Ethereum network dips to 6-month low – Here’s how it affected ETH

- Ethereum’s charges hit a six-month low up to now seven days.

- ETH was down by 6%, and metrics seemed bearish.

As L2s acquire recognition, Ethereum’s [ETH] community utilization plummets, reaching a six-month low.

This aligned with Vitalik Butarin’s 2020 roadmap, which aimed to boost scalability by offloading transactions from the mainnet.

Within the meantime, ETH bears entered the market and pushed the token’s value down.

Ethereum’s community exercise dwindles

IntoTheBlock lately posted a tweet highlighting the truth that ETH’s charges plummeted to a 6-month low this week because it dropped by over 29%.

The drop in ETH’s charges mirrored a shift in exercise to over 50 dwell Layer 2 networks. To see what’s occurring with Ethereum, AMBCrypto analyzed Artemis’ data.

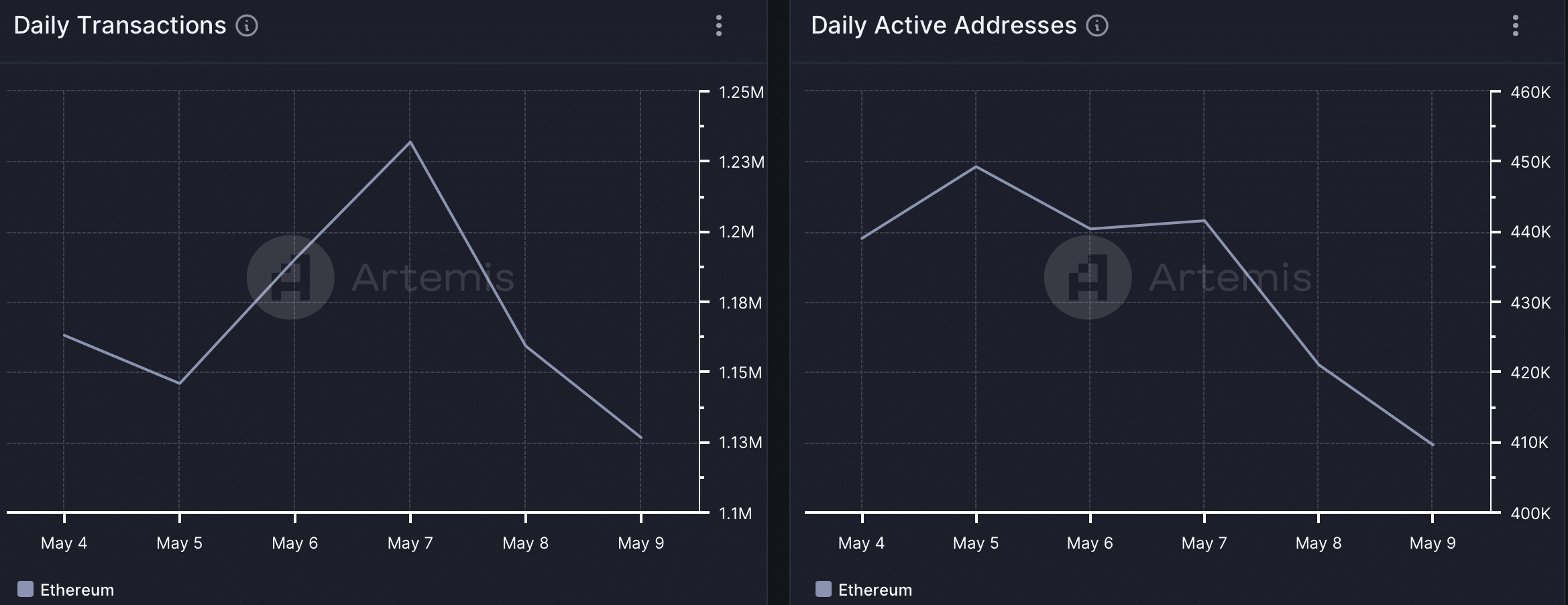

Notably, total exercise on the community had dropped, alongside the blockchain’s Every day Lively Addresses declined final week.

Supply: Artemis

ETH’s Every day Transactions additionally adopted an identical development. The decline in charges additionally precipitated the blockchain’s income to drop final week.

