Ethereum on the move: Here are 3 signs of a bullish breakout ahead

- Ethereum confirmed indicators of accumulation from buyers up to now three weeks.

- The momentum when disbelief turns into FOMO may usher in much more positive aspects for ETH.

Ethereum [ETH] attracted flak from Peter Brandt, who known as it a “junk coin” with “outrageous” gasoline charges. Regardless of the tough statements, a portion of the market had bullish conviction within the token.

On the eighth of April, it famous a 6.5% rally on the time of writing. These positive aspects got here although a bearish chart sample forecasted a drop to $2800. Are the vast majority of the members in disbelief of the present rally, or is that this a short lived retracement earlier than the subsequent leg downward?

The U.S. merchants are in disbelief

Supply: CryptoQuant

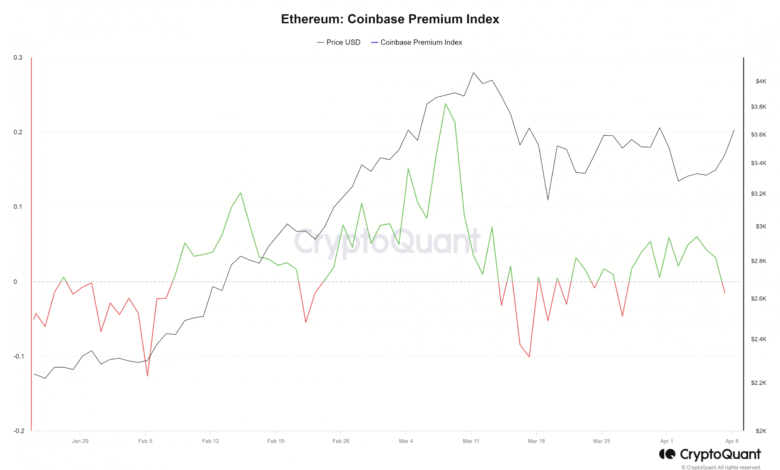

