Ethereum Plunge Drives Liquidation Above $30 Million, More Pain To Come?

The Ethereum value noticed a notable value plunge on Monday when the Ethereum Basis reportedly began promoting cash. This plunge, in flip, triggered a collection of liquidation occasions which have seen ETH merchants undergo large losses within the final day.

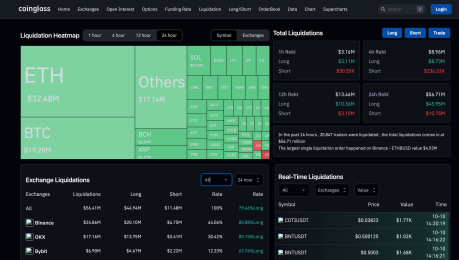

Ethereum Liquidation Volumes Cross $30 Million.

By Tuesday, October 10, the Ethereum liquidation numbers triggered by the value crash ramped up rapidly to cross the $32 million market. As anticipated, lengthy merchants suffered the vast majority of the losses with Coinglass knowledge pointing to 87.61% of all ETH liquidation volumes coming from lengthy merchants.

This meant that of the over $32 million in liquidation volumes recorded for the asset previously day, $29.56 million have been from lengthy positions. This meant that solely $2.91 million briefly positions have been liquidated.

ETH liquidations cross $30 million | Supply: CoinGlass

Ethereum additionally snagged the crown for the biggest single liquidation occasion for the 24-hour interval. The commerce was positioned on the Binance crypto alternate throughout the ETHBUSD pair with a complete worth of $4.53 million by the point the liquidation occurred.

Ethereum’s volumes additionally put it forward of Bitcoin for a similar time interval when Bitcoin often tends to steer liquidation volumes. Within the 24-hour timeframe, Bitcoin liquidation volumes got here out to $19.28 million in comparison with $32.48 million for Ethereum. However similar to ETH, the overwhelming majority of the liquidation volumes for BTC have been from lengthy merchants.

ETH value struggles beneath $1,600 | Supply: ETHUSD on Tradingview.com

Over 20,500 Crypto Merchants Undergo Losses

The liquidation volumes over the past day have been nowhere close to the very best for the yr however that doesn’t make it any much less vital. CoinGlass’s knowledge reveals that as of the time of writing, 20,525 crypto merchants have been liquidated for a complete of $56.42 million.

Of this determine, lengthy merchants have accounted for $44.9 million in losses, and quick merchants for $11.48 million. Apart from Bitcoin and Ethereum, the opposite property that noticed notable volumes have been Bitcoin Money (BCH) with $3.59 million, XRP with $2.77 million, and Solana (SOL) with $2.75 million.

The Binance alternate accounted for the biggest volumes at $24.86 million, adopted by the OKX alternate with $17.16 million. Subsequent on the listing is ByBit with $6.90 million, Huobi with $5.8 million, and the CoinEx alternate which rounded off the highest 5 with $1.05 million.

If there continues to be any massive swing in costs like what was witnessed on Monday, then the liquidation volumes are anticipated to proceed. The one means these volumes will stay low is that if property out there proceed to commerce in a decent vary.