Ethereum Nears ‘Critical Zone’ Historically Linked To Market Bottoms

Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

In accordance with a latest X submit by crypto analyst Ali Martinez, Ethereum (ETH) is inching nearer to a essential demand zone that has traditionally marked market bottoms. Notably, ETH has declined by greater than 21% over the previous two weeks.

Ethereum About To See Pattern Reversal?

Ethereum could quickly witness a reduction rally, because the second-largest cryptocurrency by market cap nears a key demand zone that has traditionally marked market bottoms and provided sturdy shopping for alternatives.

Associated Studying

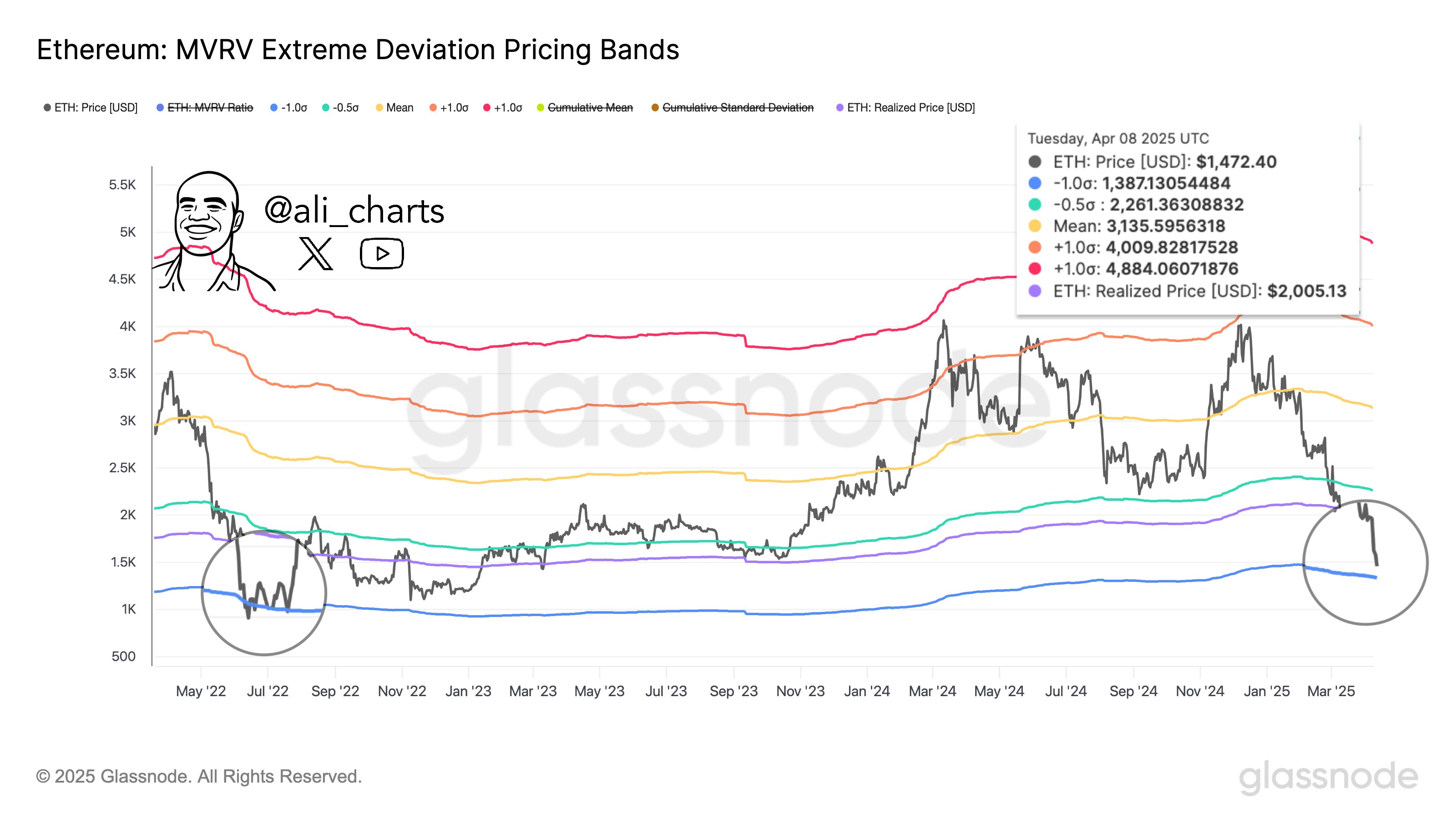

Sharing his evaluation, Martinez posted the next chart, illustrating how ETH is probably going approaching the -1 commonplace deviation pricing band primarily based on Market Worth to Realized Worth (MVRV) Excessive Deviation Pricing Bands.

In accordance with the chart, the -1 commonplace deviation pricing band lies round $1,387, whereas ETH’s realized value hovers round $2,005. The final time ETH touched this band – again in July 2022 – it marked an area market backside.

For the uninitiated, MVRV Excessive Deviation Pricing Bands are on-chain metrics that assist establish potential market tops or bottoms by measuring how far ETH’s present market worth deviates from its realized worth. These bands spotlight traditionally important overvalued or undervalued zones, typically aligning with intervals of utmost investor sentiment or value reversals.

As ETH nears the -1 commonplace deviation pricing band, it suggests the asset could also be considerably undervalued at its present value. Fellow crypto analyst TraderPA seems to assist Martinez’s view.

In an X post, TraderPA shared a weekly Ethereum chart displaying that ETH’s value decline aligns with a low Stochastic Relative Power Index (RSI) worth – indicating the cryptocurrency could also be oversold following the latest sell-off.

The Stochastic RSI is a momentum indicator that applies the stochastic oscillator components to RSI values reasonably than value, making it extra delicate and attentive to short-term actions. Not like the usual RSI – which ranges from 0 to 100 – the Stochastic RSI ranges between 0 and 1, serving to merchants establish overbought or oversold circumstances.

Whales Shedding Confidence In ETH

Whereas Martinez and TraderPA’s analyses counsel ETH could also be undervalued, latest whale exercise factors to a attainable lack of confidence. A beforehand dormant ETH whale dumped 10,702 ETH after practically two years of inactivity, signaling weakening conviction amongst massive buyers.

Associated Studying

Curiously, the whale had initially acquired ETH again in 2016, when it was valued at simply $8. Regardless of holding by means of the 2021 peak close to $4,000, the latest value drop appears to have triggered a big sell-off.

Moreover, Martinez’s newest evaluation suggests that ETH might drop to $1,200, because the asset continues to interrupt under a number of key assist ranges. At press time, ETH trades at $1,553, up 5.5% previously 24 hours.

Featured picture from Unsplash, charts from X and TradingView.com