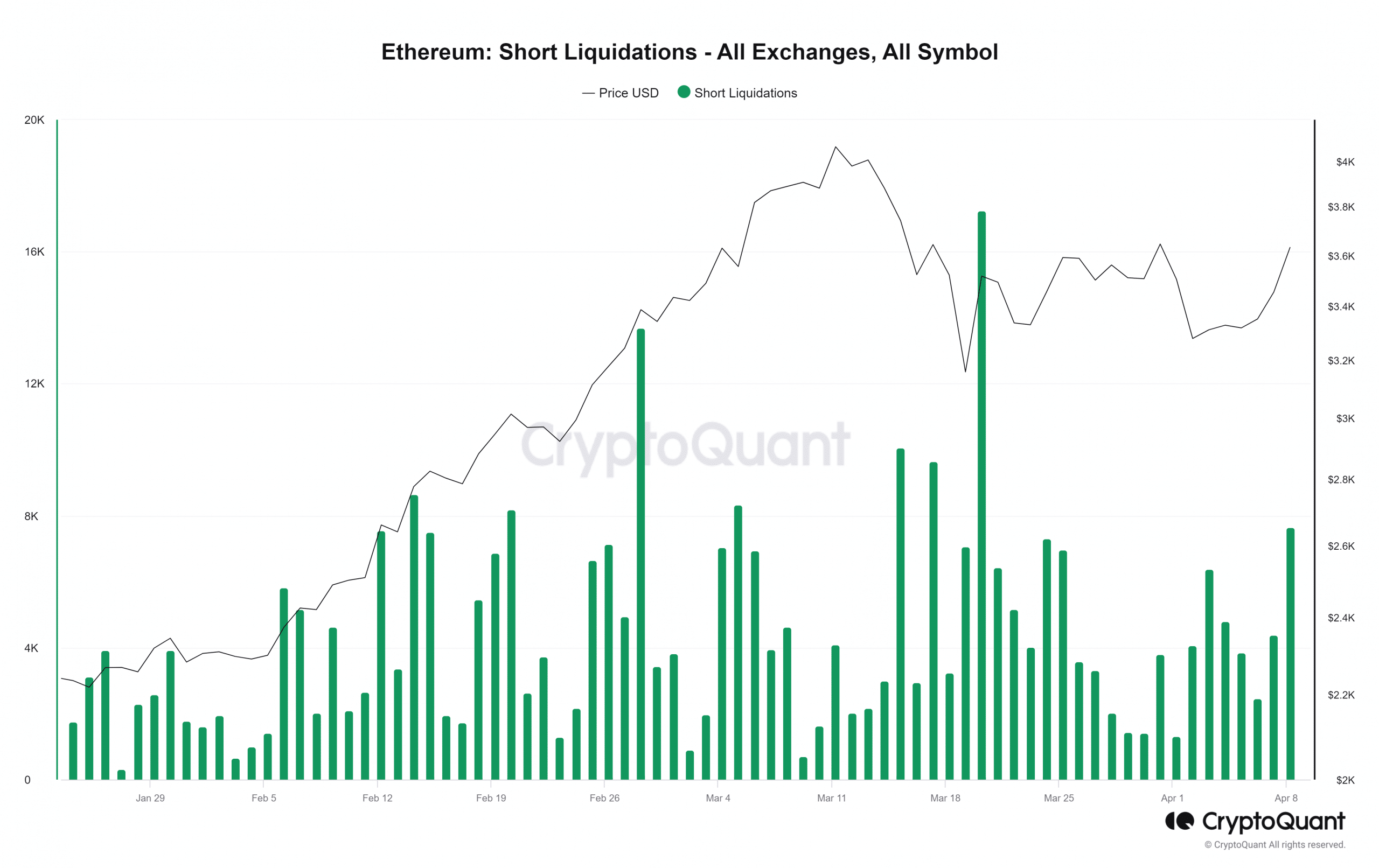

The Coinbase Premium Index represents the proportion distinction in costs between Binance and Coinbase. The previous shouldn’t be out there to U.S. residents, which is why Coinbase is an efficient index for U.S. participant enthusiasm.

From the 2nd of April to the seventh, the Coinbase premium fell towards zero. But, at the moment, ETH was within the strategy of unmaking current losses. In distinction, when there was a robust rally towards the top of February, the Coinbase premium trended swiftly greater.

ETH to $4k as soon as extra?

Supply: CryptoQuant

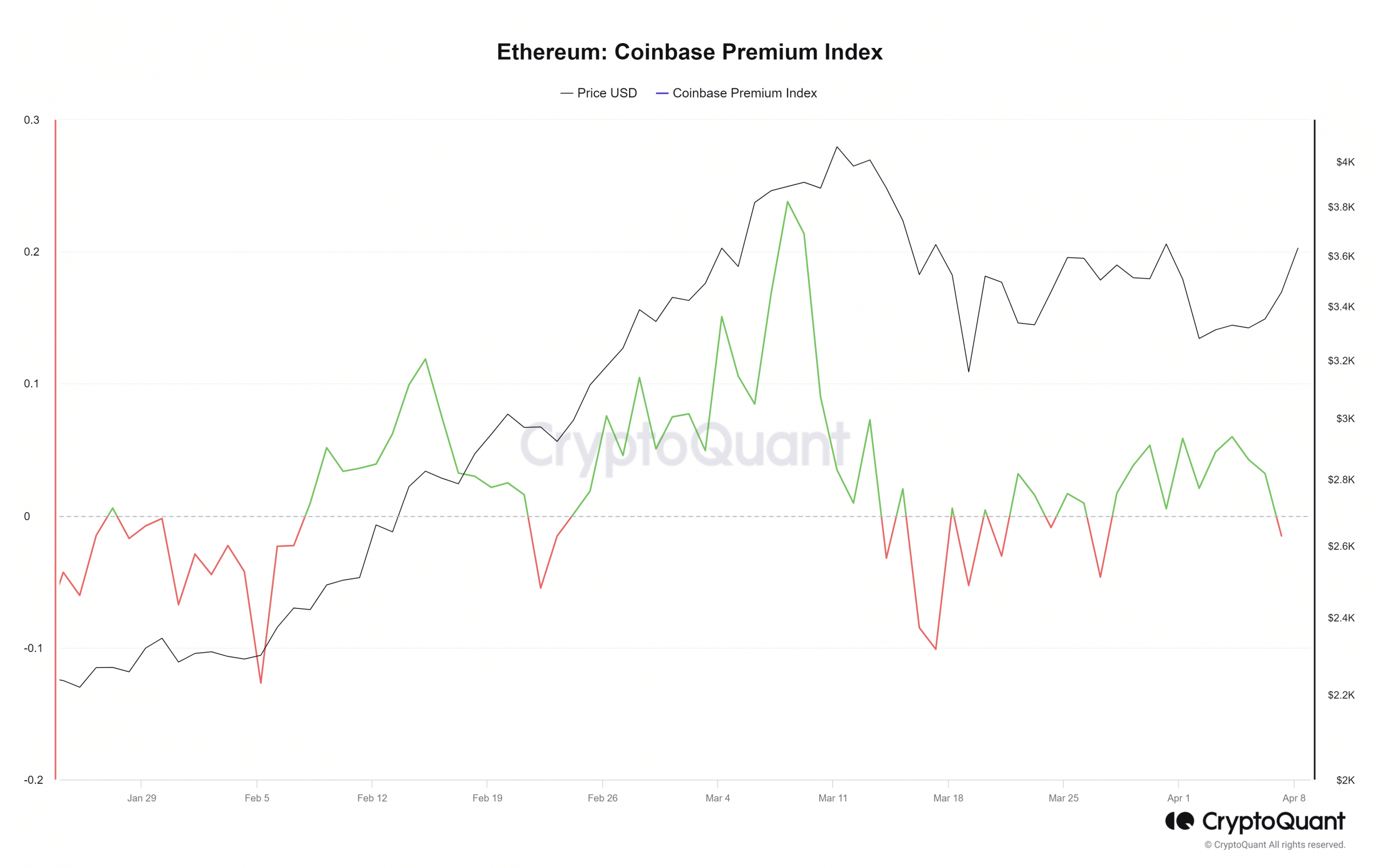

After the drop to $3056 on nineteenth March, the change reserves of Ethereum started to pattern decrease. This was an indication that customers have been offloading their tokens out of centralized exchanges. It implied accumulation and a discount within the promoting strain.

