Ethereum – Examining why these institutions dumped $123M in ETH

- ETH’s RSI fashioned a bullish divergence on the every day timeframe

- 53.88% of high merchants now maintain lengthy positions, whereas 46.12% maintain quick positions

In gentle of the bearish market, Ethereum (ETH), the world’s second-largest cryptocurrency, is being constantly dumped by establishments and whales. This has resulted in notable value drops on the charts.

The truth is, in line with a put up on X (Beforehand Twitter), establishments dumped a major 55,035 ETH value $123 million to Binance, throughout the Asian buying and selling hours.

Establishments offload tens of millions value of ETH

The on-chain analytics platform revealed that the establishments concerned had been Wintermute, a number one algorithmic buying and selling agency, and Metalpha a digital asset supervisor.

Collectively, they dumped 46,947 ETH value $104.74 million and eight,088.8 ETH value $18.05 million, respectively, in simply two hours. This important dump has the potential to affect the altcoin’s value.

Potential purpose behind the latest dump

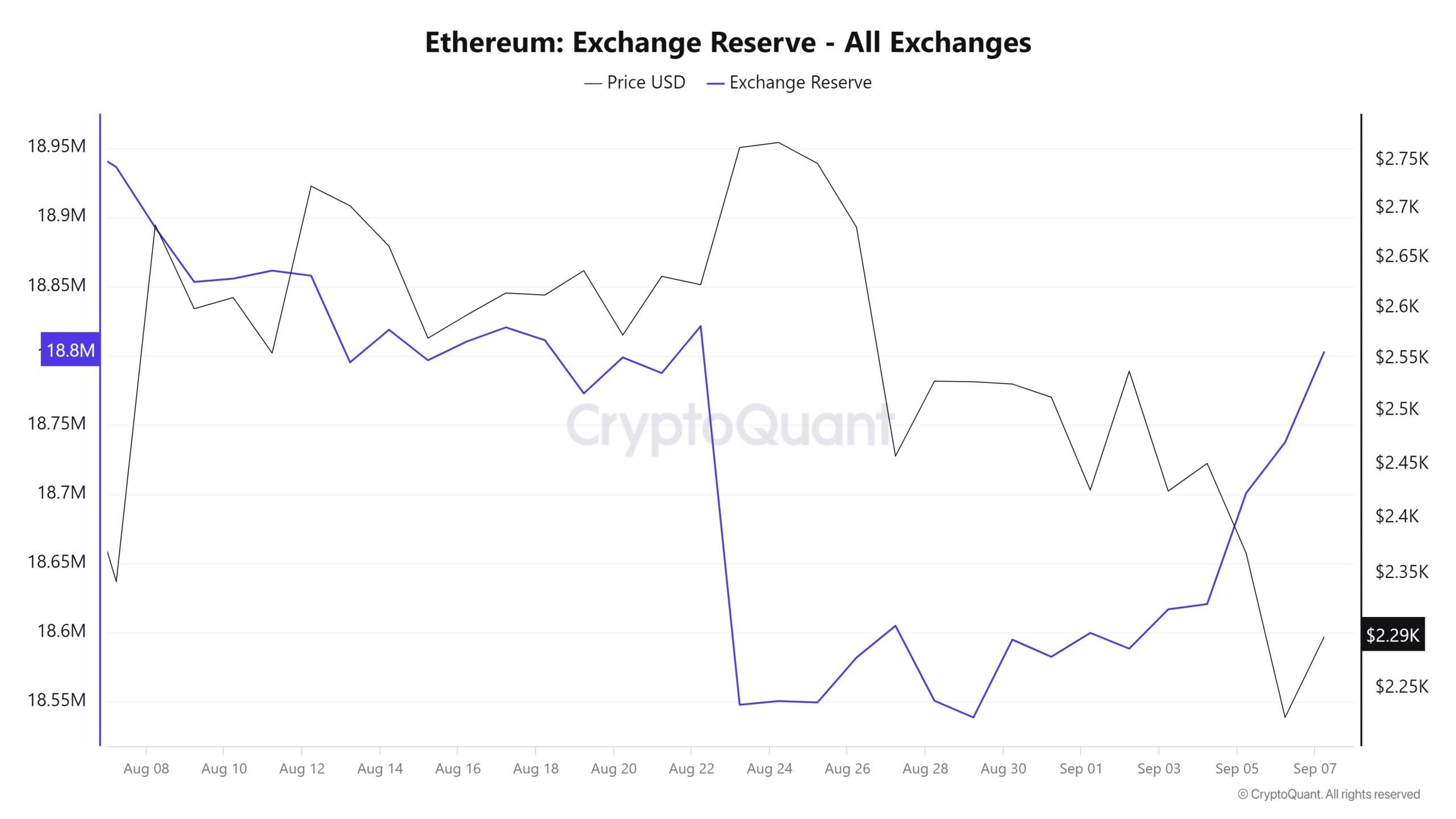

The potential causes behind this dump are the continued bearish market sentiment, the sustained rise in change ETH reserves, and the decline in Futures Open Curiosity for 3 consecutive months.

In keeping with CryptoQuant, Ethereum change reserves have been constantly rising since 28 August. Which means both whales, traders, or establishments could also be shifting their property to exchanges for a possible sell-off.

Supply: CryptoQuant

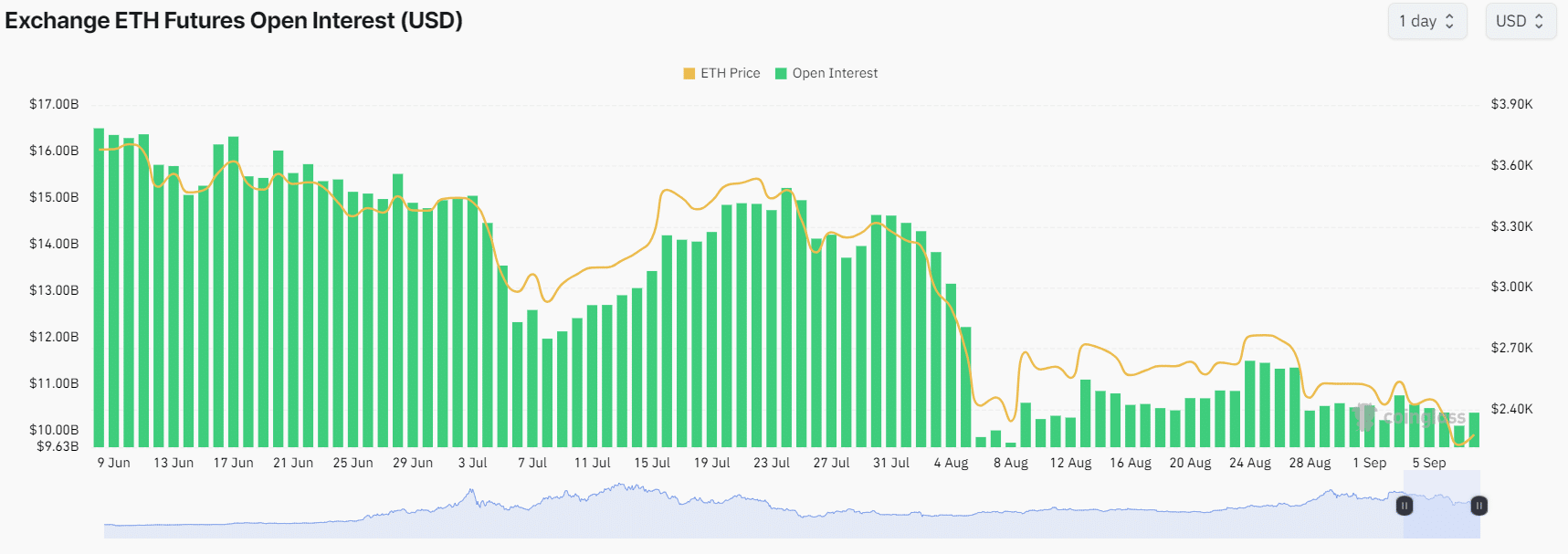

CoinGlass’s change Futures Open Curiosity has been constantly falling too. This underlined both the liquidation of lengthy positions or the expiry of Futures contracts, with no new positions being constructed.

