Ethereum holds $3K, for now – How can ETH’s price stay above it?

- Ethereum Open Curiosity has seen a slight enhance lately.

- ETH has maintained the $3000 vary regardless of poor runs.

Previously few days, Ethereum’s [ETH] worth has skilled some declines, however this isn’t the one notable change in key metrics.

The Open Curiosity has additionally seen vital actions, and its subsequent route might considerably influence merchants’ sentiment.

Ethereum Open Curiosity sees a slight rise

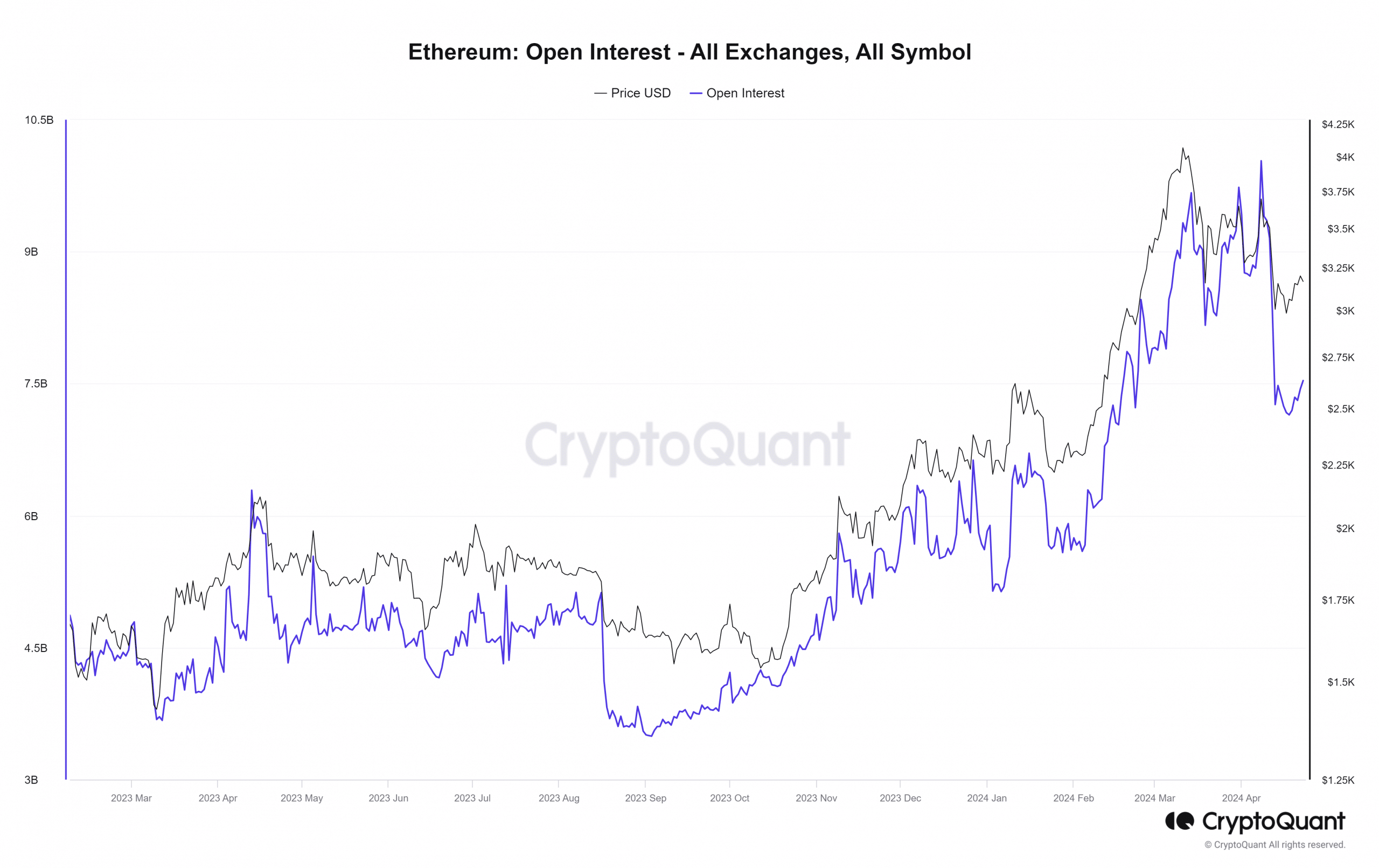

Current knowledge from CryptoQuant indicated vital modifications in Ethereum’s Open Curiosity.

AMBCrypto’s evaluation of the Open Curiosity chart revealed a notable decline ranging from across the eighth of April and persevering with till the thirteenth of April.

