Ethereum faces supply overhang as China eyes $1.3B ETH sale – What now?

- Chinese language authorities have moved 7,000 ETH to exchanges within the final 24 hours.

- These cash are a part of the 542,000 ETH seized from a crypto Ponzi scheme in 2018, which could possibly be dumped out there.

Ethereum [ETH] traded at $2,401 at press time after a virtually 2% value drop in 24 hours. This drop coincided with a bearish sentiment throughout the broader cryptocurrency market, with the Fear and Greed Index plunging to a seven-day low of 39, suggesting that merchants are in a state of concern.

Nonetheless, Ethereum holders have extra to be involved about amid a attainable sell-off of 542,000 ETH, valued at greater than $1.3 billion, by Chinese language authorities.

Ethereum’s “surprising” provide overhang

Based on onchain researcher ErgoBTC, ETH faces an surprising provide overhang after 7,000 ETH was moved to exchanges. These tokens are a part of the 542K ETH seized from the PlusToken crypto ponzi scheme in 2018.

This scheme had accrued greater than 194K Bitcoin [BTC] and 830K ETH by the point of its closure. A lot of the Bitcoin was probably offered between 2019 and 2020. A 3rd of the ETH was later offered in 2021.

The remaining stability of 542,000 ETH was consolidated in a number of addresses in August 2024. Per the researcher, a few of these cash are actually on the transfer.

On ninth October, 15,700 ETH was withdrawn from these addresses, and almost half of it was deposited to the BitGet, Binance, and OKX exchanges.

Based on the researcher, the transfers are following an analogous sample as when the authorities offered Bitcoin in 2020. This locations ETH in a precarious scenario the place promoting stress might enhance considerably within the coming weeks.

