Ethereum on the Edge? Rising Netflows and Leverage Ratios Hint at Big Moves for ETH

- Ethereum’s netflows to derivatives and elevated leverage level to potential volatility and market threat.

- Retail curiosity in Ethereum stays sturdy regardless of latest worth challenges, with energetic addresses reaching new highs.

Ethereum [ETH] has confronted challenges in latest weeks, struggling to reclaim its highs above $3,000. Since falling beneath this stage, the cryptocurrency has hovered below this mark, experiencing a 5.8% decline over the previous week.

Ethereum was buying and selling at $2,478 at press time, a 2.7% dip during the last 24 hours. This worth efficiency has generated combined reactions inside the Ethereum group, with analysts offering various outlooks on the asset’s near-term trajectory.

ETH’s improve in netflow

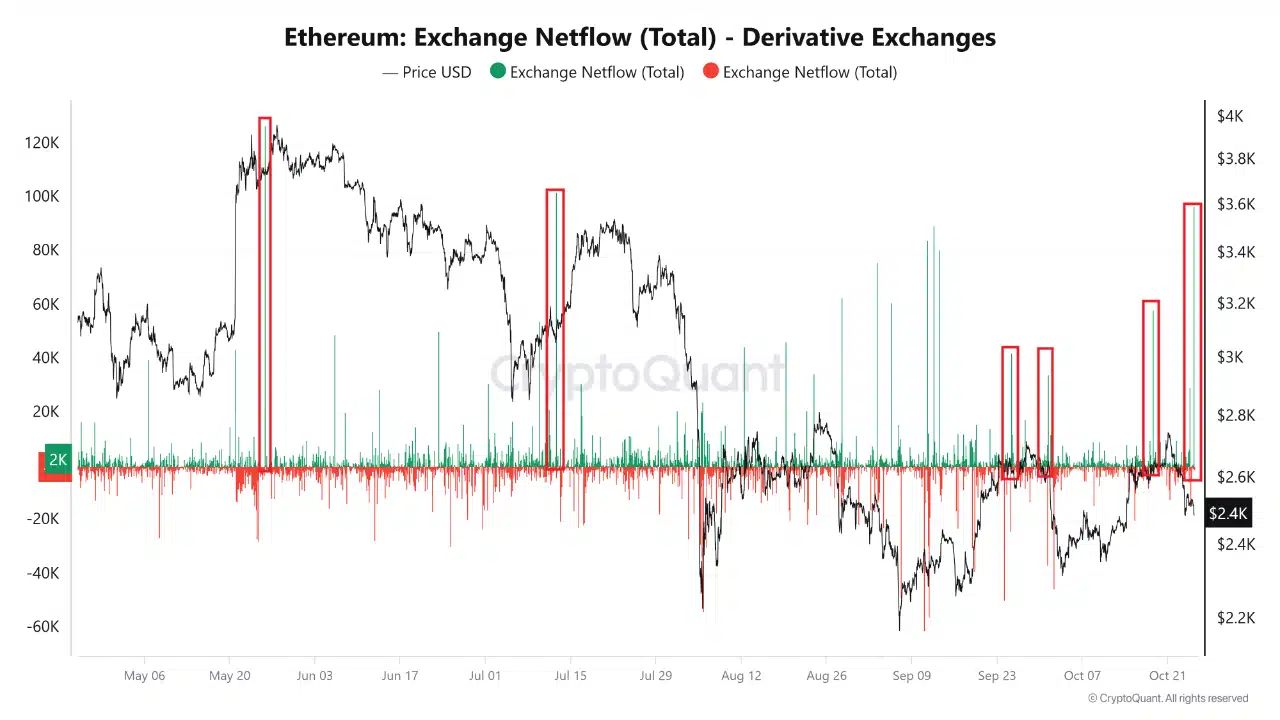

Based on CryptoQuant analyst Amr Taha, latest spikes in Ethereum netflows to spinoff exchanges sign potential for elevated market exercise. Taha highlighted a considerable influx of 96,000 ETH to derivatives exchanges, marking the biggest latest netflow.

Traditionally, spikes in netflows, similar to these noticed in Might and July, have coincided with elevated volatility and subsequent worth corrections for Ethereum. This motion means that merchants could also be positioning for potential downturns within the asset’s worth.