This downtrend has not stopped but, though there was a minor uptick within the change reserve on seventh April. This was when the $3.4k short-term resistance was reclaimed, giving some buyers a purpose to understand income.

Total, a continued downtrend within the reserves metric could be good news for long-term bulls.

Supply: CryptoQuant

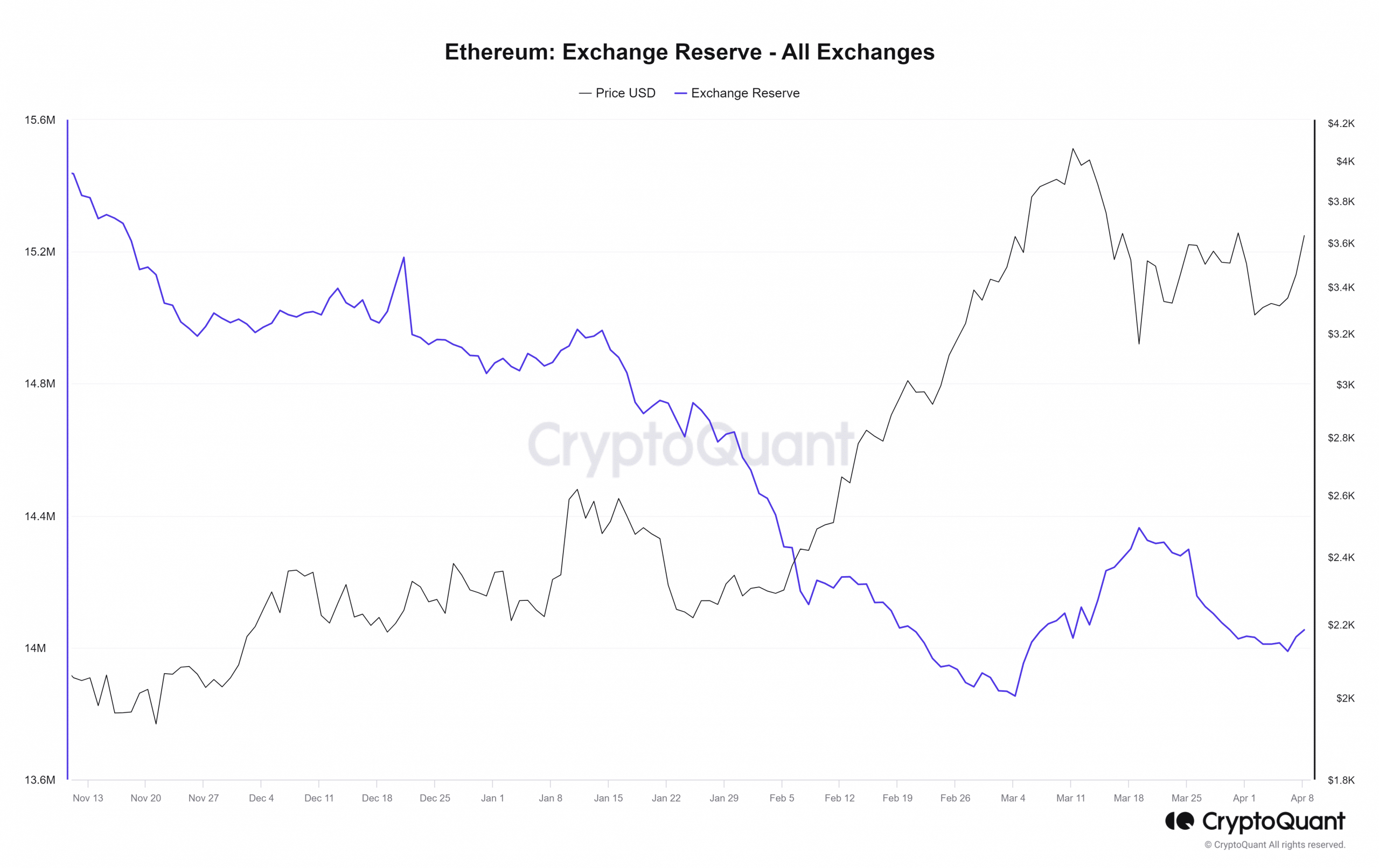

A take a look at the brief liquidations confirmed that the previous two days noticed an enormous quantity of Ethereum brief liquidations. CryptoQuant information confirmed it was price simply over 17k ETH. These liquidations, as soon as triggered, open market purchase orders which might drive costs greater.

Is your portfolio inexperienced? Verify the Ethereum Revenue Calculator

Mixed with the disbelief we noticed with the Coinbase Premium Index, it appeared seemingly that Ethereum would blow the bears out of the water if the rally continued.

Their pressured capitulation will likely be rocket gasoline for additional positive aspects. We may see a brief squeeze and $4k ETH as soon as extra this week, and the disbelief may quickly flip into FOMO.