Ethereum gas fees tank to 5-year lows: What’s behind the drop?

- Ethereum mainnet gasoline charges drop amid low community demand.

- We assess the function of Ethereum layer 2s within the declining gasoline charges and decongesting the mainnet.

Ethereum [ETH] has had fairly the status over time for having costly transaction charges, a scenario that has pushed many customers to layer 2 networks.

However, latest findings reveal that Ethereum gasoline charges have been declining.

Excessive gasoline charges on the Ethereum community have been a limiting issue, discouraging many from collaborating in DeFi inside the mainnet.

Nonetheless, latest findings revealed that gasoline charges just lately dropped to their lowest levels within the final 5 years.

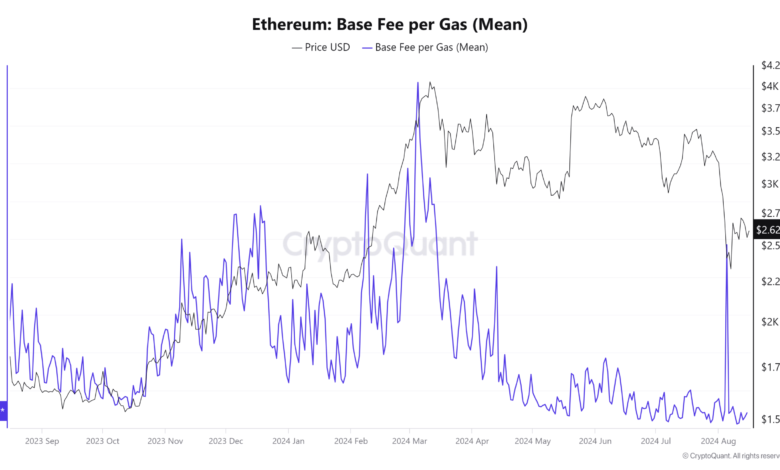

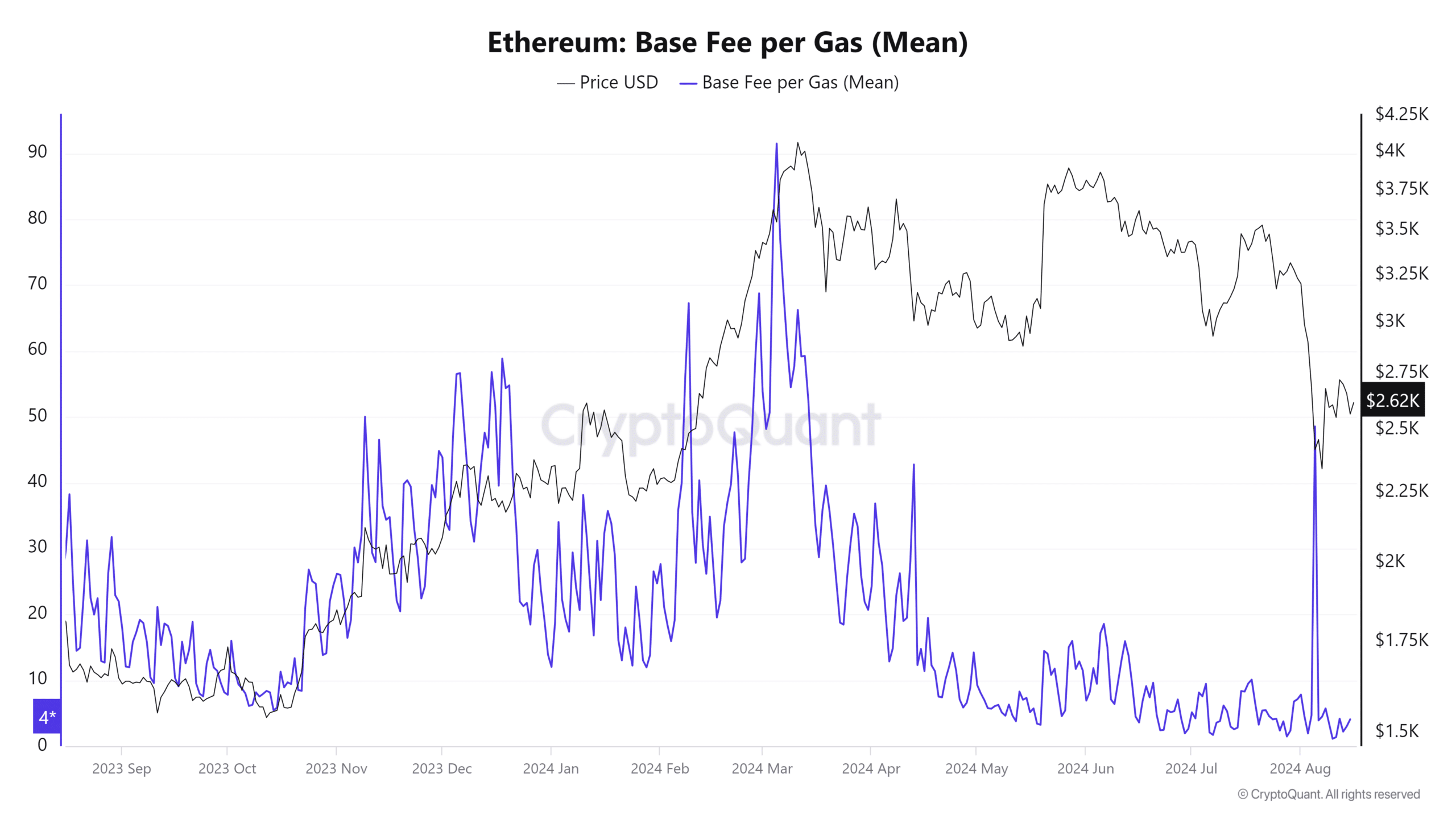

AMBCrypto discovered that gasoline price dropped to as little as 1.38 Gwei on the eleventh of August. For context, the imply base gasoline price on the community went as excessive as 91.51 Gwei on the fifth of March.

This was simply earlier than costs peaked in March, adopted by a powerful pullback.

Supply: CryptoQuant

Why are Ethereum gasoline charges declining?

One of the believable explanations for this final result is the decline in community exercise. Ethereum gasoline charges are closely influenced by provide and demand, and that is typically evident throughout excessive community exercise.

Fuel charges have traditionally rallied when demand or transactions go up, and the other can also be true. This was evident throughout the newest market crash when a spike in transactions promoting ETH was noticed.

This resulted in a gasoline price surge.

Ethereum gasoline charges hitting a brand new low could have additionally been influenced by Layer 2 exercise.

The Ethereum Layer 2 setting is now extra developed than it was in 2018, thus offsetting the mainnet congestion that drove up costs. That is evident within the Ethereum community transaction quantity.