Supply: CryptoQuant

Taha famous that the newest netflow may point out heightened volatility, including that dealer sentiment inside derivatives markets usually acts as an early indicator of upcoming worth developments for Ethereum.

Past netflows, Taha examined Ethereum’s futures sentiment, noting a collection of peaks within the sentiment index that will function contrarian indicators. These peaks have traditionally signaled native market tops, as bullish futures sentiment usually precedes worth pullbacks.

This development means that heightened optimism amongst futures merchants could point out a attainable worth correction for Ethereum.

Taha added that the sentiment spikes marked in purple on the futures sentiment chart are reflective of moments when the market has leaned overly optimistic, creating an setting conducive to market reversals.

Ethereum retail curiosity and leverage ratio

In the meantime, different on-chain metrics for Ethereum present further insights into the present market dynamics.

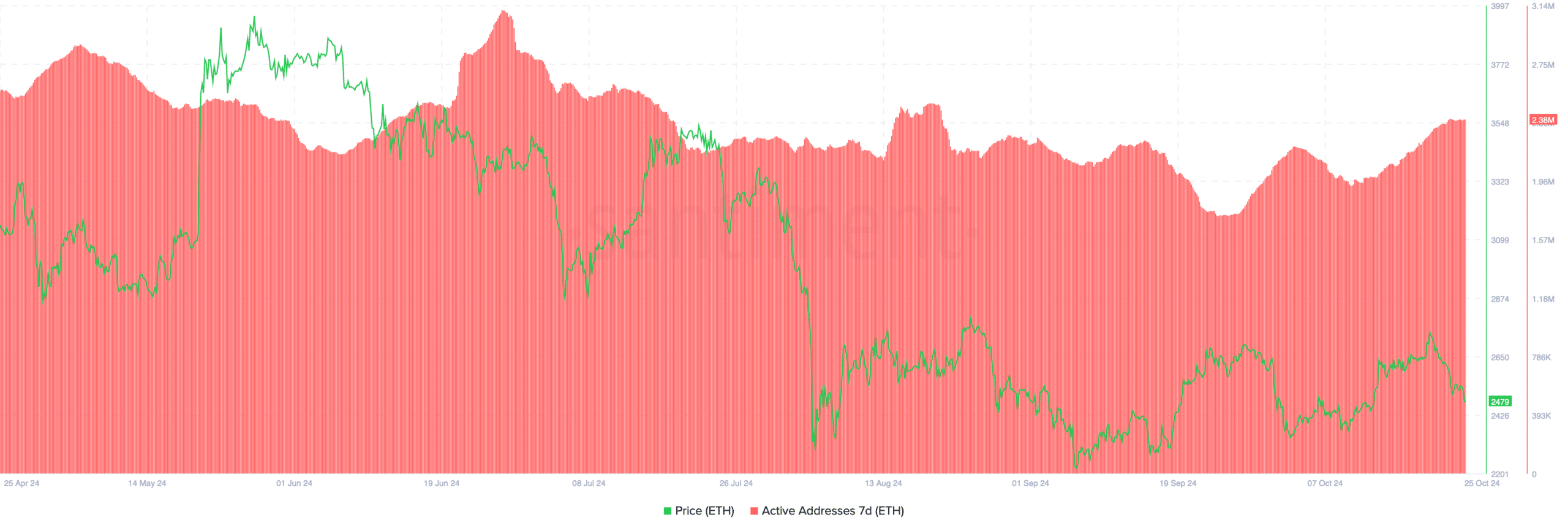

Based on data from Santiment, Ethereum’s retail curiosity has elevated in latest weeks, with the variety of energetic addresses rising from below 1.80 million final month to roughly 2.38 million right this moment.

Supply: Santiment

This rise in energetic addresses displays rising curiosity in Ethereum from retail traders, doubtlessly indicating stronger demand within the spot market.

A rise in energetic addresses is usually seen as a optimistic indicator for asset liquidity and market engagement, hinting at sustained curiosity in Ethereum regardless of latest worth declines.

