Ethereum fees plunge since Dencun, but the reason is not what you think

- Day by day charges on Ethereum have dropped by 4 instances since Dencun.

- Decrease charges decreased deflationary stress on Ether.

The recently-activated Dencun Improve made Ethereum [ETH] scaling options far more inexpensive to make use of, in some instances slashing transaction charges by as a lot as 90%.

However whereas a lot of the hype has centered round value benefits on layer-2 (L2s) as they’re popularly referred to as, the bottom layer was additionally gave the impression to be reaping the advantages of the essential technological change.

Ethereum every day payment income declines sharply

In keeping with X (previously Twitter) consumer David Alexander II, fuel charges on the mainnet have sharply dipped since Dencun’s execution on the 14th of March, with the every day transaction rely remaining roughly the identical.

Notably, Ethereum dealt with a mean of 1.23 million every day transactions previous to Dencun, accumulating a mean every day charges round $28.7 million.

At present, the transaction rely stays the identical, however the charges have tumbled to as little as $7.7 million.

Supply: Nansen

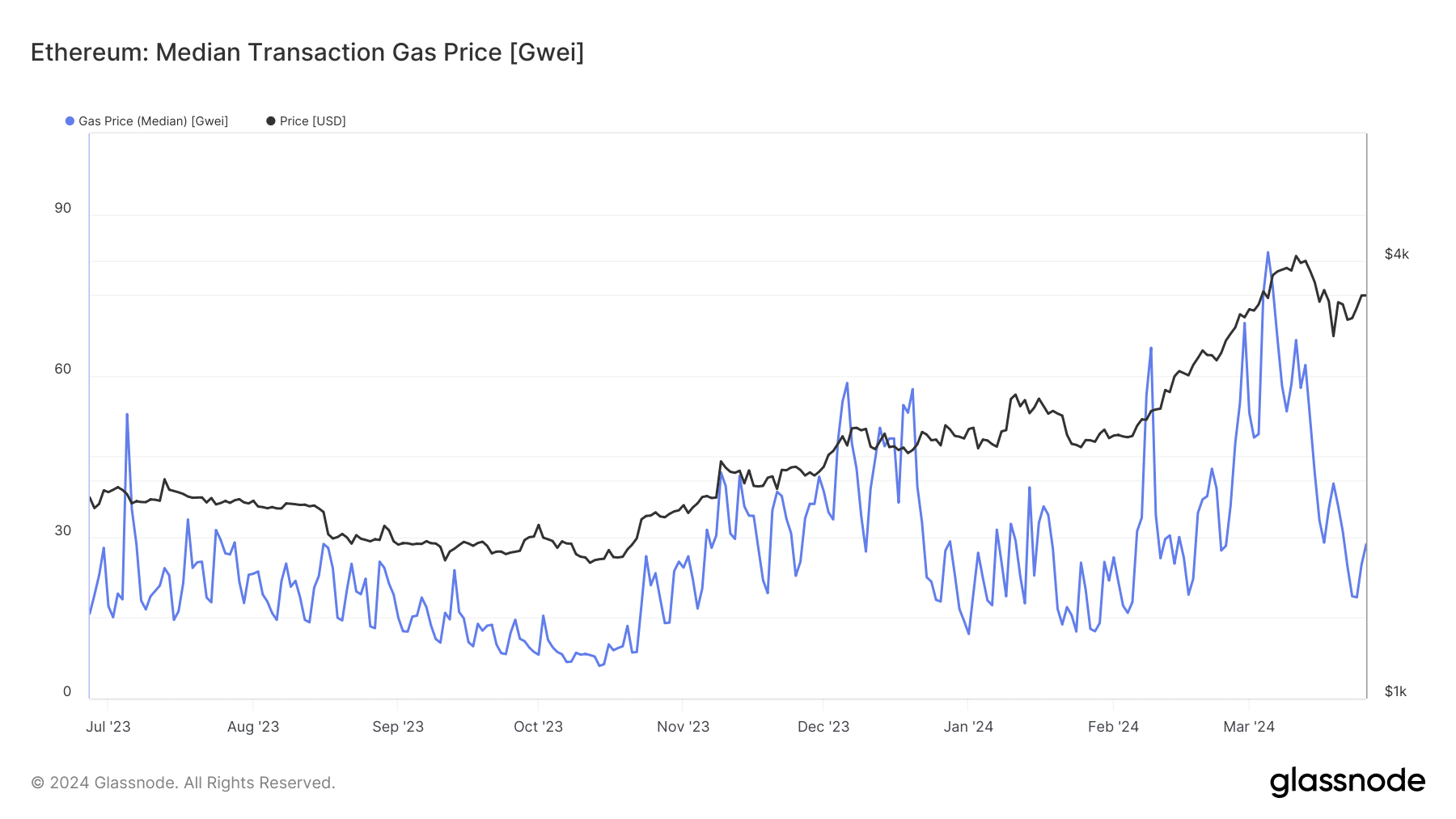

AMBCrypto investigated additional utilizing Glassnode information and noticed a pointy drop in common charges paid per transaction on Ethereum up to now two weeks.

