Ethereum makes efforts to stabilize its price – is it working?

- Ethereum noticed a document variety of day by day lively addresses.

- ETH’s assist has continued to carry.

Ethereum’s [ETH] current spike in a key on-chain metric is noteworthy, particularly contemplating its current worth tendencies and its battle to take care of ranges above a important assist line.

Nevertheless, it’s fascinating to notice that regardless of this spike, different on-chain metrics have displayed typical patterns.

Ethereum sees extra lively addresses

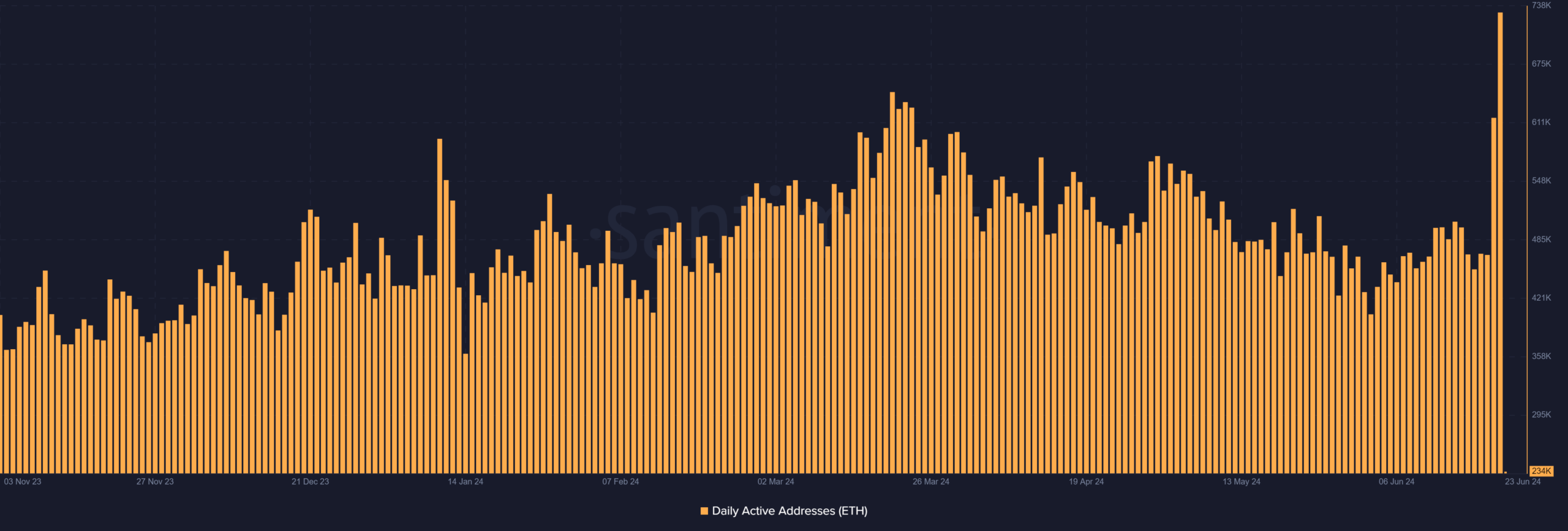

AMBCrypto’s evaluation of Ethereum’s Each day Energetic Addresses metric from Santiment revealed current consecutive spikes, indicating a major enhance in community exercise.

On the twenty first of June, the variety of day by day lively addresses reached over 617,000, marking the best stage for the reason that twenty third of March.

Nevertheless, this document was surpassed the very subsequent day, on the twenty second of June, setting one other excessive level.

Supply: Santiment

Ethereum’s Energetic Addresses indicated that by the shut of buying and selling on twenty second June, the variety of day by day lively addresses exceeded 731,000.

AMBCrypto then took a deeper have a look at the historic knowledge, which revealed that the final incidence of such excessive exercise was round ten months in the past.

In September 2023, the variety of lively addresses surged to over 1 million, marking the best recorded stage as much as that time.

