Ethereum open interest, RSI hit multi-month high – Is $3,000 near?

- Ethereum has reached an eight-week excessive because the RSI exhibits a rise in shopping for strain.

- The open curiosity at $14 billion exhibits elevated market participation by by-product merchants.

Ethereum [ETH] traded at an 8-week excessive of $2,735 at press time after an almost 4% acquire in 24 hours. In line with CoinMarketCap, buying and selling volumes has elevated by greater than 100%, displaying rising market curiosity.

The features noticed ETH document the very best quantity of brief liquidations throughout the crypto market. At press time, greater than $23 million value of ETH brief positions had been worn out per Coinglass.

A excessive variety of brief liquidations is a bullish signal because it signifies that brief sellers are turning into patrons to shut their positions. A take a look at Ethereum’s one-day chart means that these bullish traits might proceed.

Ethereum exhibits bullish indicators

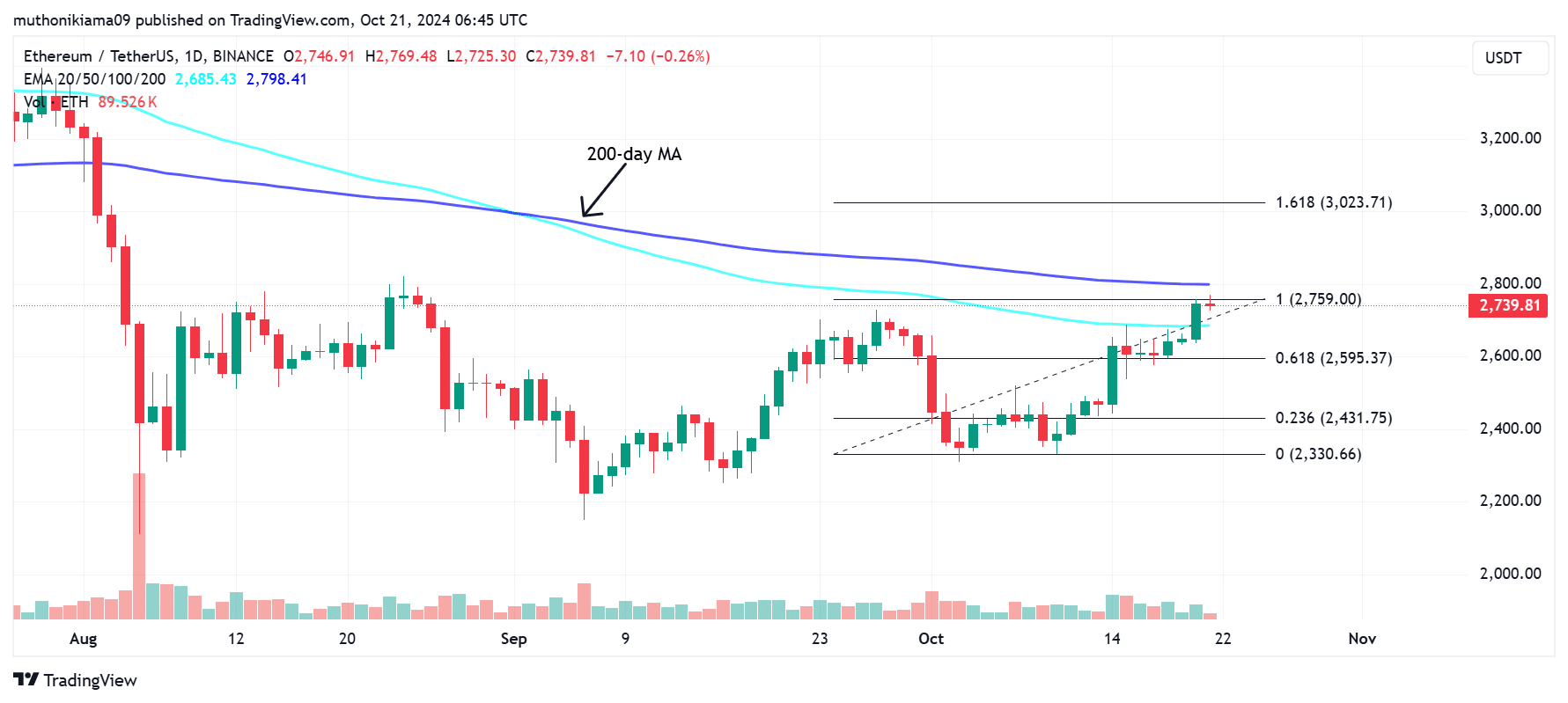

ETH flipped the 100-day Exponential Transferring Common (EMA) at $2,685, because the uptrend gained energy. The uptrend later confronted resistance as ETH approached the 200-day EMA.

