Ethereum – How whales could be key to ETH’s next bullish pivot

- Ethereum whales added to their balances as the worth prolonged its consolidation part

- Directional uncertainty prevailed as ETH inflows outweighed its outflows

Ethereum [ETH] might be on the verge of one other main run-up on the charts. The cryptocurrency has been exhibiting indicators of consolidation, with latest information suggesting that whales have been including to their balances.

That’s not all although, with an analyst named Crow highlighting an fascinating Ethereum fractal sample on X (previously Twitter) too. This discovering revealed an accumulation zone, one which has lasted since August – Just like a 2023 sample.

In truth, the 2023 fractal yielded a bullish final result after its mid-August to mid-October consolidation.

This was adopted by a powerful bullish breakout. Given these similarities, it’s value considering that historical past would possibly repeat itself.

Ethereum whales are including to their balances

A consolidation part will both conclude with a bullish final result or a bearish pattern.

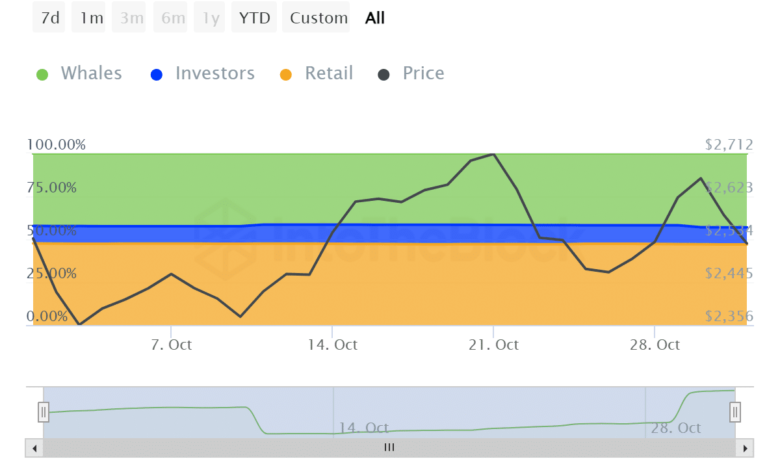

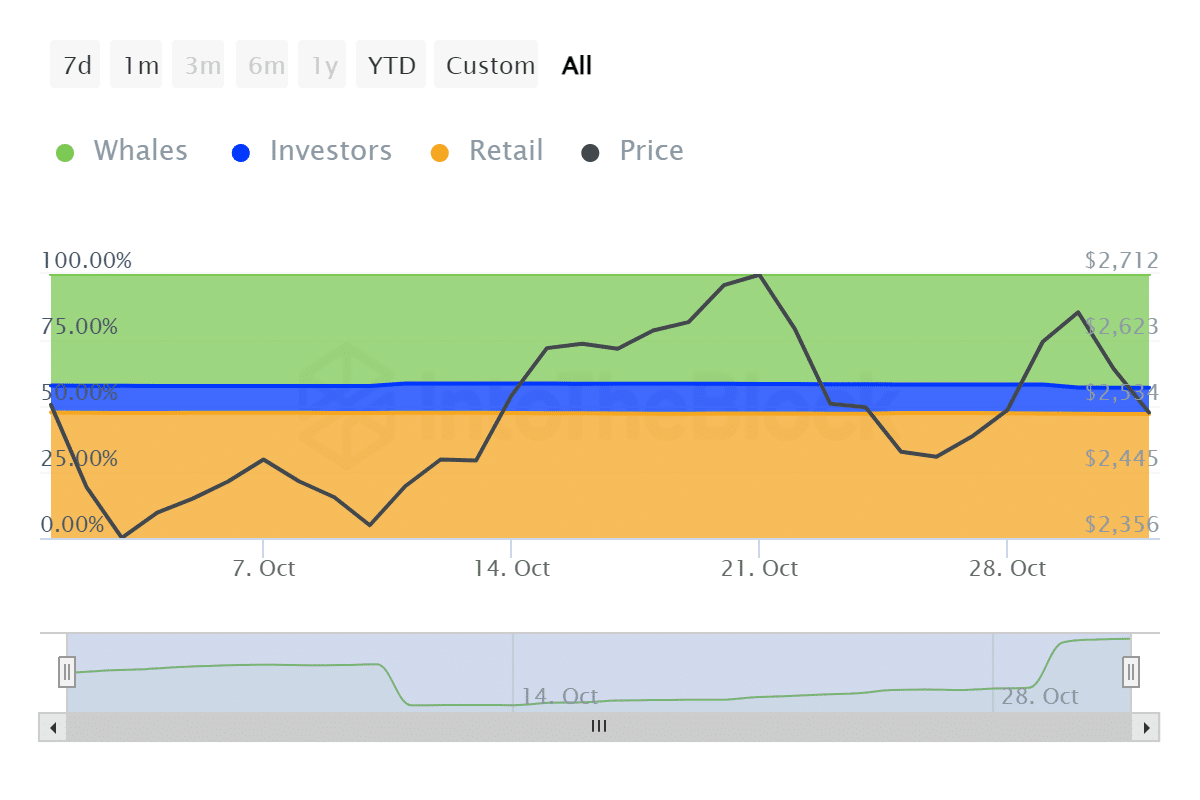

Contemplate this – Historic focus information from IntoTheBlock indicated that whale balances grew considerably during the last two weeks. Whales held 56.68 million ETH by mid-October. Nonetheless, their balances included 59.2 million ETH on 01 November.

Supply: IntoTheBlock

Each traders and retail classes noticed some outflows throughout the identical interval. The information confirmed that whales have been making the most of decrease costs too.

