Ethereum NFTs: Explaining why BAYC, MAYC are losing value

- Ethereum NFTs witness a decline in curiosity as ETH’s value surges.

- General curiosity in ApeCoin suffers as BAYC and MAYC get impacted.

Ethereum [ETH] witnessed a large surge in value over the previous couple of weeks. Though this boded effectively for ETH holders, the identical couldn’t be mentioned about Ethereum-based NFTs.

A divergence is noticed

As per Blur’s evaluation, the continued ascent within the value of ETH coincides with a declining development within the costs of NFTs denominated in ETH.

Over the previous 24 hours, notable drops have been noticed, with Bored Ape Yacht Membership (BAYC) lowering by 10% to fifteen.2 ETH, Mutant Ape Yacht Membership (MAYC) down by 11%, DeGods by 8%, Azuki by 6%, and others.

Notably, there have been at present 70 BAYC, 110 MAYC, and 100 DeGods blue-chip NFTs inside Mix that have been in public sale liquidation standing.

For context, public sale liquidation standing typically implies that the NFTs are actively listed for public sale, and potential consumers can place bids to accumulate these digital property.

The time period is usually used within the context of marketplaces or platforms that facilitate the shopping for and promoting of NFTs, indicating that the desired NFTs are a part of an ongoing public sale course of and can be found for events to bid on.

Common NFT collections similar to BAYC(Mutant Ape Yacht Membership) and MAYC(Mutant Ape Yacht Membership) have been one of many few collections that witnessed the very best quantity of correction.

One of many causes for a similar may very well be the truth that addresses may very well be extra keen on holding ETH slightly than collections on its ecosystem. This may point out that they’d extra religion within the ETH token than NFT collections on the community.

Supply: Blur

ApeCoin will get impacted

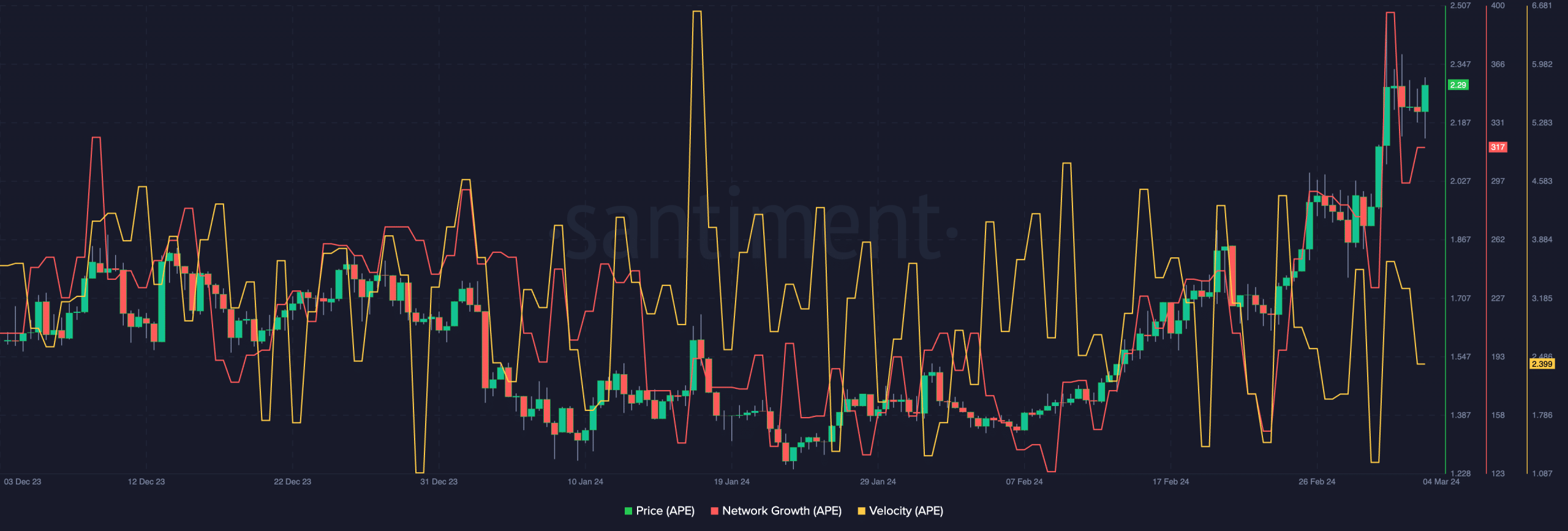

ApeCoin, the token related to Yuga Labs which created BAYC and MAYC additionally noticed a decline in value. Within the final 24 hours, the worth of APE fell by 3.35% . It was buying and selling at $2.24 on the time of writing.

The decline in value, nonetheless, wasn’t important sufficient to reverse the bullish development APE had proven by exhibiting a number of larger highs and decrease highs.

Though the development was nonetheless bullish, the community progress round APE had additionally declined. This indicated that the variety of new addresses within the APE token had additionally fallen. The shortage of curiosity showcased by new addresses could additional derail the possibilities of APE seeing inexperienced.

Learn ApeCoin’s [APE] Value Prediction 2023-2024

Furthermore, the speed at which APE was buying and selling at had additionally fallen. This recommended that the frequency with which merchants have been sending and receiving had declined.

These components may drive down the worth of APE even additional sooner or later.

Supply: Santiment