Ethereum fees fall by 50%: Are Layer 2s taking over?

- Ethereum charges dropped to its lowest level since October.

- There has additionally been an general decline in charges on L2s.

Ethereum [ETH] has lengthy been recognized for its excessive transaction charges. Nonetheless, there was a latest shift on this development, with the typical price on the community seeing a major decline.

This lower prompted the query of whether or not transaction quantity on the platform has decreased, or if Layer 2 options are absorbing the related charges.

Ethereum’s common charges decline

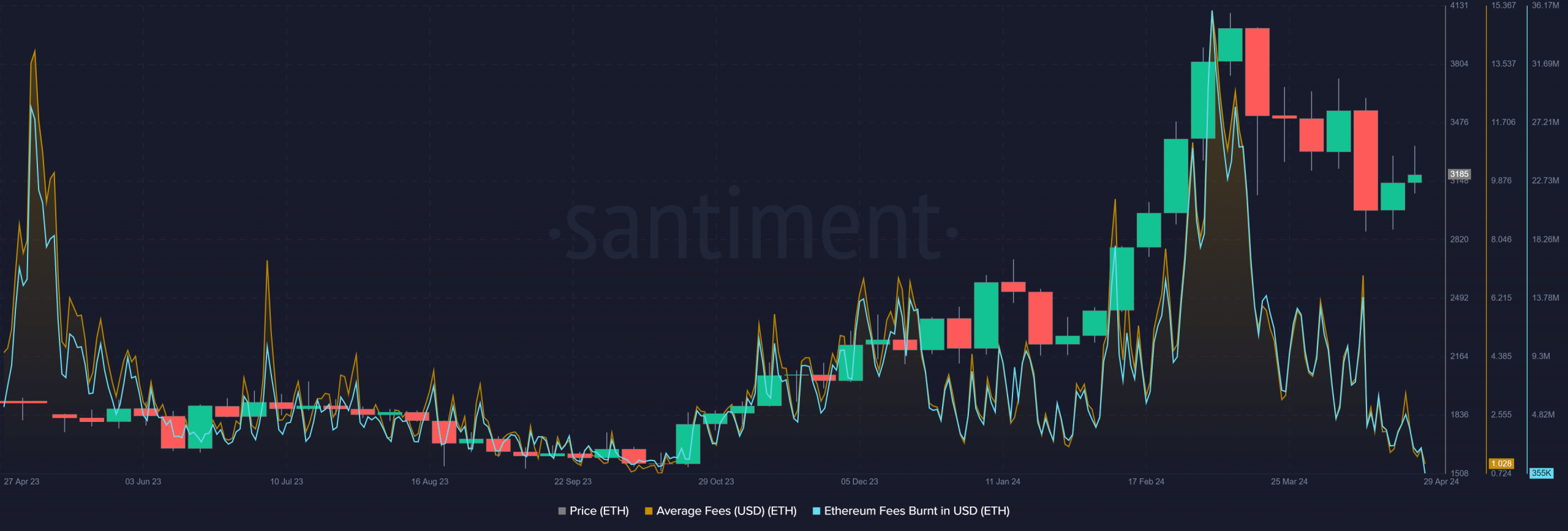

Latest Santiment knowledge indicated a decline in Ethereum charges over the previous few weeks. As of the twenty eighth of April, common charges on the community had dropped to roughly $1.28, marking the bottom level since October 2023.

Subsequently, on the time of this writing, the typical price had decreased even additional to round $1.02.

Supply: Santiment

Concurrently, there was a discount within the quantity of ETH charges burned.

On the time of this writing, the chart evaluation revealed that the burnt price has declined to its lowest stage in months, hovering round $355,000.

Comparatively, simply in March, the typical price exceeded $15, with burnt charges totaling over $35 million.

Moreover, AMBCrypto’s examination of the price development on Crypto Fees revealed a noticeable decline in Ethereum charges over latest weeks.

As of press time, the general community price stood at roughly $3.3 million.

Evaluating this determine to earlier weeks, it was evident that charges have halved.

This corroborated the findings from Santiment’s knowledge, which instructed that such price fluctuations sometimes correlate with market cycles, rising throughout value peaks and falling throughout market downturns.

Moreover, the decline is commonly attributed to a lower in community transactions.

Are L2s taking the Ethereum transactions and charges?

The latest Ethereum improve facilitated a discount in charges on Layer 2 options (L2s), resulting in a rise in transaction quantity.

Examination of consumer numbers on L2s revealed development over the previous few months, surpassing 4 million customers at current.

