Ethereum is not the only reason why Uniswap [UNI] pumped 18% in 24 hours

- UNI’s value surged after the protocol disclosed a plan to introduce the ERC-7683 commonplace.

- Open Curiosity hit a month-to-month excessive, exercise spiked, whereas the token may rise to $12.

Uniswap [UNI] broke out, rose by 18.98% and hit $9.30 in an sudden transfer inside the final 24 hours.

For a lot of members, the surge may very well be linked to the information that the percentages for the U.S. SEC to approve Ethereum [ETH] spot ETFs had elevated. Due to this, ETH’s value jumped.

Whereas that performed an element, that was not the one cause. Based on AMBCrypto’s investigation, a significant growth and different happenings on-chain had been very important to UNI’s breakout.

The Labs include a brand new commonplace

On the twentieth of Could, Uniswap Labs disclosed that it was introducing a brand new token commonplace known as the ERC-7683. For context, ERC stands for Ethereum Request for Remark.

It’s a commonplace for creating and issuing sensible contracts on the Ethereum blockchain.

Based on Uniswap Labs, the usual, if deployed, would resolve fragmentation on the community and enhance cross-chain interplay. The proposal learn,

“By implementing an ordinary, cross-chain intents methods can interoperate and share infrastructure equivalent to order dissemination providers and filler networks.”

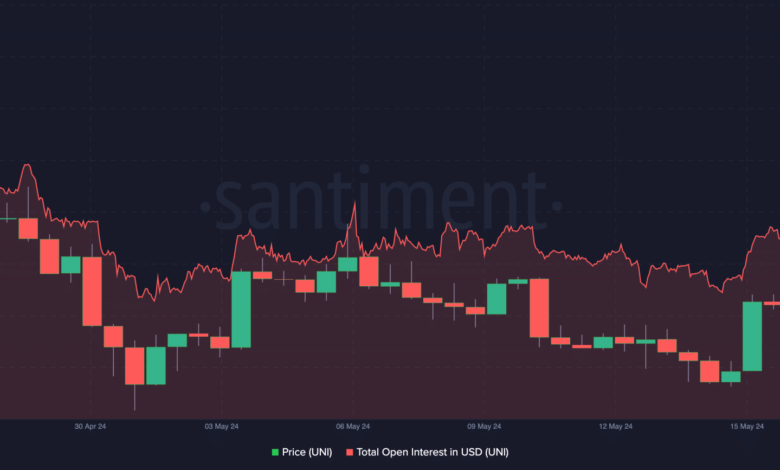

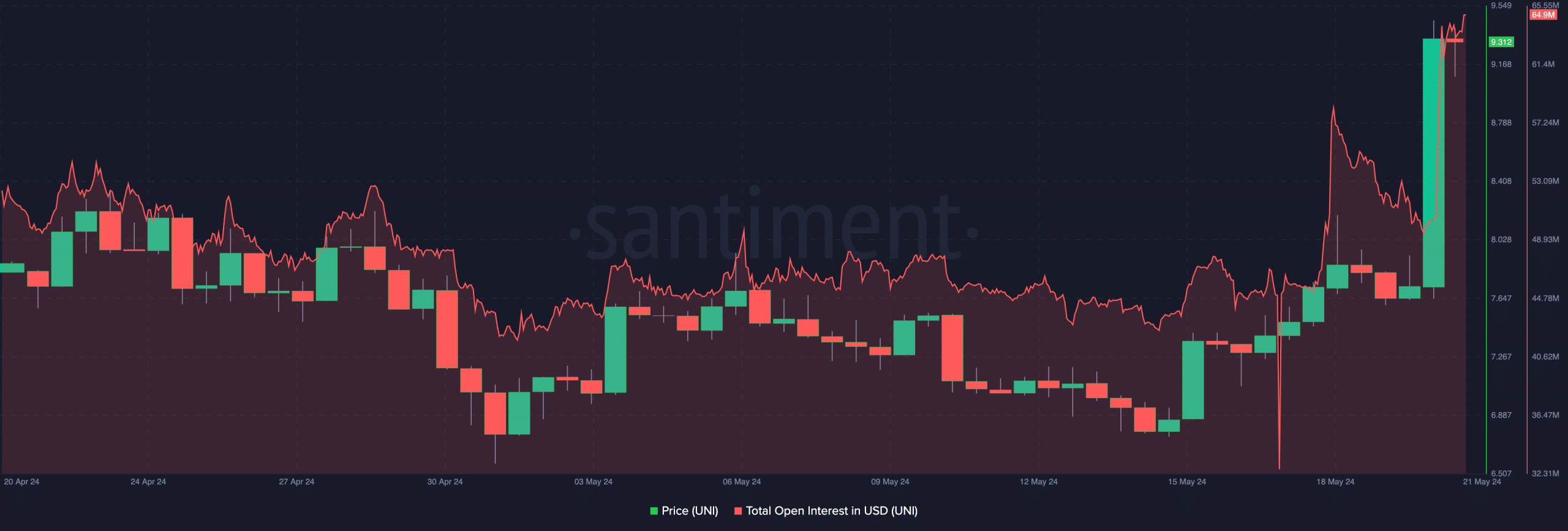

Moments after the announcement, UNI’s Open Curiosity (OI) elevated. At press time, the OI was $64.90 million. This was a worth that the metric has not reached for over a month.

