Ethereum Pectra Devnet nears launch: Will ETH climb higher?

- Builders continued to work on Plectra improve for the Ethereum community.

- Modifications in staking rewards have been mentioned to mitigate centralization and different dangers to the community.

Aside from the market restoration, the growing consideration round Ethereum [ETH] has helped it soar over the previous few days. The upcoming Plectra replace might additional assist Ethereum see inexperienced.

Builders proceed with their work

Within the 137th All Core Developers Consensus (ACDC) name, the first focus was on the progress of two testnets, Pectra Devnet 1 and PeerDAS Devnet 1.

Pectra Devnet 1 is nearing its launch, with each Consensus Layer (CL) and Execution Layer (EL) shoppers ready. The Ethereum Basis DevOps crew is rigorously testing varied shopper combos to make sure compatibility and stability.

PeerDAS Devnet 1 is presently present process bug fixes earlier than its deliberate relaunch. As soon as these points are resolved, the devnet is anticipated to be restarted by the top of the week.

Along with testnet updates, the decision additionally coated analysis on fork selection testing by the TxRX crew at Consensys. Their newly developed take a look at generator goals to determine potential bugs and deviations in shopper software program from CL specs.

The profitable launch of Pectra Devnet 1 is a major step in direction of the Pectra improve, which is anticipated to introduce a number of enhancements to the Ethereum community.

The continued growth of the fork selection take a look at generator is essential for enhancing the reliability and safety of the Ethereum ecosystem.

New modifications for stakers

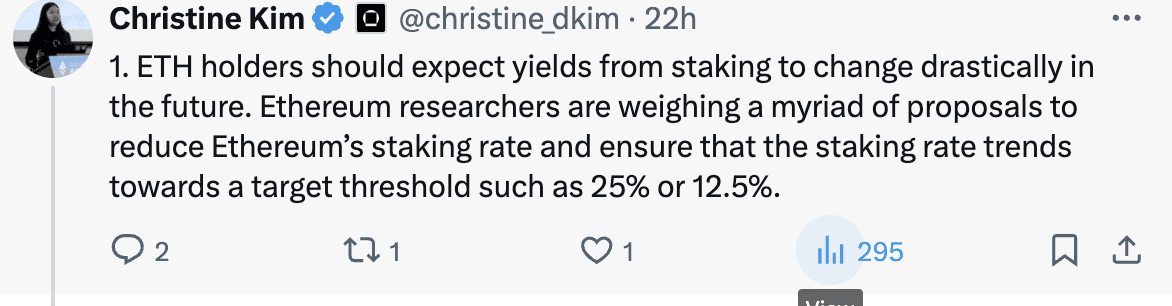

Moreover, Ethereum can be contemplating adjusting its staking rewards to take care of a decrease staking fee, probably round 25% or 12.5%.

This transformation might have a considerable affect on the returns ETH holders obtain from staking. The Ethereum Basis is exploring this feature to deal with a number of considerations.

A decrease staking fee is seen as a method to mitigate the danger of centralization, the place a good portion of ETH turns into concentrated in a couple of massive staking swimming pools.

This centralization might probably threaten the community’s safety and decentralization.

Moreover, a decrease staking fee may cut back the probability of a mass slashing occasion resulting in a sequence break up, a situation the place ETH holders may strain the protocol to revive misplaced funds.

Supply: X

How is ETH doing?

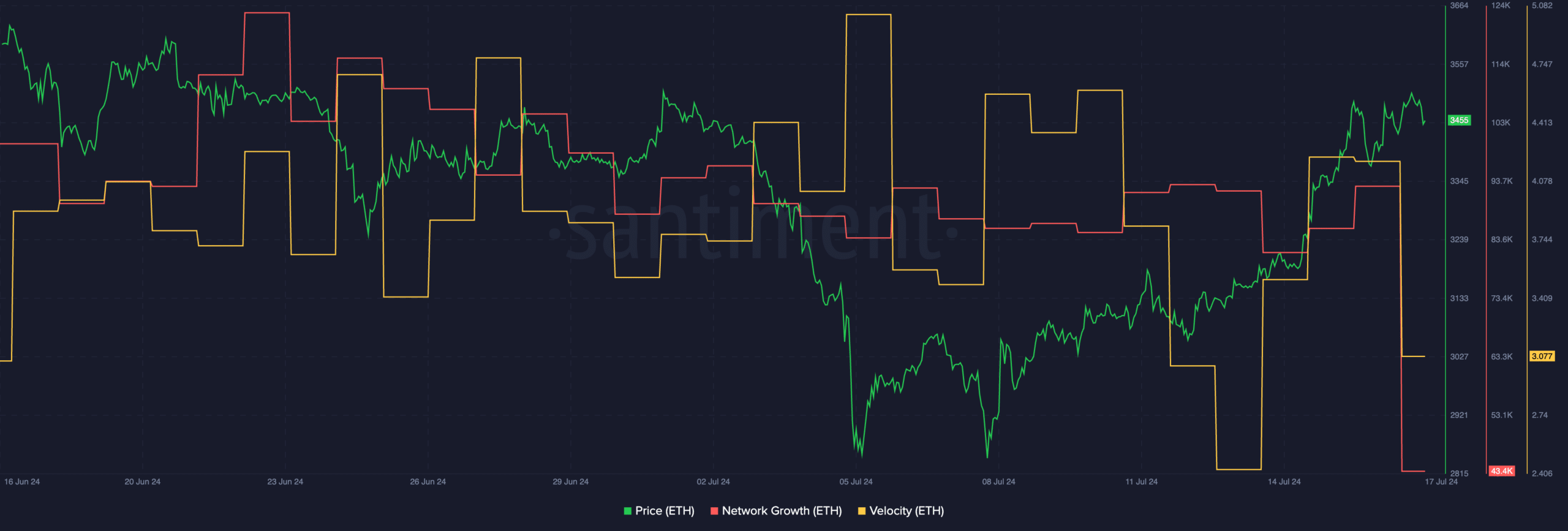

At press time, ETH was buying and selling at $3,455.17 and its value had grown by 1.16% within the final 24 hours. Regardless of the current surge in value, the community development for the Ethereum token had declined, suggesting that new addresses have been slowly shedding curiosity within the ETH token.

Learn Ethereum’s [ETH] Value Prediction 2024-25

Furthermore, the rate at which ETH was buying and selling at had additionally fallen considerably, implying that the frequency at which ETH was buying and selling at had additionally fallen.

If these tendencies proceed, ETH’s possibilities of rallying additional would diminish even additional.

Supply: Santiment