Ethereum mirrors Solana’s 2023 moves – Is 222% gains possible for ETH too?

- Ethereum mirroring Solana’s actual construction, a triangle beneath its resistance stage.

- The a number of liquidity seize that occurred on ETH might spark a rally.

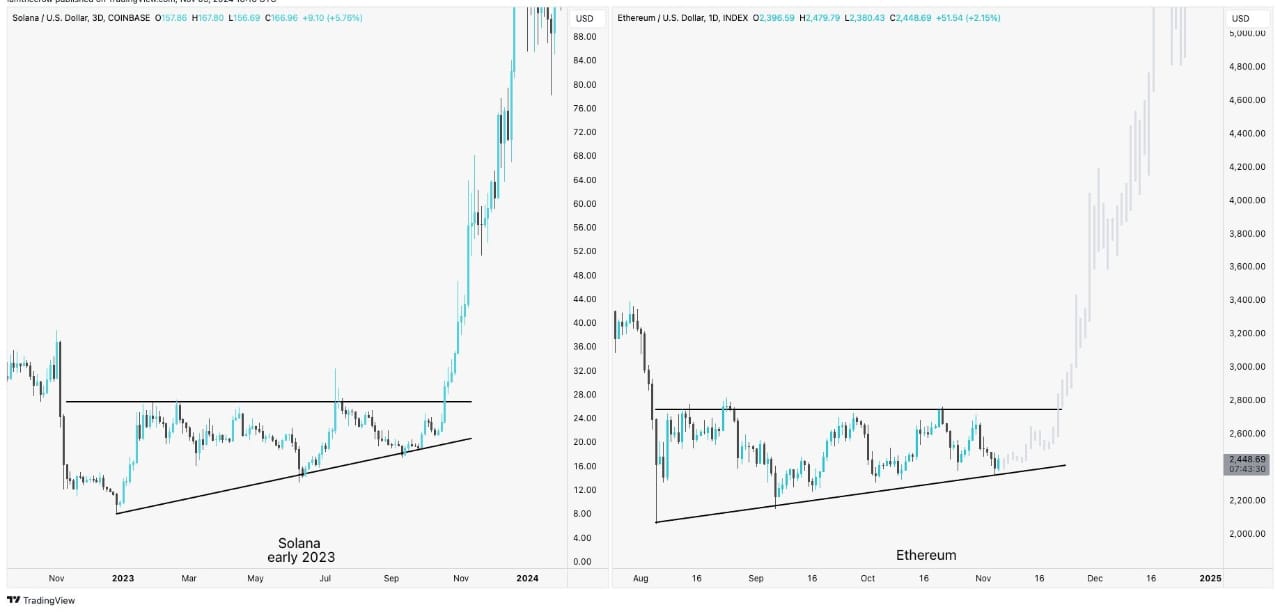

The comparability of Ethereum [ETH] and Solana [SOL] charts reveal a notable similarity between the latest value motion of ETH and that of SOL in early 2023.

Solana’s value in early 2023 fashioned an ascending triangle, consolidating beneath resistance earlier than finally breaking out, leading to a considerable rally of over 222%.

As of press time, Ethereum was mirroring this actual construction—forming an ascending triangle beneath its resistance stage, exhibiting related buildup and consolidation.

Given this sample alignment, Ethereum might doubtlessly be on the cusp of a serious bullish breakout if it follows the identical trajectory as Solana did.

Supply: Buying and selling View

The ascending triangle usually traded as a bullish continuation sample suggests a breakout might propel ETH considerably larger. Momentum indicators and dealer exercise would want to align for ETH to realize comparable positive factors.

Ought to Ethereum break above the present resistance zone, it’d result in a powerful rally, concentrating on related upside percentages, positioning ETH for one more vital uptrend.

The RSI and MACD indicators recommend…

Moreover, the Ethereum the relative power index and transferring common divergence convergence indicators factors in direction of potential market power.

The RSI was hovering close to a impartial to barely bullish territory, suggesting momentum might begin leaning upwards. The histogram for the MACD indicator was exhibiting diminishing crimson bars, hinting that bearish stress may very well be weakening.

