Ethereum mainnet daily active addresses surpass all layer-2s

Community exercise on the Ethereum mainnet has now surpassed that on layer-2 scaling blockchains as fuel charges stay low, although it could not all be natural customers.

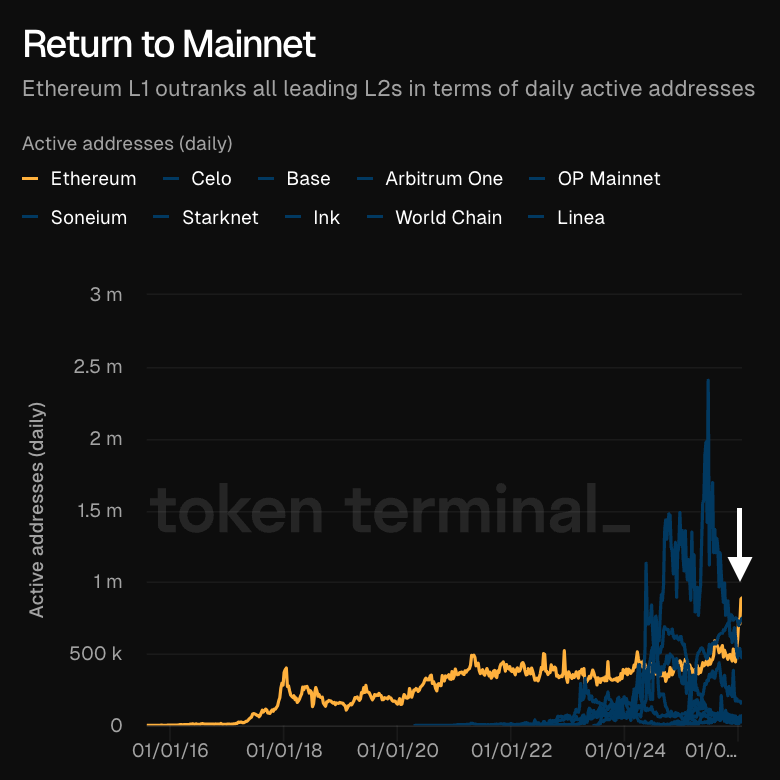

Token Terminal stated on Thursday that there was a “return to mainnet,” with day by day lively addresses on Ethereum outranking all main layer-2s.

A latest spike in lively addresses closed in on 1 million per day, with Etherscan exhibiting that lively addresses surged to round 1.3 million on Jan. 16 however have since settled to round 945,000 day by day lively addresses.

The determine is increased than all layer-2 blockchains, together with the favored networks Arbitrum One, Base Chain, and OP Mainnet. The full worth secured throughout all layer-2s presently stands at $45 billion, down 17% over the previous 12 months, in accordance with L2Beat.

Ethereum community exercise has surged this month following the Fusaka improve in December, which dramatically lowered fuel charges. Nonetheless, it may not all be real customers.

Ethereum L1 surpasses all L2 networks for day by day lively addresses. Supply: Token Terminal

Handle poisoning assaults spike

Safety researcher Andrey Sergeenkov stated on Monday that the spike in community exercise may very well be attributed partly to dusting or tackle poisoning assaults.

Handle poisoning entails scammers sending small transactions from pockets addresses that resemble reputable ones, duping customers into copying the incorrect tackle when making a transaction.

This has been made viable economically by the droop in community charges, making it cheaper to spam the community.

Associated: Efforts to bulletproof Ethereum are paying off in consumer metrics

“It’s affordable to conclude that the latest spike in Ethereum community exercise is being materially pushed by tackle poisoning campaigns,” analysts at blockchain safety agency Cyvers advised Cointelegraph on Wednesday.

Cyvers’ analysts stated that behavioral classification and a statistical correlation “strongly counsel that tackle poisoning just isn’t a marginal issue, however a major contributor to the latest rise in Ethereum transaction quantity.”

Ethereum nonetheless king for asset tokenization

Whatever the spurious exercise, Ethereum “stays the popular blockchain for on-chain property,” ARK Make investments reported on Wednesday. The property on Ethereum now exceed $400 billion, and the worldwide marketplace for tokenized property may surpass $11 trillion by 2030, it added.

Stablecoins make up the majority of these property, with Ethereum commanding a 56% share of stablecoins on-chain, and a 66% share of all tokenized real-world property when layer-2 networks are included, in accordance with RWA.xyz.

Journal: Right here’s why crypto is transferring to Dubai and Abu Dhabi