Ethereum hits 2025 lows on THESE fronts: Is ETH in trouble?

- Ethereum’s person exercise dropped to 2025 lows, signaling waning demand and potential inflationary strain.

- With weak on-chain metrics and rising competitors, Ethereum’s place as a number one blockchain is questioned.

Person exercise on the Ethereum [ETH] community is slipping, casting a shadow over demand for the main Layer-1 blockchain.

Not too long ago, ETH’s every day lively addresses and new pockets creations hit their lowest ranges in 2025. This decline highlights decreased on-chain engagement.

Ethereum’s falling person metrics increase considerations about its capacity to take care of its dominance. Quicker and cheaper opponents are intensifying the problem for Ethereum’s place.

Ethereum’s on-chain metrics sink as community demand dwindles

Ethereum is experiencing a pointy pullback in person exercise, with key community indicators falling to their lowest ranges thus far this 12 months.

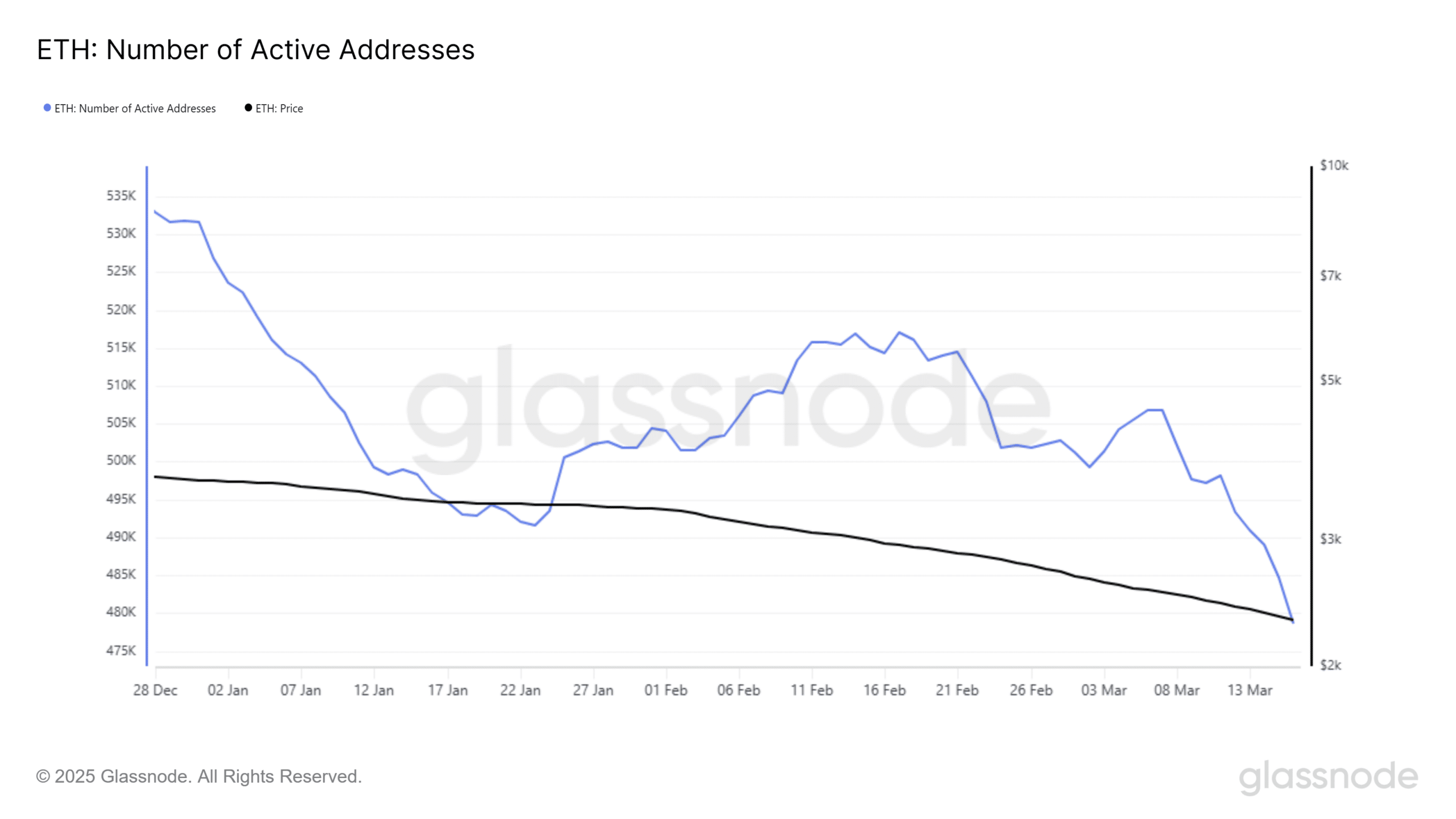

On the sixteenth of March, the variety of lively addresses collaborating in ETH transactions dropped to 361,078, the bottom every day rely recorded thus far this 12 months.

This steep decline highlights weakening on-chain engagement, a metric carefully tied to transactional demand and payment technology.

