Ethereum faces inflationary pressure: Will ETF approvals help?

- Ethereum has seen an elevated inflationary development lately.

- ETH was buying and selling at round $3,300 as of this writing.

Ethereum [ETH], beforehand acknowledged for its deflationary development, has shifted in direction of a extra inflationary sample in current months.

Whereas the mechanism to burn ETH—a part of its transaction price mannequin launched in EIP-1559—has continued, the general provide of Ethereum has nonetheless elevated.

The hope amongst traders and market observers is that demand for ETH will enhance with the finalization of approvals for exchange-traded funds (ETFs).

Ethereum turns into extra inflationary

The inflationary development in Ethereum’s provide has reportedly reached its highest degree since 2022, significantly following its current community improve in March.

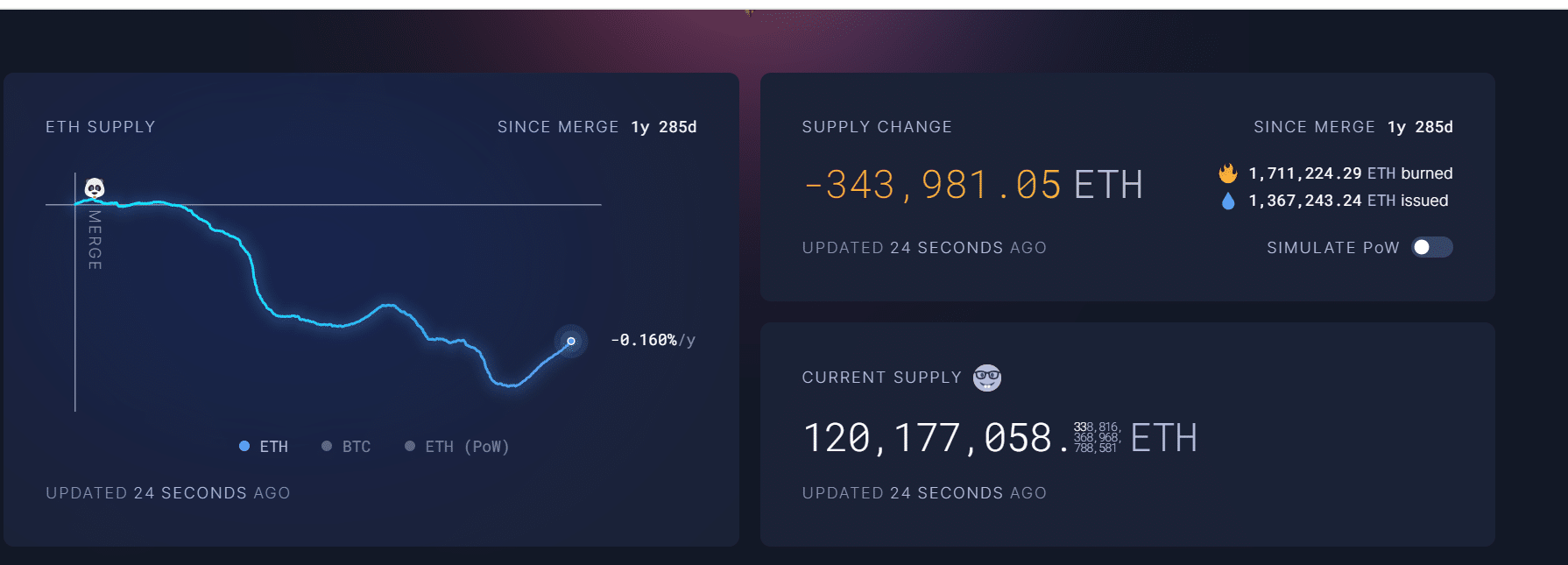

In response to information from Ultrasound Money, the overall provide of ETH has expanded by over 112,000 ETH up to now 4 months.

This enhance in provide is essentially attributed to the results of the improve, which happened on thirteenth March.

Supply: Ultrasound cash

The improve, a part of ETH’s ongoing growth and enchancment protocol, has had a big impression on the community’s financial mannequin.

Ethereum not easing up on burns

Regardless of the current inflationary developments noticed in Ethereum’s provide as a result of improve, the general stability for the reason that implementation of the Merge stays deflationary.

In response to Ultrasound Cash, over 1.7 million ETH have been burned attributable to transaction charges, whereas the overall new provide added for the reason that Merge is over 1.3 million ETH. This ends in a web discount of over 344,000 ETH being faraway from circulation.

The power of this mechanism to outweigh the provision enhance from the improve maintained ETH’s enchantment as a deflationary asset.

Such dynamics are essential for its long-term valuation, because the discount in provide, assuming regular or growing demand, can result in an appreciation in ETH’s market worth and make it a sexy maintain for traders.

Ethereum ETFs imminent

The prospects for the launch of an Ethereum ETF seem extra promising, as highlighted by Bloomberg ETF analyst Eric Balchunas.

He famous that VanEck, a big participant within the ETF market, has taken an important step by submitting an 8-A type for his or her Ethereum Belief on twenty sixth June.

This way is important for firms trying to problem securities on nationwide exchanges, signaling a readiness to proceed with the ETF.

Eric Balchunas identified the strategic timing of this submitting, drawing a parallel to VanEck’s earlier actions with their Bitcoin spot ETF, which was filed precisely seven days earlier than its launch on eleventh January.

This sample means that the ETH ETF could be following the same timeline, probably indicating an imminent launch.

The way it may impression ETH

The introduction of Ethereum ETFs may considerably impression the market dynamics for ETH.

Learn Ethereum (ETH) Value Prediction 2024-25

By facilitating broader and extra regulated entry to ETH for institutional and retail traders, these ETFs may enhance demand for ETH.

This heightened demand, coupled with Ethereum’s present deflationary mechanisms, may take up extra provide and improve Ethereum’s deflationary trajectory.