Ethereum: Is it time you ignore the noise and HODL ETH for dear life?

- The MDIA and MCA indicated that ETH was far beneath this cycle’s prime.

- Those that bought the altcoin lately had been at a loss, however extra upside might be coming.

Holding Ethereum [ETH] when it reached $4,200 to $3,445 might have been an excessive sport for some. However long-term market members who’ve seen the bulls and bears of the ecosystem appear unfazed.

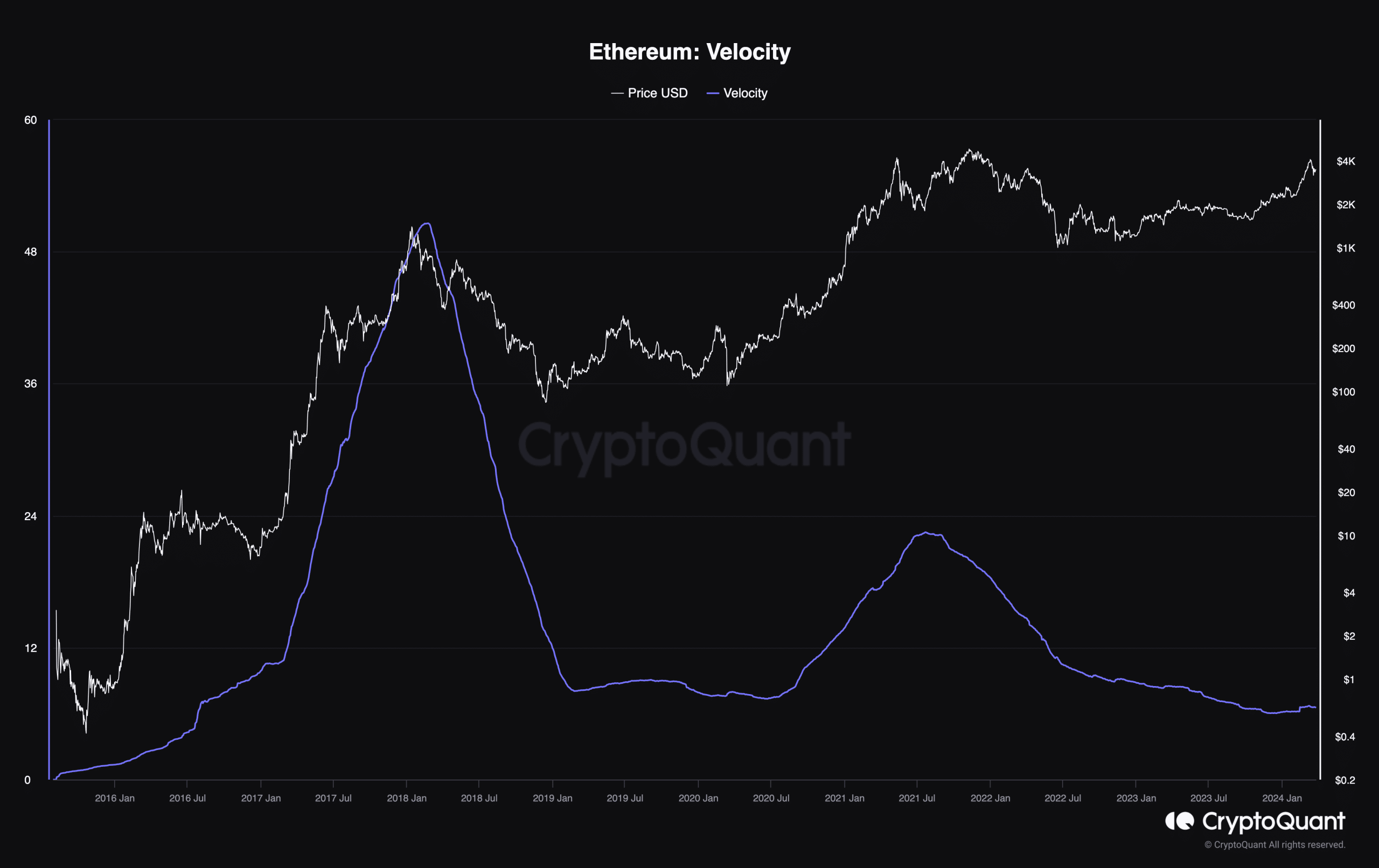

AMBCrypto bought wind of this data after analyzing the rate. Velocity is the speed at which cash are circulating within the crypto financial system. If velocity spikes, then it means cash are circulating at a speedy tempo.

Not the time to guide income

Nonetheless, AMBCrypto’s evaluation utilizing CryptoQuant showed that Ethereum’s velocity was down to six.57. The decline in velocity means that long-term holders of the cryptocurrency aren’t distributing.

