Ethereum heading for a bear market? Latest order book trends reveal clues

- Ethereum excessive order books sign rally’s peak.

- ETH could be in a bear market however let’s discover.

Ethereum [ETH], the biggest altcoin, continues to seize consideration on account of its scalability and widespread use within the blockchain house.

Nevertheless, Ethereum has been underperforming on larger timeframes for over 5 months, elevating questions on whether or not the crypto market remains to be in a bullish section.

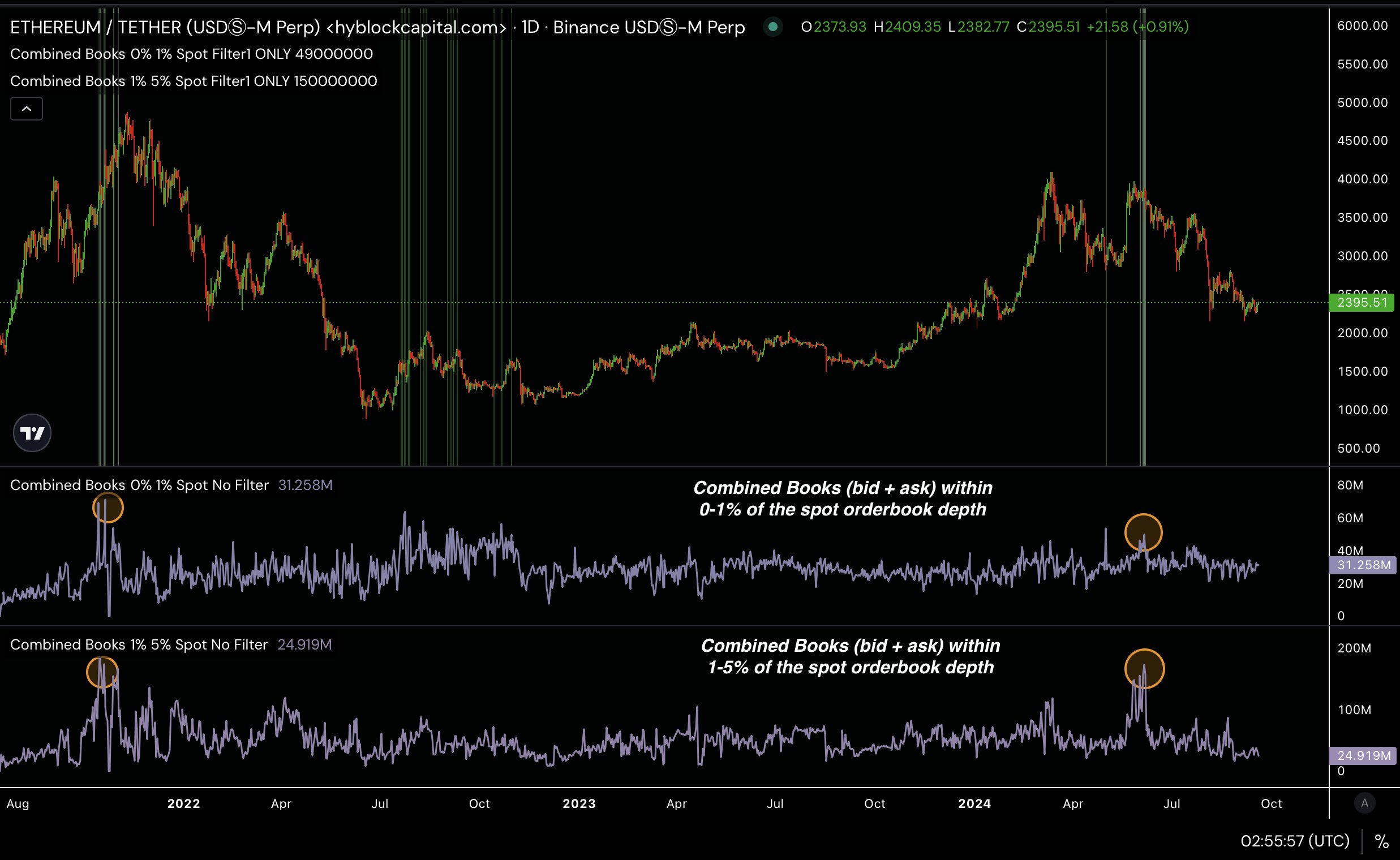

On the 1-day timeframe, ETH evaluation exhibits that the Mixed Books for spot order e book depth hit their peak in Might.