Supply: Glassnode

Fading meme coin mania to even be blamed

Whereas Dencun might have not directly aided in decreasing charges on Ethereum, it was vital to acknowledge that one of many foremost causes behind the hunch was the waning memecoin frenzy, as AMBCrypto reported beforehand.

The charges remained excessive in early March, when Ethereum-based meme tokens like Pepe [PEPE] and Shiba Inu [SHIB] surged in worth.

Nonetheless, because the month progressed, merchants turned to Solana [SOL] looking for larger returns from the swarm of meme cash issued through pre-sales.

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

ETH’s deflation fee slows down

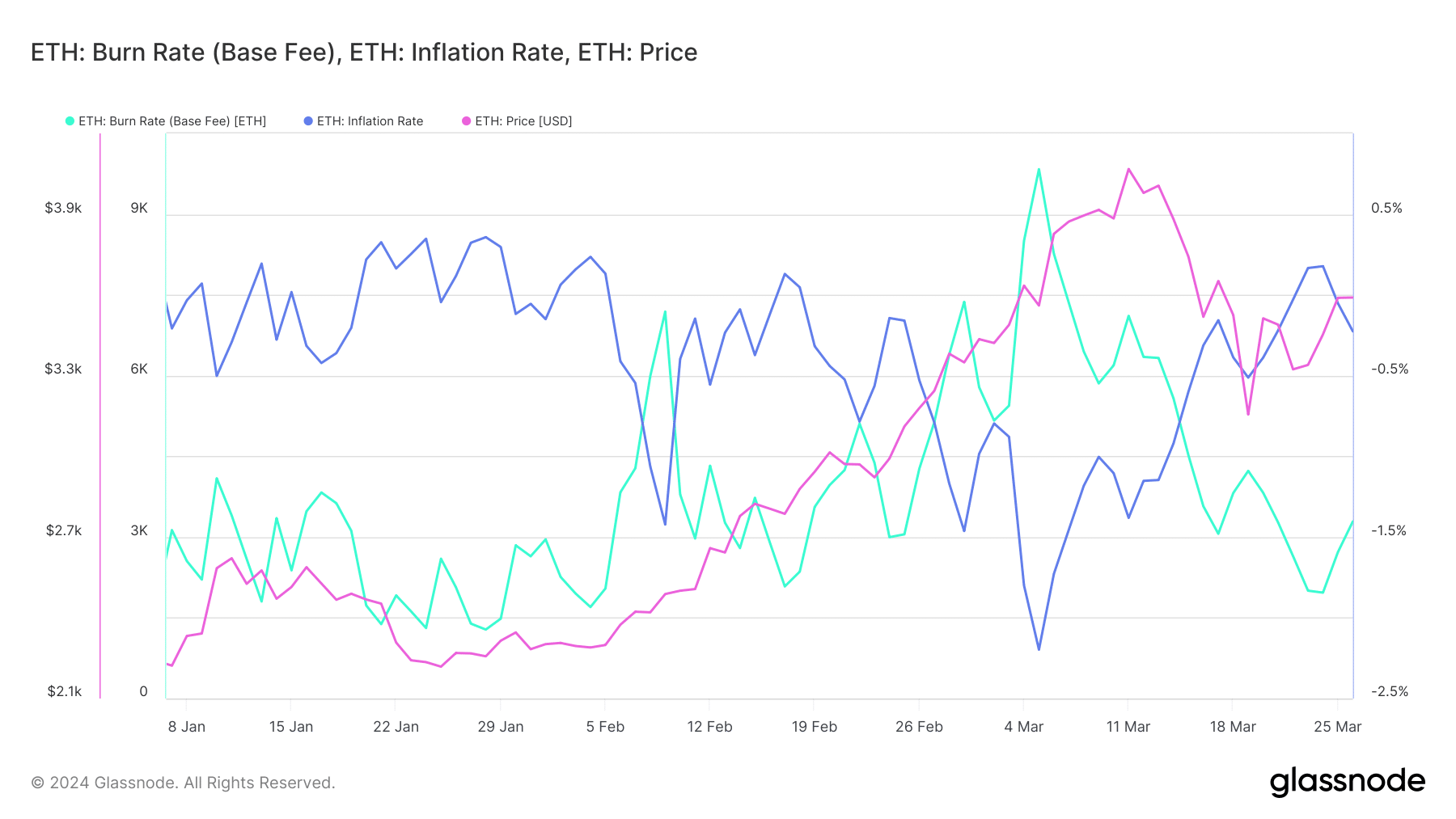

As charges on Ethereum mainnet dipped, the speed at which ETH cash have been exiting provide slowed down.

Be aware {that a} set quantity of ETH is burned for every transaction. This corresponds to the minimal quantity required for a transaction to be thought-about legitimate, i.e., base payment.

As evident, the burn fee dropped sharply in latest weeks, pushing the inflation fee up. The drop in deflationary stress seemingly had a task to play in ETH’s 12% drop since Dencun.

Supply: Glassnode