Ethereum: Is Lido ETH staking a good option post-Shapella?

Earlier this yr, Ethereum [ETH] underwent its main Shapella improve which allowed stakers to withdraw their staked Ether. This was the following main replace that Ethereum had after it became a PoS chain from PoW. On the liquidity staking entrance, Lido ETH is likely one of the hottest tokens that’s at present obtainable available in the market. Nonetheless, contemplating that Ethereum has now allowed customers to unstake their belongings, is it nonetheless a very good choice to stake ETH on Lido?

Learn Lido Staked Ether’s [stETH] Worth Prediction 2023-24

Ethereum 2.0 allowed staking

As is thought by all, Ethereum became a PoS chain from a PoW one only recently. This replace modified the dynamics and nature of the blockchain considerably. The occasion “Merge” additionally helped ETH cut back vitality consumption by greater than 99%. The shift from PoW to PoS brought about Ethereum to modify from a mining mannequin to a staking mannequin blockchain.

A have a look at liquidity staking

For starters, liquidity staking permits customers to lock up their belongings and grow to be validators, serving to enhance a PoS chain’s safety. 2020 noticed the debut of Ethereum’s beacon chain and Lido emerged to supply an ETH Liquid Staking By-product, permitting customers to stake their belongings and earn rewards in return. Individuals who have transformed their ETH to Lido Staked Ether [stETH] can readily promote the tokens for ETH at any time whereas incomes rewards on the stETH tokens they maintain.

Lido ETH advantages are fairly many

Lido ETH, as the most well-liked staking token, has a number of different advantages as effectively. As an illustration, utilizing Lido, stakers can earn rewards with out having to lock up their belongings. Stakers can get rewards for making any modest funding they select. Due to the identical, so far, 6,493,885 ETH have been staked on Lido, which has a market capitalization of over $11 billion with a 5% APR.

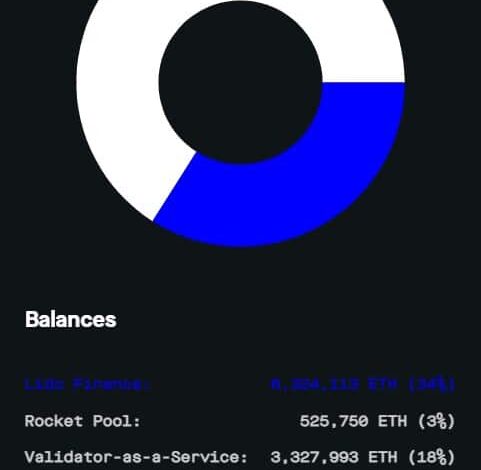

To place it into perspective, in whole, 18.7 million ETH have been staked, out of which 34% accounts for Lido steadiness, proving its recognition and mass adoption.

Supply: Staking Rewards

Ethereum community is getting stronger

Whereas stETH stays the chief in Ethereum staking, progress was seen within the total ETH staking ecosystem. As per Staking Rewards, the variety of validators has risen significantly during the last 30 days, which means that the blockchain’s safety has improved. Moreover, Glassnode’s knowledge revealed that ETH 2.0’s whole worth staked skyrocketed – An encouraging growth for the community’s future.

Supply: Glassnode

Lido ETH’s present state

At press time, stETH was buying and selling at $1,799.19, making it the 201st largest crypto by market cap, in line with CoinMarketCap. The recognition of the token was but once more confirmed when checking its metrics. As per Santiment, the entire quantity of stETH holders has risen sharply. The large gamers are additionally fascinated with stETH, as is clear from its rise within the provide held by high addresses.

Its community progress remained excessive, suggesting that extra new addresses have been created. Nonetheless, as stETH’s worth lately took a sideways path, its alternate influx spiked fairly just a few instances – A unfavorable signal for the crypto.

Supply: Santiment

A have a look at Ethereum’s efficiency

Ethereum, like most different cryptos, has additionally struggled to push its worth north in latest days.

At press time, it was buying and selling at $1,803.22 with a market cap of over $216 billion. Nonetheless, ETH is likely to be establishing its subsequent bull rally as just a few of the market indicators appeared bullish.

ETH’s Cash Move Index (MFI) bounced again from the oversold zone and was heading north. The Chaikin Cash Move (CMF) additionally adopted an analogous development, growing the possibilities of a worth uptick within the coming days. Nonetheless, the Exponential Shifting Common (EMA) Ribbon remained bearish because the 20-day EMA lay under the 55-day EMA.

Supply: TradingView

Is your portfolio inexperienced? Examine the Ethereum Revenue Calculator

stETH vs. ETH

As each tokens are available to commerce on a number of platforms, buyers may need doubts about which one to select. It’s fascinating that if stETH is that can be purchased at a decrease fee than ETH, the previous token may really be the higher alternative. Nonetheless, at press time, the distinction between the costs of each tokens was marginal. Ergo, buyers ought to take into account their selections rigorously.