Ethereum price prediction: Buy or sell this summer?

- The decline in Ethereum’s community exercise has turned Ether inflationary.

- Regardless of current worth troubles, ETH’s long-term outlook stays considerably bullish.

Ethereum’s [ETH] provide has develop into inflationary, as the overall market decline within the final month has decreased consumer exercise on the community.

In response to knowledge from Ultrasound.money, the main altcoin’s provide has risen by over 4,836 ETH up to now 30 days. Within the final week alone, this has grown by 9,000 ETH.

ETH’s provide is deemed to have develop into inflationary when there may be an uptick within the variety of cash created and added to the circulating provide, thereby growing the downward stress on the coin’s worth.

This occurs when the Ethereum community witnesses a drop in consumer exercise. On-chain knowledge from Artemis revealed a decline within the day by day depend of distinctive addresses interacting with the Ethereum blockchain up to now 30 days.

Between twenty third March and twenty second April, Ethereum’s day by day energetic tackle depend fell by 22%. This led to a corresponding fall within the community’s day by day transaction depend. In the course of the interval beneath evaluate, this dropped by 15%.

In the course of the 30-day interval in query, the community’s transaction charges peaked at $1.3 million on twelfth April and initiated a decline. Between the twelfth and twenty first of April, Ethereum’s day by day charges dropped by 8%.

When the Layer 1 (L1) community witnesses a decline in charges, it experiences a low burn charge. A lowered burn charge will increase the quantity of ETH in circulation, making the coin inflationary.

A glance into the longer term

At press time, ETH exchanged palms at $3,173. Impacted by the overall market decline within the final month, the coin’s worth dropped by 5% throughout that interval, in accordance with CoinMarketCap’s knowledge.