The 200-day EMA, presently at round $2,800 is a psychological degree for merchants. If ETH makes a decisive break above this resistance, the altcoin can have entered a long-term bullish development, which might see it rally in direction of the 1.618 Fibonacci degree above $3,000.

Supply: Tradingview

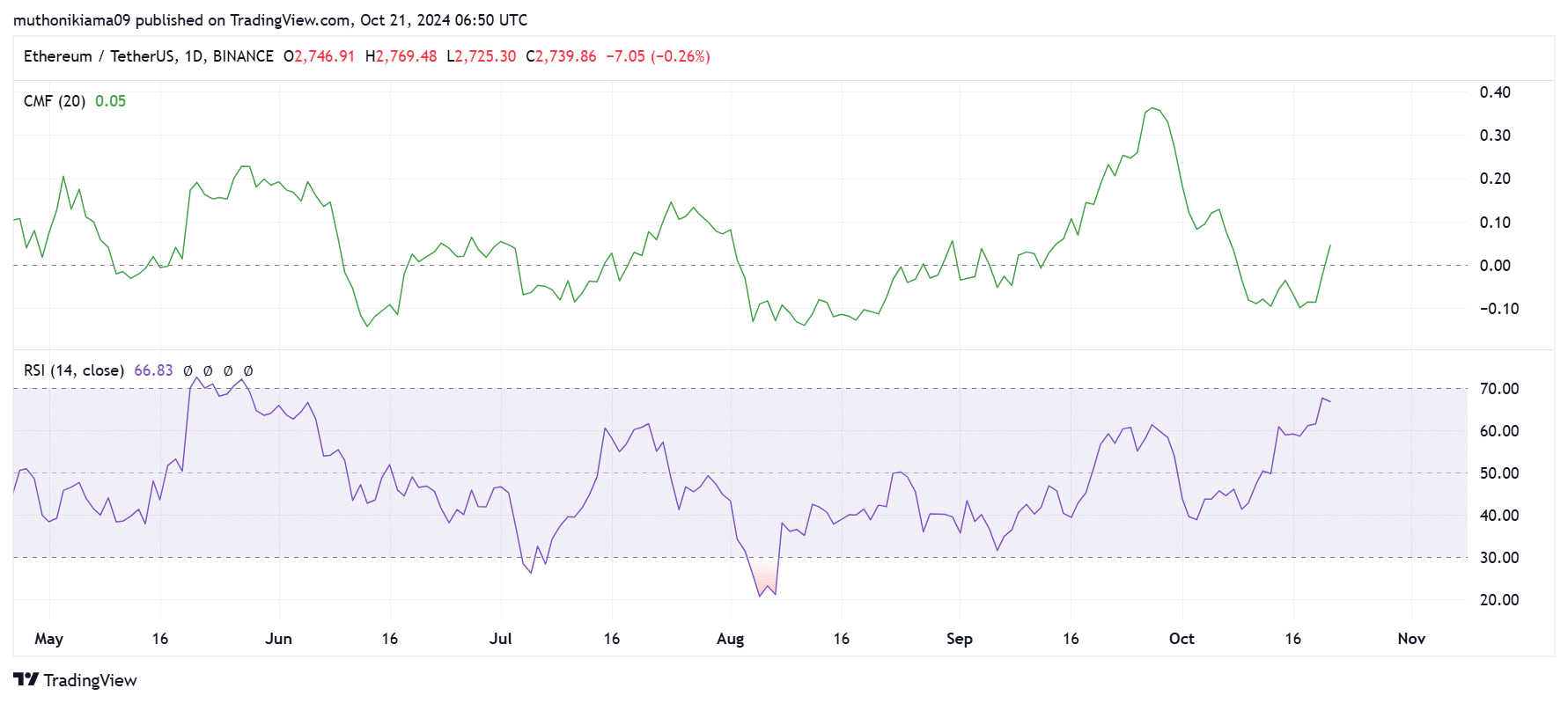

Technical indicators counsel {that a} break above the 200-day EMA is probably going. The Chaikin Cash Movement (CMF) has flipped optimistic for the primary time in practically two weeks displaying that extra capital is flowing into ETH.

Moreover, the Relative Power Index (RSI) has been making greater highs and reached its highest degree since June displaying excessive shopping for strain.

Supply: Tradingview

Regardless of an inflow of patrons, Ethereum’s RSI at 66 exhibits it’s not overbought. This means that there’s room for development.

