Ethereum Gains Momentum as Analysts Confirm Altcoin Season Is Officially Here

- Ethereum’s worth surge and transaction velocity sign the beginning of an altcoin season, as per analysts.

- Chainlink exhibits sturdy development with rising energetic addresses and open curiosity, indicating bullish sentiment.

Ethereum [ETH] has just lately demonstrated its power because the second-largest cryptocurrency by market capitalization, seeing notable beneficial properties. Over the previous 24 hours, ETH surged by practically 10%, reaching a buying and selling worth of $3,374 on the time of writing.

Whereas it stays roughly 30% beneath its all-time excessive of $4,878 recorded in 2021, the latest rally indicators potential bullish exercise within the broader altcoin market.

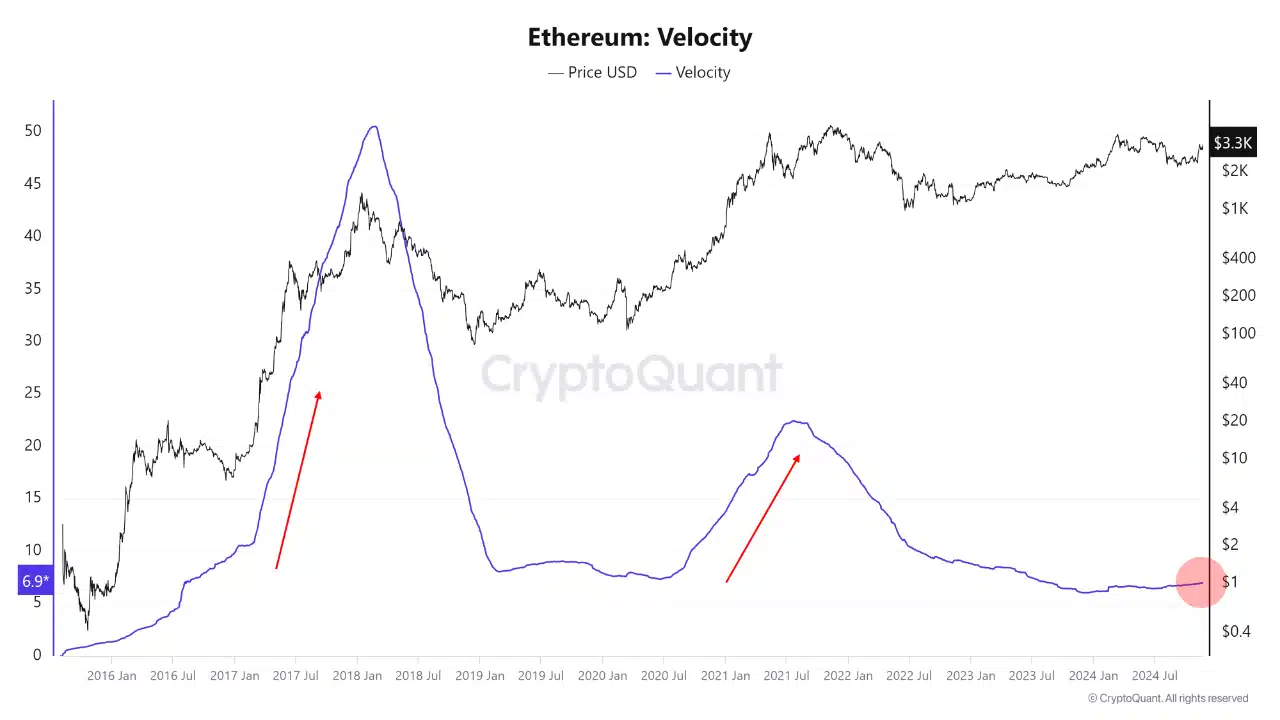

Amid this efficiency, CryptoQuant analyst Mac.D highlighted the start of an altcoin season in a submit on the QuickTake platform. The analyst pointed to Ethereum’s circulating velocity and transaction development as indicators of this rally.

Altcoin season begins

Velocity, which measures how shortly cash flow into out there by dividing the annual coin motion by the whole provide, has traditionally risen throughout altcoin market rallies.