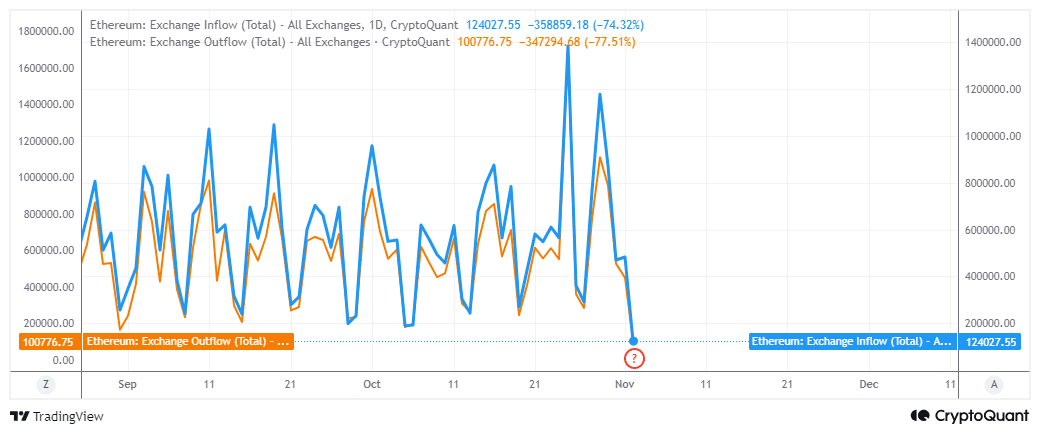

In the meantime, Ethereum alternate flows not too long ago dropped to ranges final seen in June. Trade outflows had been greater at 124,057 ETH whereas alternate outflows clocked in at 100,776 ETH on 02 November. What this meant was that exchange inflows overtook outflows – An indication of persistent promoting strain during the last three days.

Supply: CryptoQuant

Nonetheless, this draw back resulted in a retest of ETH’s two-month help on the charts. This alluded to the opportunity of a bullish pivot into the brand new week.

On the time of writing, ETH was valued at $2,502, with the altcoin notably struggling to safe some directional momentum.

Supply: TradingView

Whereas the help retest could supply some bullish optimism, there have been additionally indicators that the worth could dip decrease.The primary main signal was that the RSI dipped beneath its 50% stage. The truth that whales have been accumulating may point out the shortage of sufficient demand to gasoline a rally.

Moreover, ETH has been going through stiff competitors from the likes of SOL and SUI, one thing that has been consuming into its dominance.

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

On high of that, uncertainty has returned to the market, doubtlessly dampening sentiment and undermining ETH’s bullish potential.

In abstract, accumulation by whales is an effective signal that Ethereum continues to be engaging at its press time worth level. Nonetheless, a cloud of uncertainty could be holding again Ethereum.