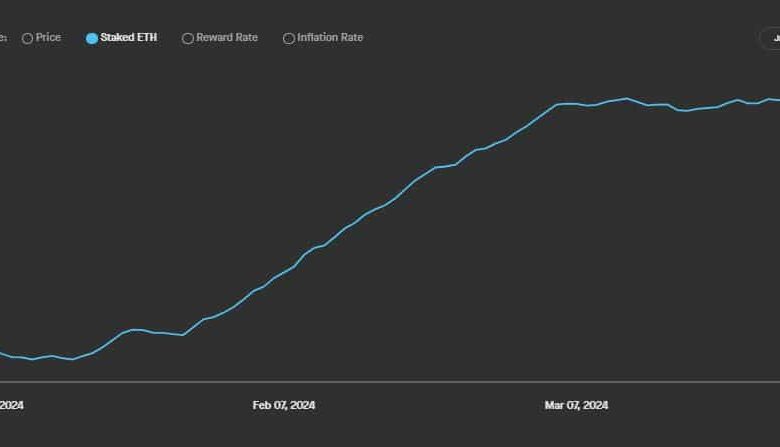

In line with AMBCrypto’s evaluation of Staking Rewards’ knowledge, ETH locked on the community has risen by 9% during the last three months. In truth, its development charge has gone parabolic since February started.

Supply: Staking Rewards

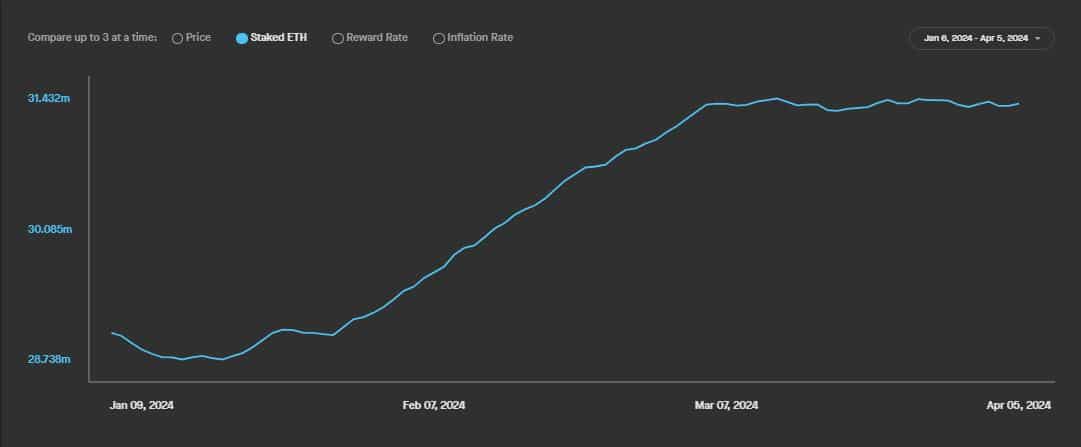

Apparently, in keeping with DeFiLlama, EigenLayer, the success story of the restaking narrative, famous an analogous development curve in its complete worth locked (TVL).

Supply: DeFiLlama

Moreover, Tom Wan, a analysis analyst at Web3 agency 21.co, revealed not too long ago that over 12% of the staked Ether has already been restaked.

These findings have strengthened the assertion made beforehand about restaking offering an impetus to ETH staking.

Why are customers leaning in the direction of restaking?

EigenLayer has taken an enormous leap in 2024, surpassing rivals to turn out to be the second-largest DeFi protocol in a really quick time frame. The success lies in its distinctive providing – Restaking.

Restaking includes reusing staked ETH to increase safety to different functions aside from Ethereum. No prizes for guessing this permits stakers to earn additional rewards on their deposited holdings. As yields on typical ETH staking continue to drop owing to a rise in individuals, restaking is a viable possibility for customers to spice up their earnings.

How does ETH profit?

Total, each staking and restaking underscore an essential broader thought – ETH as a yield-bearing asset. With secure, assured returns, customers can begin viewing it from a long-term potential, reasonably than searching for short-term positive aspects from its value fluctuations available in the market.

