Ethereum Open Interest Plunges: Cooling Off Or Cracks Forming?

Ethereum climbed again above $2,000 after a softer-than-expected US CPI print, and the transfer has merchants and analysts debating whether or not the worst is behind the coin or if it is a non permanent aid rally.

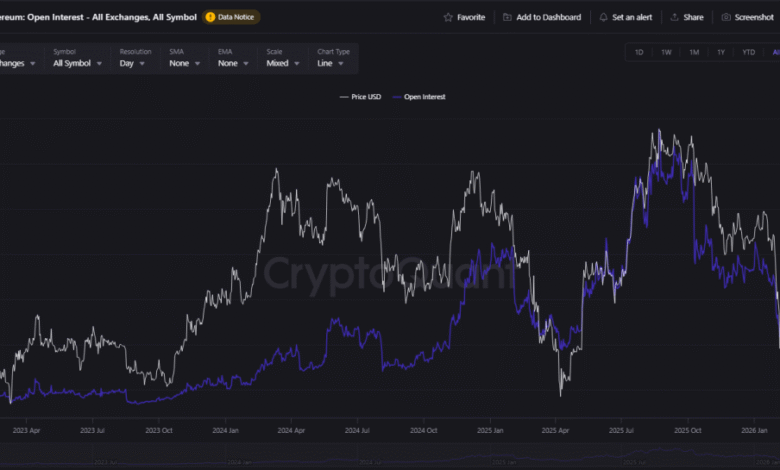

Studies say futures open interest has fallen sharply during the last 30 days, funding charges have swung into deeply unfavourable territory, and a few on-chain metrics level to a clustered assist zone under present costs.

Open Curiosity Drop Raises Questions

In line with CryptoQuant, the headline determine displaying an 80 million ETH decline in open curiosity throughout main venues grabbed consideration. That quantity, if taken at face worth, can be big. It suggests massive positions have been closed slightly than new ones being placed on.

However the scale of the change additionally invitations scrutiny; reporting errors or dollar-value comparisons mislabeled as ETH can occur. Nonetheless, a large pullback in futures publicity on exchanges together with Binance, Gate, Bybit and OKX has been logged, and that a lot seems actual.

Funding Charges And The Crowd

Funding charges on some platforms are pushing to ranges not seen in roughly three years. When merchants pay to carry quick positions, it indicators sturdy bearish conviction.

It’s reported that such extremes are usually adopted by a pointy reversal as the gang can turn into one-sided, and that results in a fast reversal because the market sentiment modifications.

This was seen on the finish of 2022, the place there was excessive shorting adopted by a fast reversal. This doesn’t imply that it’ll occur this time round as markets can stay one-sided for longer than anticipated.

Assist Zones And Technical Targets

Glassnode’s on-chain data reveals a major cost-basis space between $1,880 and $1,900, the place about 1.3 million ETH was traded.

The $2,000 mark is performing as a psychological anchor and is strengthened by shifting common clusters. A breakout from the latest falling wedge sample factors to an preliminary measured goal close to $2,150, a ceiling that might be examined earlier than increased resistance close to $2,260 after which $2,500.

These ranges should not certainties; broader market tone and Bitcoin’s route will affect whether or not they’re reached.

Diminished open curiosity lowers the danger of cascade liquidations for now, which may tame intraday volatility. On the similar time, low funding charges present that bearish bets are nonetheless energetic and could possibly be squeezed if momentum turns.

Studies say accumulation wallets elevated inflows when costs dipped, hinting at longer-term conviction amongst some buyers.

Featured picture from Unsplash, chart from TradingView