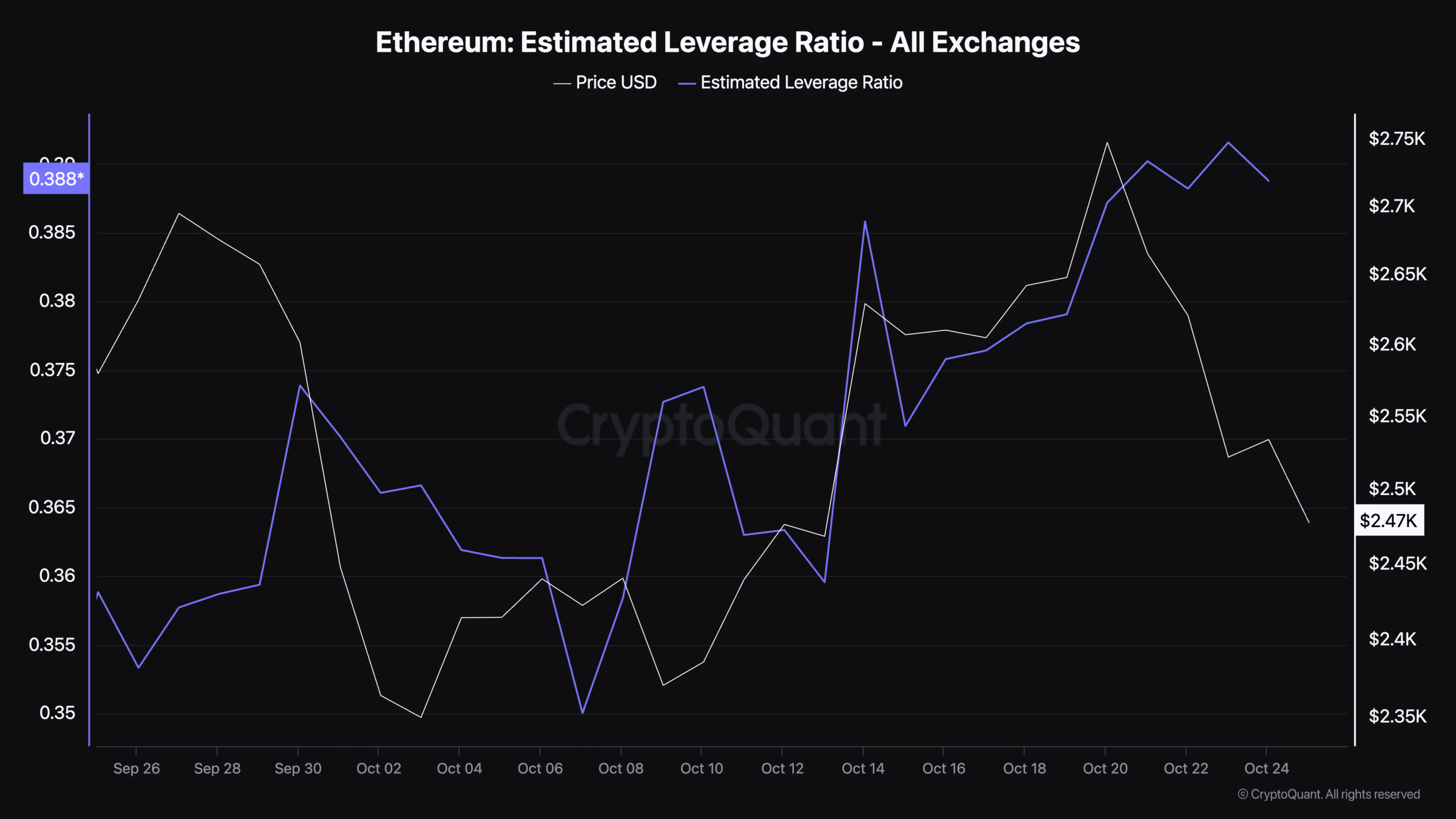

Along with retail curiosity, estimated leverage ratio has additionally risen just lately, with the metric at present standing at 0.38.

This ratio, offered by CryptoQuant, measures the diploma of leverage utilized in Ethereum trades, which may point out the extent of threat inside the market.

Learn Ethereum’s [ETH] Value Prediction 2024–2025

The next leverage ratio means that merchants are more and more utilizing borrowed funds to amplify their positions.

Supply: CryptoQuant

Whereas this will result in increased returns in bullish markets, it additionally amplifies losses throughout downtrends, including to market threat. The present leverage ratio signifies that merchants could also be taking up elevated publicity in anticipation of market actions.