Moreover, the MACD line seems to be nearing a crossover above the sign line, which is a standard bullish sign.

Supply: X

Total, these indicators suggest that ETH may expertise some shopping for momentum if extra fundamentals like liquidity seize and on-chain actions surge in keeping with value patterns.

The impression of the liquidity seize on ETH value motion

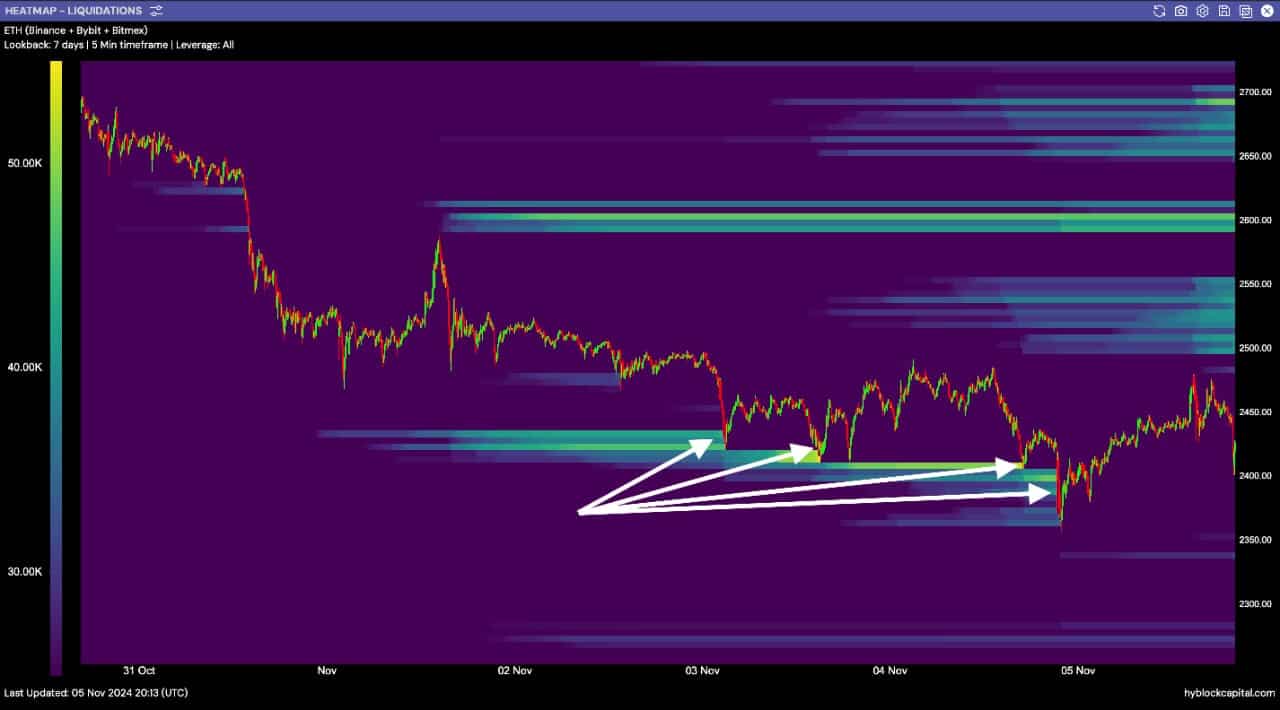

Wanting on the ETH liquidity heatmap clearly indicated a well-known sample: one other day marked by a strategic liquidity seize.

Worth motion constantly reached down to soak up liquidity, making a collection of wicks that steered market makers and bigger gamers have been shaking out weaker palms.

The situation appeared poised for ETH to rebound after this liquidity seize, particularly as there stays a big cluster of liquidity in shut proximity above the present value.

Supply: Hyblock Capital

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

These larger liquidity ranges act as magnets, making it possible that Ethereum will intention to maneuver upward subsequent, concentrating on these areas. This might doubtlessly lead ETH to gaining related 222% positive factors as SOL.

Merchants can anticipate that ETH, following this liquidity sweep, might leverage the regained momentum to climb and seize the close by liquidity swimming pools, resulting in doubtlessly bullish short-term motion.