Ethereum outshines Solana as SOL/ETH ratio plunges – What now?

- The SOL/ETH ratio has dropped to a six-week low of 0.058 as Ethereum outperforms Solana.

- Solana has been caught in consolidation because of a scarcity of contemporary shopping for exercise.

Solana [SOL] was buying and selling at $233, at press time, after a slight 1.5% drop up to now 24 hours. The altcoin has been underperforming, because it was the one coin among the many high ten largest cryptos by market capitalization with a seven-day loss.

Solana’s underwhelming efficiency has did not mirror good points throughout the broader altcoin market and has led to SOL falling to a six-week low in opposition to the biggest altcoin, Ethereum [ETH].

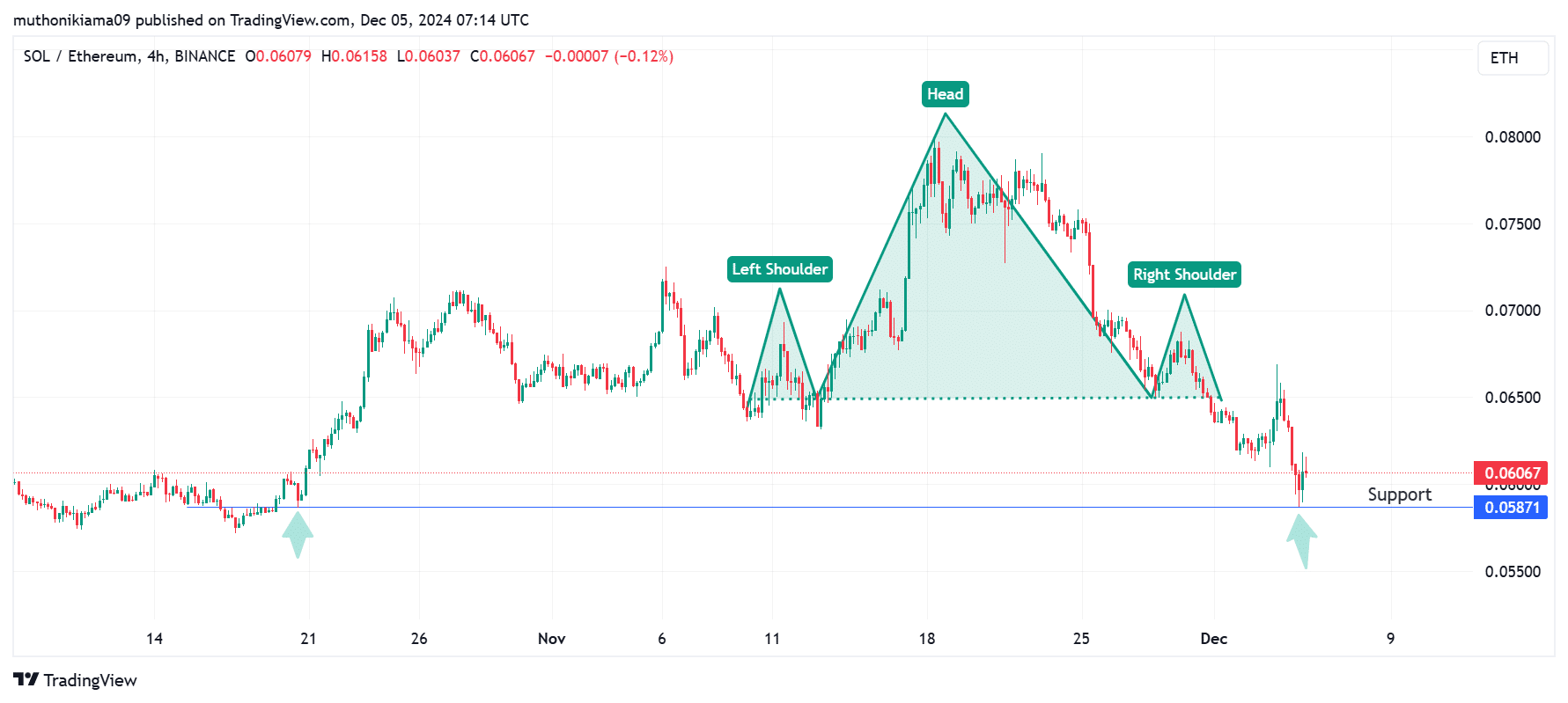

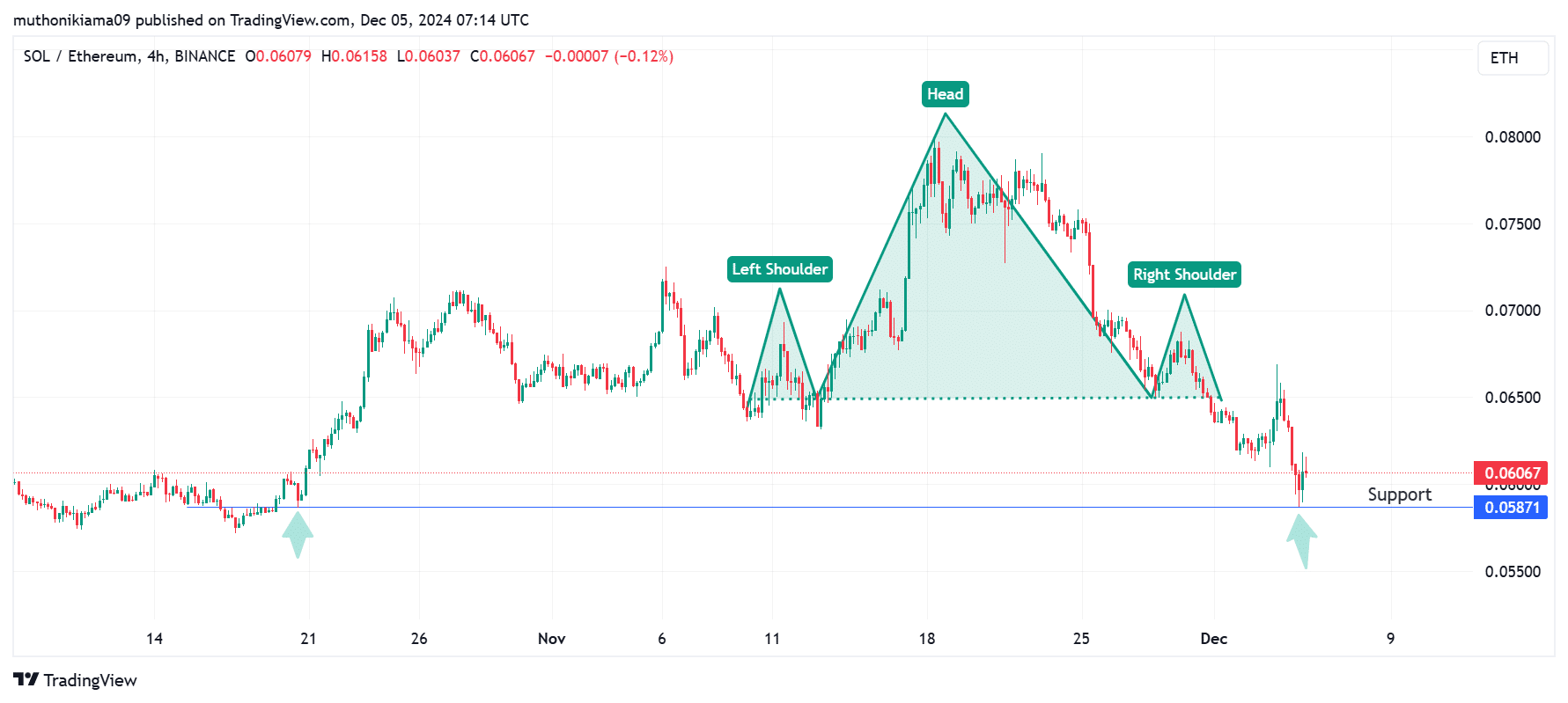

On the time of writing, the SOL/ETH ratio had fallen to 0.606 after bouncing from assist at 0.058 on the four-hour chart.

This decline confirmed that Ethereum was outpacing Solana when it comes to good points. The declining ratio follows the formation of a bearish head-and-shoulders sample.

Supply: TradingView

The bearish pattern has pushed SOL/ETH to a assist degree of 0.058. The final time SOL examined this assist was in late October earlier than beginning a rally. Whether or not this pattern will repeat is determined by shopping for exercise round Solana.

