Ethereum Historical Indicator Flashes Long-Term Buy Signal – Is History Repeating?

Este artículo también está disponible en español.

Ethereum has been struggling beneath the $2,800 mark for days, unable to reclaim it as help to kickstart a restoration rally. This key stage stays a major barrier for bulls, and because the value continues to consolidate beneath it, bearish sentiment is rising. Many analysts name for a continuation of the downtrend, reflecting the downbeat temper out there. Traders, who as soon as believed Ethereum would rally alongside Bitcoin this yr, at the moment are exhibiting indicators of doubt.

Associated Studying

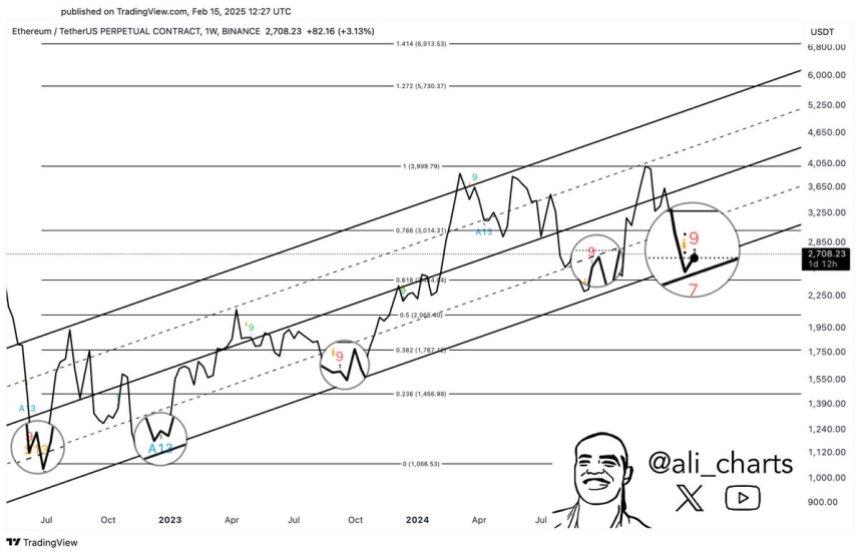

Nevertheless, not everyone seems to be bearish. Some buyers stay optimistic, pointing to indicators that Ethereum could also be gearing up for a restoration part. Crypto analyst Ali Martinez just lately shared a technical evaluation revealing that the TD Sequential indicator has flashed a purchase sign on Ethereum’s weekly chart. This uncommon occasion has traditionally indicated the start of a major development reversal. Martinez factors out that each time this indicator is triggered in the course of the weekly timeframe, Ethereum usually follows with robust upward momentum, signaling a possible bullish part forward.

As Ethereum hovers beneath the $2,800 resistance, merchants and buyers are watching intently. If historical past repeats itself and the TD Sequential sign proves correct, Ethereum might shock the market with an aggressive transfer into larger value ranges.

Ethereum Prepares For A Restoration Part

Ethereum is testing important liquidity beneath the $3,000 stage, a major psychological value level that analysts imagine will decide Ethereum’s efficiency within the coming weeks. This stage has turn into a battleground between bulls and bears, with sentiment out there remaining extremely divided.

Retail buyers, dropping confidence within the potential for a near-term restoration, proceed to promote, contributing to downward stress on the worth. In the meantime, bigger gamers look like making the most of the dip, accumulating Ethereum at an accelerated tempo, signaling confidence within the asset’s long-term potential.

Martinez just lately shared a technical analysis on X, highlighting a major historic sample on Ethereum’s weekly chart. Martinez famous that every time the TD Sequential indicator has flashed a purchase sign close to the decrease boundary of Ethereum’s long-term ascending channel, costs have traditionally rebounded with power. This indicator, broadly utilized by merchants to identify development reversals, means that Ethereum could also be nearing a pivotal second.

In accordance with Martinez, the same setup is unfolding now as Ethereum consolidates just under key resistance ranges. If the TD Sequential sign performs out because it has up to now, Ethereum may very well be gearing up for a strong restoration rally. Reclaiming the $3,000 stage and holding it as help would mark step one towards reversing the bearish development and initiating a long-term uptrend. The approaching weeks will likely be essential for Ethereum as buyers look ahead to indicators of a breakout or an extra decline.

Associated Studying

ETH Consolidates Earlier than A Massive Transfer

Ethereum (ETH) is buying and selling at $2,690 after days of sideways buying and selling and market indecision. This era of stagnation has left buyers speculating in regards to the short-term path of ETH, as sentiment stays divided between bullish restoration and additional draw back potential. The shortage of momentum above key resistance ranges has contributed to uncertainty, with each bulls and bears struggling to take decisive management.

For Ethereum to provoke a restoration uptrend, bulls should reclaim the $2,800 mark as help. This important stage has acted as a key barrier in current weeks, and breaking above it could pave the way in which for a push towards the $3,000 mark. A profitable transfer above $3,000, a psychological and technical resistance stage, would affirm a reversal of the downtrend and set up bullish momentum out there.

Associated Studying

Nevertheless, the chance of additional draw back stays if ETH fails to reclaim the $2,800 stage. A retracement might take the worth into decrease demand zones round $2,500, the place stronger help could also be discovered. The following few buying and selling periods will likely be important, as Ethereum’s value motion will possible dictate market sentiment and affect its short-term trajectory. Traders are watching intently for a decisive breakout or additional consolidation because the market stays unsure.

Featured picture from Dall-E, chart from TradingView