Ethereum faces key week as election nears – Will $3K be in sight?

- Ethereum might expertise elevated liquidity because the election cycle involves an in depth.

- Nevertheless, numerous elements solid doubt on its rebound potential.

With only a week till the election, the crypto market is poised for heightened liquidity – a possible catalyst for Ethereum [ETH] to interrupt free from its downward stoop. As ETH sits at a positive greed index, this might sign a promising shopping for alternative.

Nevertheless, uncertainty clouds its rebound. If the earlier sample repeats, Solana might as soon as once more capitalize on Bitcoin’s market peaks, because it did not too long ago with 4 days of sturdy day by day positive factors at the same time as BTC pulled again, doubtlessly limiting ETH’s restoration prospects.

In consequence, this weekend might show pivotal, setting the stage for ETH to intention for the $3K mark, offered market situations are favorable.

Ethereum’s core metrics going through strain

This cycle has been significantly difficult for Ethereum. Regardless of a 40% enhance in day by day energetic addresses throughout its mainnet and Layer 2 networks, the ETH worth hasn’t saved tempo, faltering practically 7% after closing at $2.7K only a week in the past.

To compound these points, Ethereum’s community fees have reached their lowest ranges, falling behind opponents like Solana. This creates an extra problem for Ethereum; with such low charges, issues about community safety might come up.

Total, a confluence of things has prevented ETH from capitalizing on Bitcoin’s peaks. Traders are rising more and more unsure about Ethereum’s future, main them to see higher potential in different blockchains.

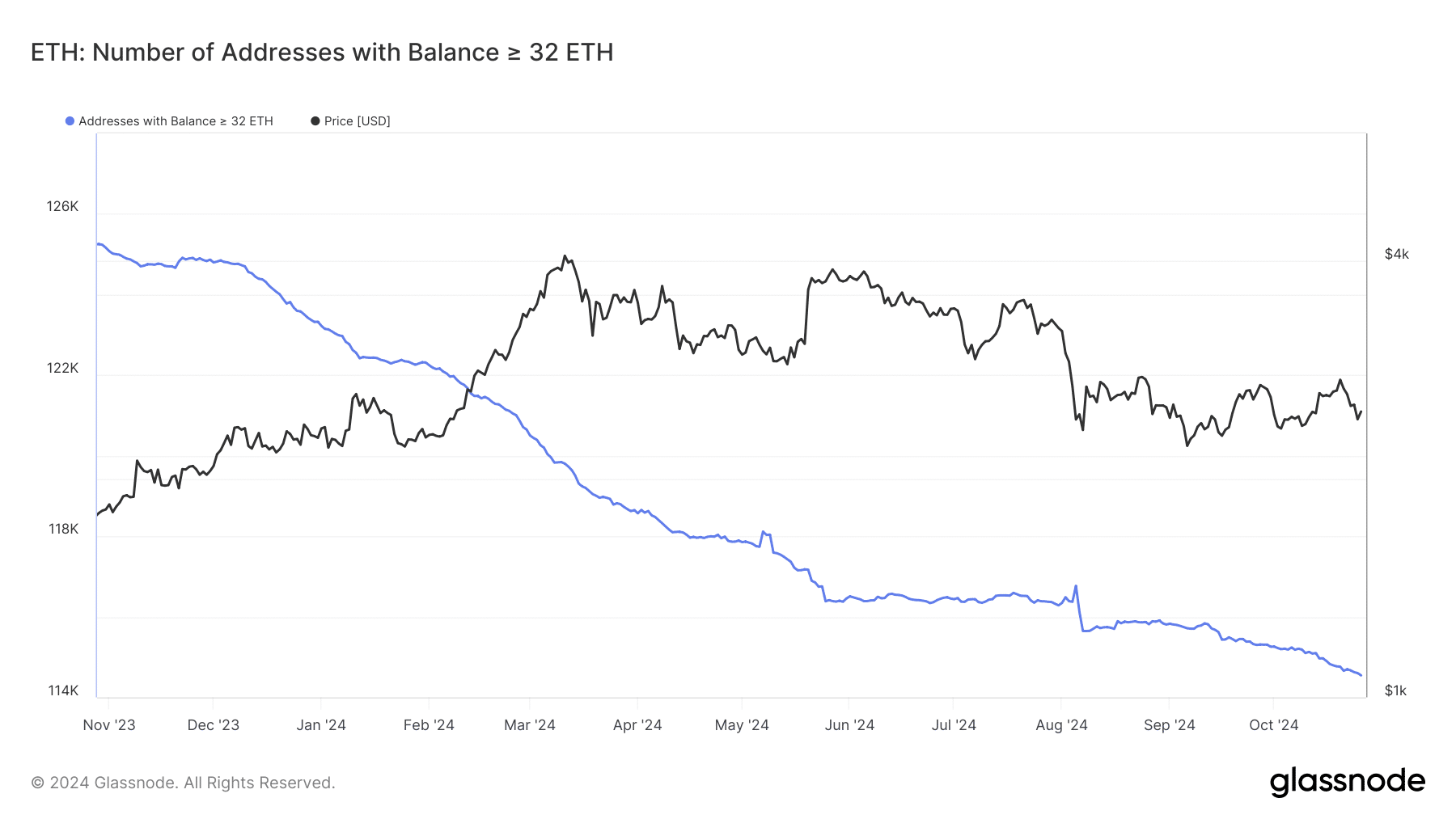

Supply : Glassnode

Including to those challenges, the variety of validators on the Ethereum community has dropped considerably, with staked wallets at a year-low. The proof-of-stake (PoS) consensus mechanism requires a minimal of 32 ETH to stake, and this decline in validators raises issues concerning the community’s total well being.