This metric, which displays the highs in passive restrict orders (bids and asks), typically alerts the top of a rally, adopted by a bearish development.

Supply: Hyblock Capital

Historic information helps this, exhibiting that ETH might have peaked through the bull run that led to Might, now the market is in a consolidation section.

Since then, ETH has been shifting sideways, with no clear course. However does this point out a bear market?

Is ETH in a bear market

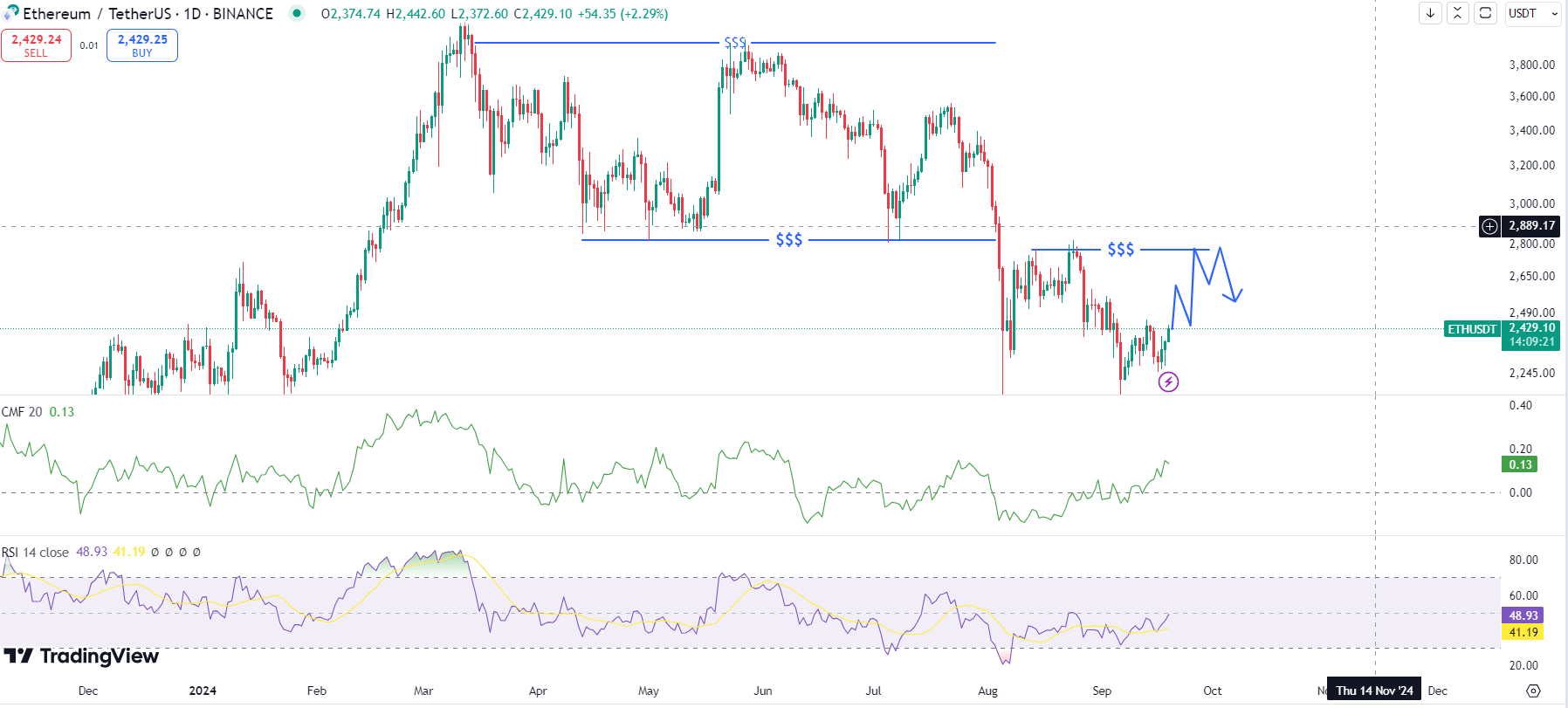

Taking a look at ETH’s worth motion suggests the opportunity of a bear market. The ETH/USDT pair has been trending downwards since early June, breaking under its vary on the each day timeframe through the market crash on August 5.