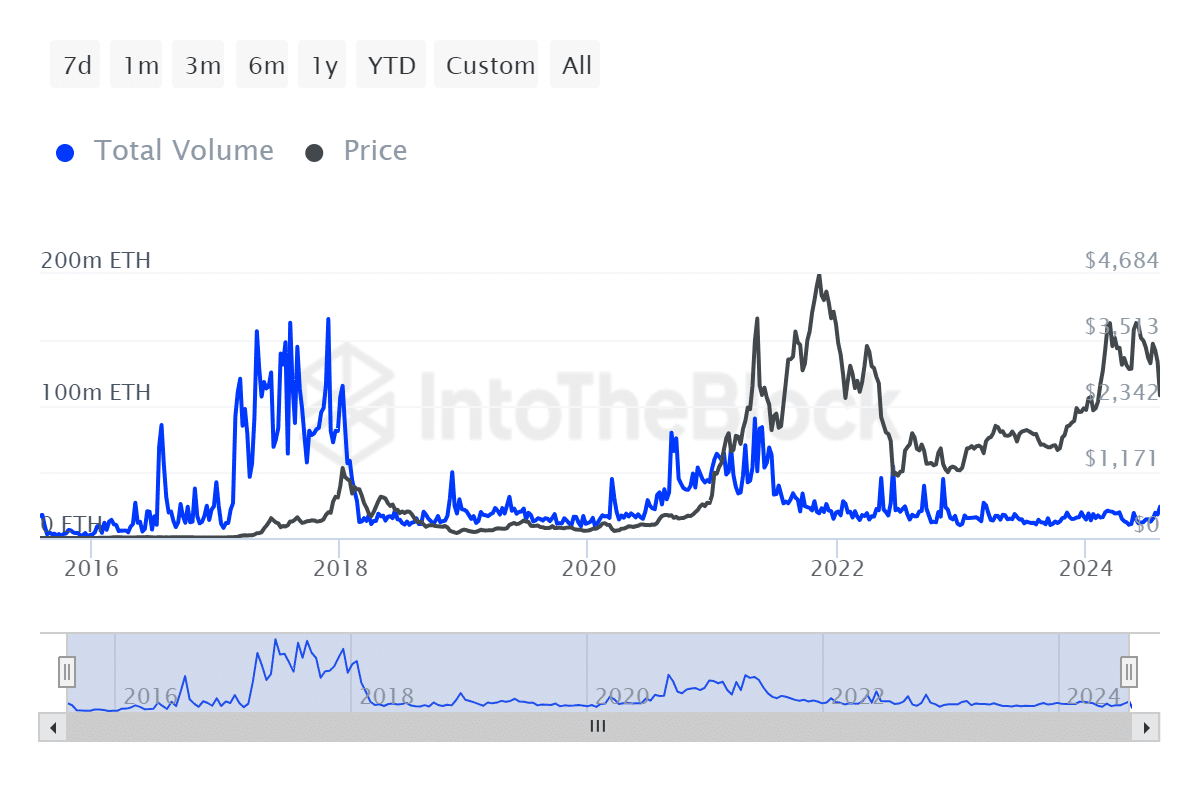

Supply: IntoTheBlock

Ethereum transaction quantity on the peak of the 2017 bull run peaked at 165.97 million ETH. The determine was significantly average throughout the 2021 bull run, with quantity peaking at 90.44 million ETH.

The very best transaction quantity recorded to this point in 2024 was 20.19 million ETH, simply earlier than the altcoin reached an YTD excessive.

Based mostly on the transaction volumes, it’s clear that the quickly rising Ethereum layer 2 setting has a big affect on the Ethereum mainnet.