Is your portfolio inexperienced? Try the ETH Revenue Calculator

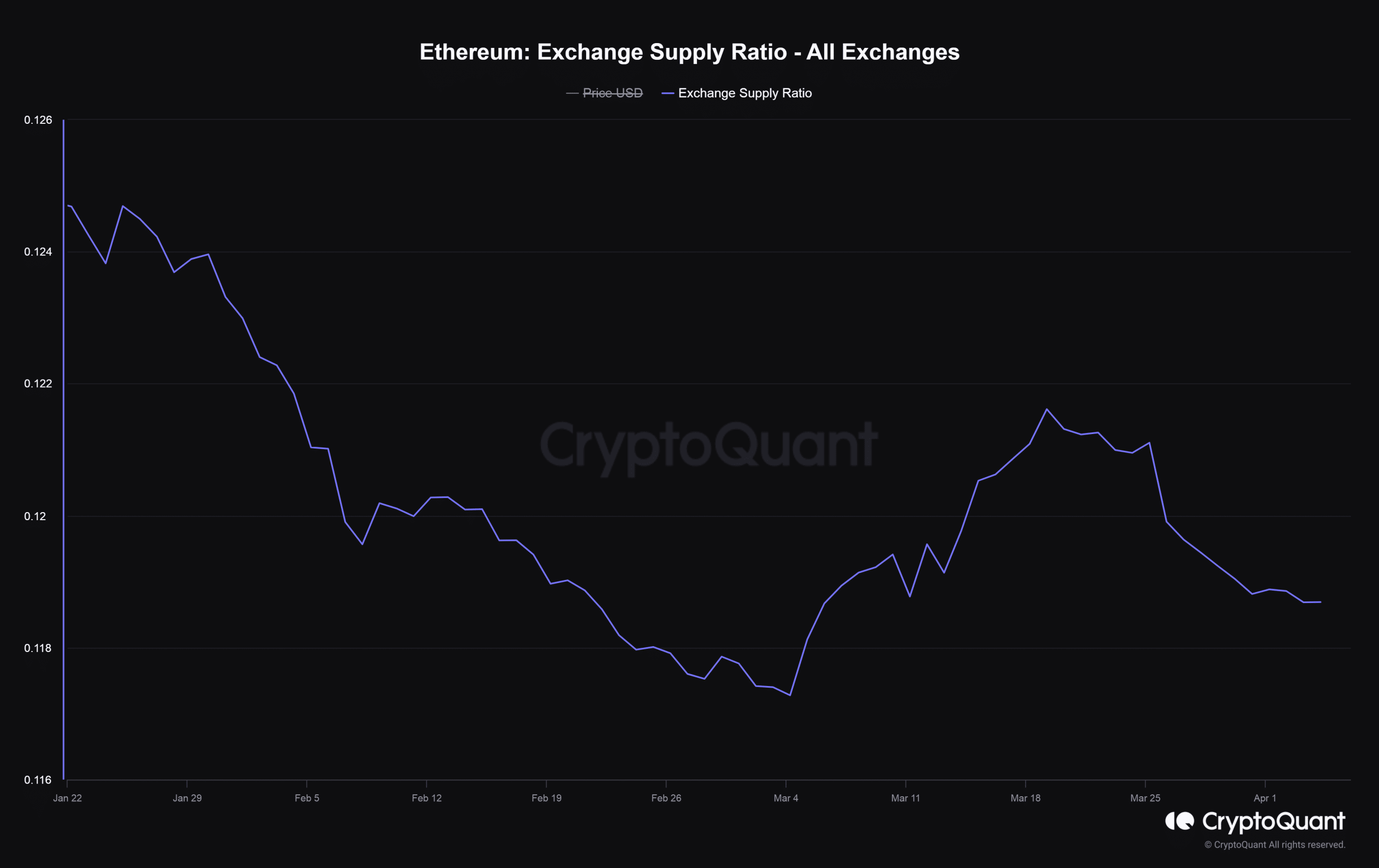

Apparently, the outcomes can already be felt. Ethereum’s alternate provide ratio, as an example, plummeted to multi-year lows, in keeping with AMBCrypto’s evaluation of CryptoQuant knowledge.

This might step by step result in a shortage available in the market, which when matched by rising demand, may exert optimistic stress on ETH’s value.

Supply: CryptoQuant