Ethereum netflows surge – Can ETH rally past $2800 now?

- Ethereum noticed a surge in deposits over withdrawals.

- ETH’s worth patterns confirmed a possible breakout.

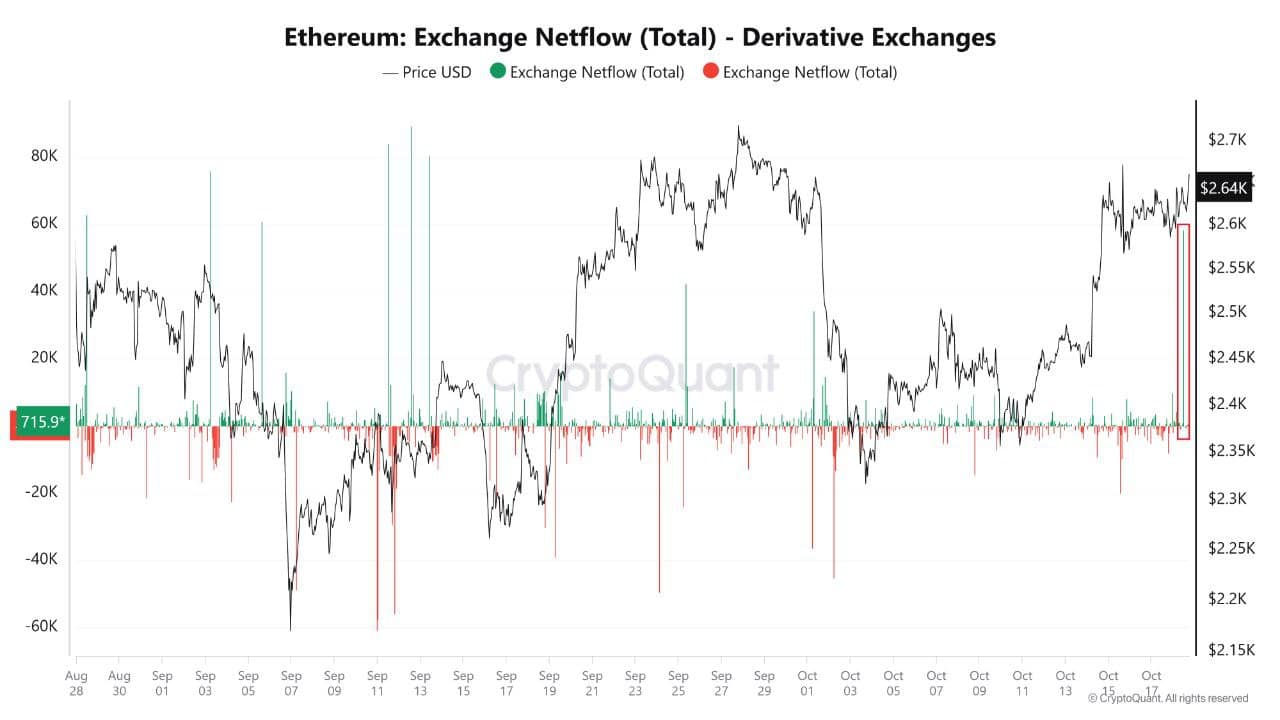

Ethereum’s [ETH] netflows on by-product exchanges not too long ago surpassed 50,000 ETH per day, indicating a major surge in deposits over withdrawals.

This development has merchants speculating concerning the potential influence on ETH worth actions.

A spike in deposits could sign both impending promoting strain or elevated borrowing to gasoline lengthy positions, suggesting volatility is on the horizon.

With market individuals anticipating main worth swings, Ethereum’s outlook for the approaching months may very well be a key focus for buyers.

Supply: CryptoQuant

ETH worth and inflation fee

Ethereum’s worth motion has remained within the highlight. Over the previous week, ETH has risen by 8.53%, and as of press time worth stood at $2605.63.

ETH/USDT is presently positioned inside an ascending triangle, and a breakout from this sample may push the value greater. The following key goal for ETH is $2800, which may very well be surpassed if the bullish momentum continues.

On the ETH/BTC pair, it’s buying and selling close to a essential help degree at $0.039 on the weekly chart. Regardless of bearish sentiment out there, this help degree has held agency, indicating the potential of a bounce.

Such a rebound couldn’t solely profit ETH but in addition spark a broader rally within the high 100 altcoins.

Supply: TradingView

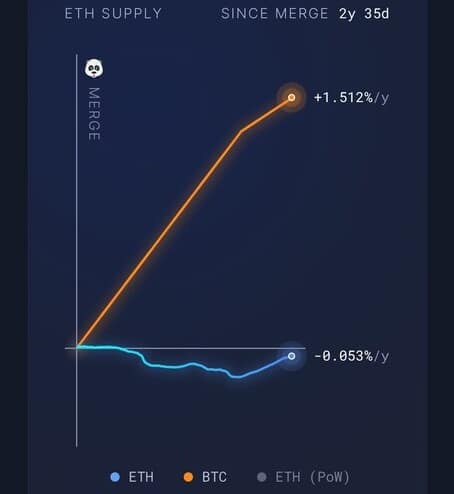

Inflation stays a vital think about Ethereum’s total market efficiency. Presently, Ethereum’s inflation fee stands at +0.31% per yr, a determine decrease than each Bitcoin and gold.

For the reason that Merge, which transitioned Ethereum to Proof-of-Stake, over 135,000 ETH have been burned, lowering provide. This burn mechanism has continued to reinforce its deflationary facet.

Regardless of the subdued worth motion in current months, the community’s rising demand and deflationary traits are setting the stage for potential long-term worth will increase.

The mixture of Ethereum’s provide discount and growing community utilization is prone to drive ETH costs greater sooner or later.

Supply: X

Main sensible contract platform

Ethereum’s dominance because the main sensible contract platform stays unchallenged. Since its inception in 2015, Ethereum has been the muse for innovation within the DeFi and NFT sectors.

With ETH 2.0 now reside, the community is extra scalable, safe, and energy-efficient than ever earlier than. These developments are contributing to Ethereum’s continued progress within the blockchain area.

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

The continuing growth and use of Ethereum’s blockchain, coupled with its decreased inflation and deflationary mechanisms, are key drivers behind the expectation of upper costs.

Ethereum is well-positioned for robust efficiency within the close to time period. Protecting an in depth eye on Ethereum’s subsequent strikes is required, particularly with the potential for positive aspects as 2025 approaches.