Earlier than the decline, Open Curiosity exceeded $10 billion, falling to round $7.2 billion throughout the downturn.

Nevertheless, there was a current uptick in Open Curiosity, reaching roughly $7.4 billion on the time of reporting. This steered renewed inflows of funds into Ethereum.

Supply: CryptoQuant

Nevertheless, the character of those funds, whether or not dominated by quick or lengthy positions, remained to be decided.

The dominance of quick positions would suggest an anticipated decline in worth, probably resulting in adverse sentiment.

Conversely, the dominance of lengthy positions would counsel an anticipated worth rise, seemingly fostering constructive sentiment. The route of the Netflow might present perception into which place may turn into dominant.

Lengthy or quick?

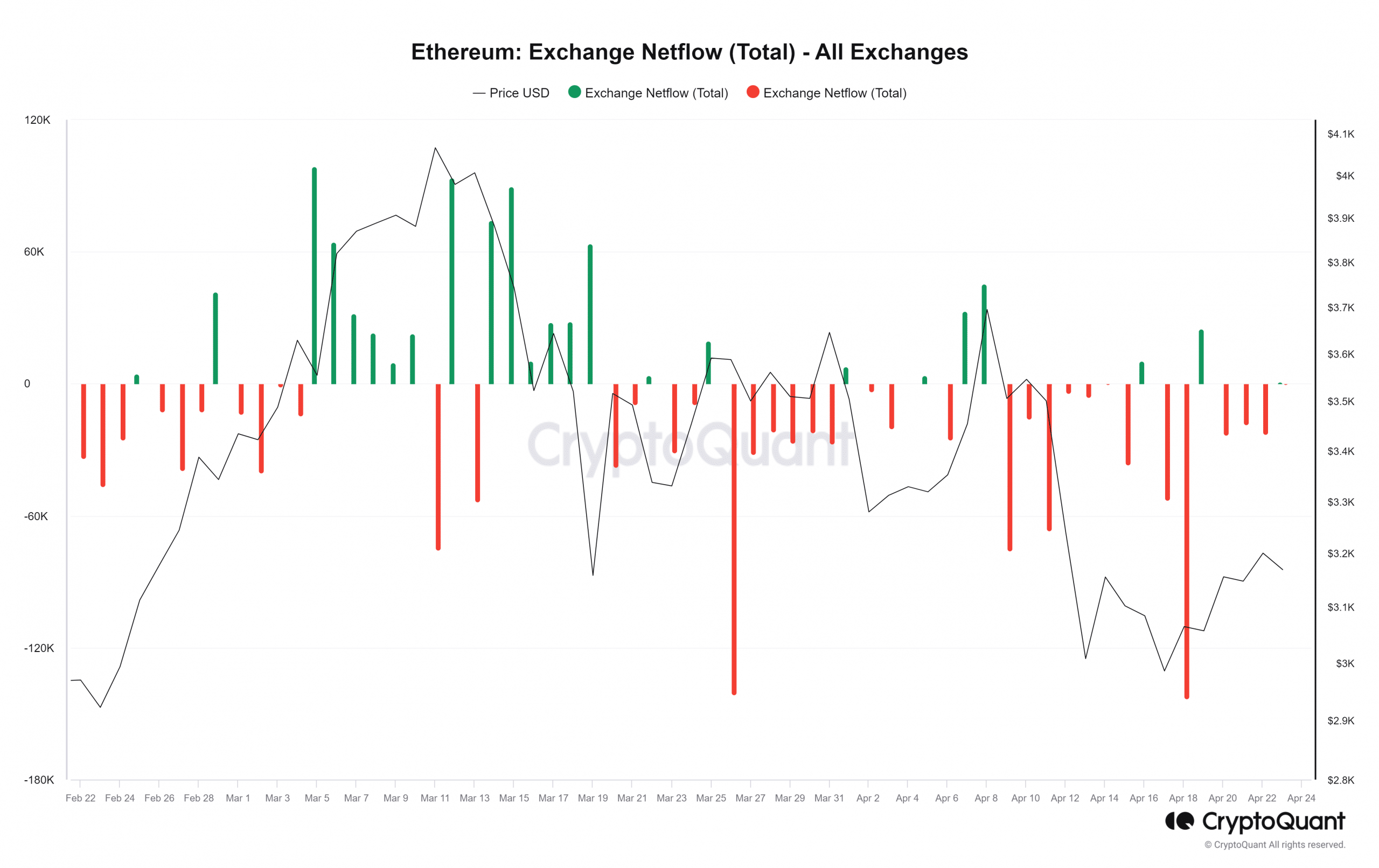

Whereas not assured because of the potential influence of different occasions, the route of the Netflow can supply insights into which positions may turn into dominant.