Since then, it has struggled to get better, pointing to the potential for a bear market. Nevertheless, ETH’s worth candles are presently inexperienced, indicating a attainable retracement in direction of $3000 from the aggressive sell-off.

Supply: TradingView

Worth might stall across the $3,000 stage. If ETH breaks and sustains above $3,000, a possible rally may observe. But when it fails and falls again under that stage, the bear market will probably be confirmed.

Supporting this, the Chaikin Cash Stream and Relative Energy Index (RSI) are each trending positively, hinting at bullish momentum till ETH hits the $3,000 zone.

Stability on all exchanges

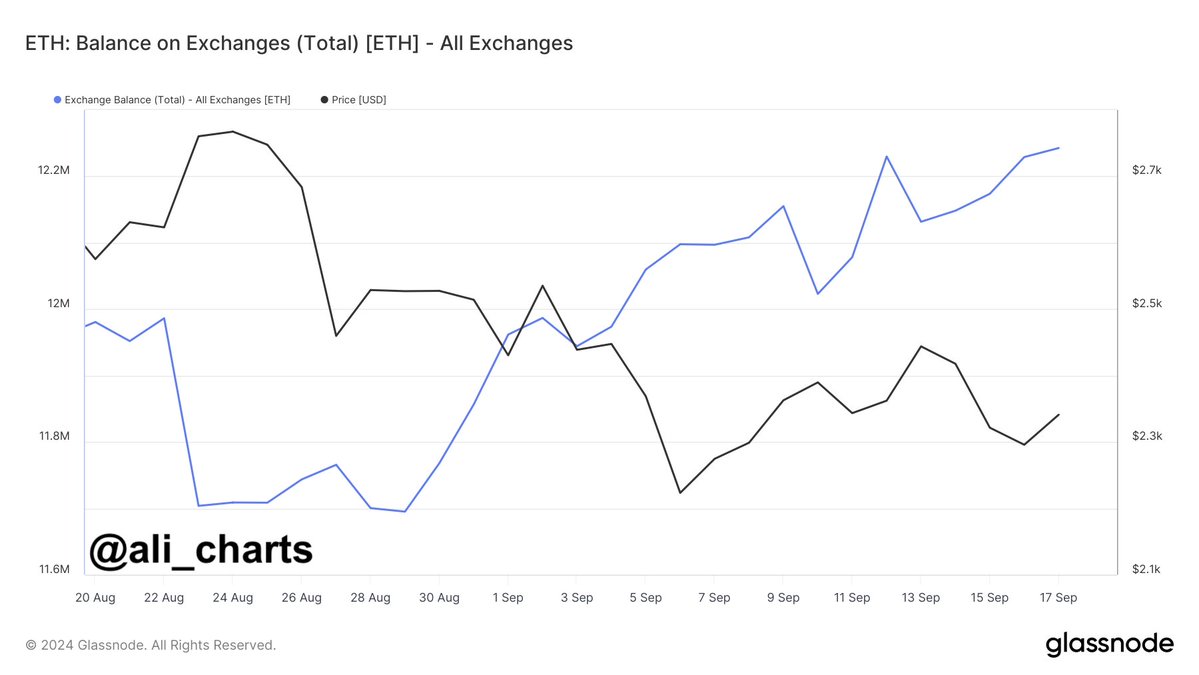

Furthermore, a deeper have a look at the stability of ETH on exchanges raises additional considerations a few potential bear market.

Over 547,600 ETH, price greater than $1.5B as at press time, have been transferred to exchanges previously three weeks.

This alerts that merchants could also be taking income or chopping their losses, each of that are bearish indicators.

Supply: Glassnode

When merchants transfer massive quantities of ETH to exchanges, it often signifies an intent to promote, which may contribute to downward worth strain.