Supply: Glassnode

The decline in lively utilization lowers the quantity of ETH burned via gasoline charges, growing the asset’s inflationary strain. A weaker deflationary narrative might erode investor confidence.

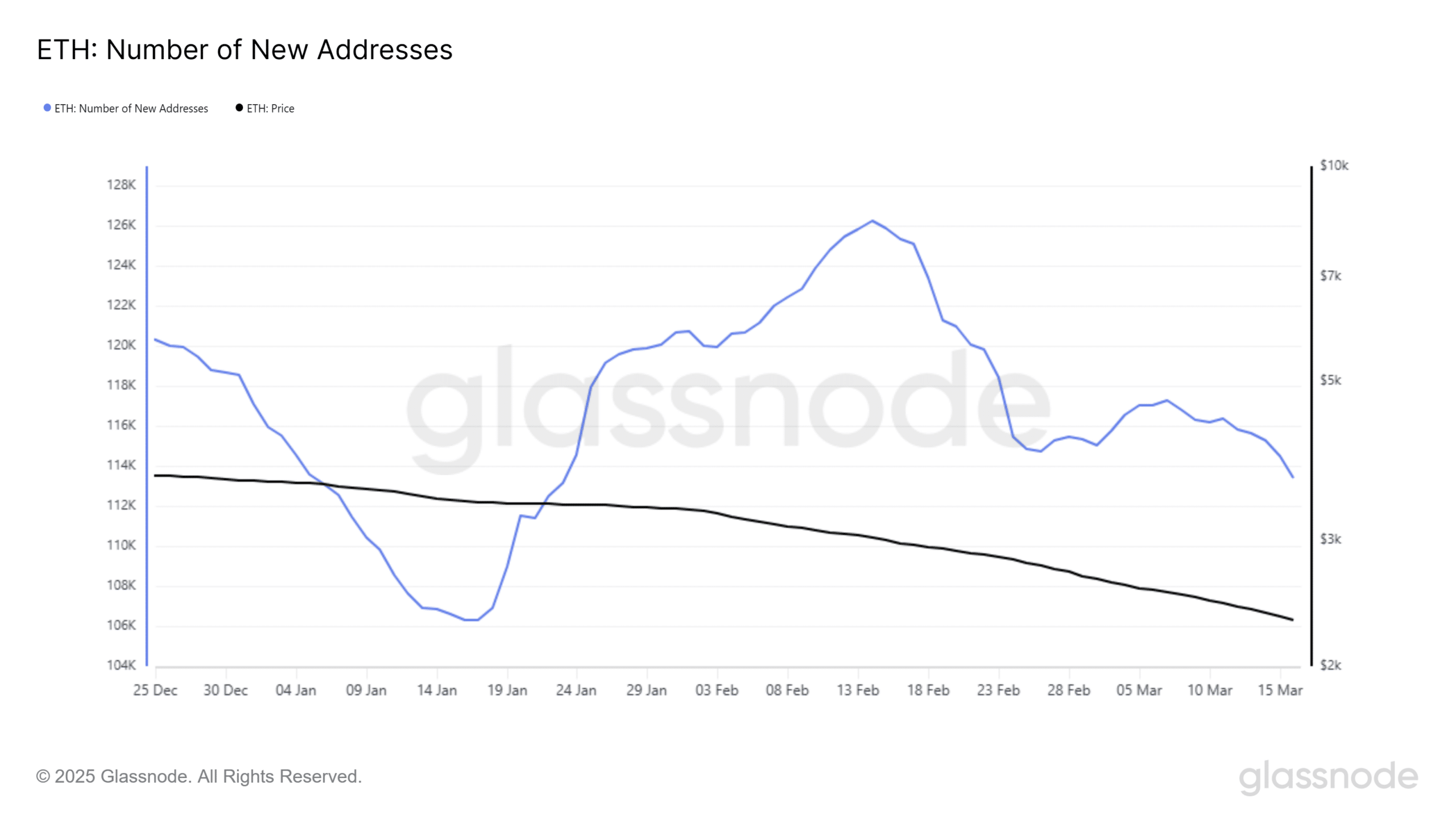

New pockets creation has additionally dropped sharply. On Sunday, solely 86,539 new ETH addresses have been created, the bottom this 12 months.

This development displays declining speculative curiosity and decreased natural onboarding to the Ethereum community.

Supply: Glassnode

Collectively, these on-chain metrics counsel a broader cooling in person urge for food for Ethereum as considerations over inflation and various blockchain ecosystems proceed to mount.

Influence on ETH’s provide

With on-chain exercise declining, Ethereum’s provide is shifting towards inflation. Over the previous month, over 71,000 ETH, value $135 million, was added to the circulating provide, surpassing 120 million ETH.

The lower in transactions has led to fewer charges being burned, weakening Ethereum’s deflationary mechanism. With out sturdy demand to counter the elevated issuance, the excess provide is creating constant downward strain on ETH’s value.

This development is elevating investor considerations concerning the community’s long-term worth.