These spikes recommend a heightened stage of engagement on the Ethereum community, which could possibly be pushed by varied elements equivalent to market actions, new developments within the ecosystem, or elevated adoption.

Nevertheless, these spikes didn’t impression the quantity.

What of Ethereum’s quantity?

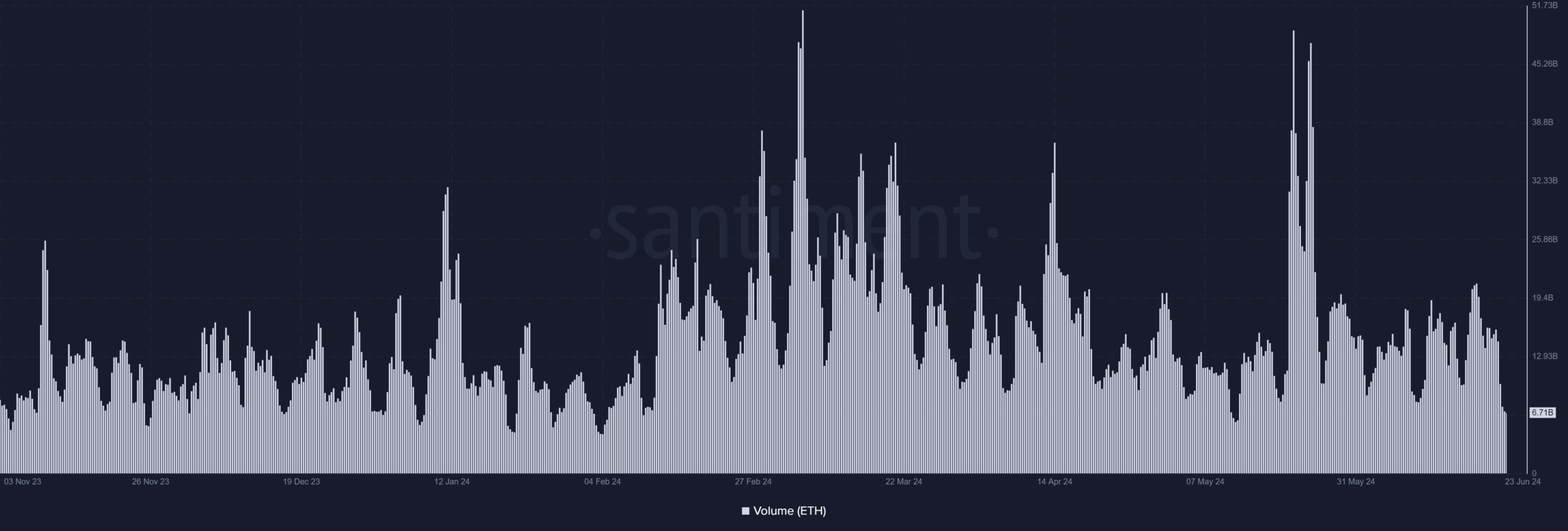

AMBCrypto’s evaluation of Ethereum’s buying and selling quantity reveals an fascinating distinction to the spikes in day by day lively addresses. Regardless of the rise in lively addresses, buying and selling quantity declined.

By the tip of buying and selling on the twenty second of June, the quantity stood at round $9 billion, which could initially appear substantial.

Nevertheless, when in comparison with the $15 billion recorded within the earlier buying and selling session, this represents a major lower.

Supply: Santiment

The discrepancy urged that whereas extra addresses had been lively, probably indicating elevated person interactions or transactions on the community, these didn’t translate into greater buying and selling volumes.

This pointed to probably smaller, much less value-intensive transactions dominating the exercise through the interval.

