Ethereum Eyes $3,900 – Key Resistance Break Could Spark A Surge

Este artículo también está disponible en español.

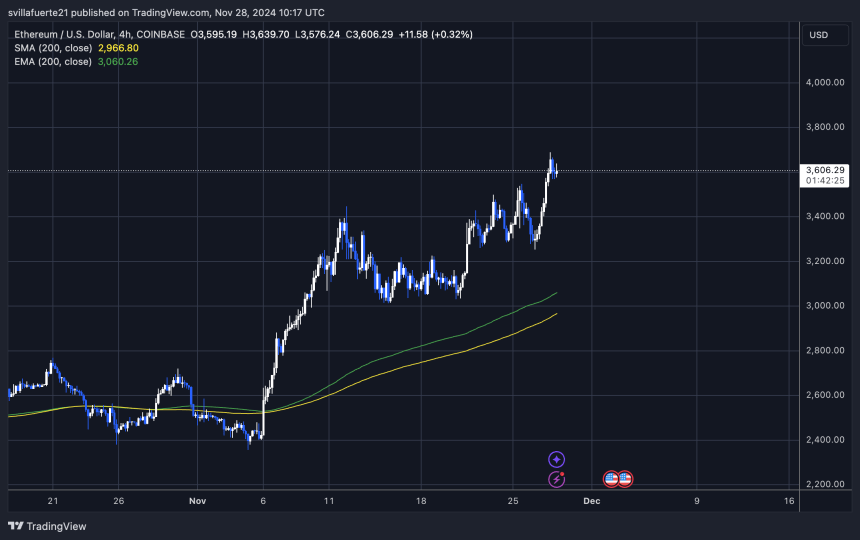

Ethereum has been making waves within the crypto market, reaching its highest ranges since June after hitting a neighborhood excessive of $3,688 simply hours in the past. This spectacular worth motion has sparked pleasure amongst buyers and analysts, with many anticipating additional surges within the coming hours.

Ethereum is now eyeing a breakout above its yearly highs, which may set the stage for an much more aggressive rally.

Associated Studying

Crypto analyst Carl Runefelt shared a technical evaluation on X, highlighting the importance of Ethereum’s present resistance. In accordance with Runefelt, ETH is at a important juncture, dealing with a significant resistance degree that would decide its subsequent transfer. Ought to Ethereum break above this barrier, it would rapidly pump to $3,900, solidifying its bullish momentum.

Because the broader market sentiment stays robust, Ethereum’s worth motion stays unpredictable, particularly because it leads altcoins on this upward pattern. Traders are actually desperate to see whether or not ETH can keep its upward trajectory and set up new milestones within the days forward.

Ethereum Reaching New Highs

Ethereum is making headlines because it reaches new highs, driving the wave of bullish momentum whereas Bitcoin consolidates under the $100,000 mark. This rally has positioned Ethereum as a key driver within the altcoin market, which continues to submit large positive factors and entice investor consideration.

With the broader market sentiment enhancing, Ethereum’s efficiency is changing into a focus for merchants and analysts alike.

Associated Studying

Crypto analyst Carl Runefelt recently shared a technical analysis on X, emphasizing Ethereum’s important resistance degree. In accordance with Runefelt, Ethereum is presently at a make-or-break level. A profitable breakout above this resistance may set off a pointy rally, doubtlessly sending ETH to $3,900. If this degree is surpassed, Ethereum would possible goal yearly highs above $4,000, solidifying its place as a frontrunner within the ongoing market surge.

The approaching days will probably be essential for Ethereum as merchants carefully watch its capability to take care of upward momentum and overcome these key worth ranges. With the altcoin market gaining power and optimism rising, Ethereum’s subsequent transfer may set the tone for the broader crypto panorama. Whether or not it achieves a breakout or consolidates additional, the eye on Ethereum highlights its function in shaping this bullish market cycle.

ETH Value At A Turning Level

Ethereum is presently buying and selling at $3,600, a vital degree that may outline its subsequent worth path. Because the market watches carefully, Ethereum’s capability to carry above this worth will decide whether or not it will possibly proceed its bullish momentum or face a pullback.

If ETH maintains power above $3,600, it’s more likely to surge additional, concentrating on the subsequent important milestone: yearly highs at $4,080. A breakout above this degree wouldn’t solely reaffirm the bullish pattern but in addition place Ethereum for a possible continuation towards even larger ranges.

Nevertheless, Ethereum may face a short-term correction if it fails to carry above $3,600. The primary main demand zone lies at $3,400, which might act as a important help degree. A failure to maintain even this degree may result in additional declines, with the subsequent potential help zones forming at lower cost ranges.

Associated Studying

Market sentiment stays cautiously optimistic, with many analysts highlighting the significance of Ethereum’s present worth motion. The approaching days will probably be pivotal as buyers and merchants search for indicators of power or weak point at this important juncture. Whether or not Ethereum consolidates additional or surges towards new highs, its efficiency will possible have a major impression on the broader altcoin market.

Featured picture from Dall-E, chart from TradingView