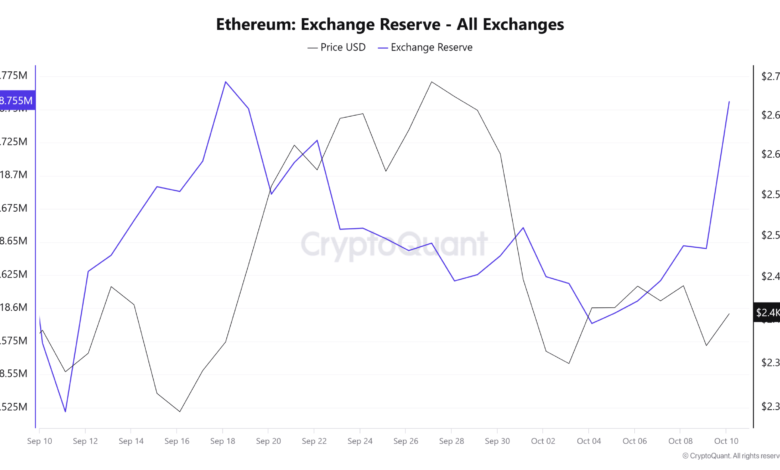

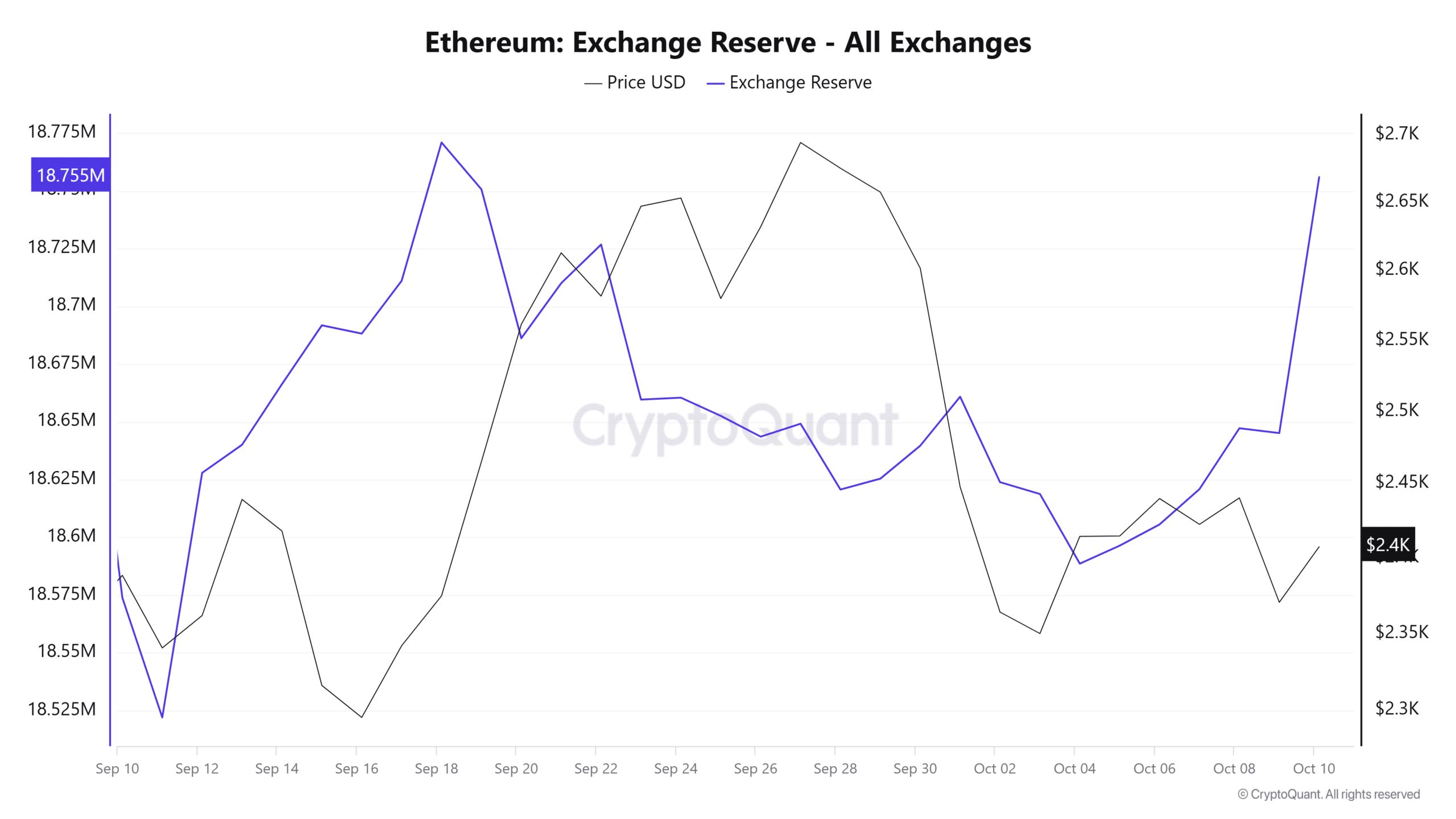

Ethereum trade reserve hit a three-week excessive

These deposits have triggered a surge in Ethereum trade reserves to a three-week excessive as seen on CryptoQuant.

Within the final 24 hours, the full variety of ETH held on exchanges has elevated by greater than 110,000 tokens to achieve the very best degree in three weeks.

Supply: CryptoQuant

This information reveals that many merchants are transferring their cash to exchanges with the intent to promote. Moreover, the very best enhance in reserves occurred on spinoff exchanges. This might lead to a spike in Ethereum’s volatility.

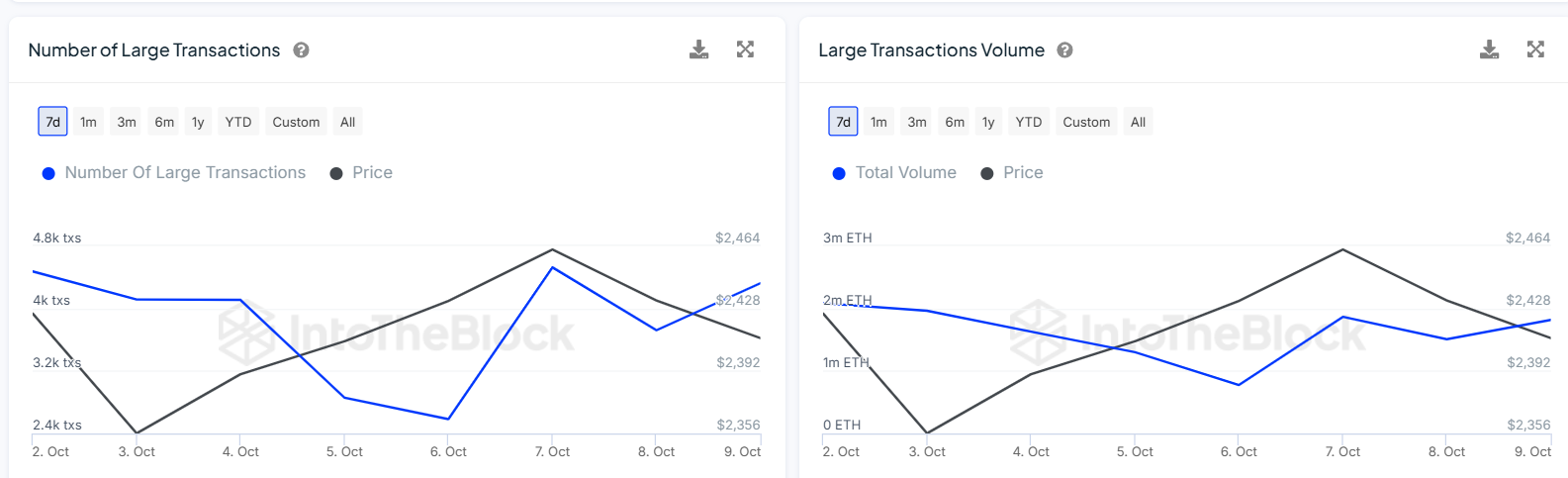

Knowledge from IntoTheBlock additionally reveals a spike in massive transaction volumes suggesting that whale exercise is on the rise. Provided that Ethereum isn’t gaining regardless of an increase in massive transactions, it might recommend that these transactions are on the promote facet and never on the purchase facet.

Supply: IntoTheBlock

Liquidation information reveals that these excessive trade deposits are having a bearish affect on Ethereum. Based on Coinglass, greater than $31 million price of ETH was liquidated within the final 24 hours, with $27M being lengthy liquidations.