- Bitcoin’s short-term holders present restraint, lowering promoting strain and signaling potential for secure progress.

- With much less speculative capital, Bitcoin’s market is changing into extra resilient, indicating decreased draw back volatility.

Bitcoin [BTC] is navigating risky situations, with a notable shift amongst short-term holders (STHs), who now management 40% of the community’s wealth.

Regardless of latest losses, these sometimes reactive sellers are displaying restraint, lowering promoting strain.

Whereas that is far under previous peaks, the place new investor wealth reached 70-90%, it indicators a extra balanced, tempered bull market.

This shift suggests a possible turning level for Bitcoin, with much less draw back volatility, paving the best way for stability and progress.

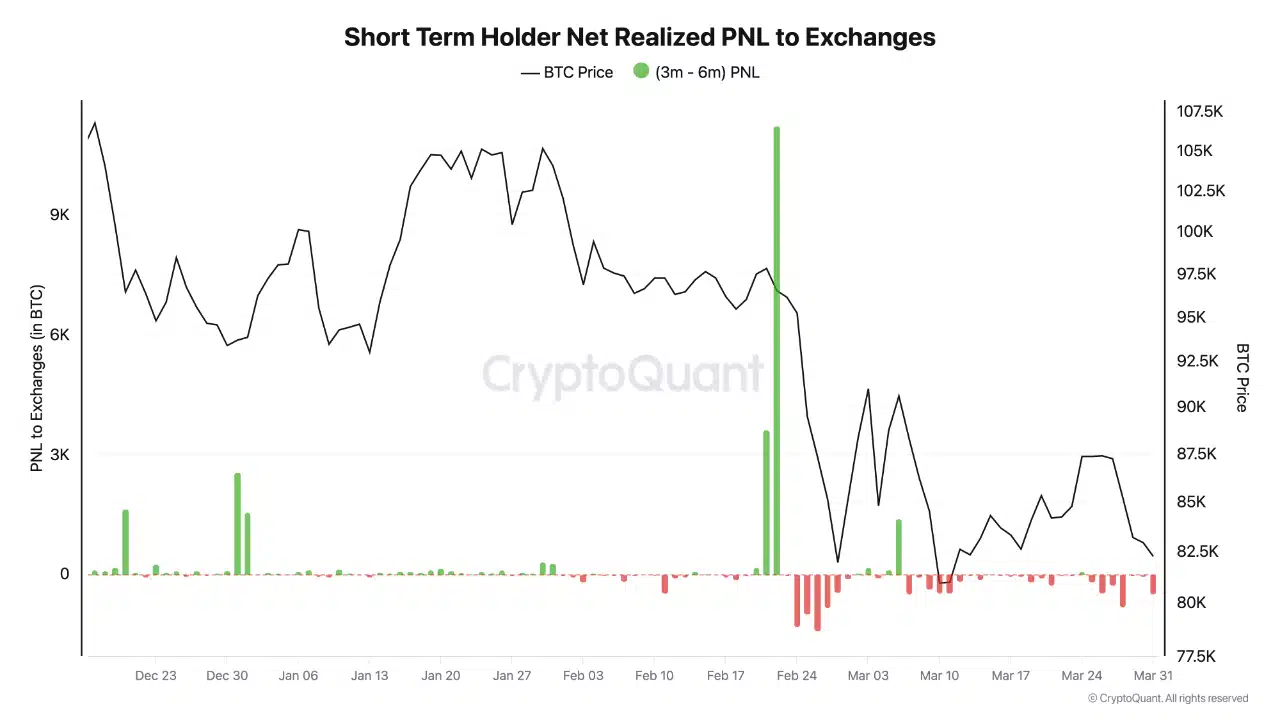

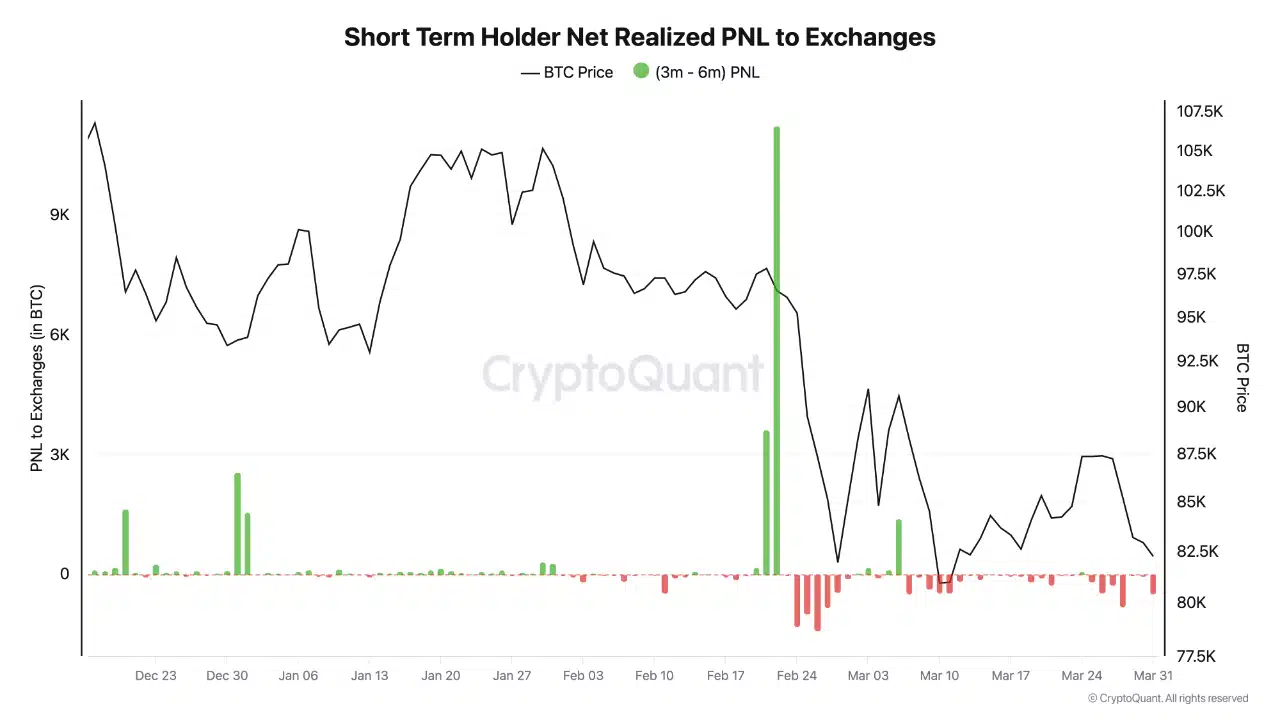

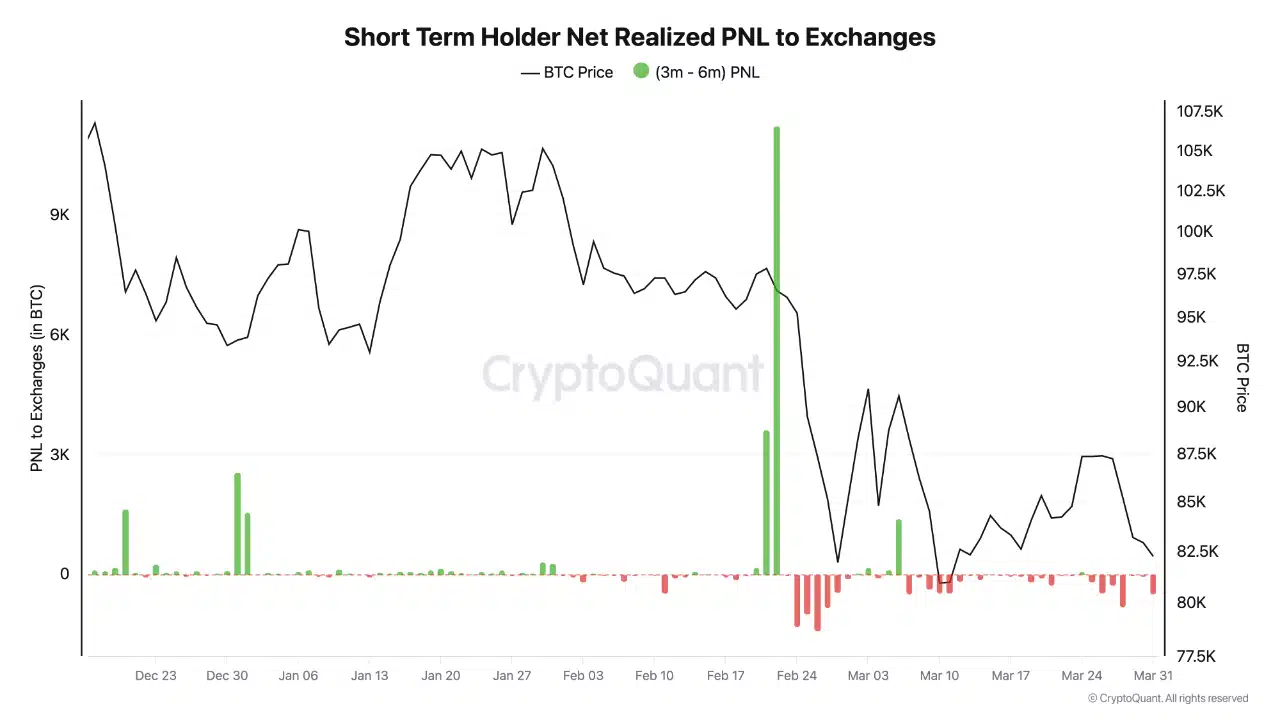

Brief-term holder realized PNL tendencies

Supply: Cryptoquant

The data illustrates the web realized revenue and loss (PNL) of STHs sending Bitcoin to exchanges, set in opposition to BTC’s value actions.

Notably, massive spikes in inexperienced bars (profit-taking) are seen in late December and mid-February, indicating moments of heightened promoting exercise.

Nevertheless, as Bitcoin’s value declined from its peak, the pink bars (loss realization) grew extra frequent, notably from late February to early March.

This shift signifies elevated promoting at a loss, suggesting capitulation amongst some STHs.

Apparently, promoting strain has since eased, with fewer excessive spikes in both path.

This development implies rising market resilience, as STHs seem much less reactive, doubtlessly stabilizing value fluctuations and lowering draw back volatility within the close to time period.