Open curiosity and leverage ratio spike

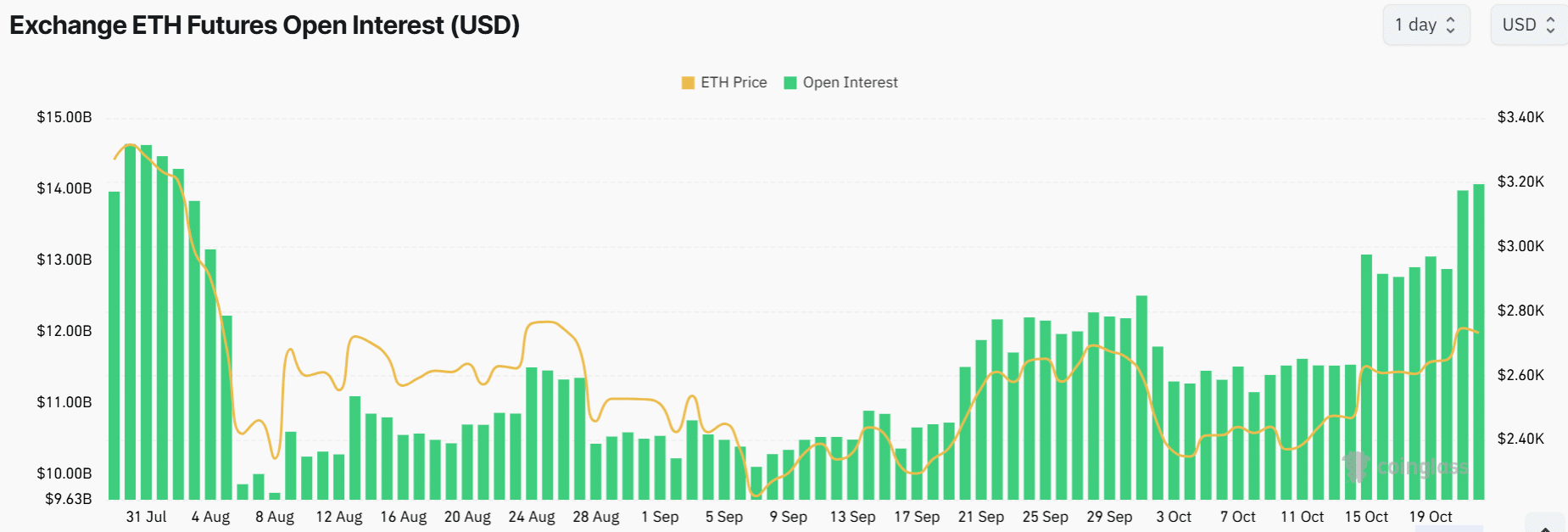

Ethereum’s open curiosity has elevated to the very best degree since August as knowledge from Coinglass exhibits. This metric stood at $14 billion at press time signaling {that a} excessive variety of market contributors and capital is flowing into ETH.

Supply: Coinglass

A rise in open curiosity is normally bullish if merchants are opening lengthy positions. Nevertheless, this improve may also end in worth volatility.