Nonetheless, an in depth evaluation of Develop the Pie indicated that the variety of energetic addresses throughout main L2s is beneath 2 million.

AMBCrypto’s evaluation additionally confirmed a decline in transaction rely, which was round 6.3 million.

Moreover, an evaluation of fees on L2 platforms revealed a major lower during the last 30 days, with whole charges amounting to lower than $1 million.

This implies that regardless of the rising variety of customers, the lower in energetic customers and charges indicated a discount in transactions.

The general decline could pave the way in which for a rise as soon as the worth of Ethereum begins to rise.

ETH sees a weak begin to the week

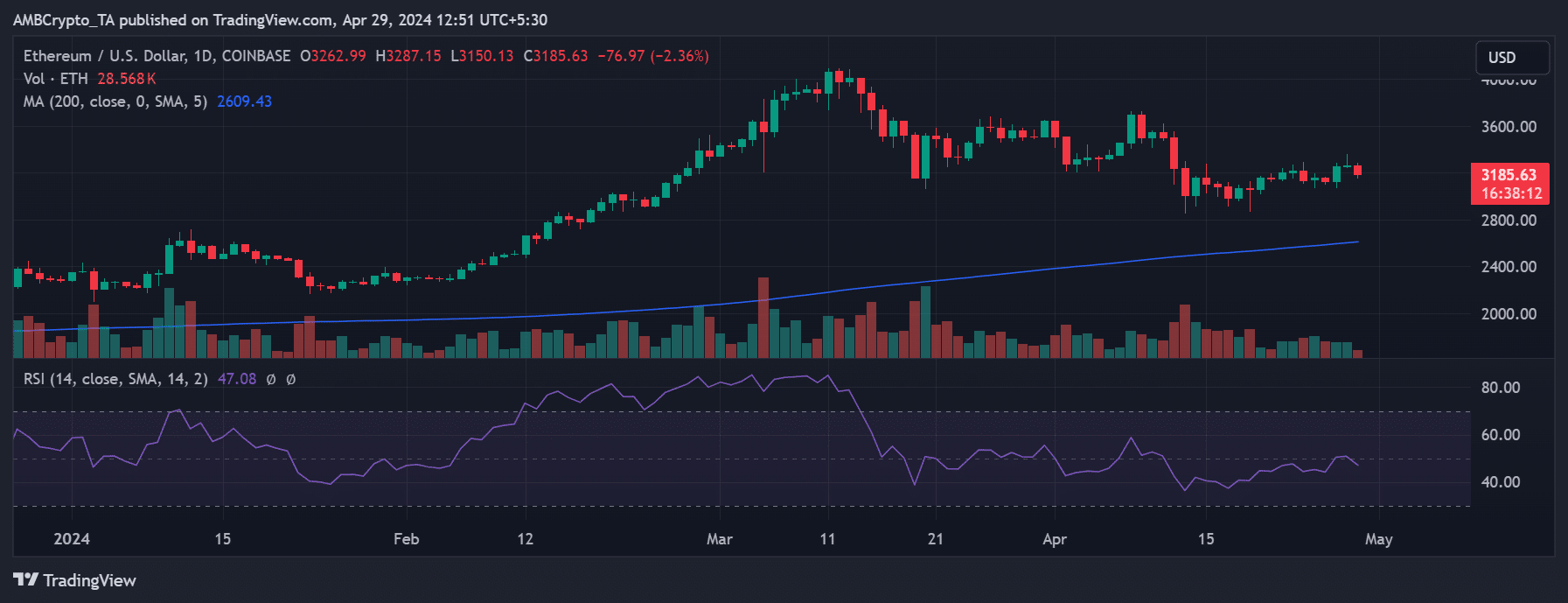

AMBCrypto’s evaluation of Ethereum’s value chart indicated that it has largely remained throughout the $3,000 value vary in latest days.

Whereas it briefly touched the $4,000 mark in March, it has since retreated from that stage. Additionally, there was a interval in April when it dipped beneath the $3,000 threshold.

Notably, the top of the earlier week noticed a major uptick, with a 3.93% improve pushing its value to round $3,253.

Supply: TradingView

Though it maintained a optimistic development on the twenty eighth of April, the rise was much less pronounced, hovering round 1% and buying and selling at roughly $3,262.

Learn Ethereum’s [ETH] Value Prediction 2024-25

Nonetheless, as of the present writing, it has skilled a decline of over 2%, buying and selling at round $3,180.

Given the noticed development in charges, there are indications that merchants anticipate a forthcoming value improve for Ethereum.