Ethereum price predicted to hit $4000 again – Here’s why

- Ethereum displayed a bullish market construction on the 1-day chart.

- Nevertheless, patrons have been combating for management and successful at press time.

Ethereum [ETH] witnessed a destructive Coinbase Premium after the current retracement from $4.1k.

The issues surrounding an Ethereum ETF may clarify why U.S. buyers have grown much less bullish on the asset in March.

One other AMBCrypto report highlighted that long-term ETH holders weren’t promoting their tokens. Technical evaluation additionally outlined a bullish outlook.

The retest was excellent in hindsight

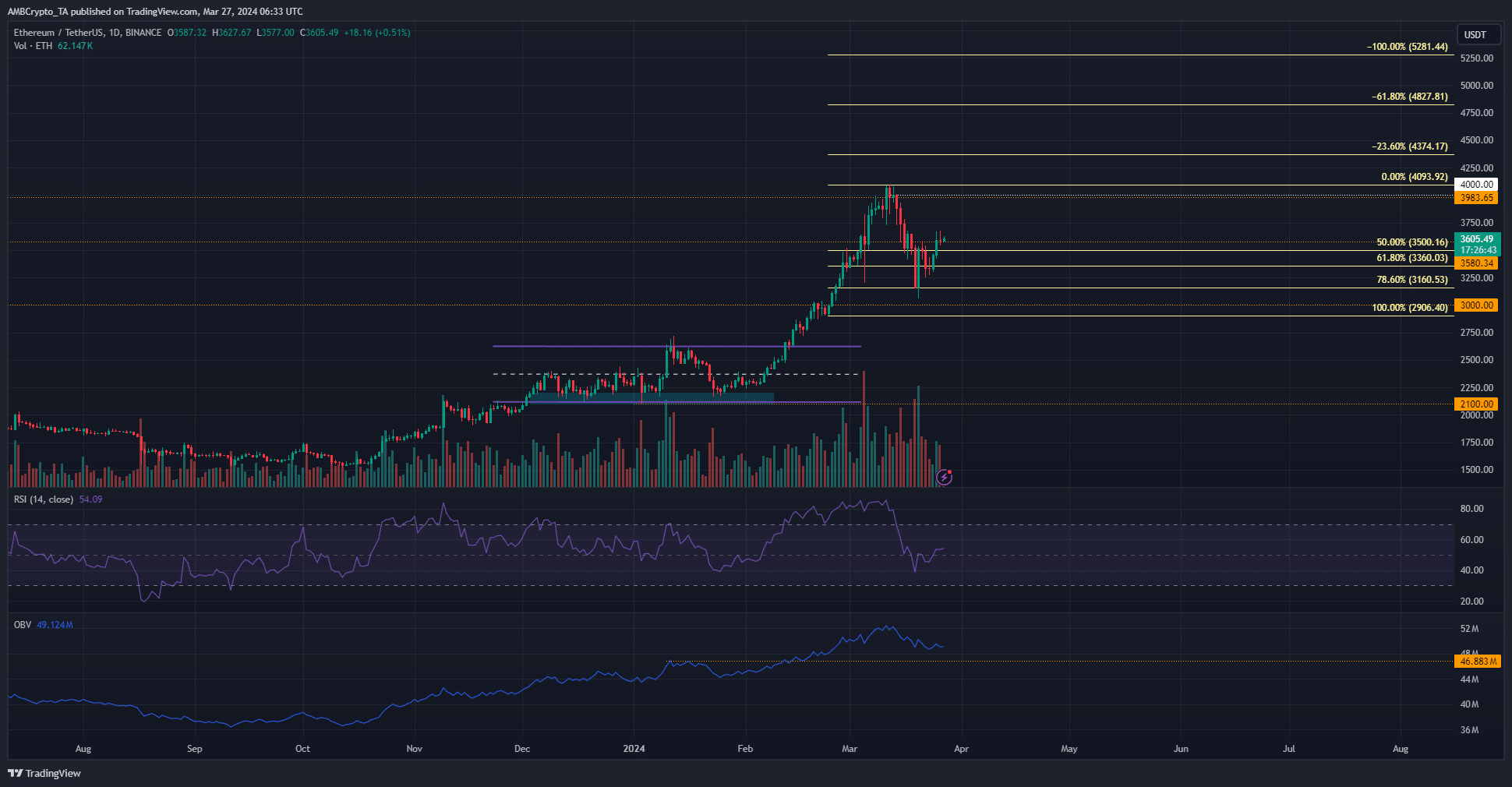

Supply: ETH/USDT on TradingView

The 1-day chart of Ethereum shaped a swing low at $3056 on the twentieth of March. Regardless of the deep retracement, the market construction remained bullish on the day by day timeframe.

The RSI, which sank beneath 50, was at 54 at press time.

This indicated that bearish momentum briefly held sway, however the bulls have been combating for management as soon as once more. In the meantime, the OBV didn’t take a look at the mid-February resistance as help.

