Ethereum Futures can tell you this about ETH prices in February

- Ethereum’s futures month-to-month quantity rose to a three-year excessive on the Chicago Mercantile Change Group in January.

- Open curiosity on the trade additionally registered a brand new excessive in January.

- Key volatility markers confirmed that the coin remained susceptible to cost swings.

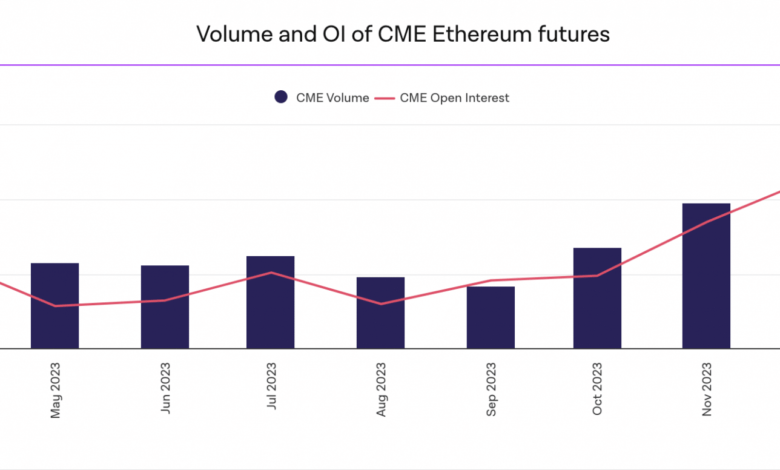

Ethereum’s [ETH] futures month-to-month quantity on derivatives market Chicago Mercantile Change Group (CME Group) closed January at a 26-month excessive, information from The Block’s information dashboard confirmed.

CME Group is among the world’s largest derivatives marketplaces, with over 120,000 lively customers unfold throughout 60 international locations. The buying and selling exercise on the trade is noteworthy because it enjoys patronage from many institutional buyers, one in every of which is BlackRock.

In line with information from The Block, ETH futures buying and selling quantity on the trade totaled $24.34 billion in January, marking a 16% surge from December’s $21.13 billion.

Aside from the buying and selling quantity that climbed to a multi-month excessive on the trade, ETH’s open curiosity additionally registered a major uptick in January. Per The Block’s information, ETH’s open curiosity on CME Group in January was $732 million, its highest since January 2022.

Supply: The Block

Whereas ETH’s value rose briefly post-ETF approval in January, it spent the remainder of the month declining and lingering inside a slim vary. At press time, the coin exchanged palms at $2317, going through resistance on the $2370 value degree.

Regardless of its sideways motion for many of January, ETH’s futures open curiosity on one of many largest derivatives exchanges climbed by 11% throughout that interval.

Though the month noticed some profit-taking exercise, funding charges throughout exchanges remained optimistic. This urged that regardless of ETH’s value consolidation inside a slim vary, buyers continued to open commerce positions in favor of a value rally.

Danger of value swings on a wider time-frame

An evaluation of ETH’s value motion on a weekly chart revealed the potential for a value swing.

Supply: TradingView

For instance, the hole between the higher and decrease bands of the coin’s Bollinger Bands (BB) indicator has progressively widened because the yr started.

How a lot are 1,10,100 ETHs value in the present day?

When this hole widens on this method, it alerts a rise in value volatility. Confirming the risky nature of ETH’s market, the worth of the coin’s Bollinger Bandwidth has additionally risen because the yr began.

Additional, the coin’s Common True Vary -which measures market volatility by calculating the common vary between excessive and low costs over a specified variety of durations – has climbed by 23% because the starting of the yr.