Delays in transaction validation can result in community congestion, driving customers away. This cycle has seen a notable migration from ETH to SOL, the place Solana’s excessive throughput permits quicker transaction speeds and decrease charges.

This pattern underscores Ethereum’s battle to retain its person base.

Election liquidity received’t be sufficient

If the community doesn’t sort out these challenges, the election buzz might solely yield short-term positive factors for ETH, missing the energy wanted for a real breakout.

Ethereum should revitalize its market dominance, which has severely dwindled within the earlier market cycle, presently sitting at simply 13% – its lowest degree towards Bitcoin since April 2021.

Whereas excessive Bitcoin dominance usually indicators the beginning of an altcoin season, if this pattern doesn’t reverse, ETH might battle to reclaim its main place available in the market.

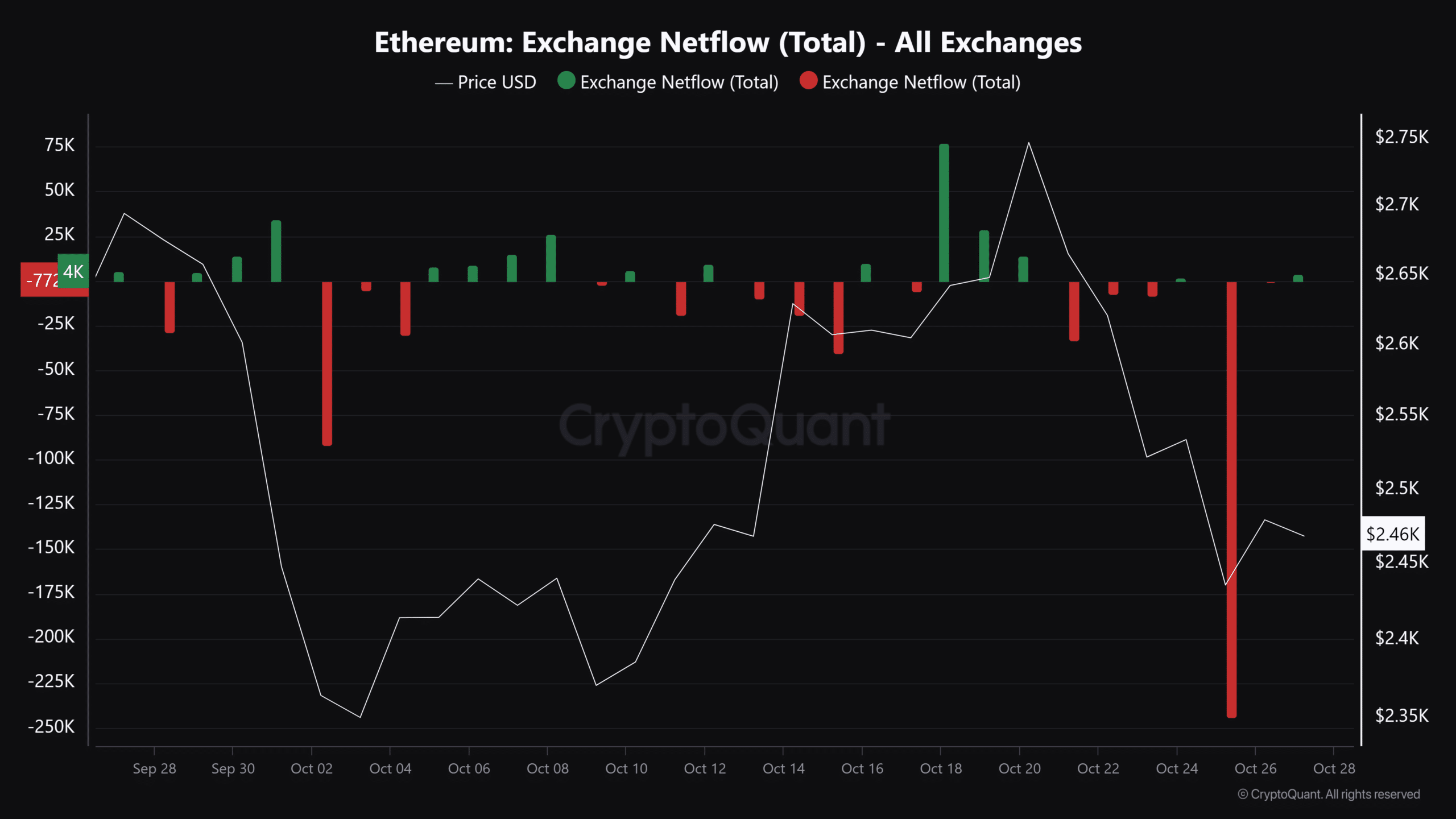

Supply : CryptoQuant

Apparently, a spike in ETH outflows occurred simply two days in the past, with 244,000 ETH withdrawn from exchanges. This implies that traders understand the present worth as a dip, doubtlessly serving to bulls keep the $2.4K help line.

Nevertheless, the impression on the value did not materialize.

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

That stated, because the election approaches its conclusion, there’s a big likelihood that ETH would possibly expertise short-term positive factors. This might assist reverse its present pattern and help bulls in conserving bearish strain in verify.

Nevertheless, the prospects for Ethereum to interrupt out of its stoop stay restricted except it manages to take care of community well being. With out addressing these points, there’s a big danger that the present underperformance might turn out to be a long-lasting pattern, jeopardizing ETH’s market place.