Subsequently, shopping for stress remained stronger in the long run.

The promoting quantity in March was important, however not sufficient to overthrow the patrons. The Fibonacci retracement ranges (pale yellow) confirmed that the $3160 was a important help stage.

Costs bounced from this stage with out closing the 1-day candle beneath it.

Moreover, the $3580 resistance was on the verge of being breached. The proof at hand advised extra beneficial properties have been more likely to arrive.

The argument for an ETH transfer previous $4000

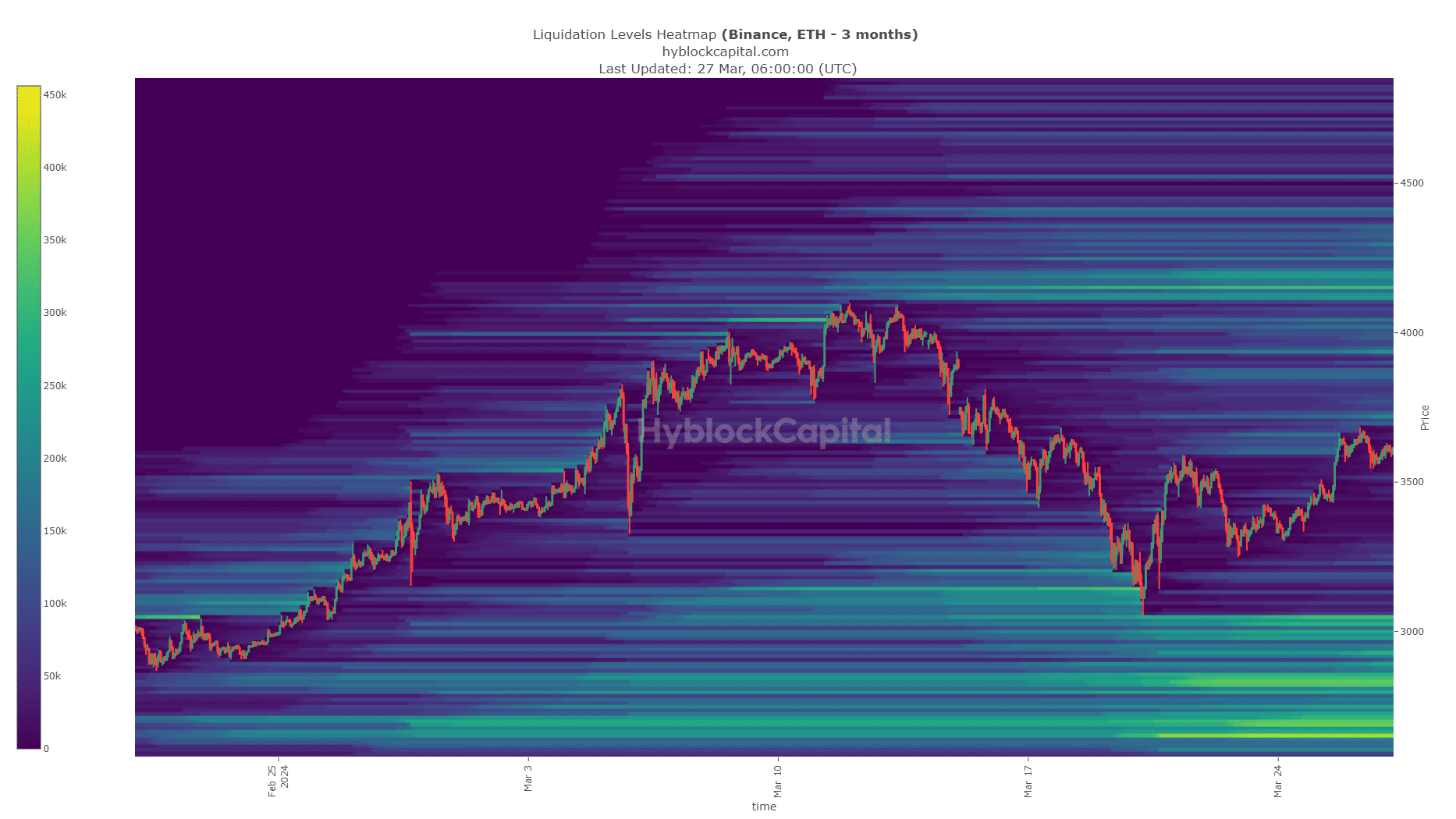

Supply: Hyblock

The transfer to $3000 worn out an estimated $8 billion in liquidation ranges. Additional losses may have resulted in larger losses for the bulls, however costs reversed and commenced to climb larger.

Life like or not, right here’s ETH’s market cap in BTC’s phrases

To the north, the $3940 and $4150 have been the subsequent areas of curiosity to observe. They’ve a excessive variety of liquidation ranges concentrated round them.

ETH may resolve to gather this liquidity and reverse, or breakout, relying on sentiment round each Ethereum and Bitcoin [BTC].

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.