Supply: CryptoQuant

Regardless of at present low velocity ranges of roughly seven occasions the whole provide, Ethereum’s position as a main collateral asset for institutional traders is poised to play a pivotal position.

The analyst emphasised {that a} rise in ETH’s worth might stimulate DeFi liquidity and make sure the onset of an altcoin season.

Ethereum’s latest beneficial properties come within the context of a broader narrative. Whereas Bitcoin has outpaced Ethereum in latest rallies, Ethereum’s position as a spine for DeFi and a best choice for institutional collateral positions it for substantial affect.

Nevertheless, challenges comparable to competitors from quicker and cheaper blockchain networks like Solana, Tron, and Aptos spotlight the hurdles Ethereum should overcome. But, as Ethereum’s transaction development and velocity enhance, it’s anticipated to drive liquidity creation, benefiting the altcoin ecosystem.

LINK as a case research

A better take a look at one of many distinguished altcoins, Chainlink, helps the altcoin season thesis. LINK has recorded a 16.6% improve up to now week, bringing its buying and selling worth to $15.26.

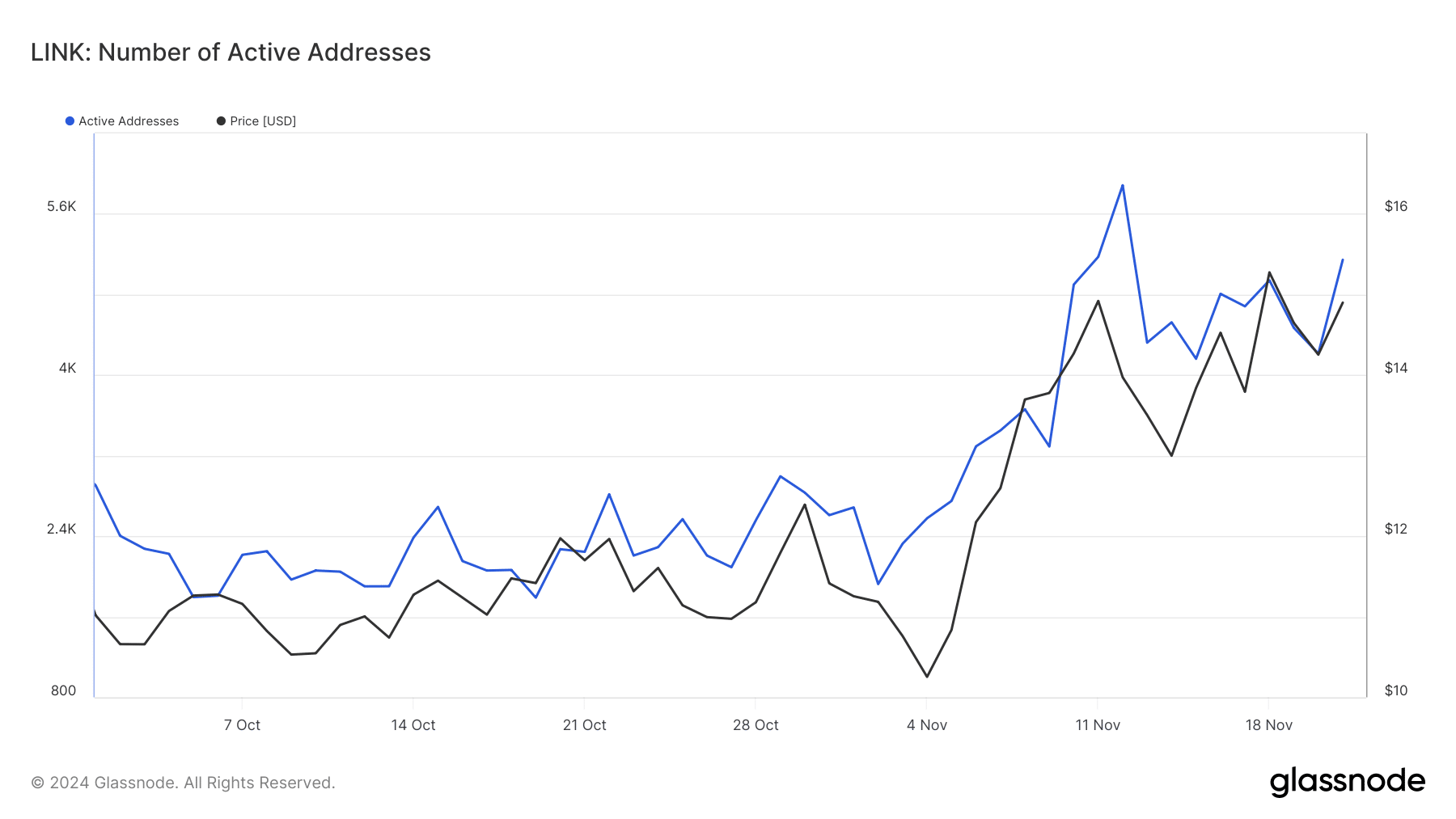

This development aligns with Ethereum’s rising exercise and suggests broader altcoin momentum. Key metrics bolster this case: LINK’s energetic addresses—a measure of retail curiosity—have surged, rising from beneath 2,000 in October to over 5,000 by twenty first November, in line with Glassnode.

Supply: Glassnode

Learn Ethereum’s [ETH] Value Prediction 2024–2025

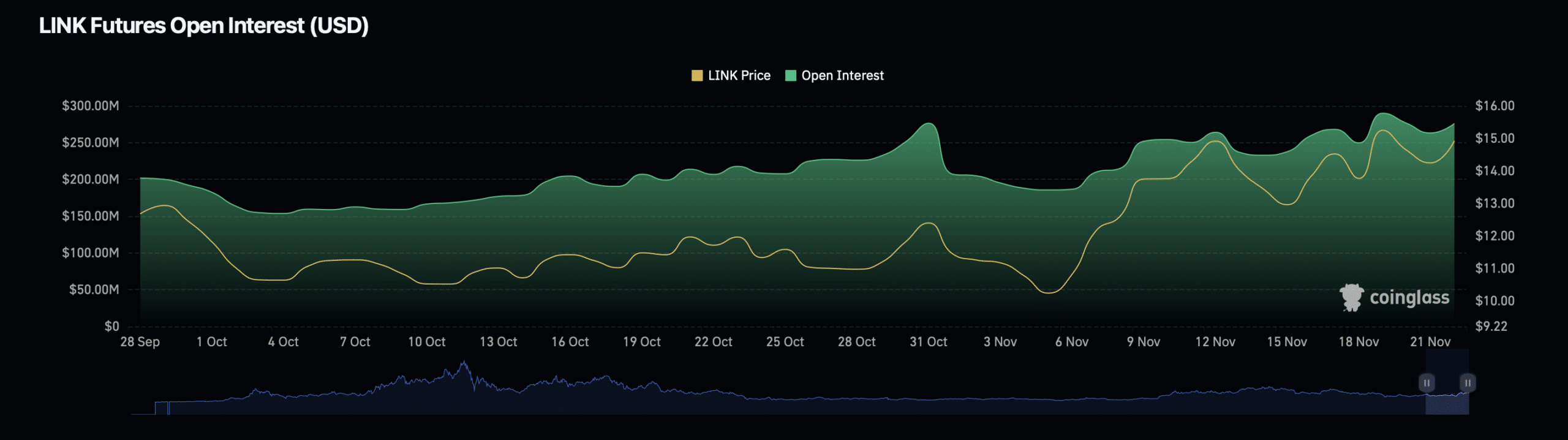

Additional strengthening the argument for an altcoin season, Chainlink’s derivatives data additionally exhibits bullish indicators. Knowledge from Coinglass signifies a 7.76% improve in LINK’s open curiosity, now valued at $294.88 million.

Supply: Coinglass

Moreover, LINK’s open curiosity quantity has risen by 0.86%, reaching $726.97 million. These metrics counsel heightened investor exercise and confidence in LINK’s near-term efficiency.