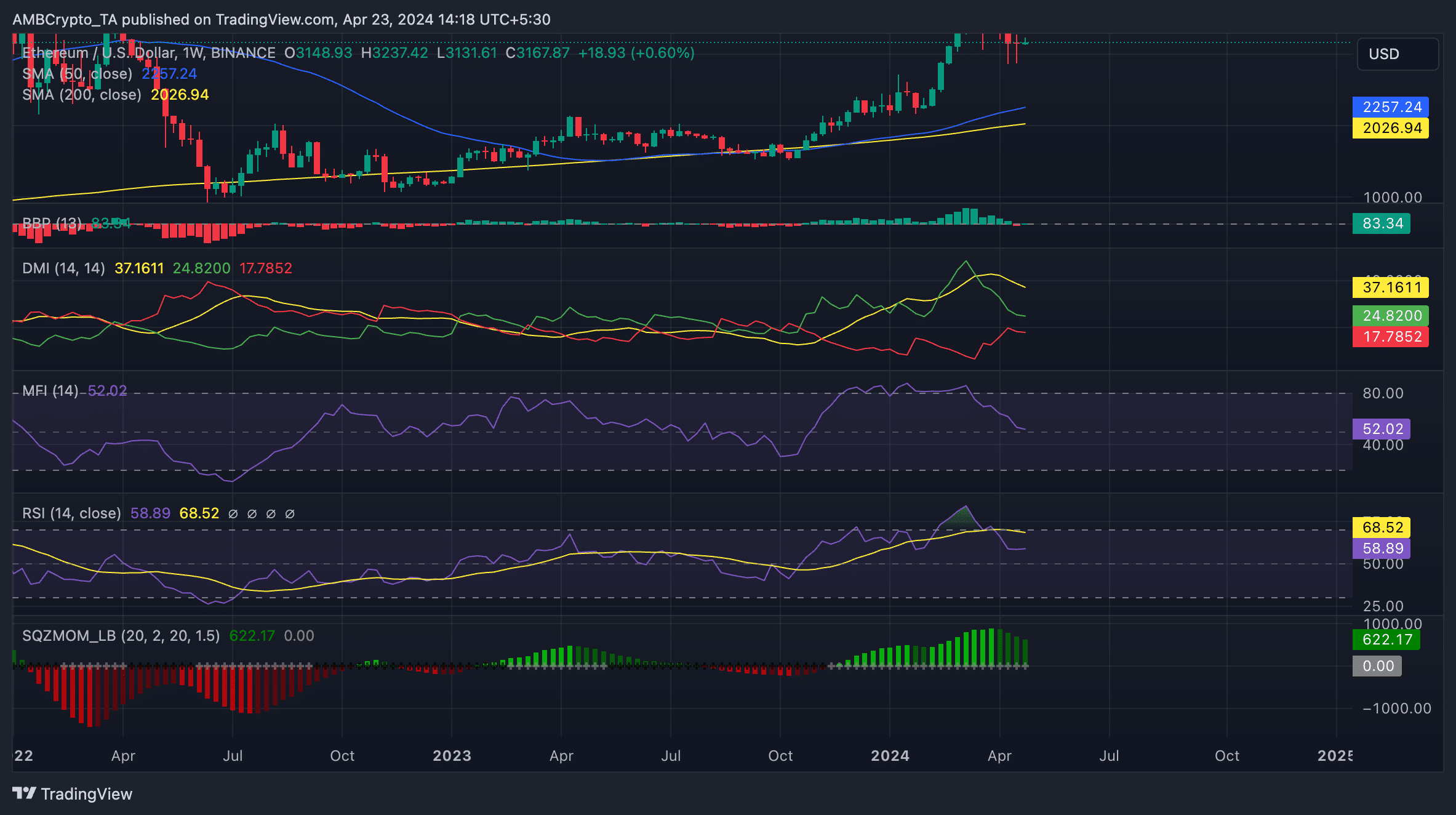

Nevertheless, regardless of the current market headwinds, ETH’s 50-day transferring common (MA), which initiated a golden cross when the bull market rally started in October 2023, nonetheless lies above its 200-day MA on a weekly chart.

This suggests that the coin’s shorter-term transferring common has remained above the longer-term transferring common for a while. That is typically seen as a bullish sign, because it signifies that ETH has skilled a sustained worth improve since October 2023, regardless of a number of drawbacks.

Market members might interpret this as an indication of continued power within the asset’s worth.

Readings from the coin’s Directional Motion Index confirmed this bullish outlook. The coin’s optimistic directional index (inexperienced), which additionally crossed above its unfavorable directional index (pink) in October 2023, has since maintained this place.

This crossover is thought to be a bullish sign because it indicators an increase within the bullish momentum. If it happens over an prolonged interval, like in ETH’s case, merchants view it as a affirmation of an uptrend in an asset’s worth and a sign of an additional worth rally.

One other indicator worthy of observe right here is ETH’s Squeeze Momentum Indicator. It measures an asset’s momentum and tracks the consolidation section of the marketplace for merchants trying to commerce in a sideways market.

Worth chart readings confirmed that ETH’s Squeeze Momentum Indicator has posted inexperienced upward-facing bars since November 2023.

When this indicator reveals upward-facing inexperienced bars, the asset in query is experiencing upward momentum.

Regardless of the a number of declines in ETH’s worth up to now a number of weeks, its Squeeze Momentum Indicator continues to show inexperienced upward-facing bars, indicating that the rally will proceed in the long run.

Though the coin’s outlook stays bullish in the long run, the surge in ETH profit-taking exercise since mid-February has led to a decline in a few of its key momentum metrics.

As of this writing, ETH’s Relative Energy Index (RSI) and Cash Circulate Index (MFI) have been 58.77 and 52.01, respectively.

Whereas these values relaxation above 50, they recommend that current market bearish traits have led to a slight decline in shopping for stress.

Nevertheless, a mixed studying of ETH’s RSI, MFI, and the indications assessed above confirmed that the coin is just not in excessive overbought or oversold circumstances. It additionally indicators that the present pattern might proceed to be secure with a slight bullish bias.

Supply: ETH/USDT on TradingView

ETH futures market

In ETH’s derivatives market, its futures open curiosity reached a year-to-date peak of $15 billion on ninth April and has since declined by 33%, per Coinglass knowledge. As of this writing, the coin’s futures open curiosity was $10 billion.

This decline signaled a fall in buying and selling exercise in ETH’s futures market. When an asset’s open curiosity declines on this method, it implies that market members are closing out their positions with out opening new ones.

Is your portfolio inexperienced? Test the Ethereum Revenue Calculator

Because the open curiosity decline started, the coin has closed 5 days with a unfavorable funding charge, with the most recent being on twenty second April. On these days, futures merchants positioned bets in favor of a decline within the coin’s worth.

At press time, ETH’s funding charge throughout exchanges was 0.0023%, displaying that lengthy merchants have regained management.