In the event that they did, ETH’s worth might need declined rather more than it has completed.

Supply: CryptoQuant

Moreover, the metric’s standing was additionally a sign that members had been satisfied of ETH’s bullish future. Two different metrics we thought of had been the Imply Coin Age (MCA) and the Imply Greenback Invested Age (MDIA).

The MDIA is the typical funding right into a cryptocurrency at any given time. Conversely, the MCA is the typical buy age of an asset. A combination of those two can sign when to purchase and when to promote.

If the MDIA drops, then it means market members have purchased at an costly worth. When this occurs, the worth of the cryptocurrency falls.

However, an growing MDIA is an indication that accumulation is occurring and costs are low cost.

Accumulating ETH often is the proper name

At press time, the MDIA elevated, and the MCA additionally did the identical. Traditionally, the uptrend is an efficient indicator that costs haven’t topped but.

Subsequently, ETH’s worth may be thought of to be buying and selling at a reduction. Going ahead, this may be adopted by a major worth enhance.

Ought to the readings of those metrics proceed to rise, Ethereum might need a primary cease at $3,800. After that, the worth would possibly retest $4,000 inside a brief interval.

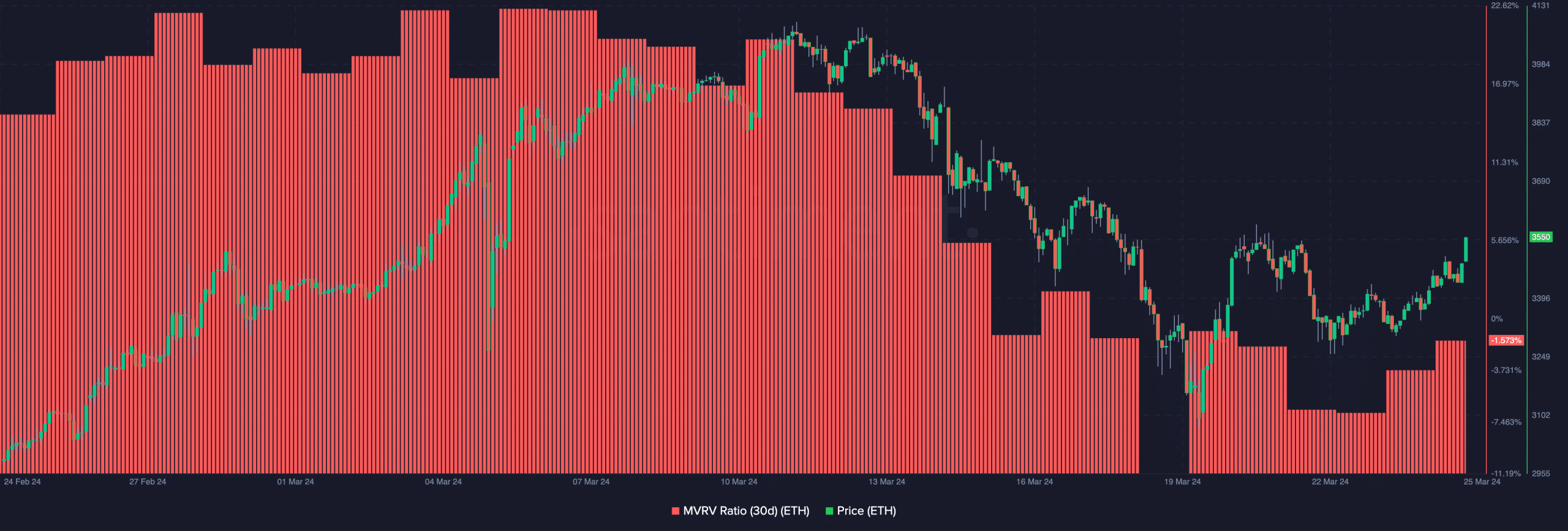

To verify if the altcoins provided a shopping for alternative, AMBCrypto looked within the Market Worth to Realized Worth (MVRV) ratio path.

This metric tells if a cryptocurrency is undervalued, overvalued, or at a good worth.

At press time, the 30-day MVRV ratio was -1.573%. Which means each Ethereum holder who decides to promote their cash now would make a median lack of 1.573%.

Supply: Santiment

Once we contemplate historical past, this MVRV studying seems nice for accumulation. In bull cycles when ETH hit an area prime, the ratio was properly over 40%.

Learn Ethereum’s [ETH] Value Prediction 2024-2025

Subsequently, one can assume that ETH has not hit half its potential this cycle.

If we go by the historic information, then the worth of the cryptocurrency would possibly hit 5 figures earlier than the bull market ends. However that can also be topic to unexpected occasions which could come into play.