BTC & ETH ETF outflow continues

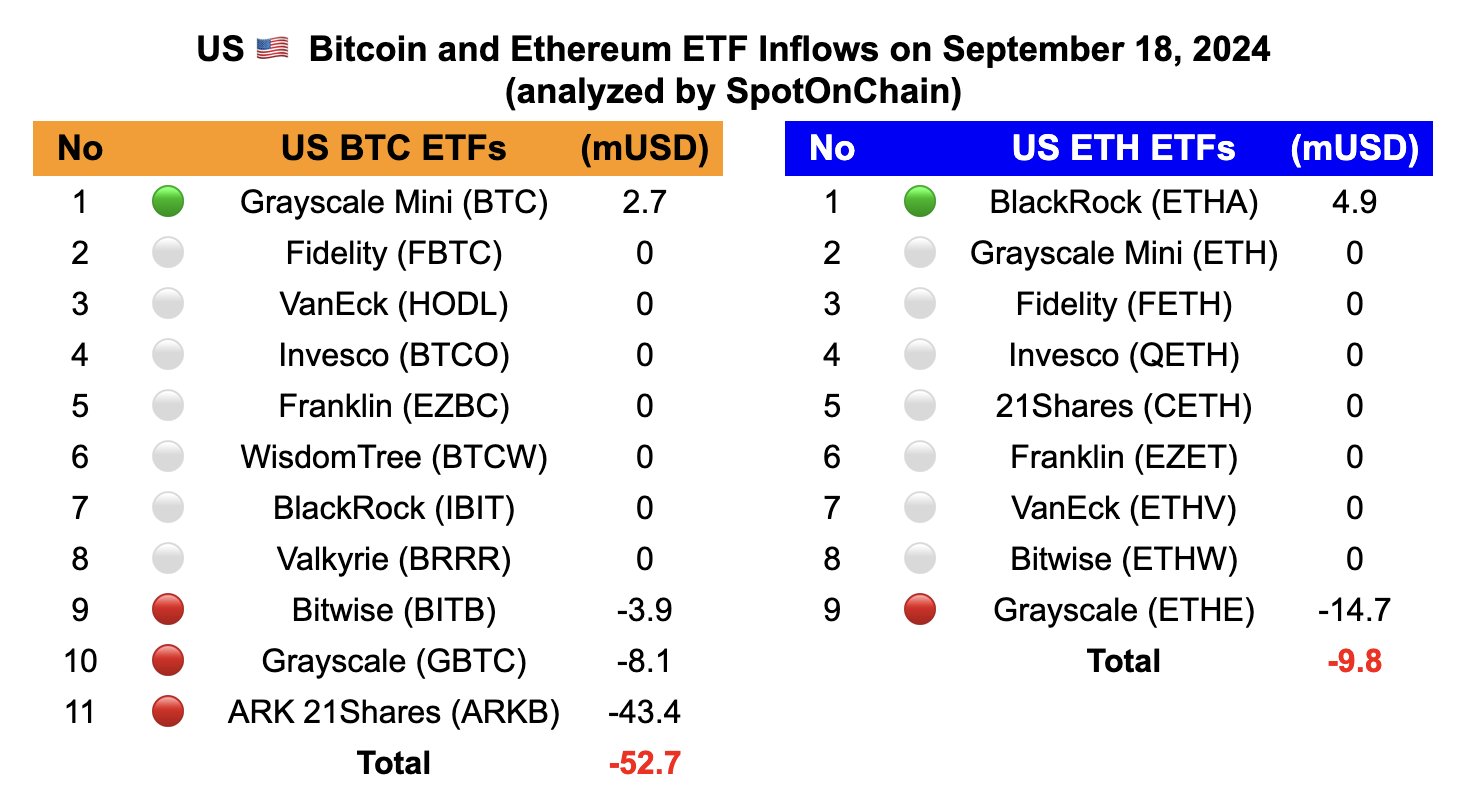

Moreover, Ethereum and Bitcoin ETF outflows additionally counsel a bearish development. The web move for Ethereum ETFs turned destructive, with outflows of $9.8 million as of September 18, 2024.

In the meantime, Bitcoin noticed $52.7M in outflows, additional reinforcing considerations a few broader market downturn. Ethereum ETFs have skilled continued outflows, and Bitcoin ETFs have turned destructive after 4 days of inflows.

Supply: SpotOnChain

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

This habits, particularly throughout vital market phases, factors to attainable bearish sentiment or consolidation.

Whereas it’s nonetheless unclear whether or not we’re formally in a bear market, these components counsel Ethereum’s worth may wrestle to maneuver larger within the quick time period until market situations shift drastically.