Learn Ethereum’s [ETH] Value Prediction 2024-25

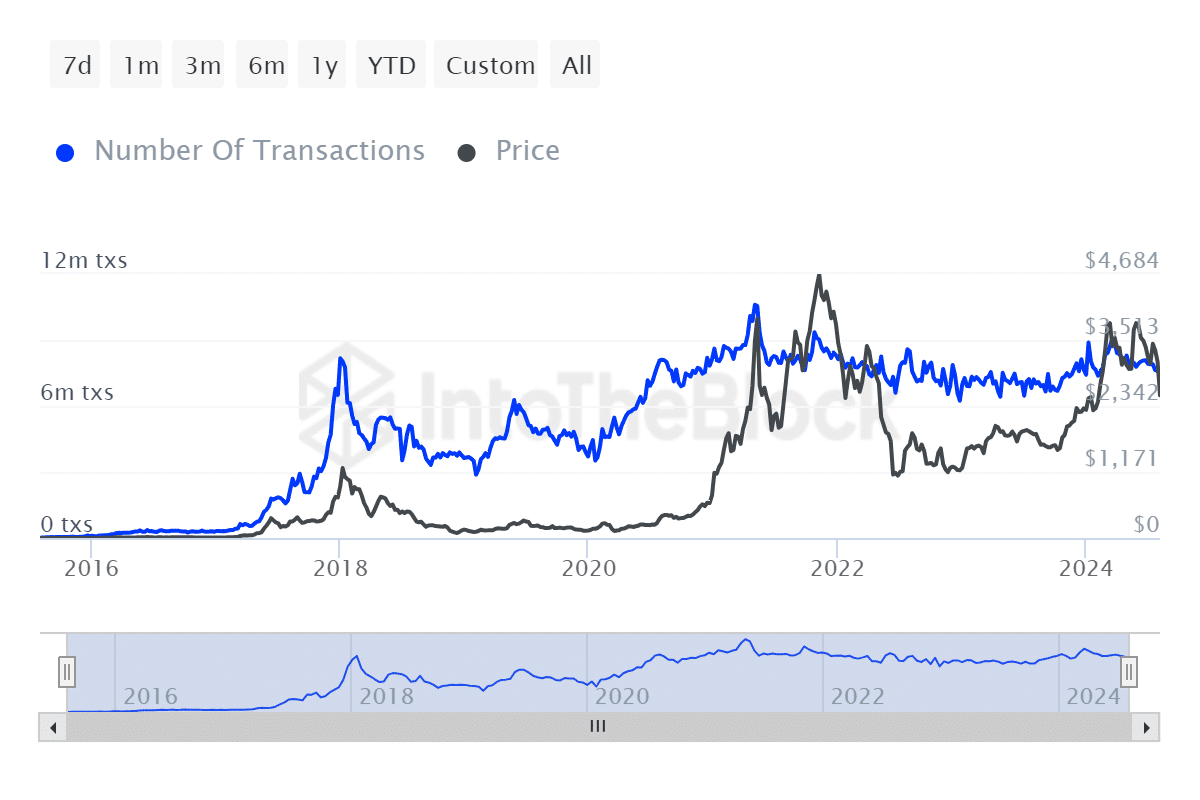

Congestion was down significantly in the previous couple of years, therefore the declining gasoline charges. This was additional supported by constructive transaction progress over time, courtesy of constructive consumer progress.

Supply: IntoTheBlock

Ethereum transactions maintained an general constructive trajectory over time. An inverse correlation in comparison with gasoline charges, highlighting the affect of layer 2 networks.