Ethereum Leads Market While Altcoins Lose Ground – Details

Ethereum is buying and selling at a essential stage after a number of days of promoting strain and mounting hypothesis, with bulls struggling to take care of momentum as Bitcoin and the broader crypto market flip bearish. Value motion has shifted right into a cautious part, and ETH now faces the problem of defending key demand zones that would decide the weeks forward.

Associated Studying

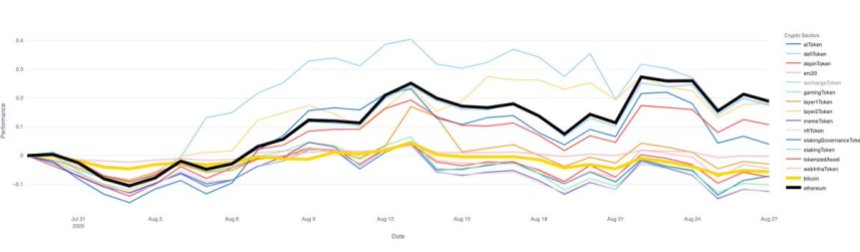

Regardless of this pullback, Ethereum stays the standout performer available in the market. Contemporary information from Glassnode reveals that over the previous month, no altcoin sector has outperformed ETH, though DeFi and Layer 2 ecosystems got here shut. This resilience underscores Ethereum’s dominance even in occasions of broader market weak point, reinforcing its function because the spine of decentralized finance and blockchain infrastructure.

The pattern additionally means that the market is coming into what many analysts describe as “Ethereum season,” the place ETH leads efficiency and capital rotation from Bitcoin into altcoins begins to speed up. With establishments, whales, and retail traders watching carefully, Ethereum’s capacity to carry its floor whereas others falter highlights its power heading into the following stage of the cycle.

Ethereum Leads Market As Capital Rotation Accelerates

In line with Glassnode, Ethereum has established itself because the clear leader available in the market over the previous month. No altcoin sector has managed to outperform ETH throughout this era, with solely DeFi and Layer 2 ecosystems coming shut. Notably, most altcoin sectors ended the month in decline, reinforcing Ethereum’s relative power in a risky atmosphere.

This efficiency alerts a transparent shift in capital rotation, as flows start transferring away from Bitcoin and into Ethereum, marking what many analysts see as the start of a brand new stage within the cycle.

Capital rotation has lengthy been an indicator of crypto market dynamics. Historically, rallies start with Bitcoin dominance earlier than liquidity spreads into Ethereum after which, finally, into smaller altcoins. The newest information reveals ETH taking middle stage on this course of, attracting each institutional curiosity and whale accumulation. This implies that traders view Ethereum as the following engine of development, supported by sturdy fundamentals and increasing adoption throughout DeFi, NFTs, and enterprise use circumstances.

Nonetheless, sentiment stays divided. Some analysts argue that this cycle is structurally longer, stretched by institutional merchandise like spot ETFs and elevated international adoption, which means Ethereum may proceed to outperform for months. Others stay cautious, warning that the market’s present weak point may very well be the early sign of a broader bearish pattern.

No matter these opposing views, Ethereum’s management in efficiency and its capacity to outpace almost each altcoin sector spotlight its rising significance in defining the following stage of the crypto market. For a lot of, ETH is setting the tone for the place capital flows—and alternatives—are headed subsequent.

Associated Studying

ETH Pulls Again After Explosive Rally

Ethereum is buying and selling round $4,366 after a pointy weekly decline of almost 9%, following its latest push to new highs close to $4,800. The weekly chart highlights a strong rally that started earlier this summer time, lifting ETH from lows beneath $2,000 to nearly double its worth in just some months. Nevertheless, the newest crimson candle reveals that sellers are stepping in because the market digests this steep run-up.

Regardless of the correction, ETH stays firmly above its main transferring averages. The 50-week ($2,863), 100-week ($2,819), and 200-week ($2,446) transferring averages are all trending upward, confirming that the long-term construction remains to be bullish. These ranges now function sturdy layers of help ought to deeper retracements happen.

Associated Studying

Within the brief time period, Ethereum is testing the $4,200–$4,300 demand zone, which aligns with earlier resistance ranges from 2022 and early 2024. Holding this zone would strengthen the case for consolidation earlier than one other try at breaking $4,800. A failure, nevertheless, may open the door for a transfer again towards $3,800.

Featured picture from Dall-E, chart from TradingView