ETH’s bear development weakens

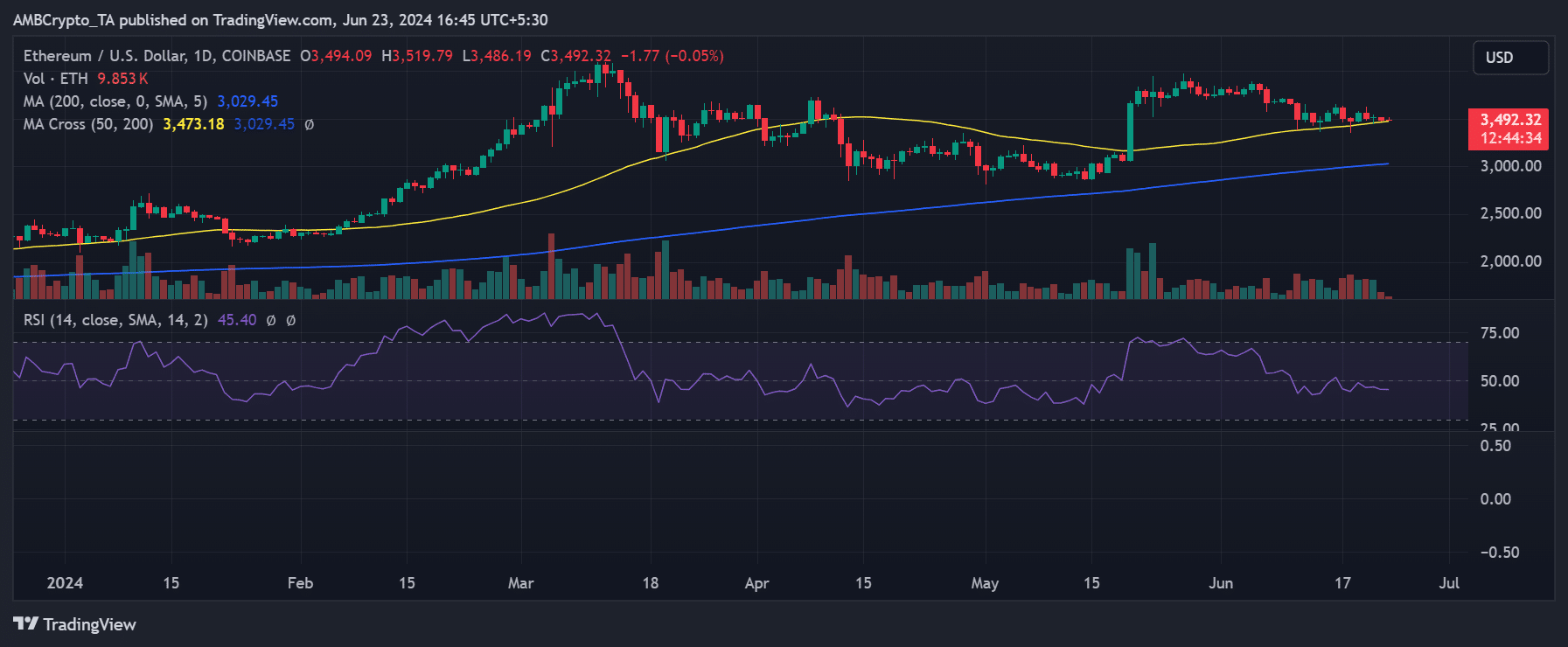

Ethereum’s worth chart indicated that it was presently striving to take care of its assist stage.

AMBCrypto’s evaluation of the day by day timeframe chart confirmed that though there was a decline in its worth over the previous couple of days, the assist stage has successfully held at round $3,400.

As of the most recent knowledge, Ethereum was buying and selling at roughly $3,490, experiencing a slight decline.

This means tentative stability, because it manages to remain above the essential $3,400 assist stage, which could possibly be pivotal in figuring out its short-term worth trajectory.

Supply: TradingView

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

The evaluation of Ethereum’s Shifting Common Convergence Divergence (MACD) indicated that it was in a bearish development at press time.

Nevertheless, the habits of the MACD strains urged that this bearish development was weakening. Ought to the worth enhance, this might diminish additional, doubtlessly signaling a reversal or not less than a slowdown in downward momentum.