Notably, it was stunning to see the blockchain’s utilization drop when its gasoline value declined. As per Ycharts, ETH’s gasoline value dipped from 47.5 Gwei to eight.5 Gwei during the last month.

Ethereum turns bearish

Whereas the blockchain’s community exercise dwindled, its value motion additionally turned bearish. In response to CoinMarketCap, ETH’s value has dropped by greater than 6% within the final seven days.

On the time of writing, it was buying and selling at $2,920.99 with a market capitalization of over $350 billion.

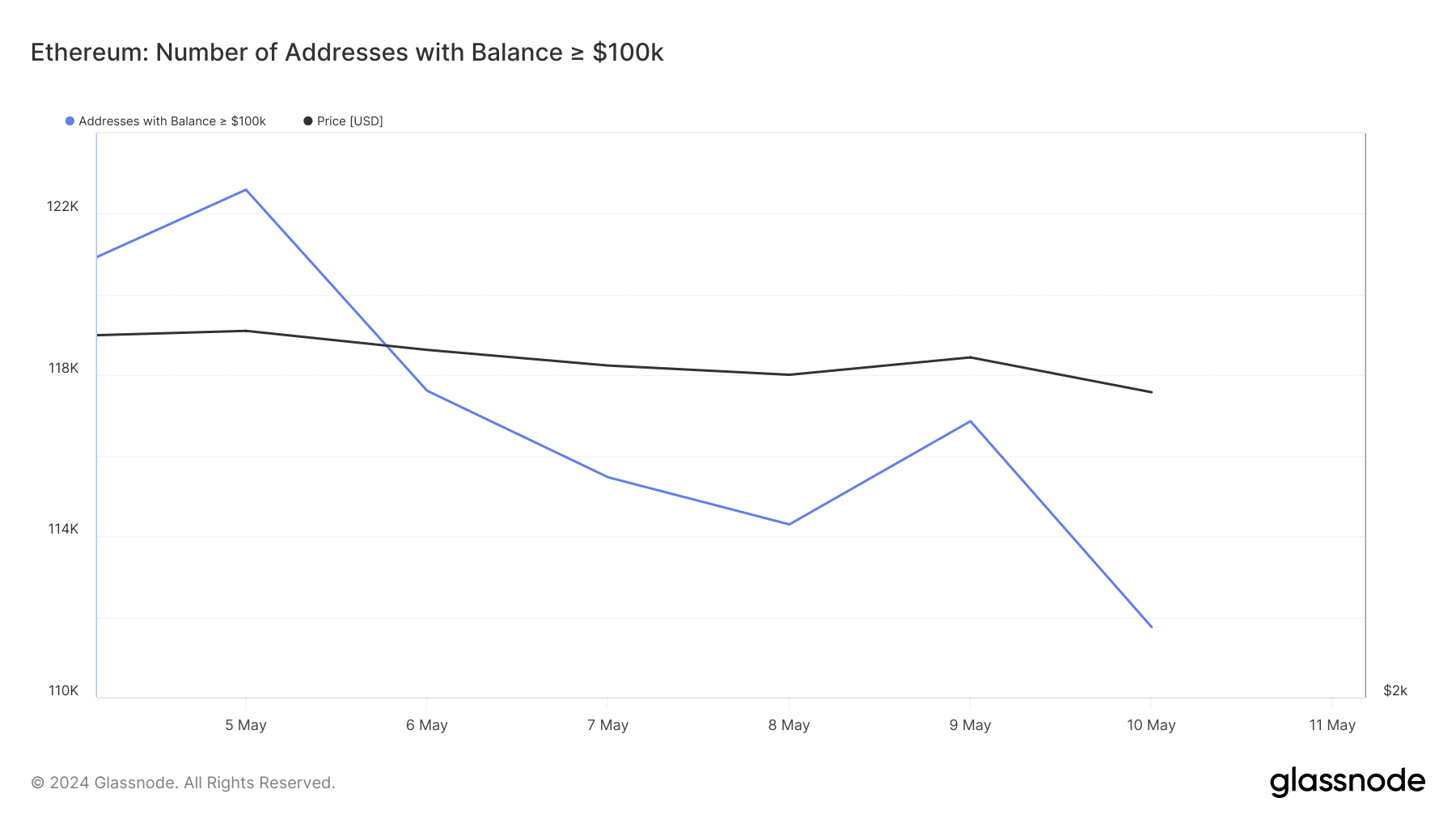

AMBCrypto’s have a look at Glassnode’s information revealed a attainable purpose behind this value decline. We discovered that ETH’s variety of addresses with balances larger than $100k sank during the last seven days.