AMBCrypto’s evaluation of the Netflow chart confirmed a current enhance in Ethereum outflow. Over the past seven days, over 260,000 ETH, valued at over $781 million, have left exchanges.

Supply: CryptoQuant

As compared, the influx was considerably decrease, confirming the dominance of outflows.

This steered that extra merchants are withdrawing their ETH from exchanges, sometimes indicating a constructive signal, as these merchants seemingly anticipated a worth rise.

Primarily based on this commentary, we might predict the dominance of lengthy positions as ETH’s Open Curiosity will increase.

Learn Ethereum’s [ETH] Value Prediction 2024-25

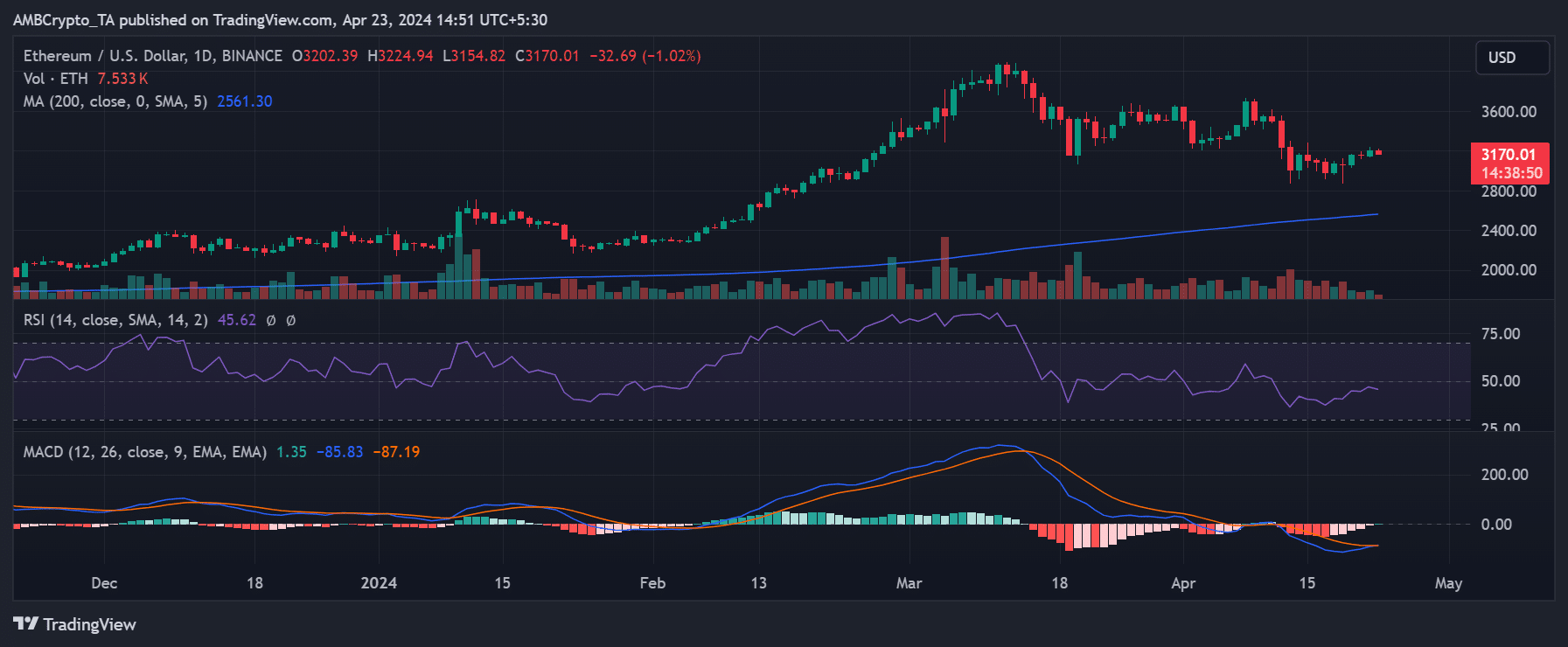

Ethereum nonetheless caught in bear development

AMBCrypto’s evaluation of the Ethereum worth chart revealed that it has struggled to maintain consecutive uptrends of late. Nevertheless, it has demonstrated extra uptrend worth than downtrends.

By the shut of buying and selling on the twenty second of April, Ethereum was buying and selling at over $3,200, reflecting a rise of over 1.7%. On the time of this writing, it was buying and selling at round $3,190, experiencing a decline of over 1%.

Supply: TradingView