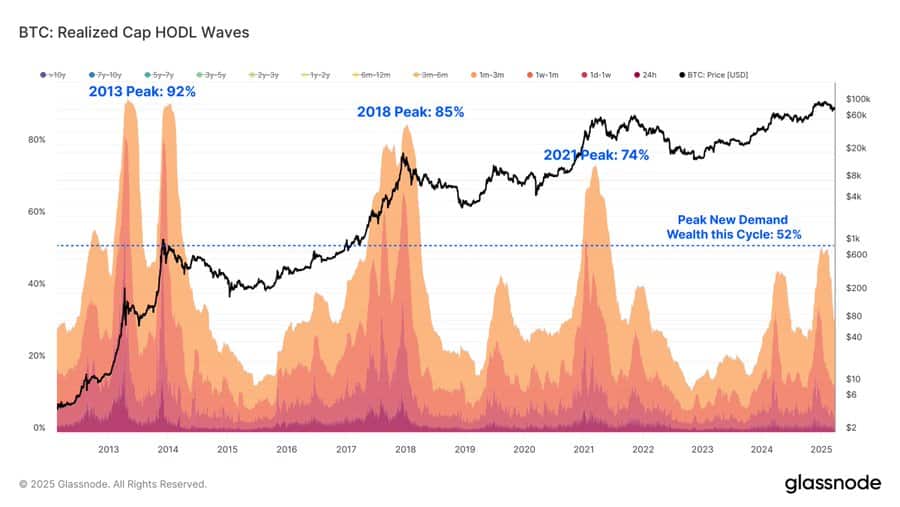

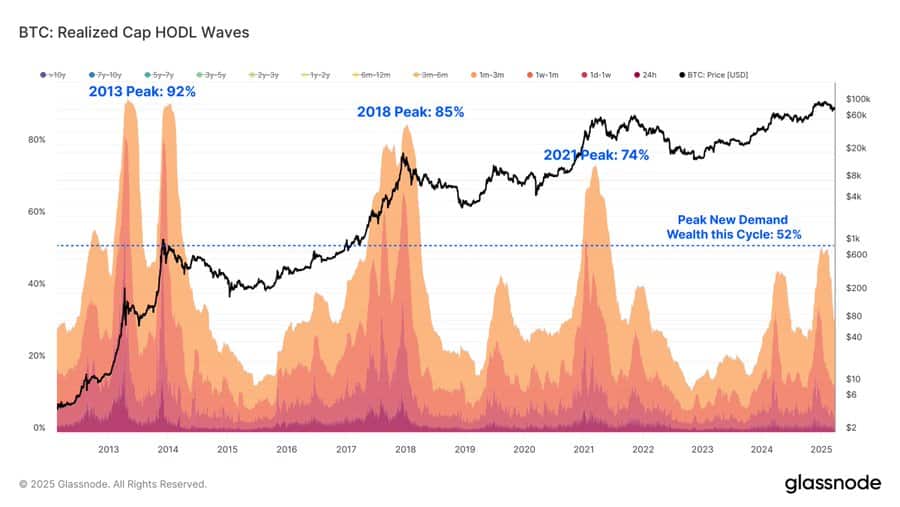

This shift in short-term holder habits aligns with a broader development seen throughout Bitcoin’s market cycles, the place new investor wealth has performed a diminishing position in every successive peak.

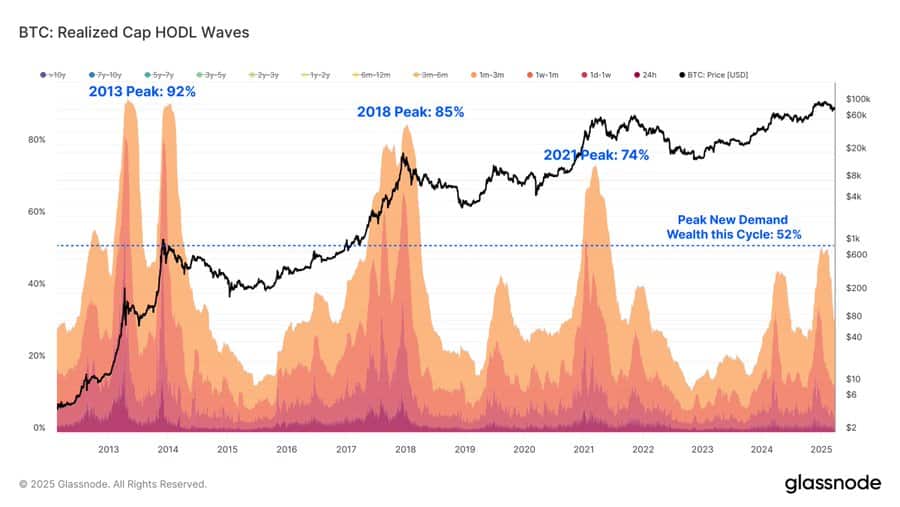

A extra evenly distributed market cycle

Supply: Glassnode

In earlier bull cycles, STHs controlled 70-90% of the community’s wealth at peak demand, as seen in 2013 (92%), 2018 (85%), and 2021 (74%).

Nevertheless, within the present cycle, this determine has solely reached 52%, reflecting a extra balanced distribution of BTC possession.

This implies that LTHs are sustaining stronger conviction, lowering the dominance of speculative capital. With fewer newcomers driving excessive volatility, Bitcoin’s market construction seems extra resilient.

What does this imply for BTC’s future?

The easing promoting strain from short-term holders suggests Bitcoin’s value might expertise decreased volatility, fostering a extra secure uptrend.

With long-term holders sustaining a dominant share, the market construction seems much less reliant on speculative surges, reinforcing sustainability.

Supply: TradingView

BTC is hovering close to $84K, with RSI at 46.93 — indicating impartial momentum.

If shopping for strain strengthens, BTC might regain bullish momentum; in any other case, consolidation or minor pullbacks might proceed. Total, this shift hints at a maturing market, the place excessive value swings are much less frequent.

Subsequent: U.S. debt disaster might catapult Bitcoin to world dominance, BlackRock CEO warns

Source link