This clearly indicated that whales have been promoting their holdings.

Supply: Glassnode

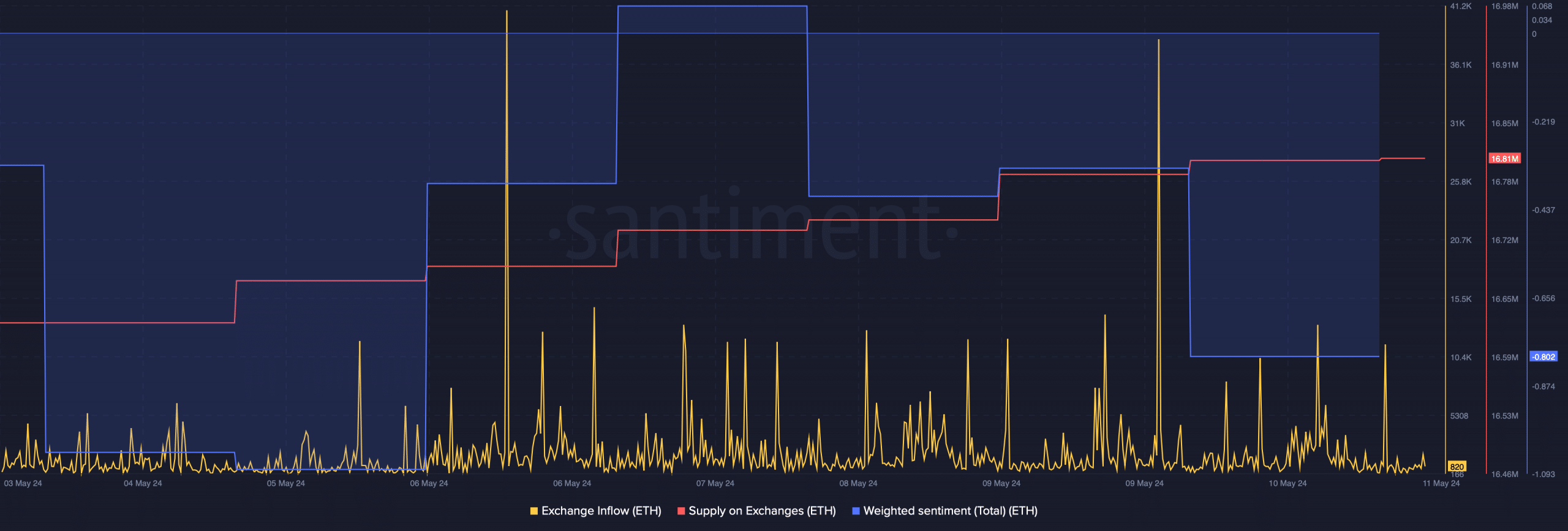

Not solely whales, however promoting sentiment was total dominant available in the market. Our evaluation of Sentiment’s information identified that ETH’s Alternate Influx spiked twice final week.

Moreover, its Provide on Exchanges elevated. This hinted at a sell-off, which could have triggered the worth correction.

The damaging value motion additionally had a damaging influence on market sentiment. Ethereum’s Weighted sentiment dropped in the previous couple of days, suggesting that bearish sentiment across the token was dominant.

Supply: Santiment

AMBCrypto then analyzed ETH’s every day chart to see whether or not an extra value drop is more likely to occur.

We discovered that its Relative Power Index (RSI) was resting underneath the impartial mark. Its Cash Move Index (MFI) additionally registered a downtick.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

The king of altcoins was resting underneath its 20-day Easy Shifting Common (SMA) at press time, indicating an extra value decline.

ETH’s value had touched the decrease restrict of the Bollinger Bands, which may set off a development reversal.

Supply: TradingView