Supply: Santiment

Increasing OI signifies that more cash is coming into the market. Alternatively, a reducing OI is an indication of reducing web positions with liquidity shifting out.

Exercise rises, units UNI for one more value enhance

When put aspect by aspect with the worth, the OI was an indication that patrons available in the market had been aggressive. If the worth continues to rise, UNI’s value would possibly do the identical.

Moreover, the prediction that the token may rally increased than its March excessive may come to move. Nonetheless, there have been different modifications on the community that propelled the hike other than the OI.

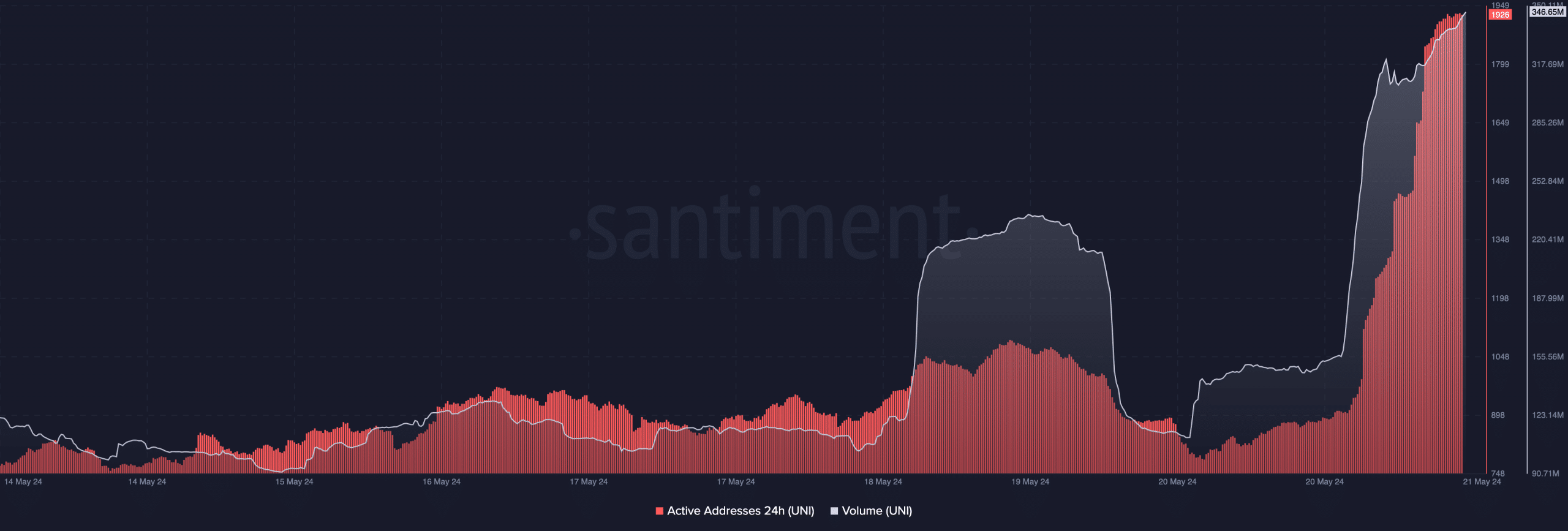

Considered one of them was the 24-hour lively addresses. Each time lively addresses improve, it signifies that a lot of customers are interacting with the blockchain.

If the metric falls, it signifies that the variety of distinctive addresses visiting the community is reducing. For UNI, on-chain information from Santiment confirmed that lively addresses rose to a weekly excessive of 1926

This sudden surge indicates rising confidence among holders. Most occasions, this results in elevated shopping for exercise and was certainly one of many causes UNI’s value moved northward.

Supply: Santiment

Practical or not, right here’s UNI’s market cap in ETH phrases

As well as, AMBCrypto obtained affirmation of the elevated curiosity from the amount. At press time, UNI’s quantity was $346.65 million.

Ought to this determine improve whereas the token’s value rises, then UNI may hit the next worth. Contemplating the momentum, the worth of the cryptocurrency would possibly hit between $12 and $15 inside a brief interval.