Ethereum hovers just above $1800- should traders short ETH?

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion.

- A bounce in ETH costs trying to find liquidity close to $1850 was a chance.

- The shortage of volatility meant merchants trying to enter the market can await extra favorable situations

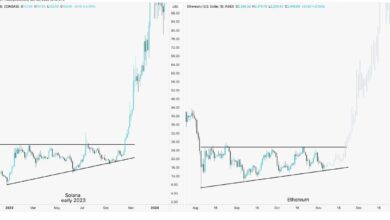

Ethereum [ETH] was buying and selling at $1832 at press time and has been in a decrease timeframe downtrend since 17 July. The bulls have been unable to defend the $1900 assist zone and didn’t put up a lot of a combat within the weeks since then.

Is your portfolio inexperienced? Test the Ethereum Revenue Calculator

The vary formation appeared to have damaged down, however ETH clung tenaciously onto the $1825 stage. Will the bulls succumb quickly, or was this value motion signaling {that a} bullish reversal was constructing power?

Regardless of the bearish construction, the sellers can’t make a lot headway

![Ethereum [ETH]](https://statics.ambcrypto.com/wp-content/uploads/2023/08/PP-2-ETH-price.png)

Supply: ETH/USDT on TradingView

On 1 August, Ethereum costs charged increased on appreciable quantity on the decrease timeframe charts however have been unable to push past the decrease excessive at $1877. It was adopted by a reversal and these short-term good points have been fully worn out.

This highlighted a liquidity hunt on 1 August from simply beneath the vary lows.

Within the week since, liquidity has seemingly constructed up simply above the $1850 stage, because it provided a transparent decrease timeframe invalidation for the bears. Due to this fact, an ETH transfer to the $1850-$1870 area seeking liquidity was attainable. It will seemingly be adopted by a swift bearish reversal.

The OBV confirmed that neither the patrons nor the sellers have been dominant since 17 July, however the value motion has been in a downtrend. The RSI additionally confirmed bearish momentum and had the higher hand in latest weeks.

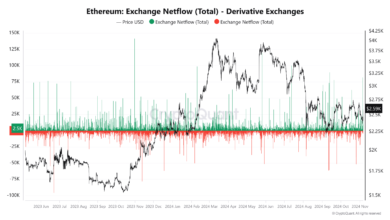

Information from Monday revealed heavy promoting stress when ETH slid towards $1800

![Ethereum [ETH]](https://statics.ambcrypto.com/wp-content/uploads/2023/08/PP-2-ETH-coinalyze.png)

Supply: Coinalyze

On Monday, 7 August, Ethereum fell from $1836 to $1808. In these few hours, the Open Curiosity noticed a fast surge increased. This was indicative of quick positions being opened en masse. When the value bounced again to the $1830 mark the OI started to climb decrease.

How a lot are 1, 10, or 100 ETH price as we speak?

The spot CVD was flat up to now 12 hours however had trended downward up to now week. Collectively, the indications confirmed sturdy short-term bearish sentiment. The rebound from $1802 doesn’t present bullish power however might have been fueled by quick overlaying.

To the south, the $1750-$1770 demand zone might appeal to the value to it. Ethereum left behind a good worth hole on the H4 chart in that area. Furthermore, it served as assist in late March and all through April.