Solana worth caught in consolidation as shopping for stress wanes

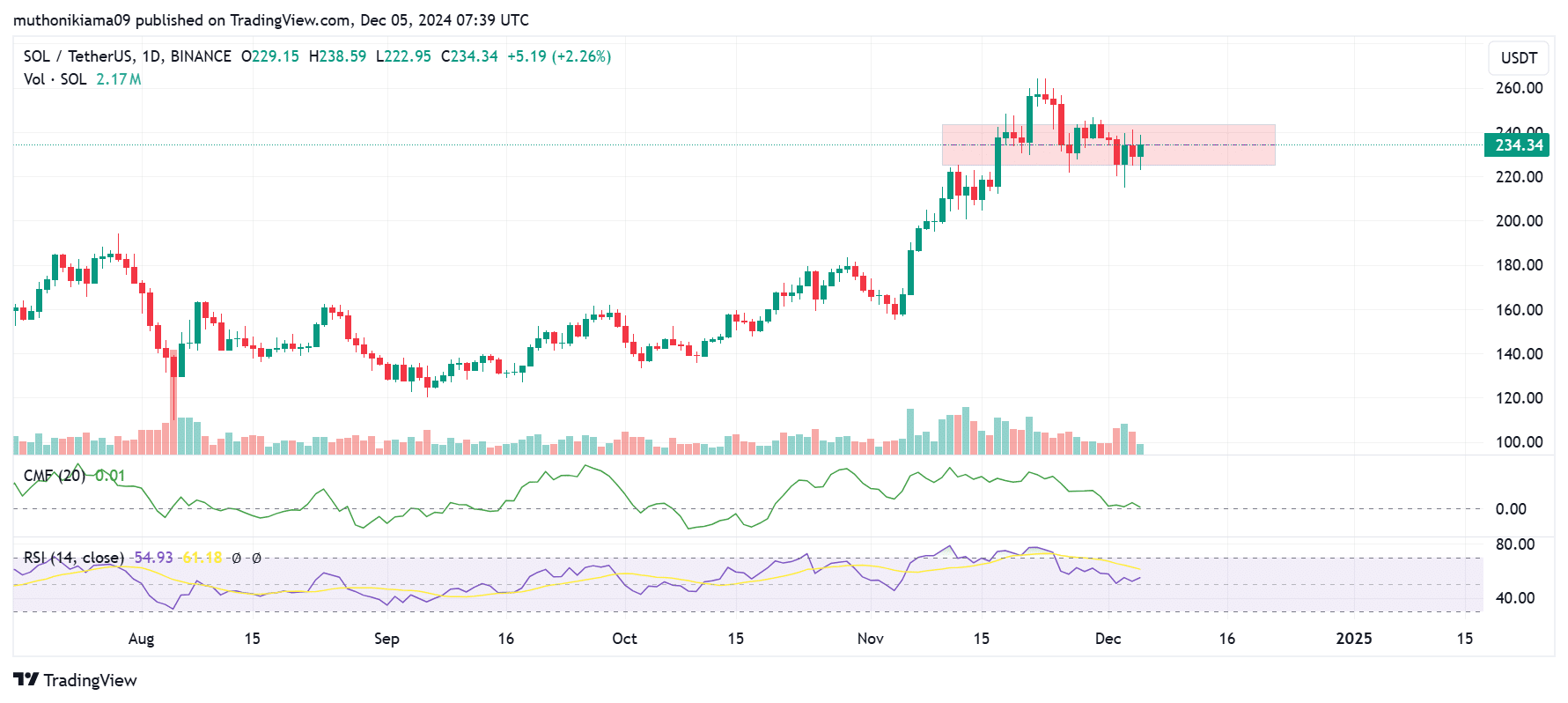

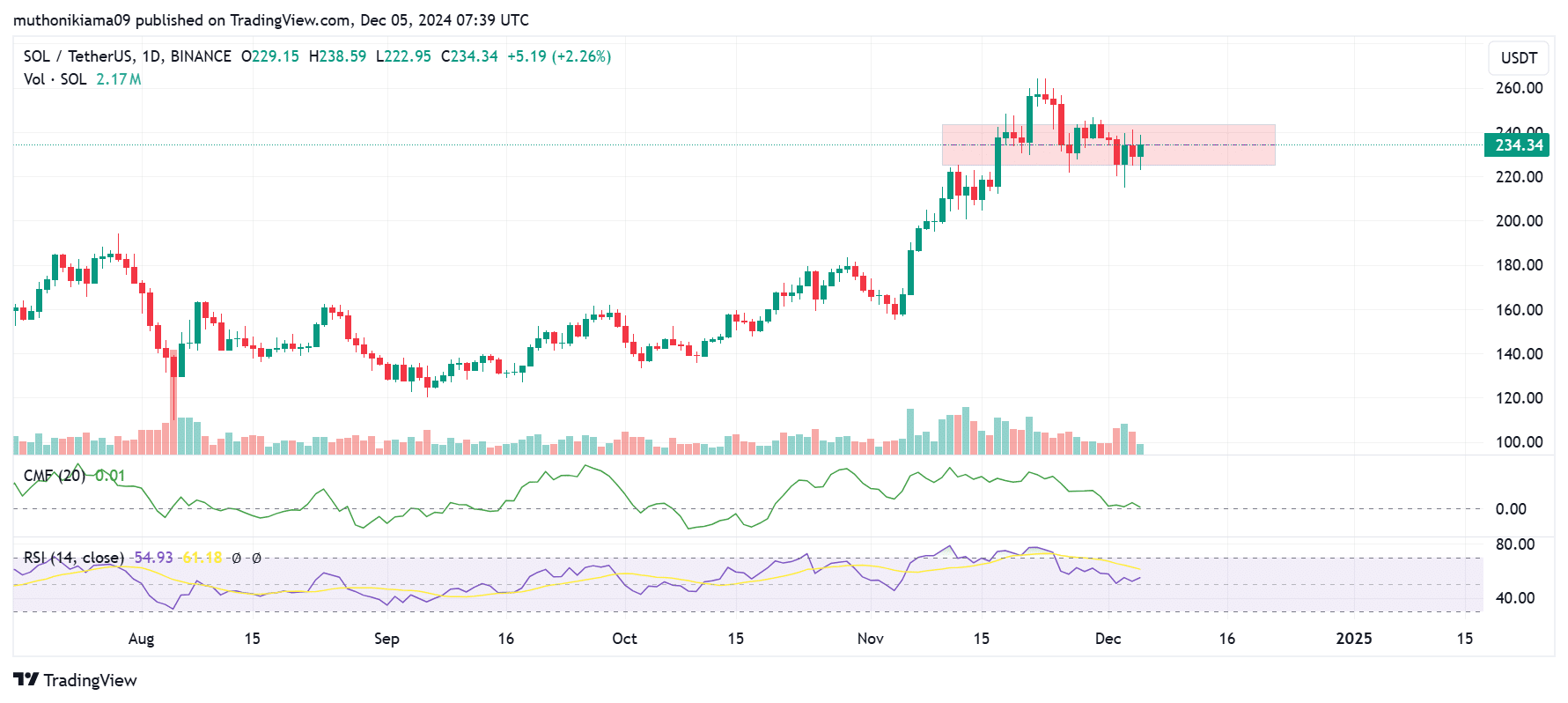

Solana has been consolidating between $225 and $243 over the previous week. The quantity histogram bars additionally shrunk, exhibiting a scarcity of sturdy buying and selling exercise to push SOL out of the range-bound buying and selling sample.

Shopping for exercise remained scarce, as indicated by the falling Chaikin Cash Circulate (CMF), which has been making decrease lows.

On the identical time, the Relative Power Index (RSI) was on a downtrend. Regardless of staying above 50, the RSI signifies that promoting exercise is rising amid low demand to soak up the bought cash.

Supply: TradingView

Solana might succumb to bearish tendencies and expertise a downward breakout because of steady promoting by the meme coin launchpad Pump.enjoyable.

In response to Lookonchain, Pump.enjoyable not too long ago transferred 100,000 SOL, valued at $23.45 million, to the Kraken change. Since its launch, the platform has deposited $265 million value of SOL to exchanges for promoting.

If consumers don’t step in to soak up these bought cash, SOL might proceed to underperform in opposition to Ethereum and different altcoins.