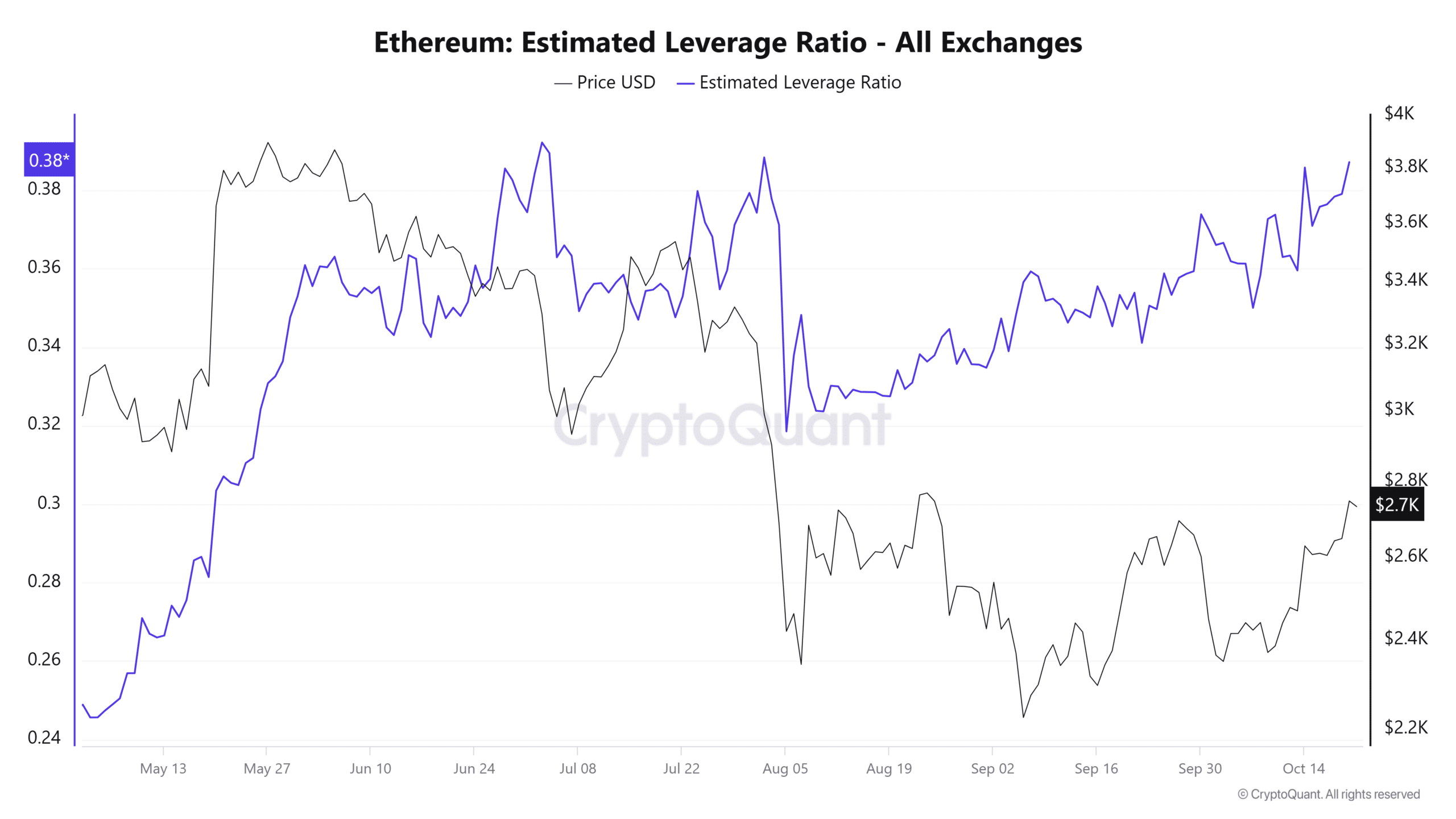

Ethereum’s estimated leverage ratio is approaching a three-month excessive suggesting that there’s an inflow of borrowed capital. If ETH makes sudden strikes, it might end in a excessive variety of compelled liquidations inflicting volatility.

Supply: CryptoQuant

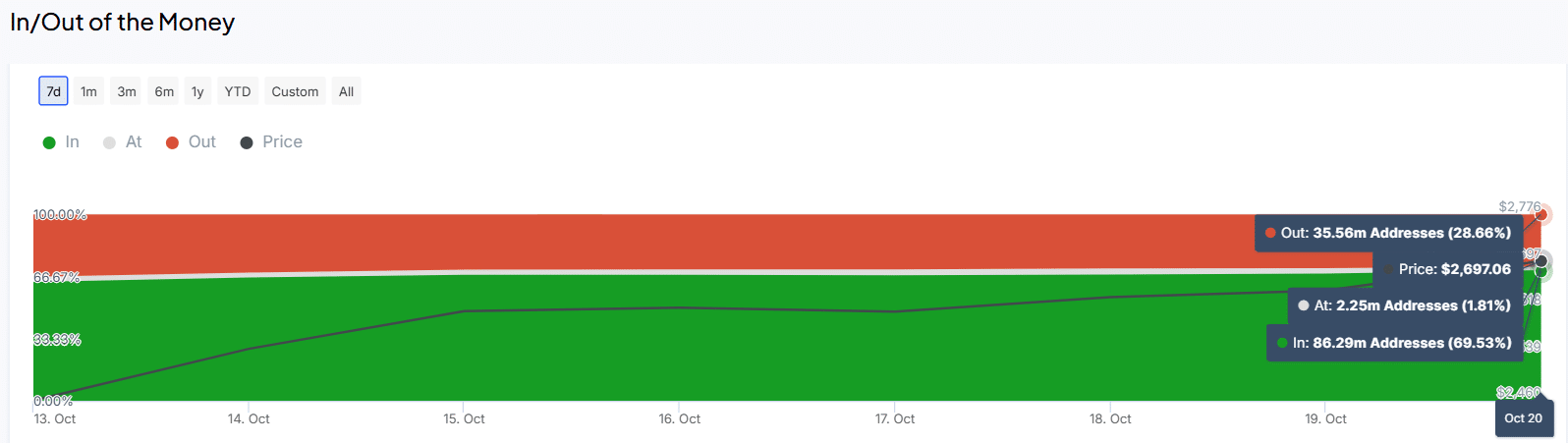

Ethereum wallets in income

Ethereum’s current features have additionally resulted in a spike within the wallets which are In The Cash (in income). At press time, 69% of all ETH addresses, had been in revenue, representing a 6% improve within the final seven days.

Supply: IntoTheBlock

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

However, the wallets in losses stood at 35 million addresses at press time, a notable decline from 42 million addresses in only one week.

As extra Ethereum wallets change into worthwhile, it might end in optimistic sentiment round ETH.