Supply: Coinglass

Right here, it’s value declaring that September is usually thought of a bearish month or a interval of value correction for cryptocurrencies, earlier than probably skyrocketing in October.

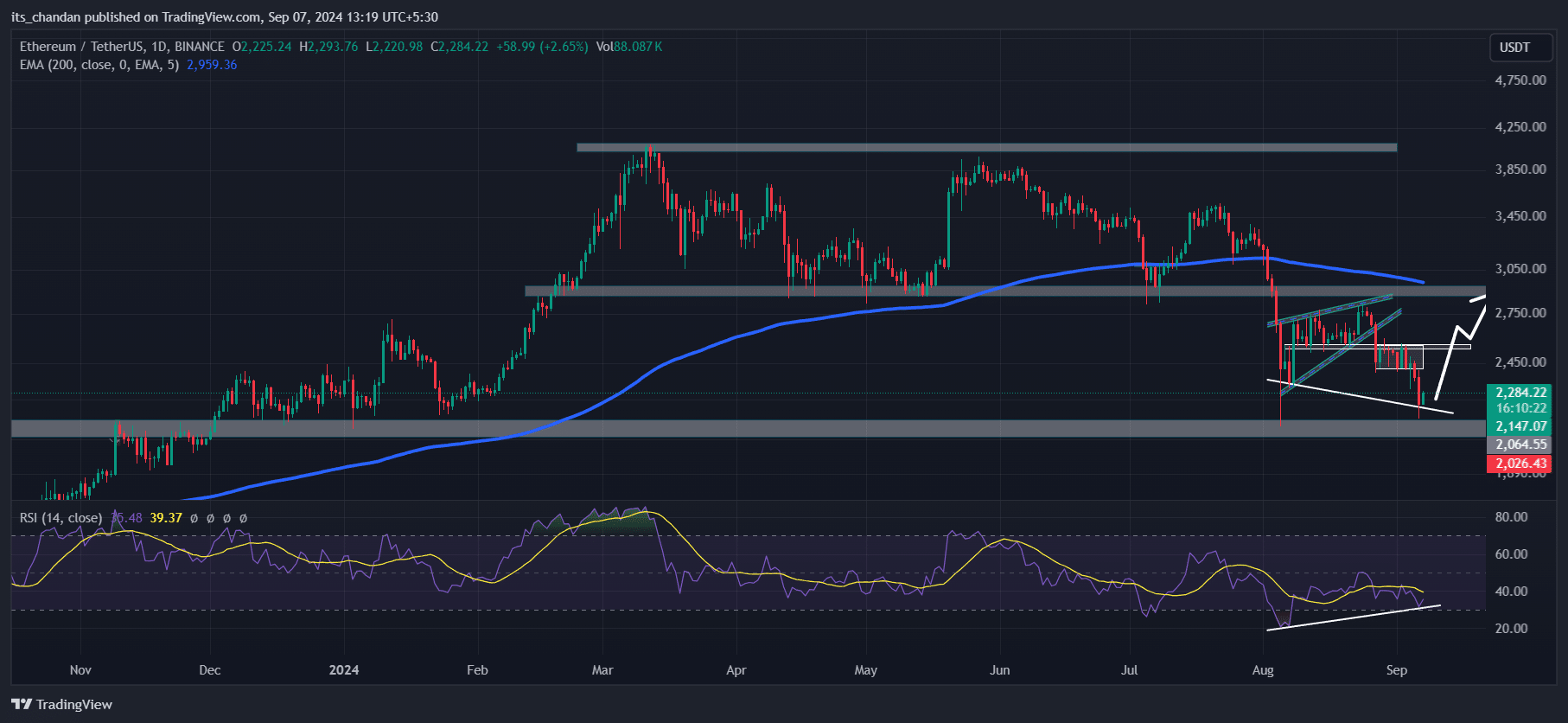

Ethereum technical evaluation and key ranges

In keeping with a take a look at the value charts, Ethereum has retested its essential help degree of $2,140. Since late 2023, this degree has acted as sturdy help for ETH.

