Ethereum fees drop drastically – Is low demand the reason?

- Ethereum’s charges have fallen to their lowest stage since 2020.

- With rising provide prior to now few weeks, Ether is again to being inflationary.

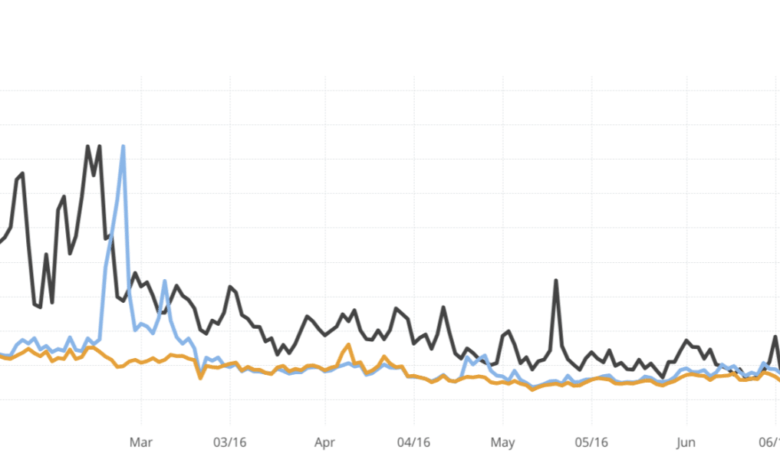

Demand for Ethereum Mainnet [ETH] has been slowing down over the previous few months, driving charges to their lowest stage since April 2020, on-chain knowledge supplier IntoTheBlock famous in a current submit on X (previously Twitter).

Whole Ethereum charges hit their lowest level since April 2020! This lower is pushed by the migration to layer 2s and the reducing utilization of purposes in Mainnet

https://t.co/XAGjJnXoDD pic.twitter.com/liNkrd1B5r

— IntoTheBlock (@intotheblock) October 13, 2023

Is your portfolio inexperienced? Examine the ETH Revenue Calculator

The information supplier additional discovered that in final week’s buying and selling session, the Layer 1 blockchain recorded a mean of 1,380 ETH in day by day transaction charges. By the tip of this weekend, the chain is projected to see just one,190 ETH in day by day common transaction charges, IntoTheBlock added.

These charges have considerably declined, plummeting by 90% from their peak in Could and standing roughly 50% decrease than the figures noticed in October 2022.

Low demand for NFTs and low DeFi exercise

The regular fall in Ethereum’s charges since Could is primarily attributable to the rising disinterest in non-fungible tokens (NFTs) and low exercise throughout the decentralized finance (DeFi) protocols hosted on the blockchain community.

Concerning NFT exercise on Ethereum, this has been overwhelmed down by the final decline in market curiosity in digital collectibles. In accordance with knowledge from CryptoSlam, it recorded a cumulative $1.7 billion in NFT gross sales quantity within the first two months of the yr, logging a month-on-month progress of 39% soar between January and February.

Nonetheless, since February, this has trended downwards. With $143.06 million recorded in September, NFT gross sales quantity on the community has plummeted by 85% within the final 9 months.

Supply: CryptoSlam

A significant indicator of decline in Ethereum’s DeFi vertical is its whole worth locked (TVL). In accordance with knowledge from DefiLlama, Ethereum’s TVL at press time was $21.54 billion.

After rallying to a excessive of $35 billion in April, the community’s TVL has since declined by 40%. On a year-to-date (YTD), Ethereum’s TVL has fallen by over 15%, and the final time it was noticed at its present stage was in January 2021, knowledge from DefiLlama confirmed.

Supply: DefiLlama

Additional, assessing the buying and selling quantity of the decentralized exchanges (DEXes) housed inside Ethereum supplied deeper insights into the decline within the chain’s DeFi ecosystem.

In accordance with knowledge from Artemis, Ethereum’s DEX buying and selling quantity has dwindled for the reason that 11 March peak of $21 billion. With solely $840 million recorded in buying and selling quantity on 12 October, this has fallen by 96% in simply six months.

Practical or not, right here’s ETH’s market cap in BTC phrases

ETH provide climbs as soon as once more

On account of the dwindling on-chain exercise and declining gasoline charges, Ethereum’s provide has as soon as once more change into inflationary. Which means that new Ether tokens are being created and added to the circulating provide, which can put downward strain on the main altcoin’s value.

In accordance with knowledge from Ultrasound.money, ETH’s provide has risen by over 10,000 ETH within the final week alone.

Supply: Ultrasound.cash