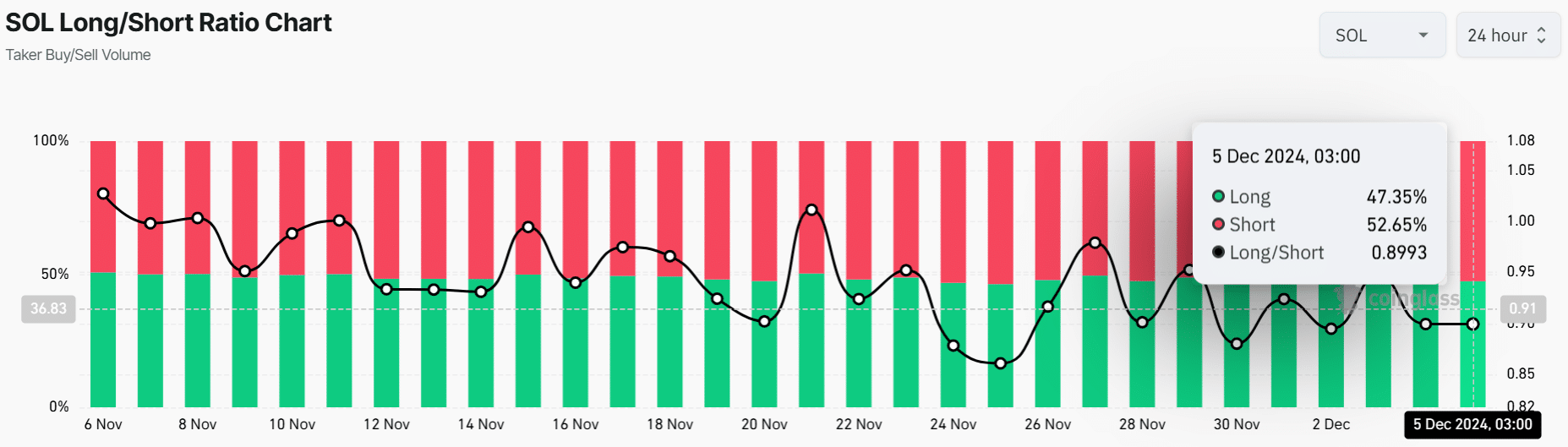

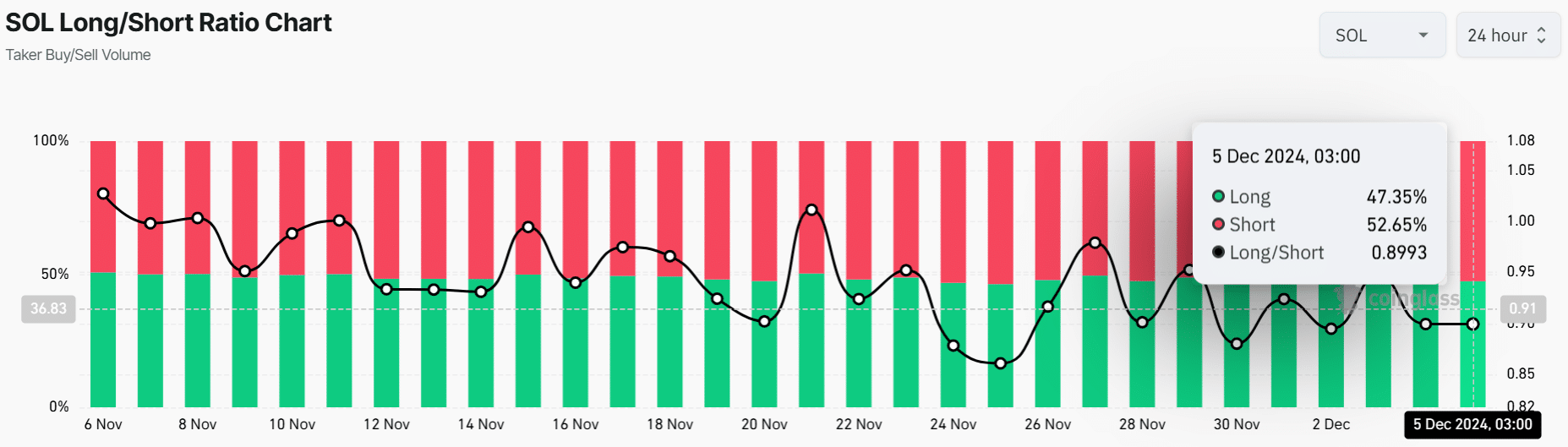

Lengthy/Brief Ratio reveals a bearish sentiment

Solana’s Lengthy/Brief Ratio additional reveals that the market sentiment round SOL is bearish after dropping to 0.89.

Learn Solana’s [SOL] Value Prediction 2024–2025

This means {that a} majority of merchants have taken leveraged brief positions on the altcoin and are anticipating an additional decline.

Supply: Coinglass

Nevertheless, an inflow of brief positions will increase the danger of a brief squeeze. Due to this fact, merchants ought to be careful for an sudden worth achieve that might trigger a cascade of brief liquidations and push the worth greater.