Nevertheless, ETH’s Relative Power Index (RSI) fashioned a bullish divergence on the every day time-frame, pointing to a development reversal.

Supply: Tradingview

Owing to the latest retest of help and the formation of a bullish divergence, there may be now a excessive chance that ETH’s value may soar by 25% or 30% to $2,500 or $2,550.

Bullish outlook by on-chain metrics

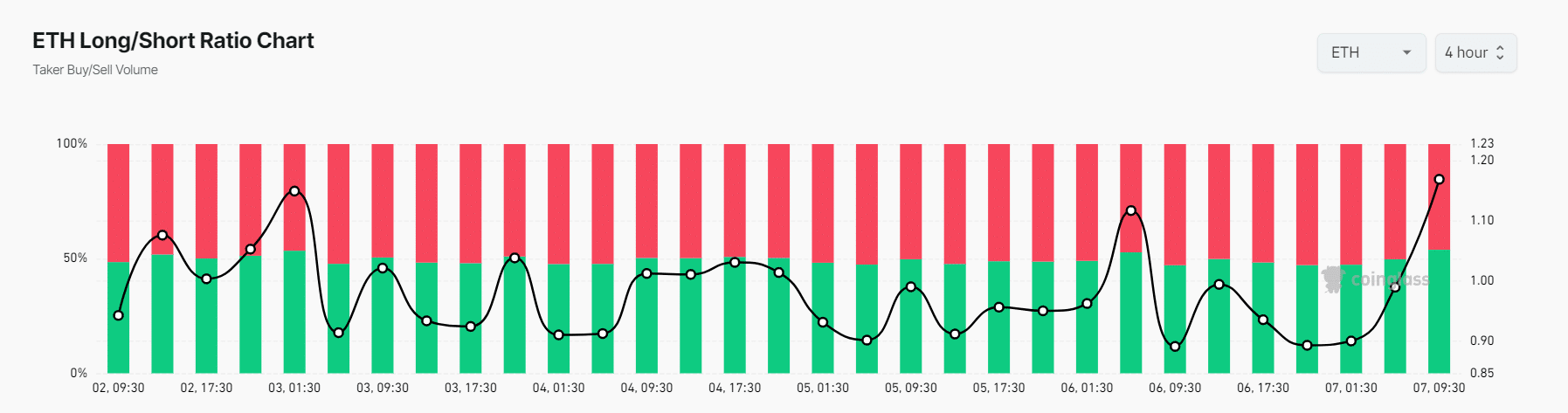

On the shorter timeframe, ETH had some bullish indicators too.

CoinGlass’s ETH Lengthy/Quick ratio, as an illustration, signaled bullish sentiment. In keeping with the identical, this ratio on a four-hour time-frame stood at 1.168 at press time (A price above 1 signifies bullish sentiment).

Supply: Coinglass

The information additionally revealed that whereas 53.88% of high merchants held lengthy positions, 46.12% held quick positions.

Additionally, over the identical interval, whole ETH Futures Open Curiosity elevated by 1.80%. This highlighted the participation of merchants as ETH revisited its sturdy help degree.

Ethereum’s value efficiency

At press time, ETH was buying and selling close to the $2,280-level, following a decline of two% within the final 24 hours.

In the meantime, its buying and selling quantity over the identical interval skyrocketed by virtually 100%, indicating increased participation from merchants and traders.