Ethereum: Hong Kong spot ETFs fail to impress, what next for ETH?

- ETH was down 3.2% within the 24-hour interval at press time.

- Derivatives market has been bearish on the coin for the final 2-3 days.

World’s second-largest cryptocurrency Ethereum [ETH] trended decrease because the itemizing of first-ever crypto spot exchange-traded funds (ETFs) in Hong Kong.

In line with CoinMarketCap, ETH rose to $3,250 shortly earlier than the funds began buying and selling on the Hong Kong Inventory Change (HKEX) – the town’s bourse.

Nevertheless, the stiff resistance pushed the digital foreign money again, inflicting it to fall to $3,020 as of this writing, a 3.2% drop within the 24-hour interval.

Effectively-known technical analyst and dealer Ali Martinez had talked in regards to the significance of $3,200 as an necessary resistance degree for ETH not too long ago.

As many as 2.43 million addresses had acquired 5.14 million ETH at this degree. Therefore, overcoming this “brick wall” was essential for a sustained rally.

Spot ETFs begin on a uninteresting word

Three spot Ether ETFs, together with three Bitcoin [BTC] spot ETFs, debuted in Hong Kong, a metropolis which has been vying to challenge itself as the following crypto hub.

Nevertheless, the shares of all of the three ETFs tied to ETH closed decrease, based on AMBCrypto’s evaluation of HKEX knowledge, as buying and selling volumes failed to select up. This, in flip, might need influenced sentiment in the direction of the cryptocurrency, inflicting it to drop.

Speculative market bets in opposition to ETH’s rise

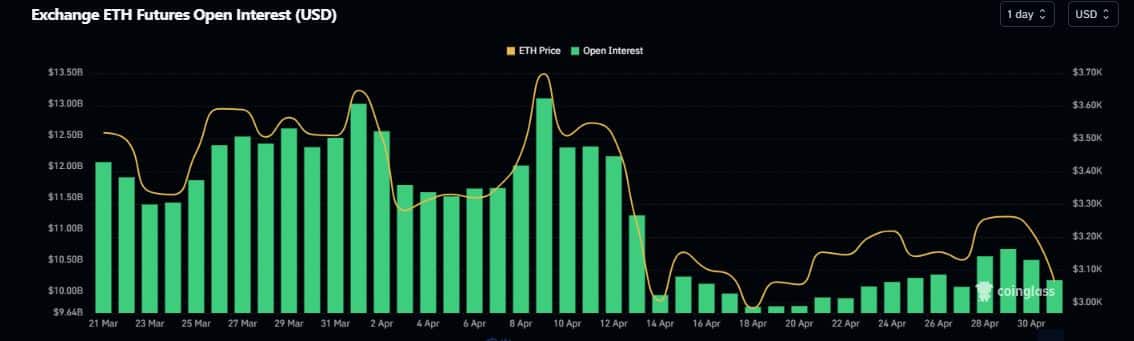

As ETH dipped within the spot market, ripples have been felt within the derivatives sector as properly. The Open Curiosity (OI) in ETH futures plunged 4.5% within the final 24 hours, as per AMBCrypto’s evaluation of Coinglass’ knowledge.

Supply: Coinglass

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

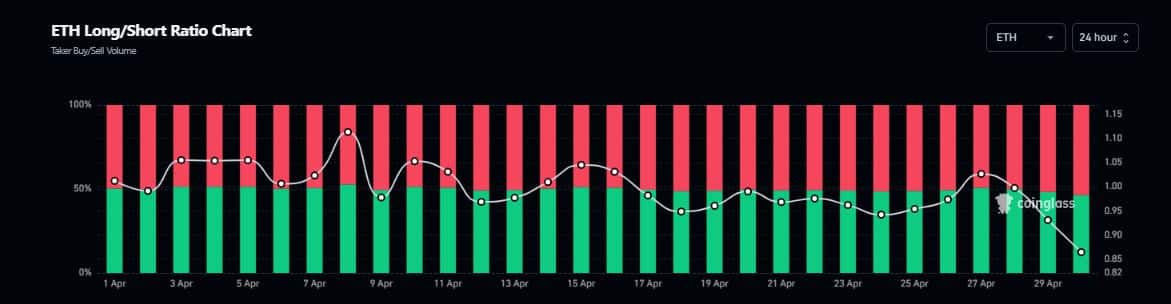

It regarded as if the derivatives market had sensed a poor opening day for Hong Kong Ether ETFs. The variety of merchants shorting the crypto in opposition to those that have been taking lengthy positions has been rising within the final 2-3 days, as per Longs/Shorts Ratio.

As of this writing, almost 53% of contributors have been bearish on the coin.

Supply: Coinglass