Ethereum: Is network activity the reason behind ETH’s price drop?

- Ethereum’s variety of wallets in loss reached a seven-month excessive

- Metrics and market indicators prompt that ETH’s worth would possibly decline additional

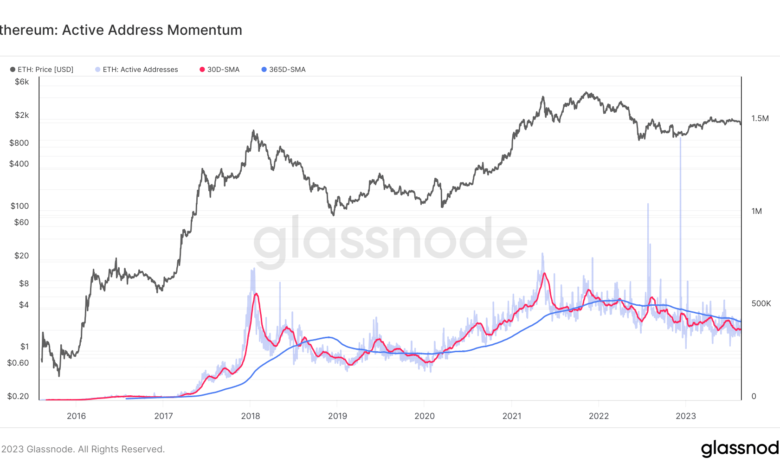

Over the previous couple of months, Ethereum [ETH] witnessed a decline in its community exercise. This was the case because the blockchain’s month-to-month common energetic addresses dropped.

The month-to-month common of energetic ETH addresses stood decrease than the yearly common. This clearly indicated low exercise, which may very well be taken as a bearish sign. Whereas the blockchain’s community exercise declined, its worth additionally didn’t shoot up.

Is Ethereum’s reluctance to push its worth up a consequence of much less community exercise?

Supply: Glassnode

Learn Ethereum’s [ETH] Value Prediction 2023-24

The explanation for ETH’s worth drop

In accordance with CoinMarketCap, ETH was down by greater than 9% within the final seven days, reflecting its sluggish habits. On the time of writing, it was buying and selling at $1,670.05 with a market capitalization of over $200 billion.

The worth drop had a significant impression on traders’ portfolios. As per Glassnode Alerts’ tweet, the variety of ETH addresses in loss reached a seven-month excessive of 42,602,870.333.

📈 #Ethereum $ETH Variety of Addresses in Loss (7d MA) simply reached a 7-month excessive of 42,602,870.333

View metric:https://t.co/eTr2V1rqmQ pic.twitter.com/lEkFdTk0XV

— glassnode alerts (@glassnodealerts) August 21, 2023

Nevertheless, upon taking a more in-depth look, the rationale behind the downtrend may not have been much less community exercise. This was as a result of whereas ETH’s energetic addresses dropped, Layer-2s like Base, Optimism [OP], and rollups gained recognition.

The first purpose behind market individuals shifting to L2s was that they provided extra scalability. For reference, Coinbase’s L2 Base bridged $251 million, with ETH accounting for $155 million out of the whole inside days of launch.

A better take a look at Ethereum’s state

A take a look at Ethereum’s on-chain efficiency gave a greater understanding of what was occurring within the ecosystem. Upon checking, it was revealed that traders in funds and trusts, together with Grayscale, have comparatively weak shopping for sentiment.

Moreover, as per CryptoQuant, ETH’s internet deposit on exchanges was excessive in comparison with the seven-day common, suggesting excessive promoting stress. Nevertheless, it was attention-grabbing to see that when ETH fell sufferer to the newest worth correction, traders took it as a chance to extend accumulation.

This was evident from Glassnode Alerts’ tweet, which identified that Ethereum’s change outflow quantity reached a one-month excessive throughout that interval.

📈 #Ethereum $ETH Change Outflow Quantity (7d MA) simply reached a 1-month excessive of 9,627.006 ETH

Earlier 1-month excessive of 9,608.990 ETH was noticed on 20 August 2023

View metric:https://t.co/LzFffVHu6i pic.twitter.com/dhJIEP4CZO

— glassnode alerts (@glassnodealerts) August 21, 2023

How a lot are 1,10,100 ETHs price right this moment

Not solely metrics, however a couple of market indicators have been additionally bearish. For instance, the Transferring Common Convergence Divergence (MACD) displayed a bullish edge available in the market.

Moreover, ETH’s Chaikin Cash Circulate (CMF) additionally registered a downtick, rising the possibilities of a worth decline. Nonetheless, the Cash Circulate Index (MFI) rebounded from the oversold zone, which can assist the token enhance its worth.